Learn | Invest | Grow

INVESTHER

Learn | Invest | Grow

INVESTHER

Learn | Invest | Grow

INVESTHER

Learn | Invest | Grow

INVESTHER

OUTCOME

OUTCOME

OUTCOME

The usability evaluations received positive feedback, showing strong support for the app’s innovative approach and its potential for widespread use.

The project's outcome inspired over 50+ women to start their independent investing journeys. This resulted in a substantial 52% increase in decision-making skills.

Achieved a Net Promoter Score (NPS) of 8.4, a positive indicator of the app's overall usability and user satisfaction.

The usability evaluations received positive feedback, showing strong support for the app’s innovative approach and its potential for widespread use.

The project's outcome inspired over 50+ women to start their independent investing journeys. This resulted in a substantial 52% increase in decision-making skills.

Achieved a Net Promoter Score (NPS) of 8.4, a positive indicator of the app's overall usability and user satisfaction.

The usability evaluations received positive feedback, showing strong support for the app’s innovative approach and its potential for widespread use.

The project's outcome inspired over 50+ women to start their independent investing journeys. This resulted in a substantial 52% increase in decision-making skills.

Achieved a Net Promoter Score (NPS) of 8.4, a positive indicator of the app's overall usability and user satisfaction.

The usability evaluations received positive feedback, showing strong support for the app’s innovative approach and its potential for widespread use.

The project's outcome inspired over 50+ women to start their independent investing journeys. This resulted in a substantial 52% increase in decision-making skills.

Achieved a Net Promoter Score (NPS) of 8.4, a positive indicator of the app's overall usability and user satisfaction.

MY ROLE

MY ROLE

MY ROLE

Developed personas, journey maps, and user stories.

Created and iterated on low and high-fidelity wireframes.

Conducted usability tests to validate design effectiveness in the market.

Developed personas, journey maps, and user stories.

Created and iterated on low and high-fidelity wireframes.

Conducted usability tests to validate design effectiveness in the market.

Developed personas, journey maps, and user stories.

Created and iterated on low and high-fidelity wireframes.

Conducted usability tests to validate design effectiveness in the market.

Developed personas, journey maps, and user stories.

Created and iterated on low and high-fidelity wireframes.

Conducted usability tests to validate design effectiveness in the market.

User Experience Designer

User Experience Designer

User Experience Designer

Tools

Tools

Tools

Figma

Adobe Creative Suite

Miro

Zoom Meetings

Figma

Adobe Creative Suite

Miro

Zoom Meetings

Figma

Adobe Creative Suite

Miro

Zoom Meetings

Figma

Adobe Creative Suite

Miro

Zoom Meetings

User Researcher

User Researcher

User Researcher

Drafted usability test plans and scripts and facilitated semi-structured interviews during usability testing.

Drafted usability test plans and scripts and facilitated semi-structured interviews during usability testing.

Drafted usability test plans and scripts and facilitated semi-structured interviews during usability testing.

Drafted usability test plans and scripts and facilitated semi-structured interviews during usability testing.

Timeline

Timeline

Timeline

8 Months

8 Months

8 Months

8 Months

THE CHALLENGE

THE CHALLENGE

THE CHALLENGE

The challenge was to understand and address the unique barriers women face in making independent investment decisions. This involved identifying their needs, behaviors, and preferences to ultimately boost their financial confidence.

The challenge was to understand and address the unique barriers women face in making independent investment decisions. This involved identifying their needs, behaviors, and preferences to ultimately boost their financial confidence.

The challenge was to understand and address the unique barriers women face in making independent investment decisions. This involved identifying their needs, behaviors, and preferences to ultimately boost their financial confidence.

The challenge was to understand and address the unique barriers women face in making independent investment decisions. This involved identifying their needs, behaviors, and preferences to ultimately boost their financial confidence.

SOLUTION OVERVIEW

SOLUTION OVERVIEW

SOLUTION OVERVIEW

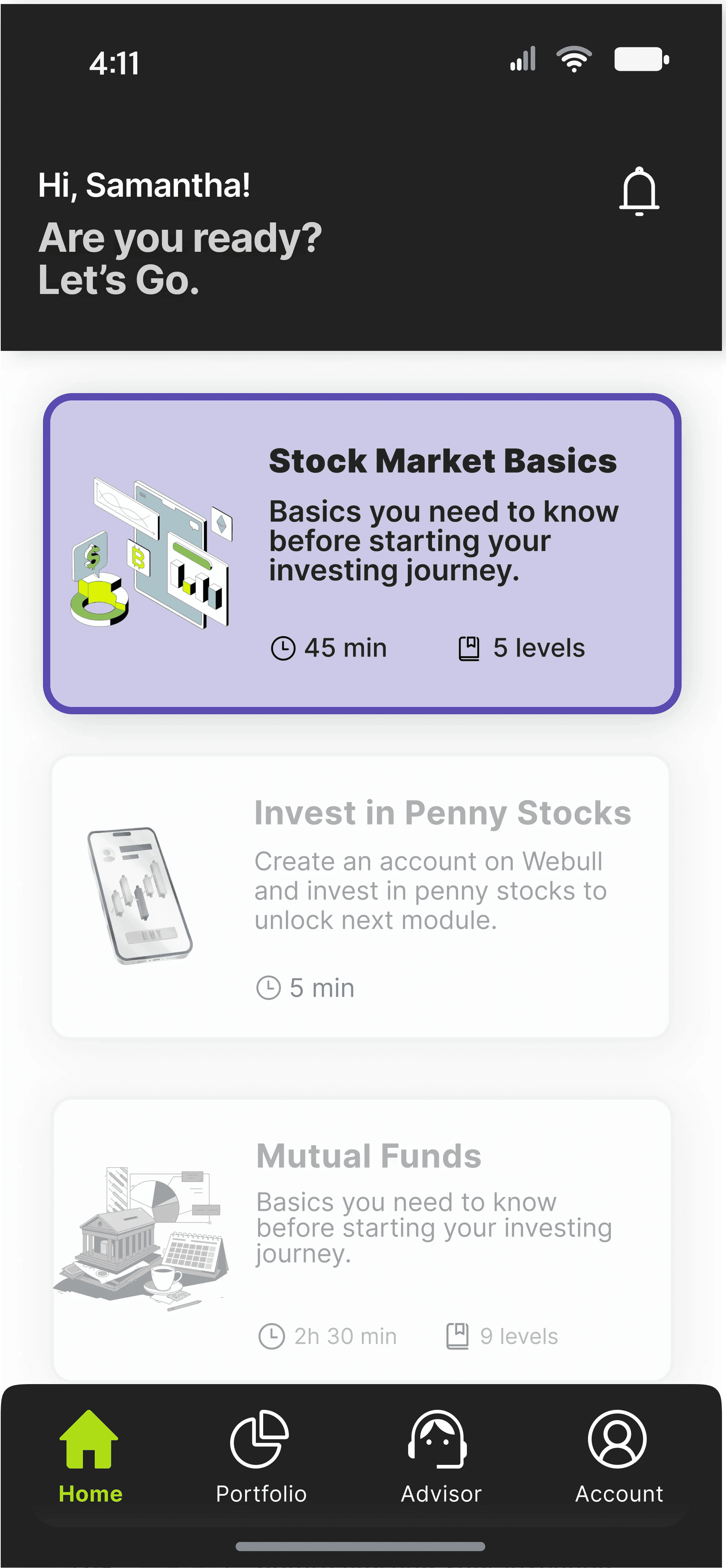

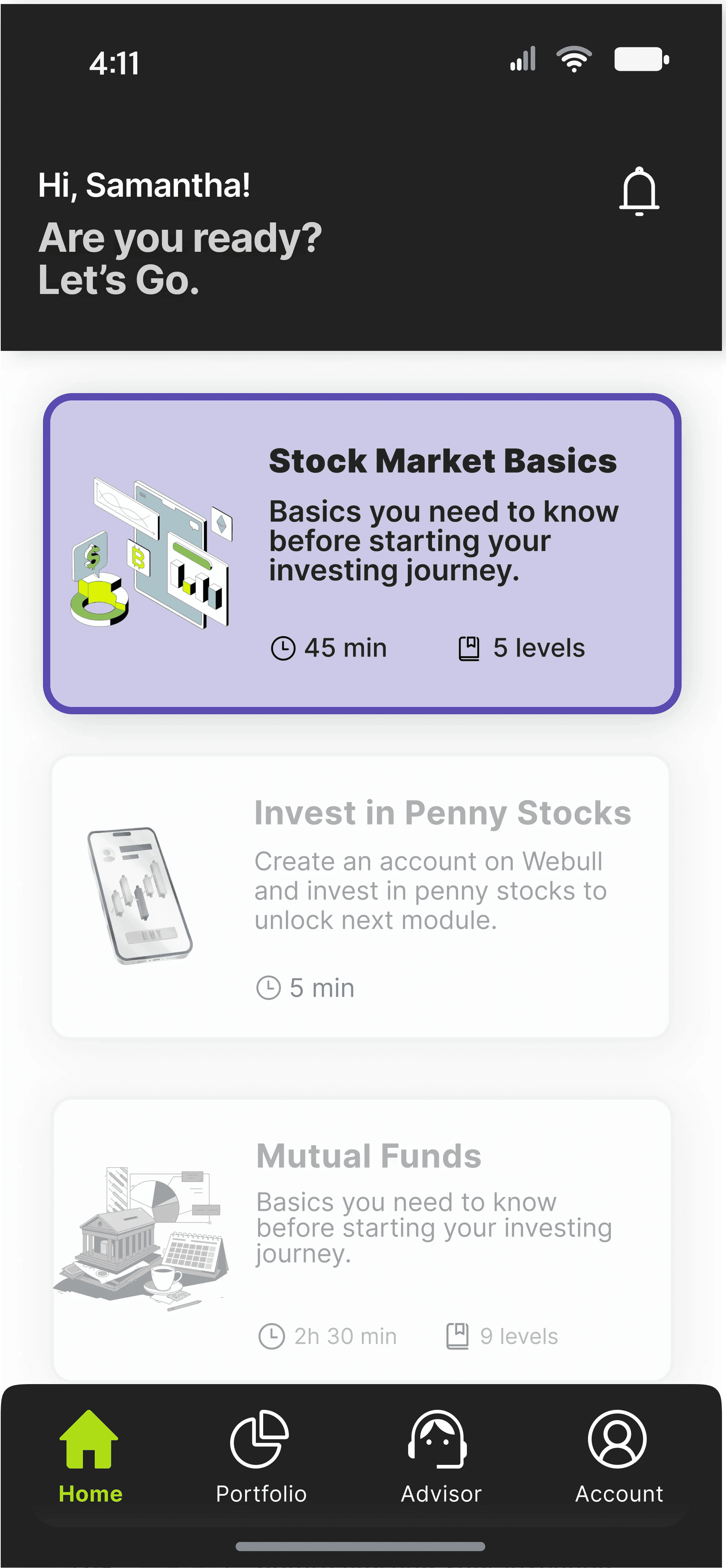

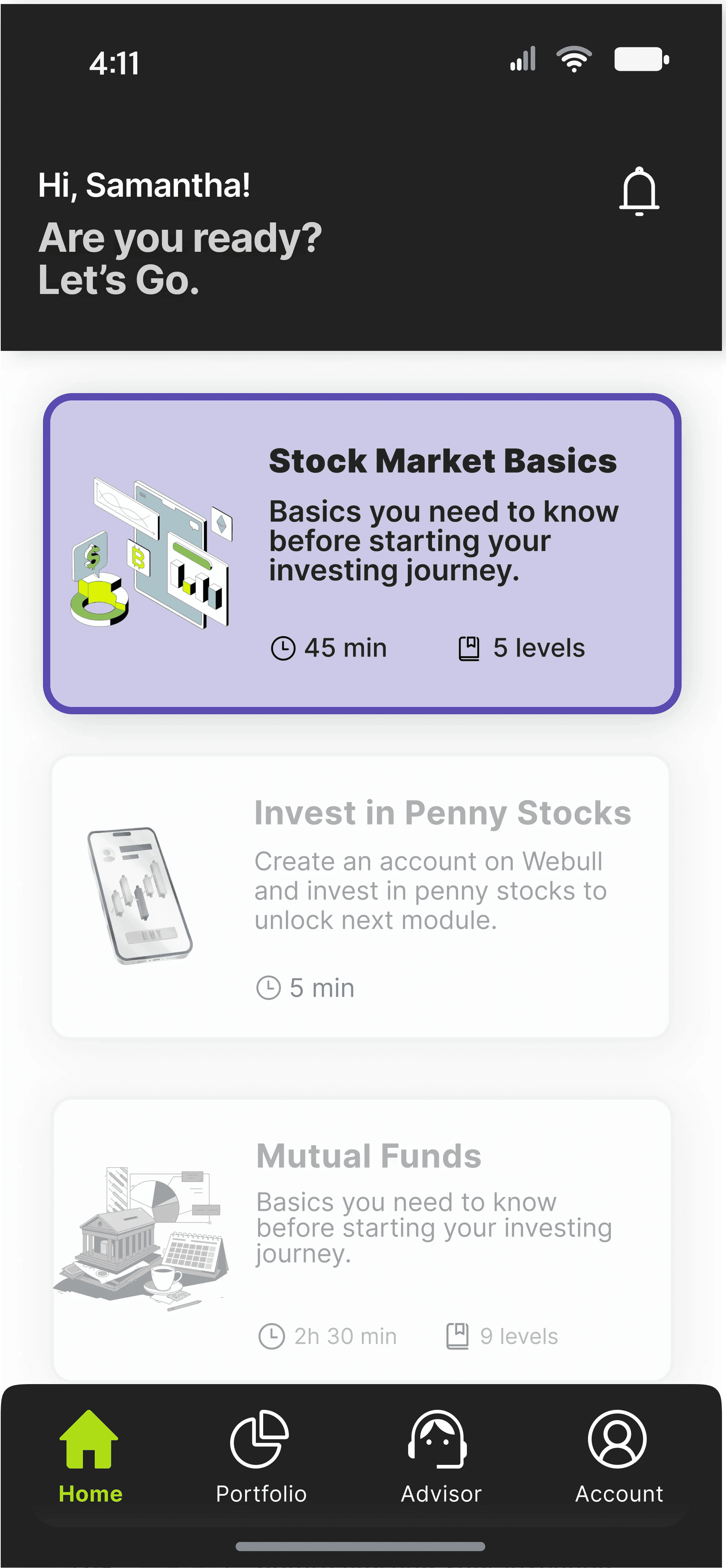

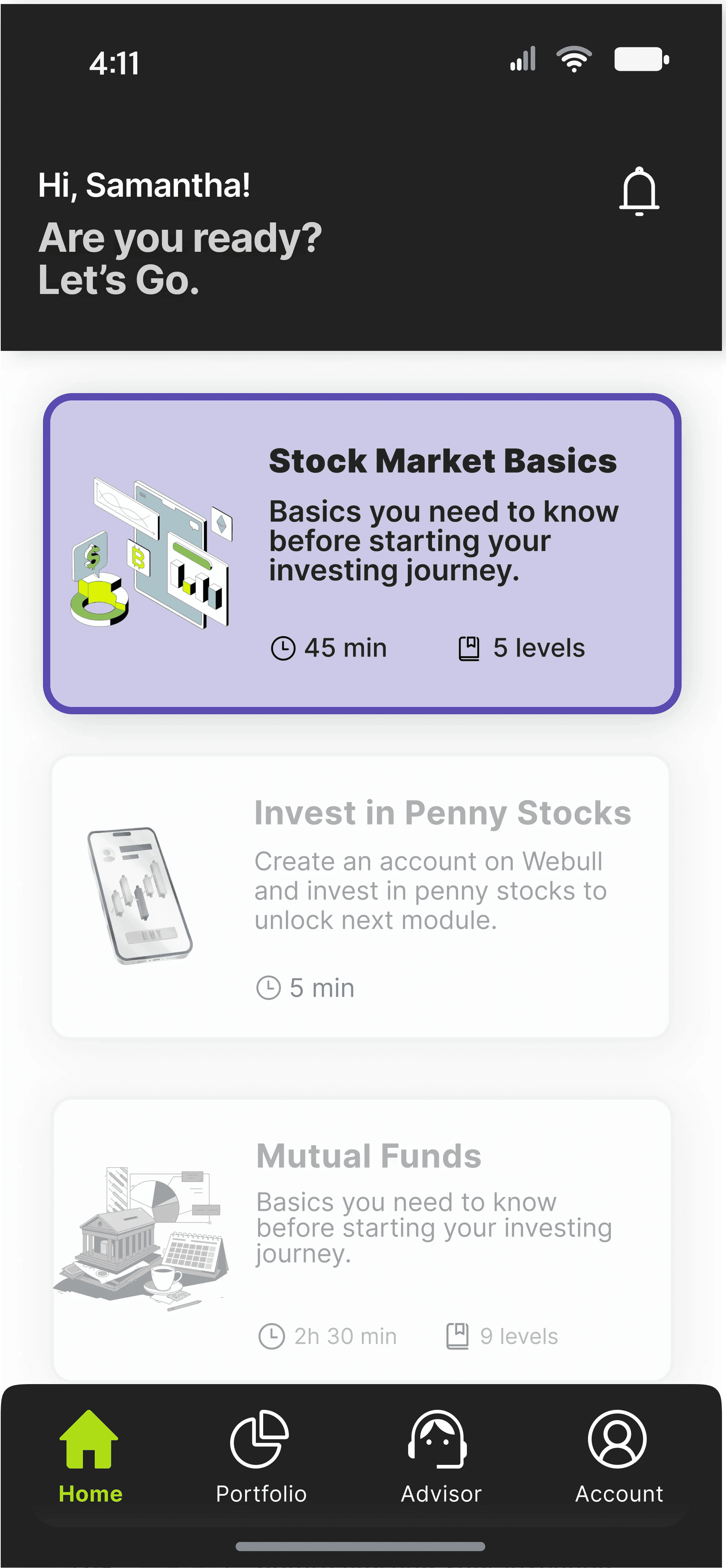

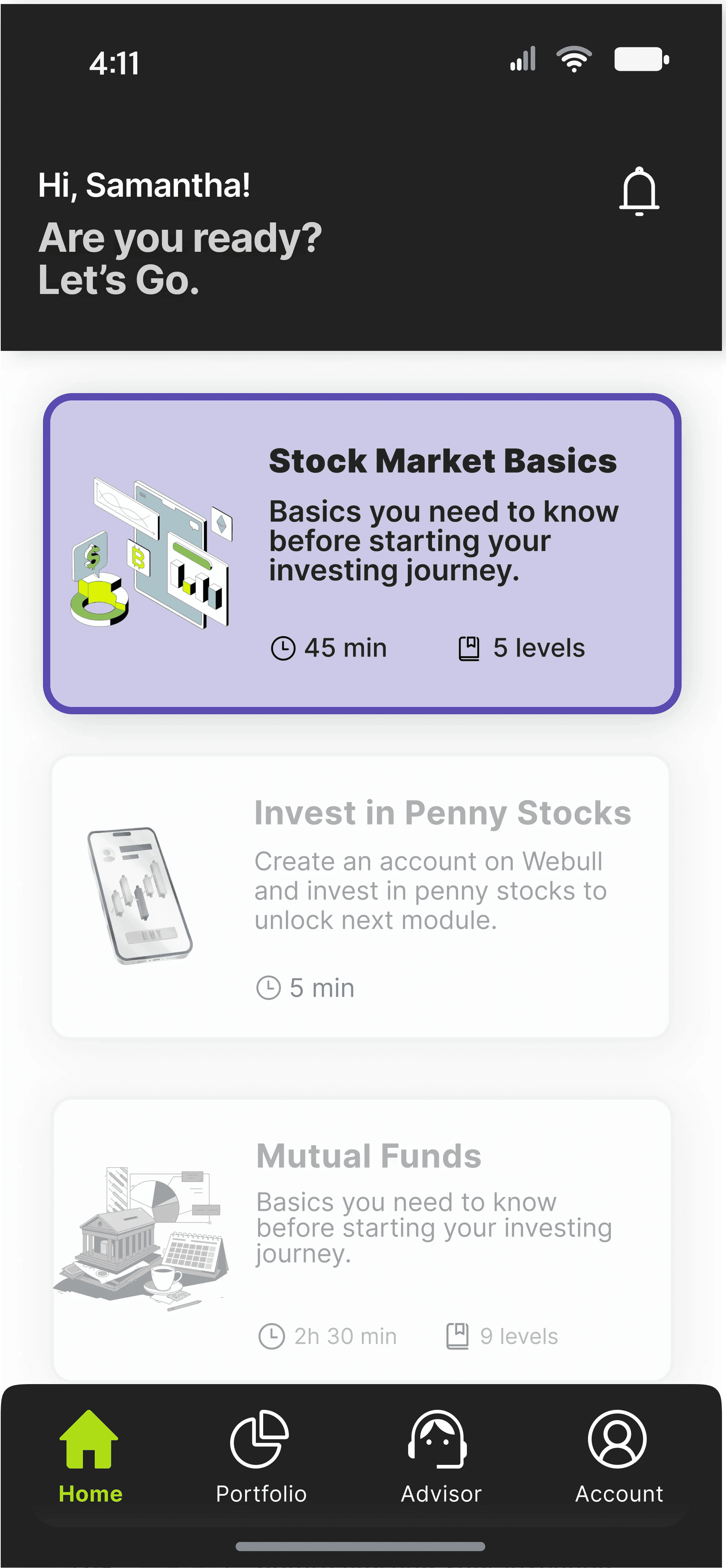

INVESTHER - FINANCIAL EMPOWERMENT APP

INVESTHER - FINANCIAL EMPOWERMENT APP

INVESTHER - FINANCIAL EMPOWERMENT APP

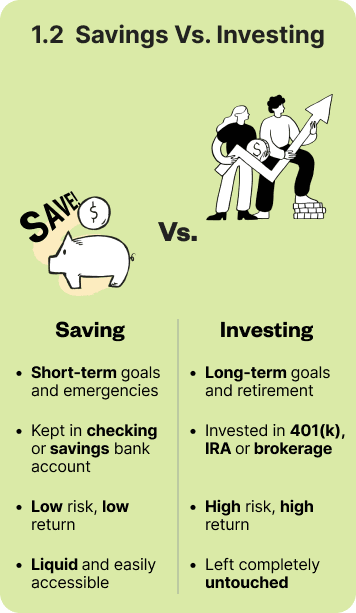

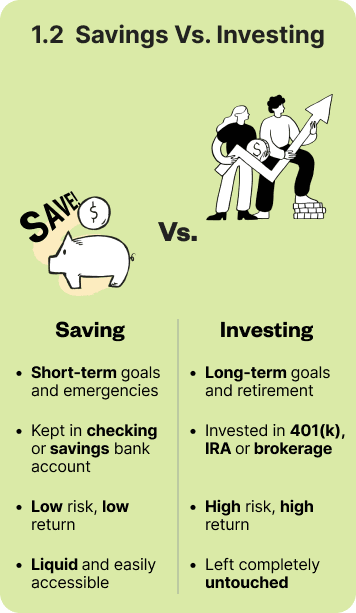

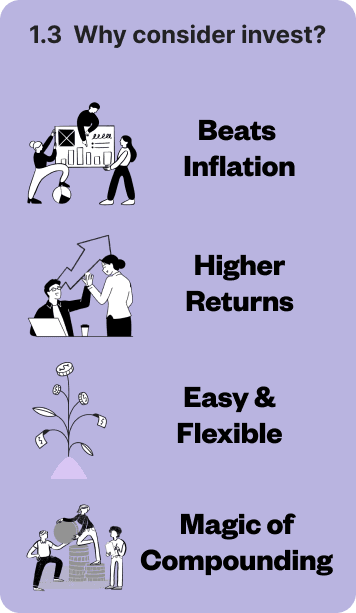

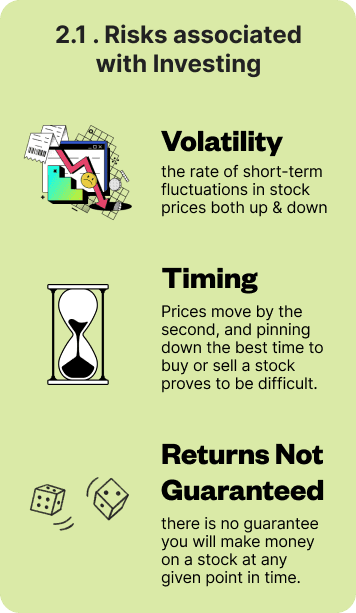

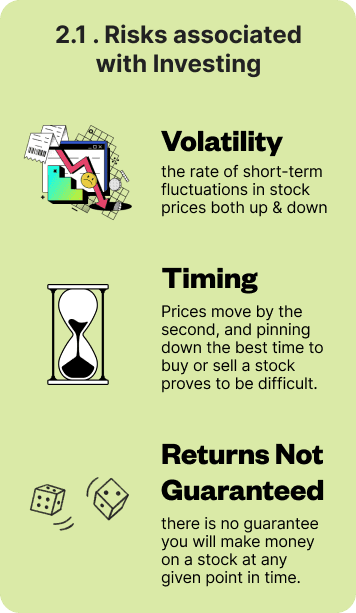

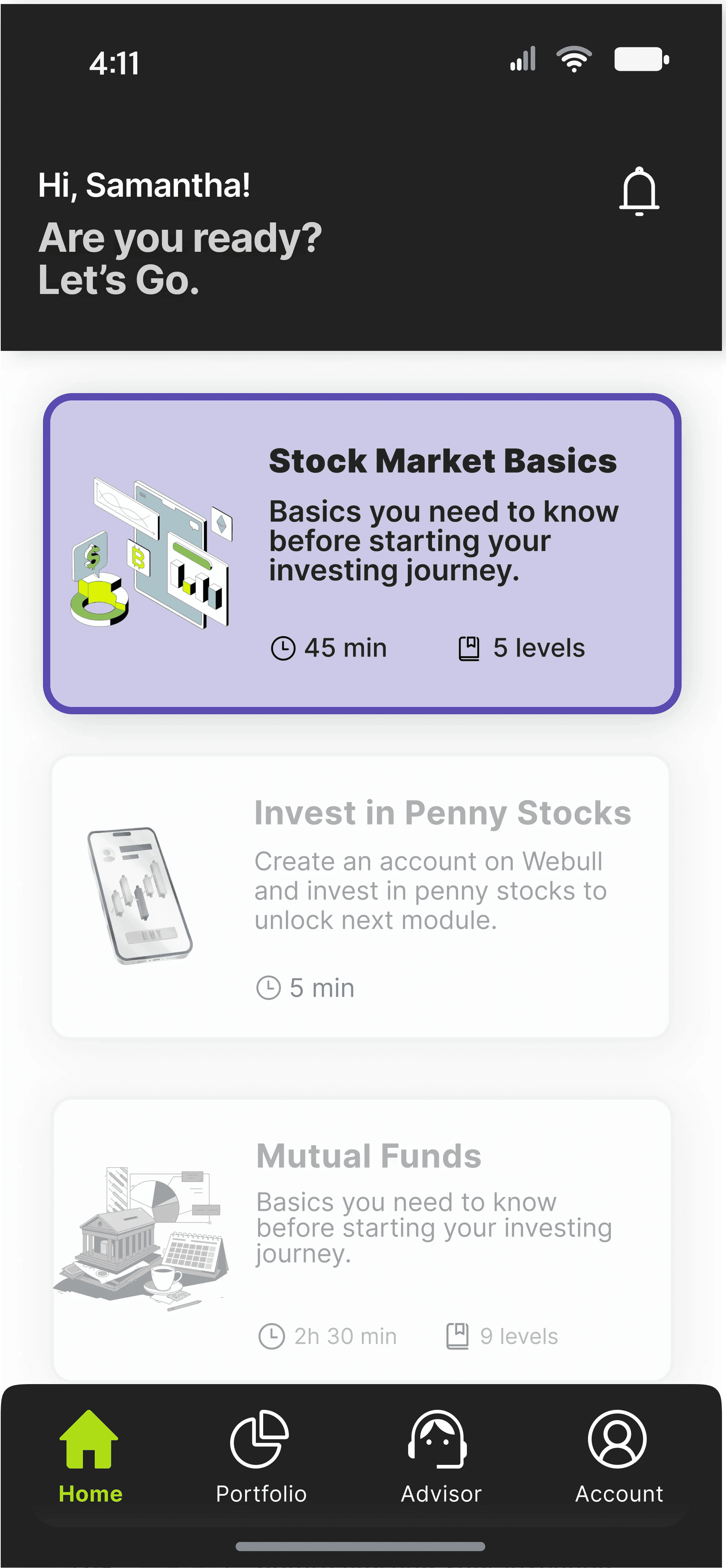

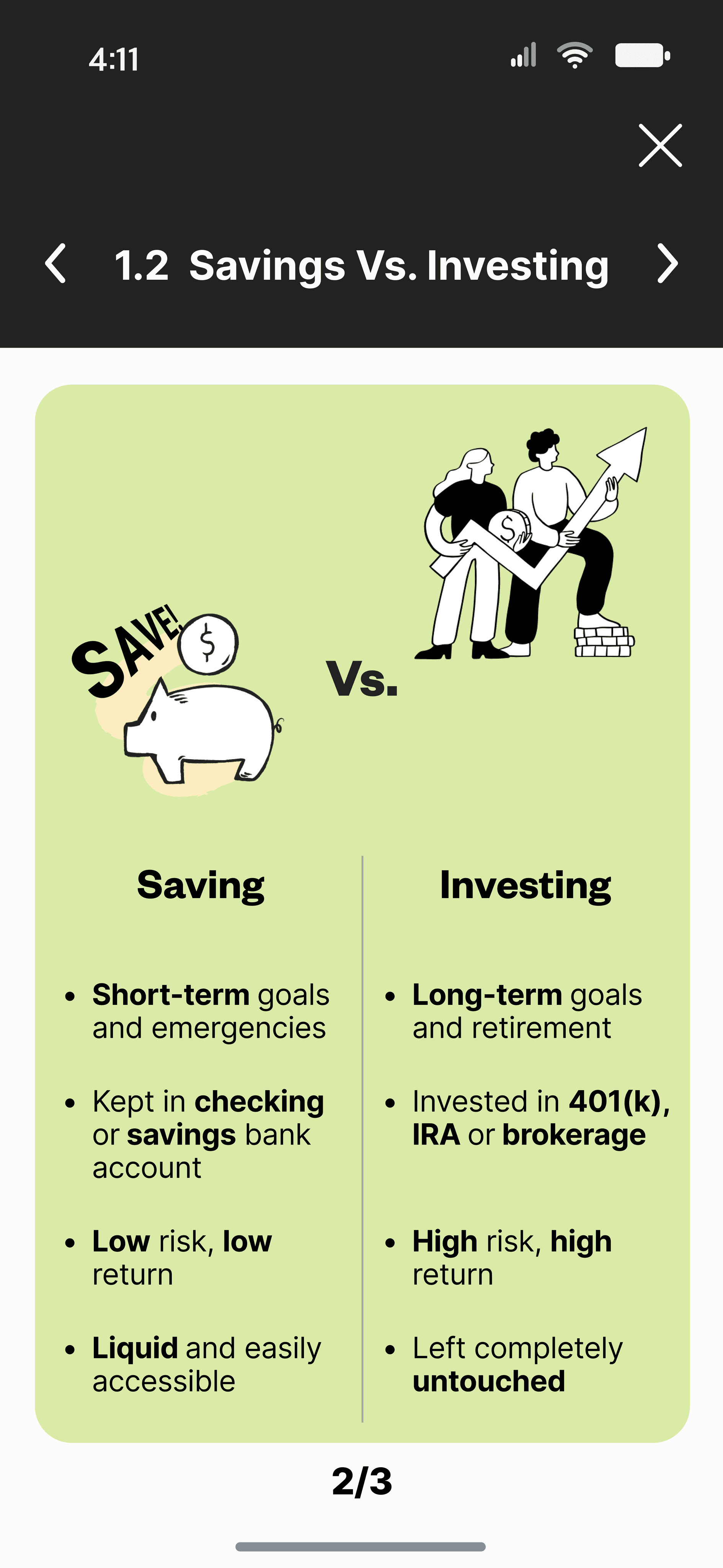

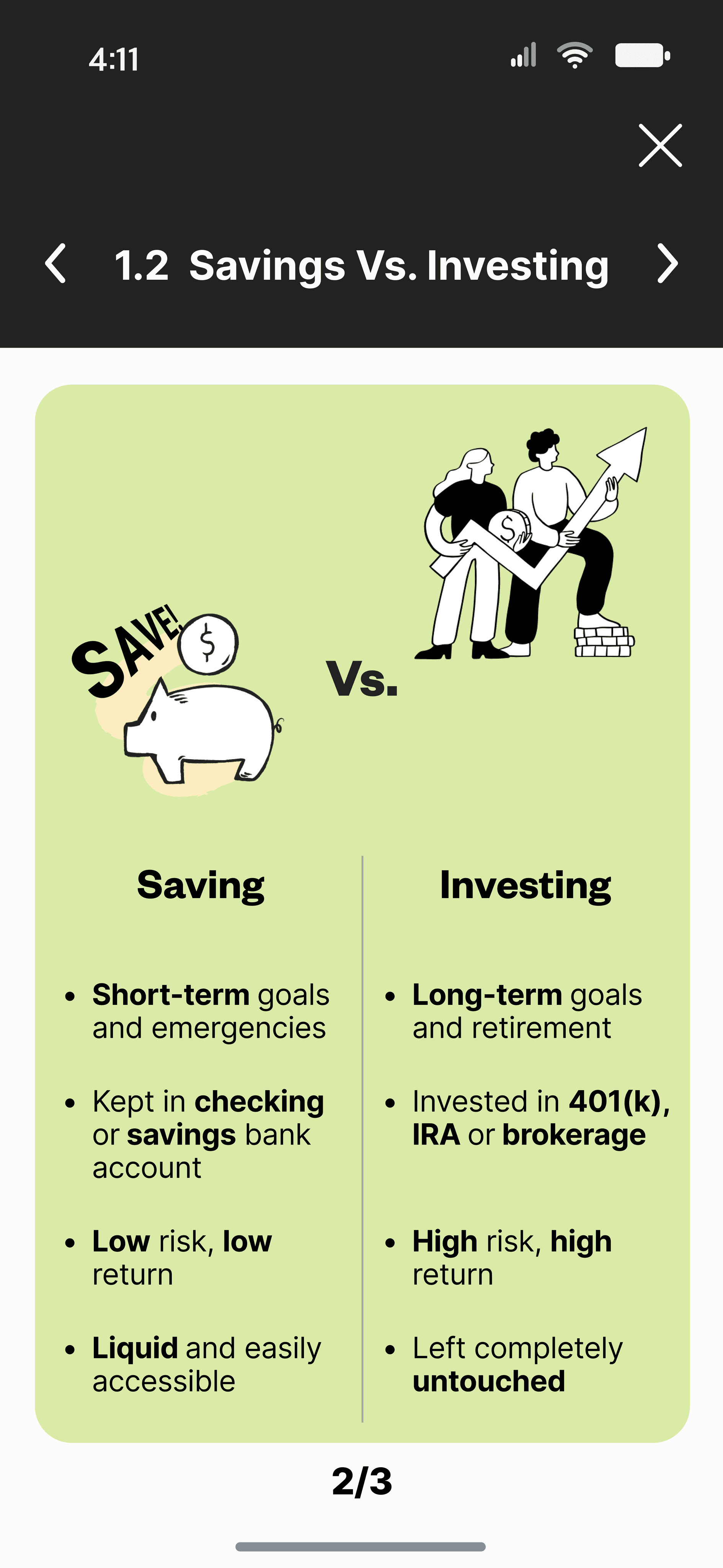

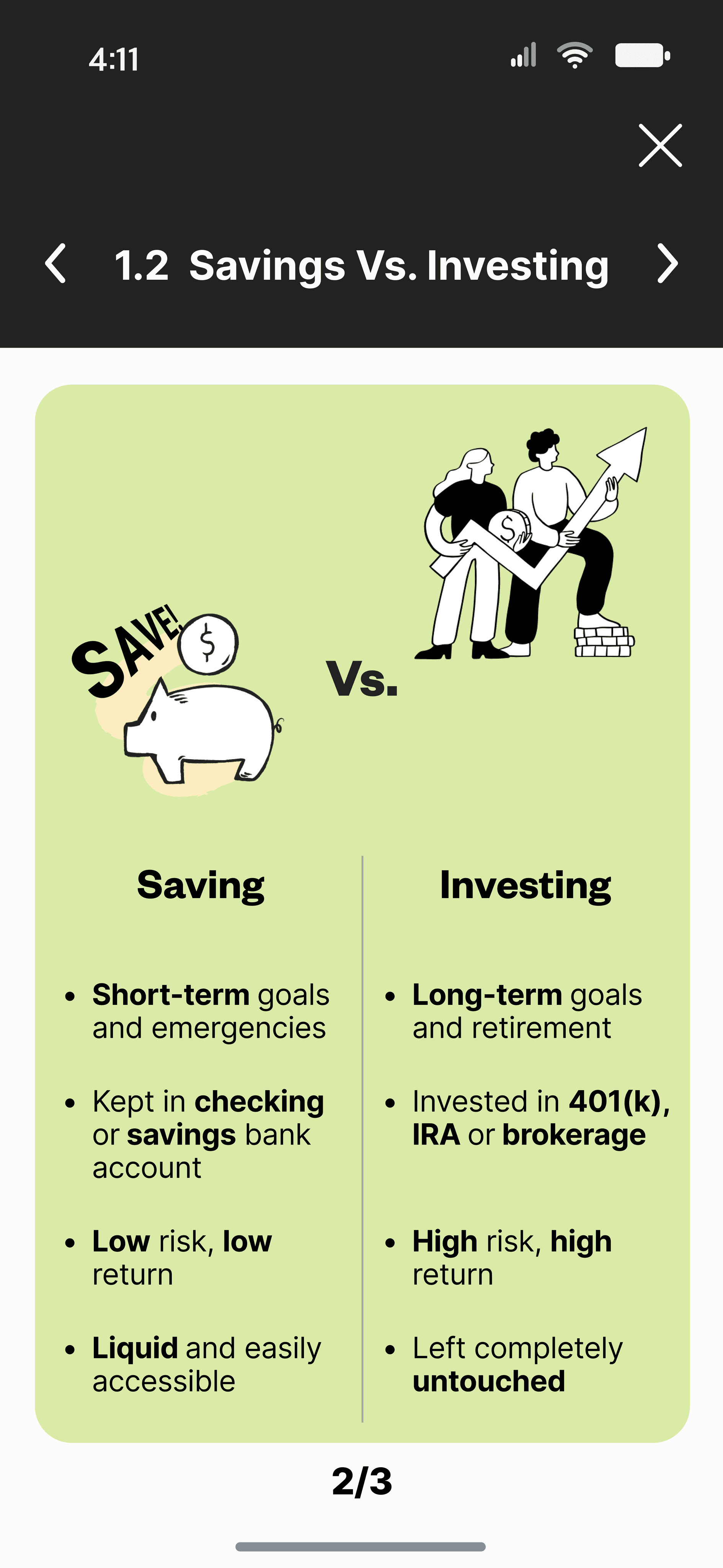

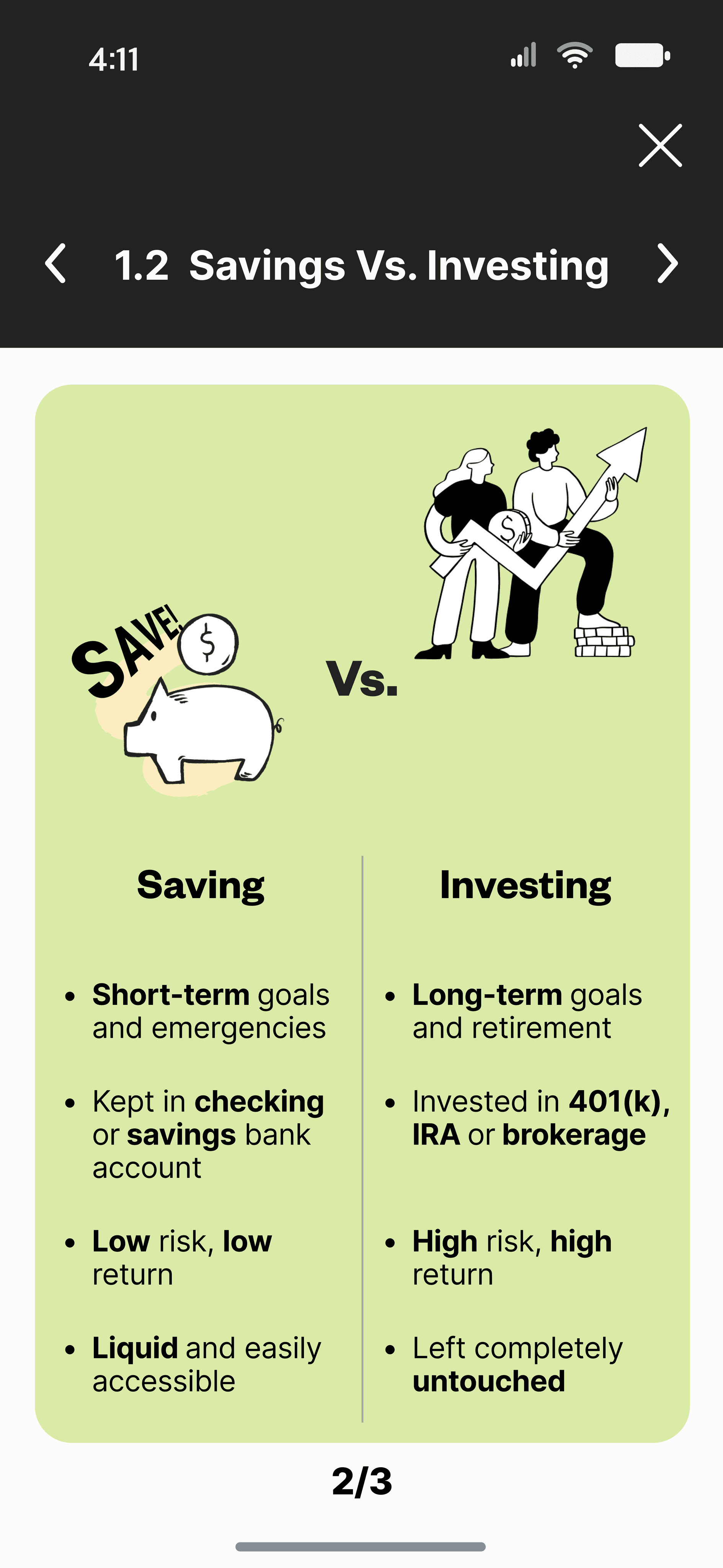

Interactive Learning:

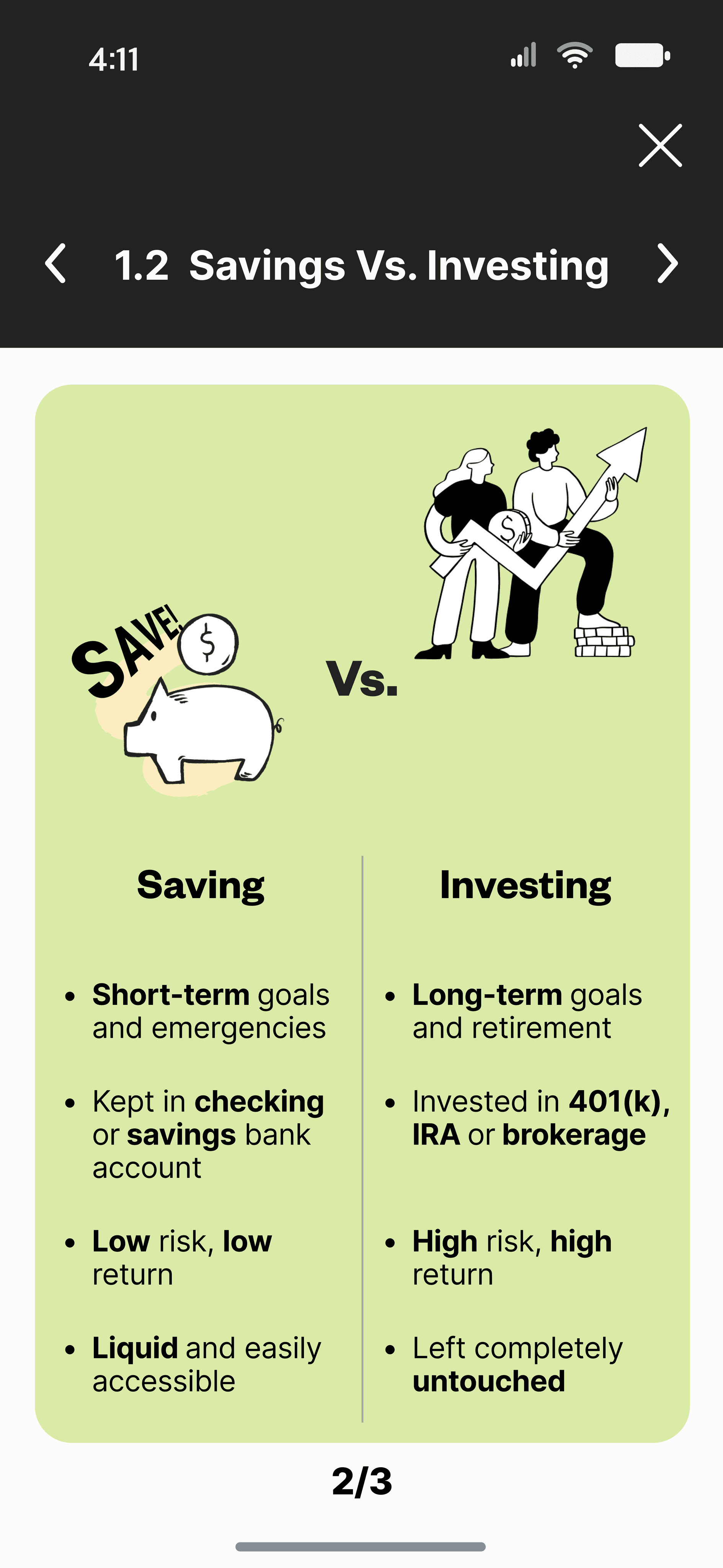

Learning is made fun and easy through placards

Interactive Learning:

Learning is made fun and easy through placards

Interactive Learning:

Learning is made fun and easy through placards

Interactive Learning:

Learning is made fun and easy through placards

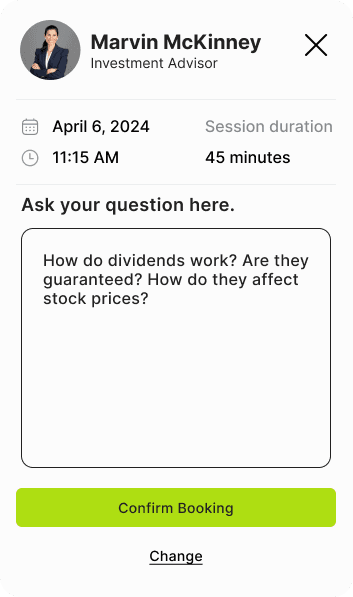

Mentorship:

Book personalized sessions for tailored advice and experience sharing.

Mentorship:

Book personalized sessions for tailored advice and experience sharing.

Mentorship:

Book personalized sessions for tailored advice and experience sharing.

Mentorship:

Book personalized sessions for tailored advice and experience sharing.

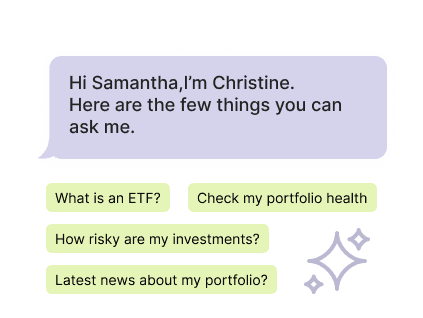

AI-Based Portfolio Feedback:

AI-driven insights help optimize investments based on individual goals

AI-Based Portfolio Feedback:

AI-driven insights help optimize investments based on individual goals

AI-Based Portfolio Feedback:

AI-driven insights help optimize investments based on individual goals

AI-Based Portfolio Feedback:

AI-driven insights help optimize investments based on individual goals

THE DISCOVERY

THE DISCOVERY

THE DISCOVERY

THE DISCOVERY

THE DISCOVERY

WOMEN LACK CONFIDENCE IN MAKING INDEPENDENT FINANCIAL DECISIONS

WOMEN LACK CONFIDENCE IN MAKING INDEPENDENT FINANCIAL DECISIONS

WOMEN LACK CONFIDENCE IN MAKING INDEPENDENT FINANCIAL DECISIONS

WOMEN LACK CONFIDENCE IN MAKING INDEPENDENT FINANCIAL DECISIONS

WOMEN LACK CONFIDENCE IN MAKING INDEPENDENT FINANCIAL DECISIONS

Women seek to start their financial investment journey in the US stock market for confident decision-making and a secure financial future. Reports show that 59% of women lack investment confidence.

A BNY Mellon survey found 31% of women discouraged by complicated language. Women face higher financial risks and approach retirement with less savings due to longer lifespans, shorter careers, lower earnings, and fewer pension benefits.

Women seek to start their financial investment journey in the US stock market for confident decision-making and a secure financial future. Reports show that 59% of women lack investment confidence.

A BNY Mellon survey found 31% of women discouraged by complicated language. Women face higher financial risks and approach retirement with less savings due to longer lifespans, shorter careers, lower earnings, and fewer pension benefits.

Women seek to start their financial investment journey in the US stock market for confident decision-making and a secure financial future. Reports show that 59% of women lack investment confidence.

A BNY Mellon survey found 31% of women discouraged by complicated language. Women face higher financial risks and approach retirement with less savings due to longer lifespans, shorter careers, lower earnings, and fewer pension benefits.

Women seek to start their financial investment journey in the US stock market for confident decision-making and a secure financial future. Reports show that 59% of women lack investment confidence.

A BNY Mellon survey found 31% of women discouraged by complicated language. Women face higher financial risks and approach retirement with less savings due to longer lifespans, shorter careers, lower earnings, and fewer pension benefits.

Women seek to start their financial investment journey in the US stock market for confident decision-making and a secure financial future. Reports show that 59% of women lack investment confidence.

A BNY Mellon survey found 31% of women discouraged by complicated language. Women face higher financial risks and approach retirement with less savings due to longer lifespans, shorter careers, lower earnings, and fewer pension benefits.

PRIMARY RESEARCH

PRIMARY RESEARCH

Users expressed that they rely on others for financial decisions due to their lack of knowledge, which results in low self-confidence.

Users expressed that they rely on others for financial decisions due to their lack of knowledge, which results in low self-confidence.

Users expressed that they rely on others for financial decisions due to their lack of knowledge, which results in low self-confidence.

Users expressed that they rely on others for financial decisions due to their lack of knowledge, which results in low self-confidence.

Lack of Financial Knowledge

Lack of Financial Knowledge

Lack of Financial Knowledge

Lack of Financial Knowledge

USER INSIGHTS

USER INSIGHTS

USER INSIGHTS

USER INSIGHTS

My lack of knowledge and distrust have affected my decisions to be more risk-averse and passive when engaging with financial investments.

-Usha G.

My lack of knowledge and distrust have affected my decisions to be more risk-averse and passive when engaging with financial investments.

-Usha G.

My lack of knowledge and distrust have affected my decisions to be more risk-averse and passive when engaging with financial investments.

-Usha G.

"

75% of users faced challenges with complex financial terminology and concepts, leading to low confidence, frustration, and self-doubt in making informed investment decisions.

75% of users faced challenges with complex financial terminology and concepts, leading to low confidence, frustration, and self-doubt in making informed investment decisions.

75% of users faced challenges with complex financial terminology and concepts, leading to low confidence, frustration, and self-doubt in making informed investment decisions.

75% of users faced challenges with complex financial terminology and concepts, leading to low confidence, frustration, and self-doubt in making informed investment decisions.

Challenges with Terminology and Concepts

Challenges with Terminology and

Concepts

Challenges with Terminology and Concepts

Challenges with Terminology and Concepts

Challenges with Terminology and Concepts

Investors prefer secure and steady options and shy away from risk in their financial decisions, constrained by inadequate understanding and assurance, and apprehensive of parting with their laboriously earned wealth.

Investors prefer secure and steady options and shy away from risk in their financial decisions, constrained by inadequate understanding and assurance, and apprehensive of parting with their laboriously earned wealth.

Investors prefer secure and steady options and shy away from risk in their financial decisions, constrained by inadequate understanding and assurance, and apprehensive of parting with their laboriously earned wealth.

Investors prefer secure and steady options and shy away from risk in their financial decisions, constrained by inadequate understanding and assurance, and apprehensive of parting with their laboriously earned wealth.

Fear of losing their money

Fear of losing their money

Fear of losing their money

Fear of losing their money

Users heavily rely on friends, family, and trusted individuals for financial guidance, often without verifying the accuracy of the information, which impacts their investment decisions.

Users heavily rely on friends, family, and trusted individuals for financial guidance, often without verifying the accuracy of the information, which impacts their investment decisions.

Users heavily rely on friends, family, and trusted individuals for financial guidance, often without verifying the accuracy of the information, which impacts their investment decisions.

Users heavily rely on friends, family, and trusted individuals for financial guidance, often without verifying the accuracy of the information, which impacts their investment decisions.

Peer influence

Peer influence

Peer influence

Peer influence

External articles sometimes provided valuable knowledge, but their complex terminology and superficial content confused me.

-Shivani M.

External articles sometimes provided valuable knowledge, but their complex terminology and superficial content confused me.

-Shivani M.

External articles sometimes provided valuable knowledge, but their complex terminology and superficial content confused me.

-Shivani M.

External articles sometimes provided valuable knowledge, but their complex terminology and superficial content confused me.

-Shivani M.

"

"

OLD HMW STATEMENT…

OLD HMW STATEMENT…

RED OCEAN ALERT!

RED OCEAN ALERT!

RED OCEAN ALERT!

After conducting primary research and affinity mapping, I discovered I was dealing with a "red ocean" situation—highly competitive with many similar challenges. To navigate this and create a "blue ocean" of unique opportunities, I applied the 5 Whys & Problem Tree Analysis technique to drill down and refine the issue further, uncovering more specific insights and opportunities for innovation.

After conducting primary research and affinity mapping, I discovered I was dealing with a "red ocean" situation—highly competitive with many similar challenges. To navigate this and create a "blue ocean" of unique opportunities, I applied the 5 Whys & Problem Tree Analysis technique to drill down and refine the issue further, uncovering more specific insights and opportunities for innovation.

After conducting primary research and affinity mapping, I discovered I was dealing with a "red ocean" situation—highly competitive with many similar challenges. To navigate this and create a "blue ocean" of unique opportunities, I applied the 5 Whys & Problem Tree Analysis technique to drill down and refine the issue further, uncovering more specific insights and opportunities for innovation.

After conducting primary research and affinity mapping, I discovered I was dealing with a "red ocean" situation—highly competitive with many similar challenges. To navigate this and create a "blue ocean" of unique opportunities, I applied the 5 Whys & Problem Tree Analysis technique to drill down and refine the issue further, uncovering more specific insights and opportunities for innovation.

How might we reduce the lack of confidence in financial investment decision-making among working women?

How might we reduce the lack of confidence in financial investment decision-making among working women?

How might we reduce the lack of confidence in financial investment decision-making among working women?

SCOPING

SCOPING

SCOPING

BLUE OCEAN

BLUE OCEAN

BLUE OCEAN

REFRAMING THE PROBLEM

REFRAMING THE PROBLEM

REFRAMING THE PROBLEM

HOW MIGHT WE…

HOW MIGHT WE…

HOW MIGHT WE…

" …reduce the complexity of financial terms for women starting their Independent financial investment journey in the US stock market?"

" …reduce the complexity of financial terms for women starting their Independent financial investment journey in the US stock market?"

" …reduce the complexity of financial terms for women starting their Independent financial investment journey in the US stock market?"

HOW BIG?

HOW BIG?

HOW BIG?

35%

35%

35%

Women feel that complicated language discourages them from investing or investing more than they currently do.

Women feel that complicated language discourages them from investing or investing more than they currently do.

Women feel that complicated language discourages them from investing or investing more than they currently do.

I struggled with financial jargon and trust issues, gradually gained confidence through successful investments, and sought user-friendly resources for clarity.

I struggled with financial jargon and trust issues, gradually gained confidence through successful investments, and sought user-friendly resources for clarity.

I struggled with financial jargon and trust issues, gradually gained confidence through successful investments, and sought user-friendly resources for clarity.

Needs user-friendly resources and support for gradual risk-taking and understanding investment options.

Needs user-friendly resources and support for gradual risk-taking and understanding investment options.

Needs user-friendly resources and support for gradual risk-taking and understanding investment options.

Single working woman

8 months into investing in stocks and bonds

0.8/10 confidence level.

Single working woman

8 months into investing in stocks and bonds

0.8/10 confidence level.

Single working woman

8 months into investing in stocks and bonds

0.8/10 confidence level.

Shivani M.

27 years

Shivani M.

27 years

Married dependent woman

1 year into investing in stocks, gold, mutual funds

1/10 confidence level.

Married dependent woman

1 year into investing in stocks, gold, mutual funds

1/10 confidence level.

Married dependent woman

1 year into investing in stocks, gold, mutual funds

1/10 confidence level.

Struggled with transitioning from fixed deposits to stocks, understanding financial jargon, managing risk, and needing user-friendly investment resources.

Struggled with transitioning from fixed deposits to stocks, understanding financial jargon, managing risk, and needing user-friendly investment resources.

Struggled with transitioning from fixed deposits to stocks, understanding financial jargon, managing risk, and needing user-friendly investment resources.

Desires accessible, straightforward information to simplify complex financial terms and boost investment confidence.

Desires accessible, straightforward information to simplify complex financial terms and boost investment confidence.

Desires accessible, straightforward information to simplify complex financial terms and boost investment confidence.

Shruti R.

27 years

Shruti R.

27 years

Married working woman

12 years into investing in stocks and bonds

9/10 confidence level.

Struggled with limited knowledge, was hesitant about partnerships, was cautious about initial investments, balanced, practical decisions with emotions, and maintained confidence.

Requires straightforward, simple investment tools for confident decision-making and balancing risk with security.

Shruti R.

27 years

Married working woman

12 years into investing in stocks and bonds

9/10 confidence level.

Married working woman

12 years into investing in stocks and bonds

9/10 confidence level.

Married working woman

12 years into investing in stocks and bonds

9/10 confidence level.

Struggled with limited knowledge, was hesitant about partnerships, was cautious about initial investments, balanced, practical decisions with emotions, and maintained confidence.

Struggled with limited knowledge, was hesitant about partnerships, was cautious about initial investments, balanced, practical decisions with emotions, and maintained confidence.

Struggled with limited knowledge, was hesitant about partnerships, was cautious about initial investments, balanced, practical decisions with emotions, and maintained confidence.

Requires straightforward, simple investment tools for confident decision-making and balancing risk with security.

Requires straightforward, simple investment tools for confident decision-making and balancing risk with security.

Requires straightforward, simple investment tools for confident decision-making and balancing risk with security.

Jigna R.

36 years

Jigna R.

36 years

USER PERSONAS

USER PERSONAS

USER PERSONAS

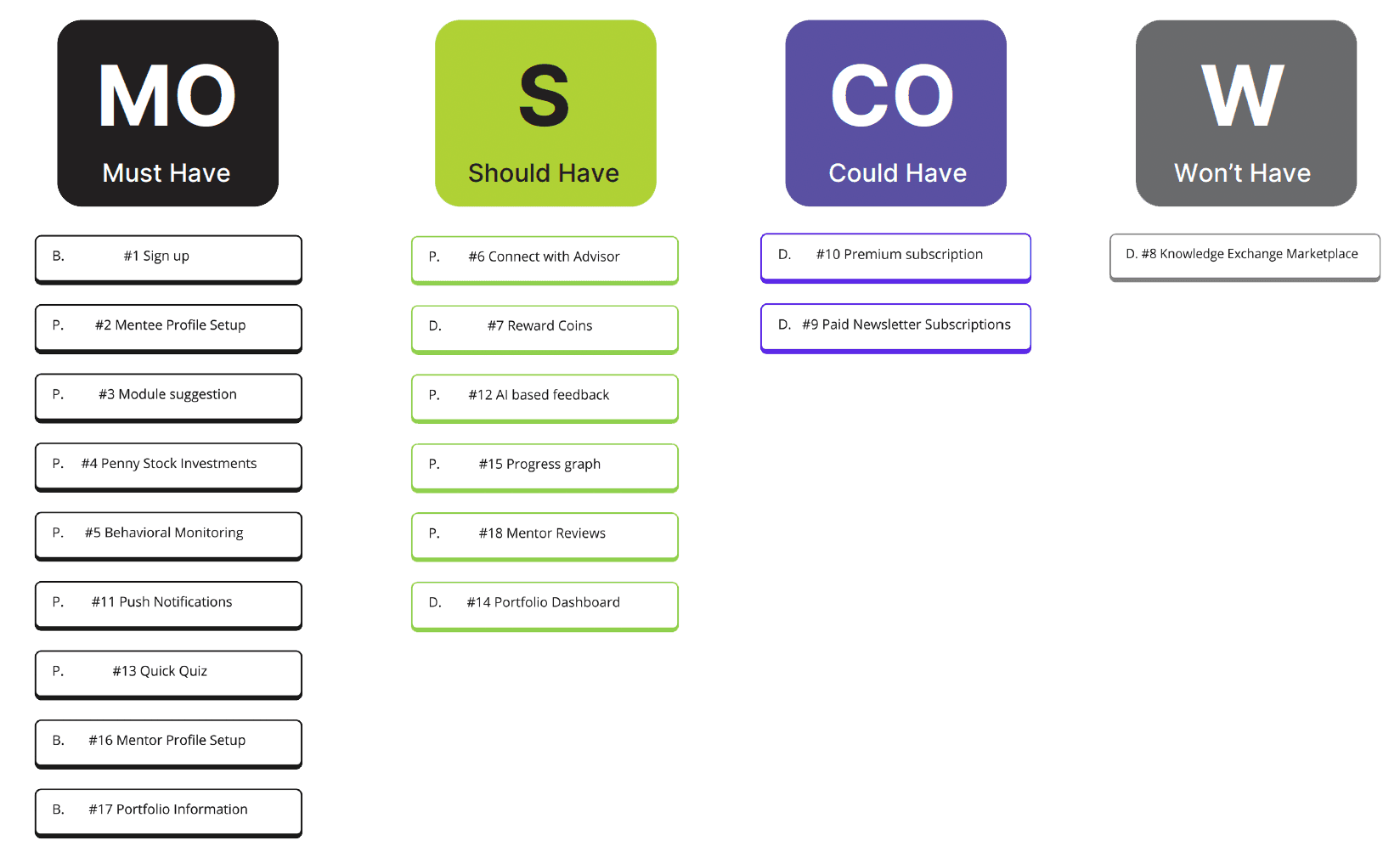

DESIGN SCOPING

IDEATING

Applying the MoSCoW method for mentor features prioritizes essential needs, ensuring critical functions are addressed first. This approach enhances the mentee experience, streamlines development, and focuses on impactful features while deferring less crucial elements to future updates.

Applying the MoSCoW method for mentor features prioritizes essential needs, ensuring critical functions are addressed first. This approach enhances the mentee experience, streamlines development, and focuses on impactful features while deferring less crucial elements to future updates.

Applying the MoSCoW method for mentor features prioritizes essential needs, ensuring critical functions are addressed first. This approach enhances the mentee experience, streamlines development, and focuses on impactful features while deferring less crucial elements to future updates.

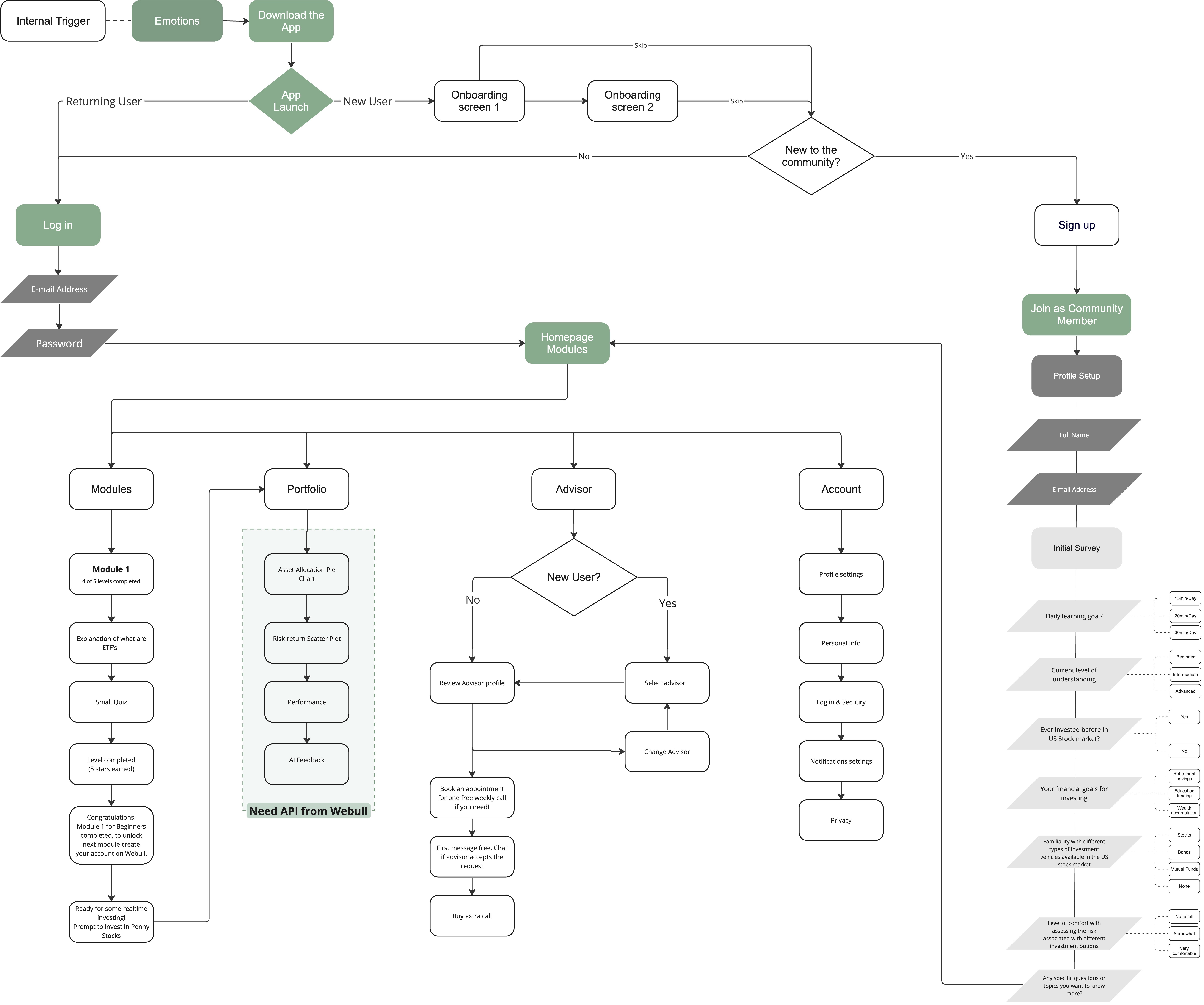

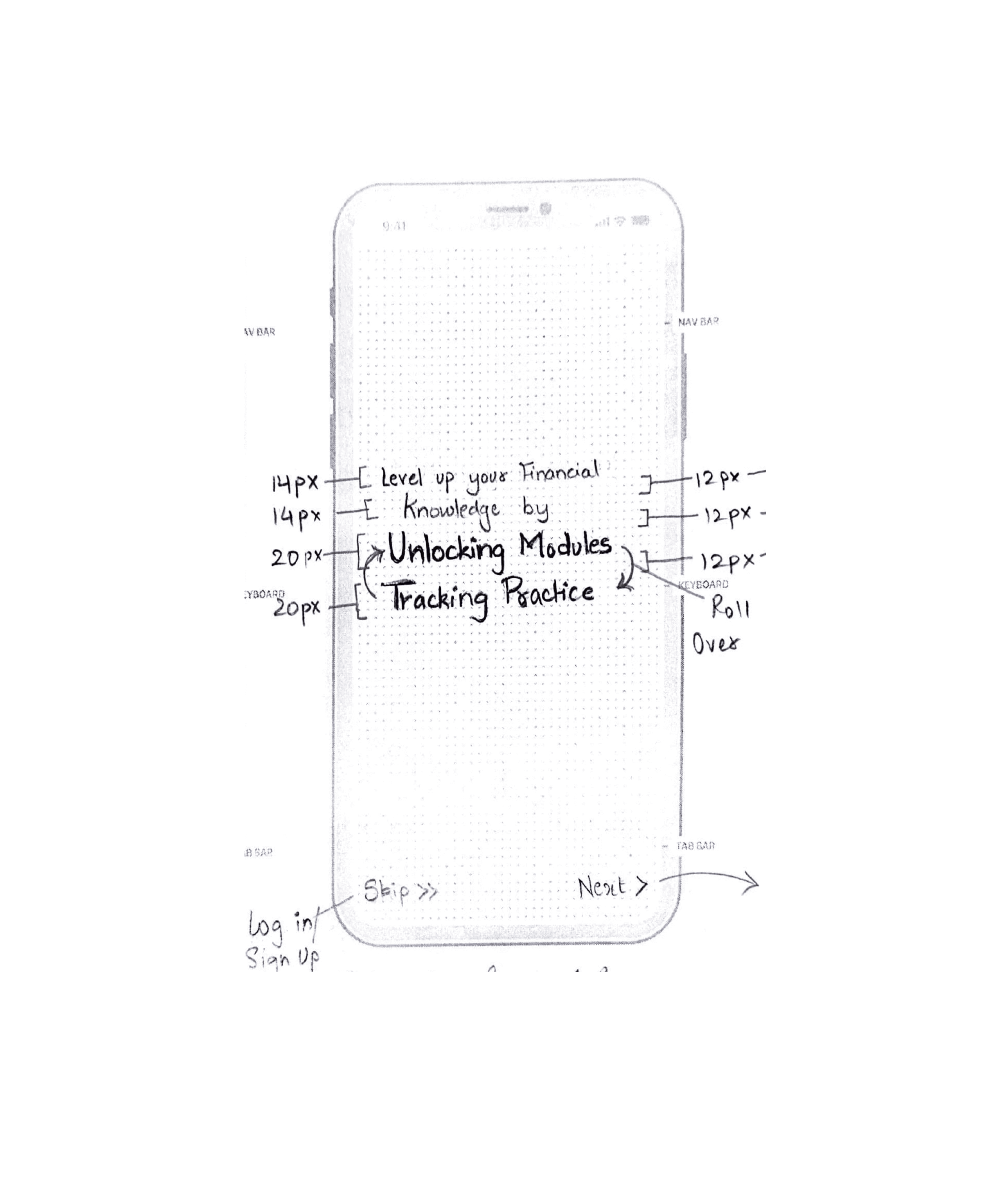

STRUCTURE

STRUCTURE

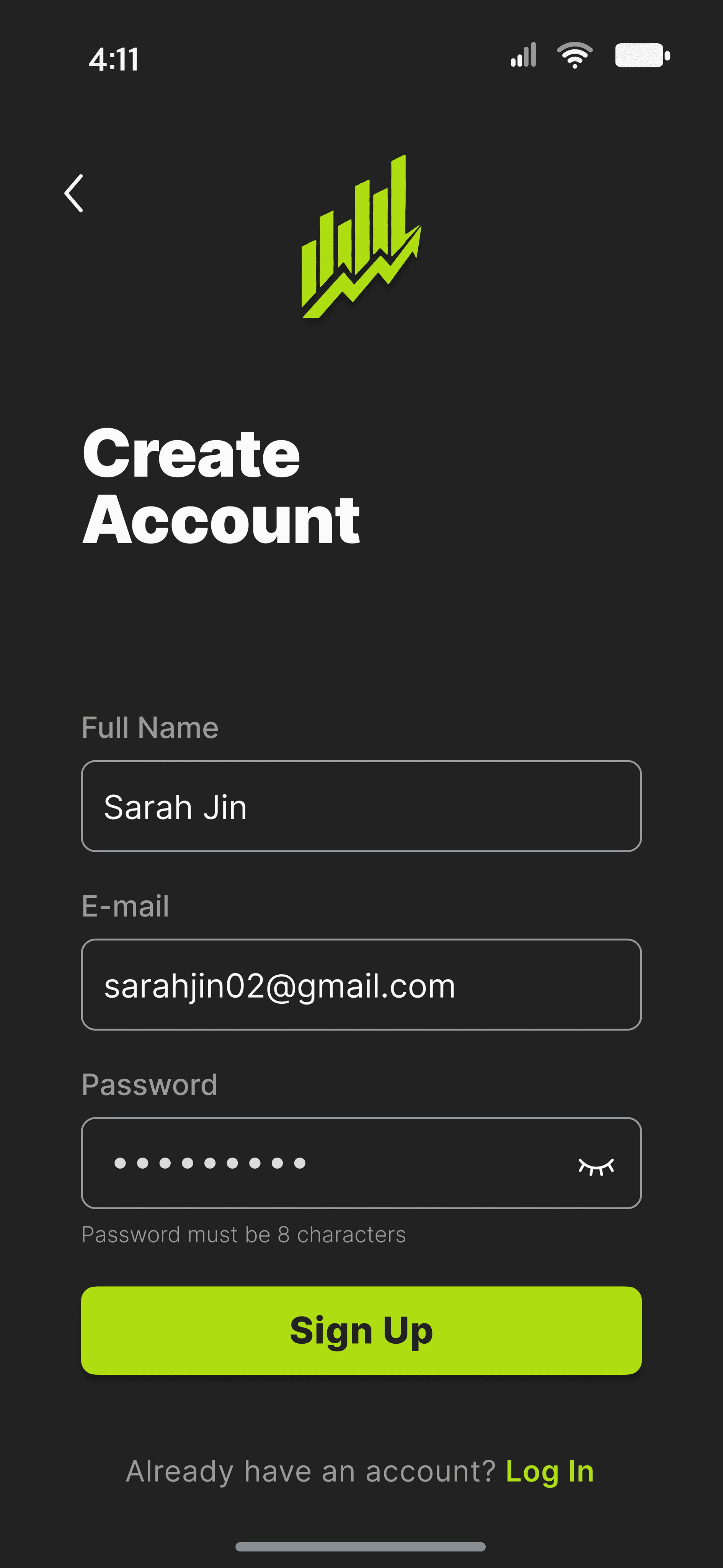

Creating an intuitive user flow ensures a seamless and enjoyable journey through the application. I mapped out users' steps as they engaged with the app, from selecting advisors to booking sessions and accessing tailored content. By designing a clear and efficient path, I enhanced the user experience, allowing users to achieve their financial goals easily. Through this process, I aimed to foster a supportive and empowering user environment, leading to greater satisfaction and success for the mentees.

Creating an intuitive user flow ensures a seamless and enjoyable journey through the application. I mapped out users' steps as they engaged with the app, from selecting advisors to booking sessions and accessing tailored content. By designing a clear and efficient path, I enhanced the user experience, allowing users to achieve their financial goals easily. Through this process, I aimed to foster a supportive and empowering user environment, leading to greater satisfaction and success for the mentees.

Creating an intuitive user flow ensures a seamless and enjoyable journey through the application. I mapped out users' steps as they engaged with the app, from selecting advisors to booking sessions and accessing tailored content. By designing a clear and efficient path, I enhanced the user experience, allowing users to achieve their financial goals easily. Through this process, I aimed to foster a supportive and empowering user environment, leading to greater satisfaction and success for the mentees.

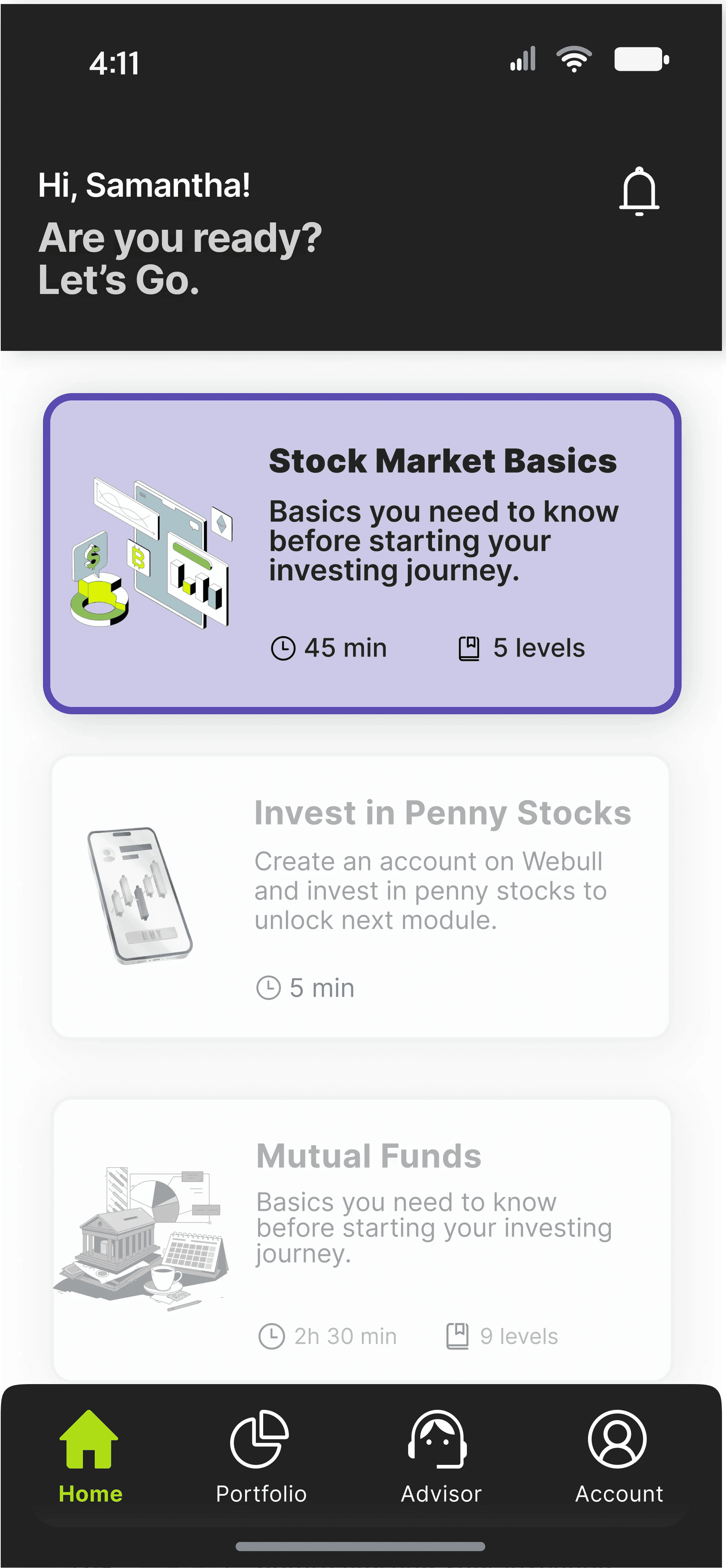

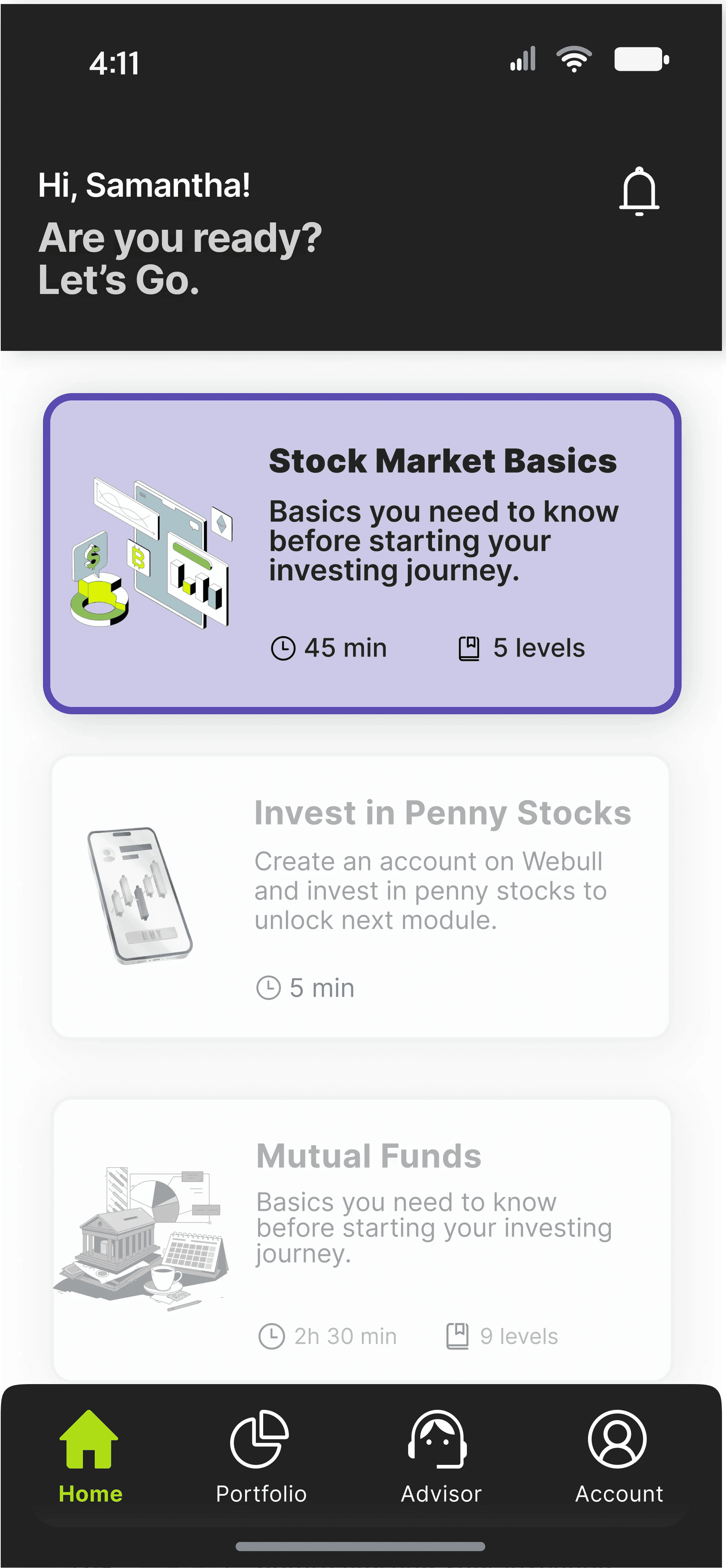

Dashboard

Dashboard

Dashboard

Module Screen

Onboarding Quiz

Dashboard log in

Module Screen

Onboarding Quiz

Dashboard log in

Module Screen

Onboarding Quiz

Dashboard log in

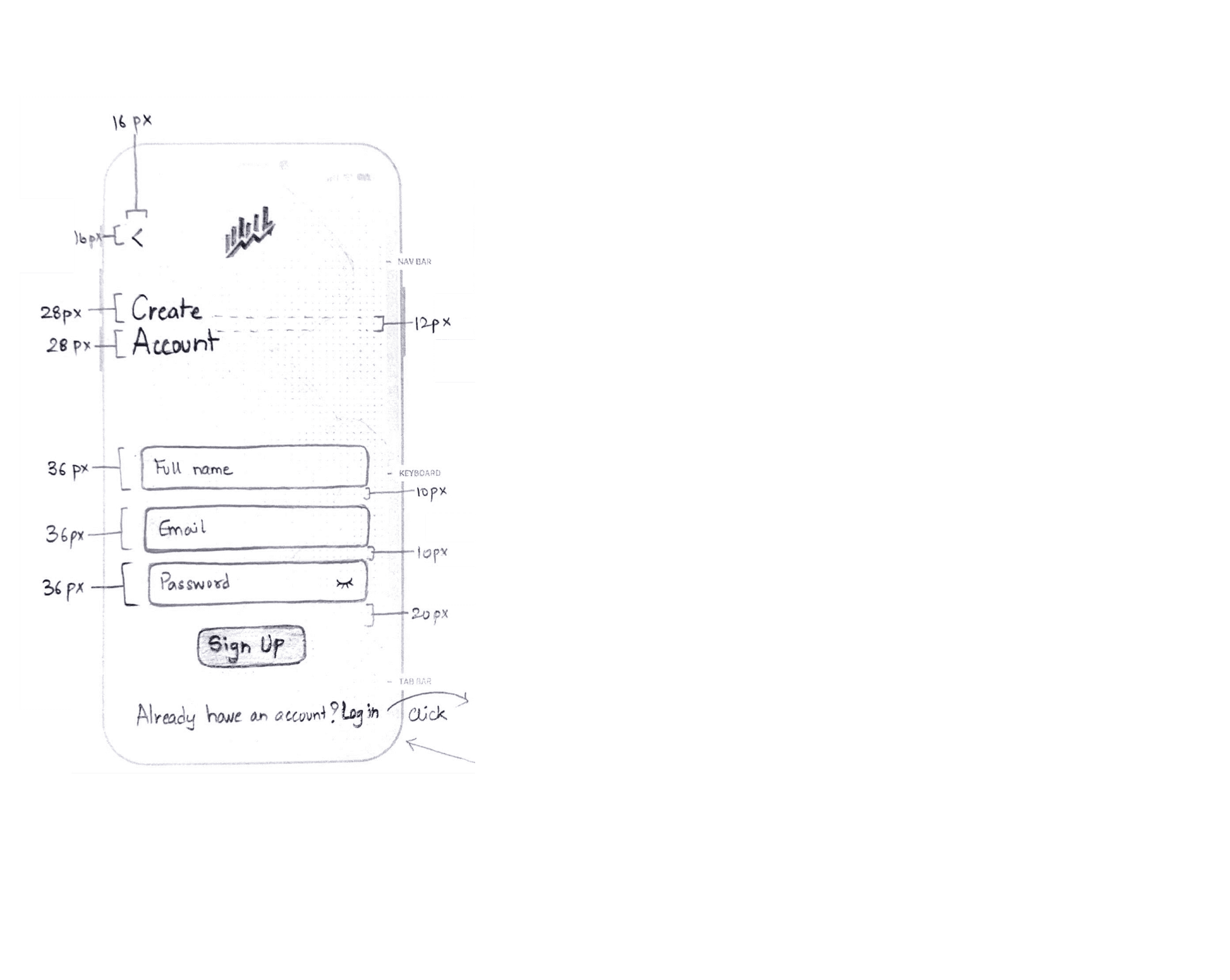

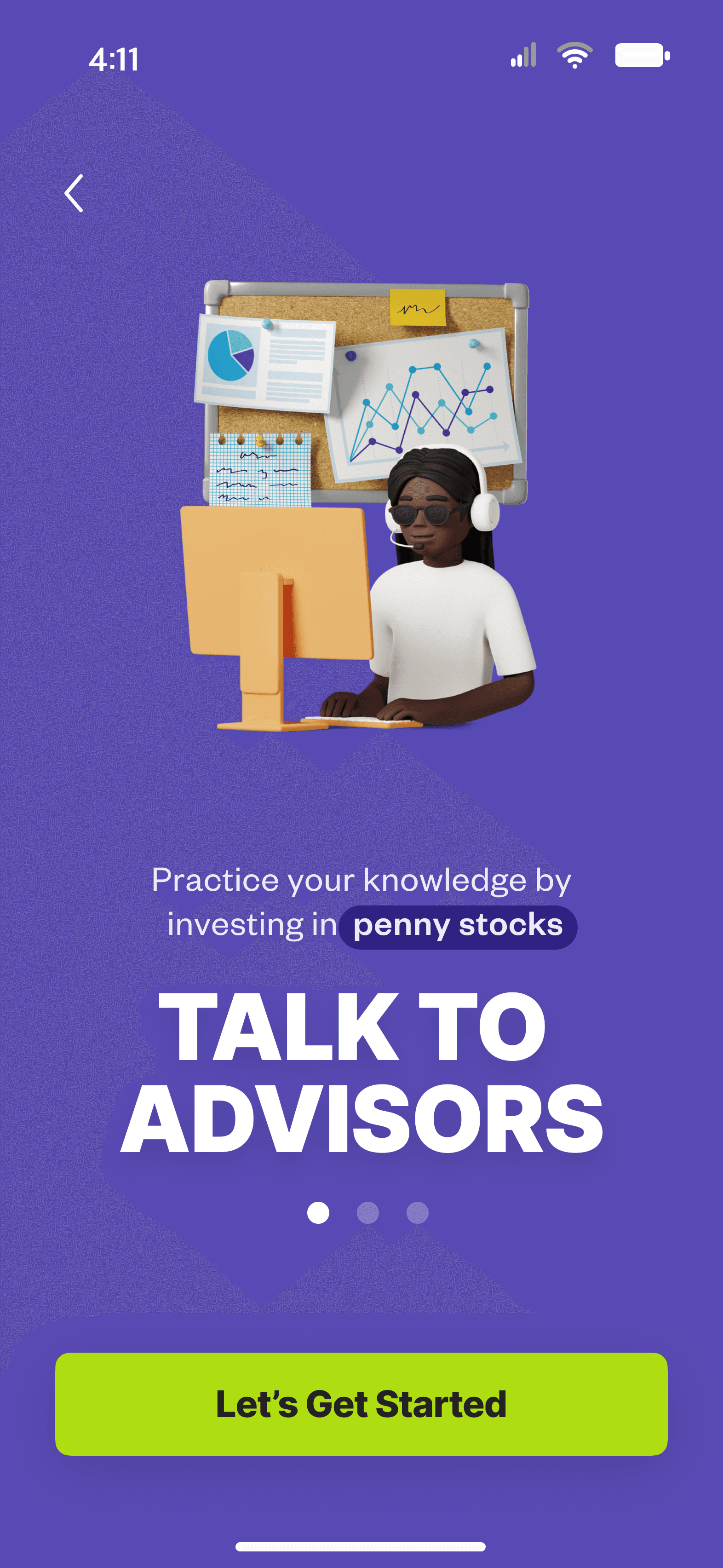

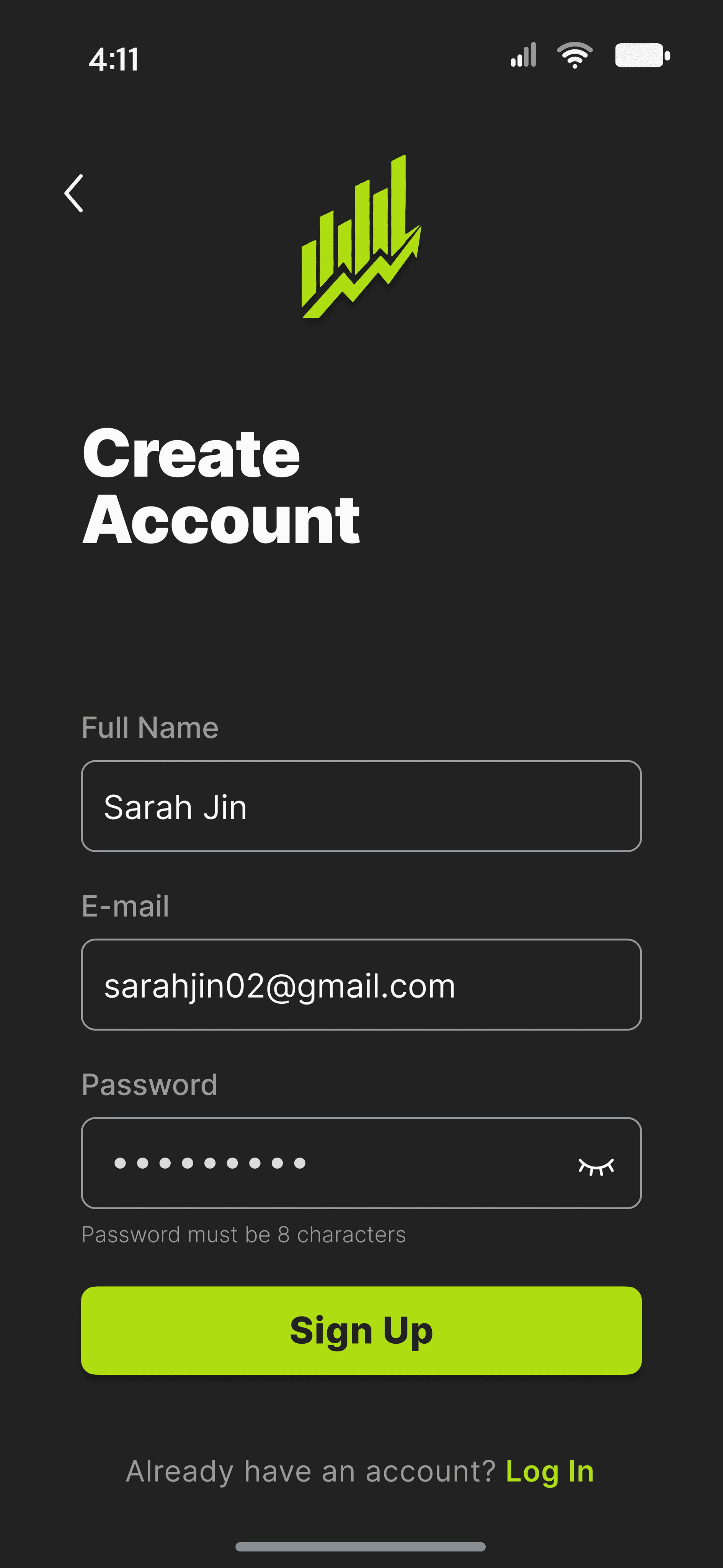

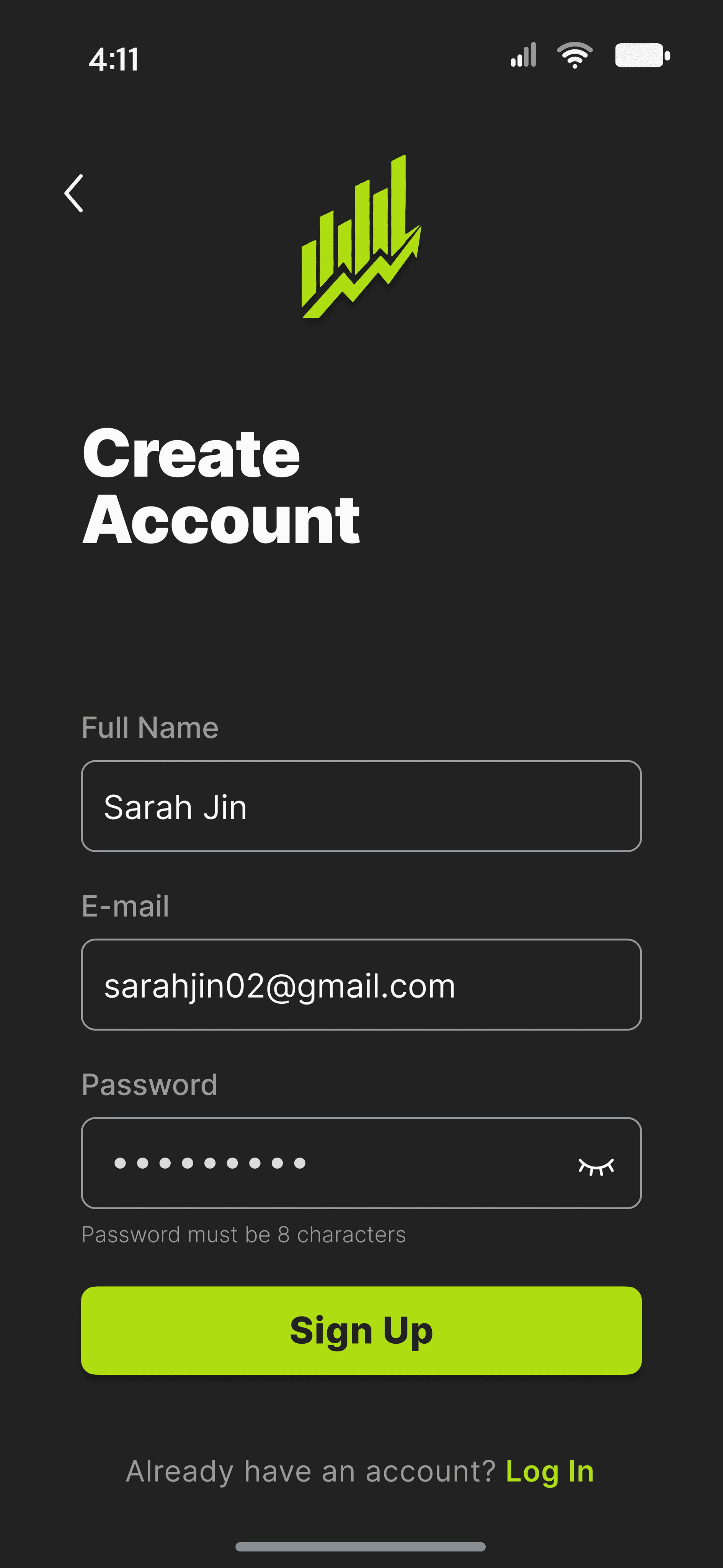

Onboarding Screen

Onboarding Screen

Onboarding Screen

Onboarding Screen

Onboarding Screen

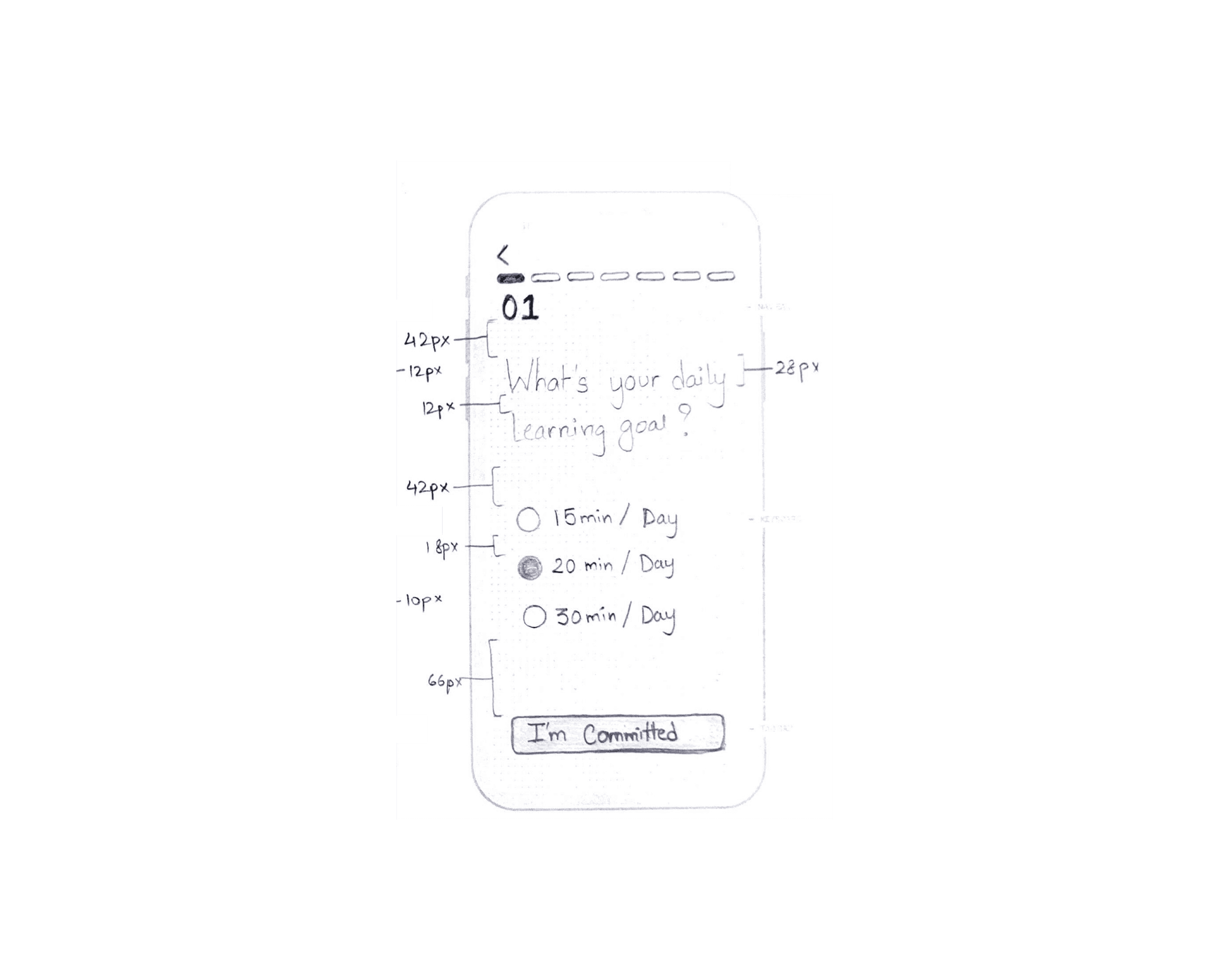

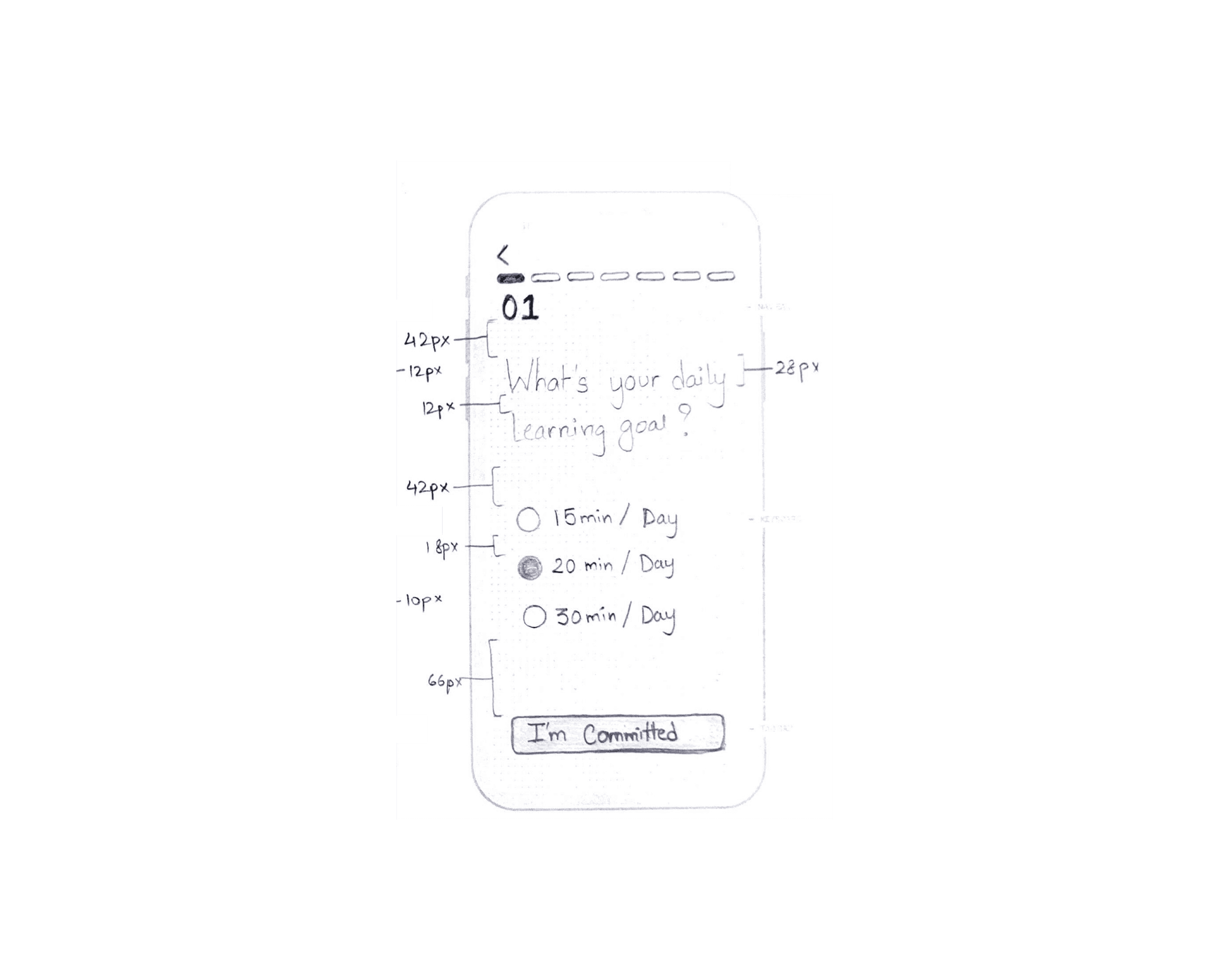

Onboarding Quiz

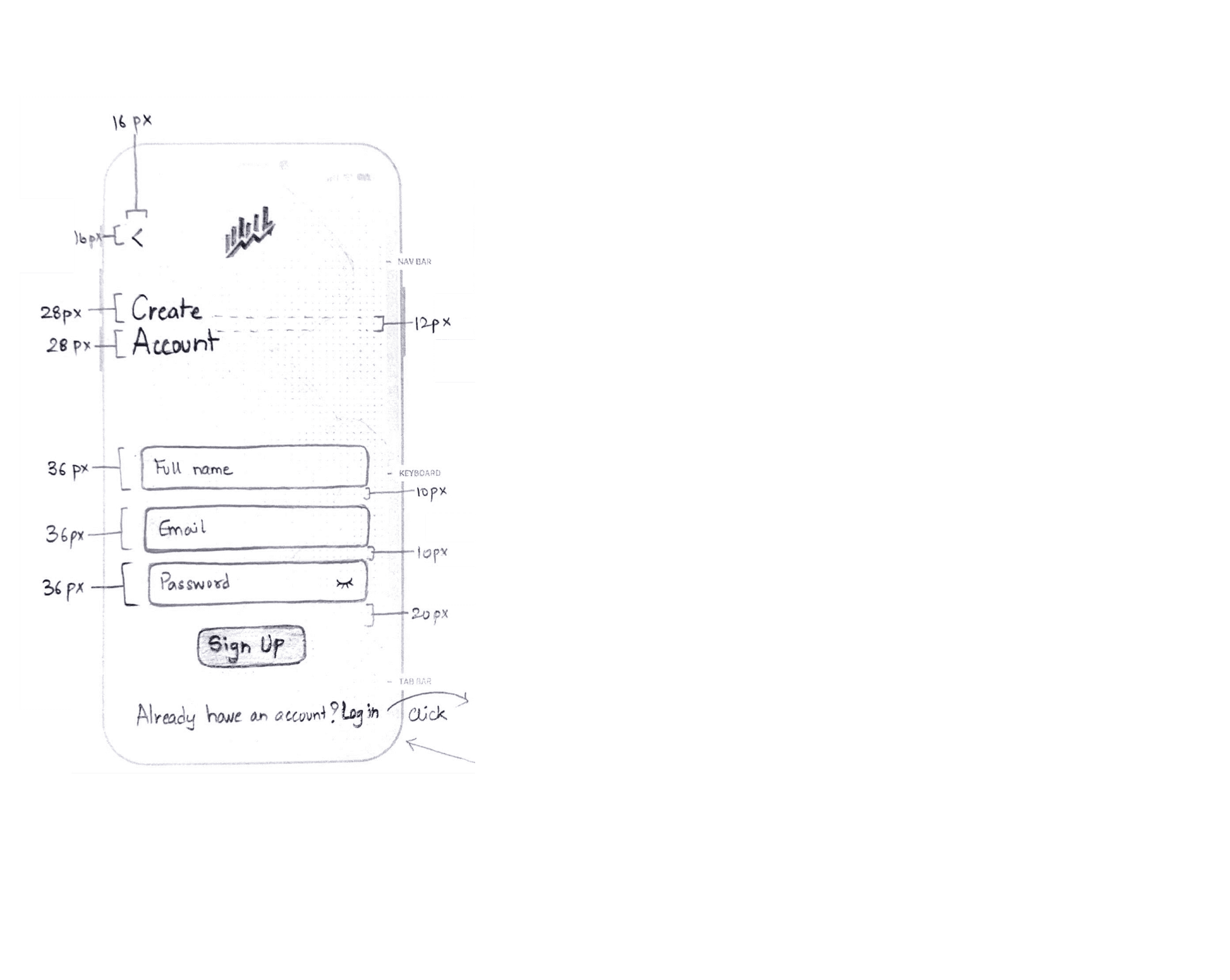

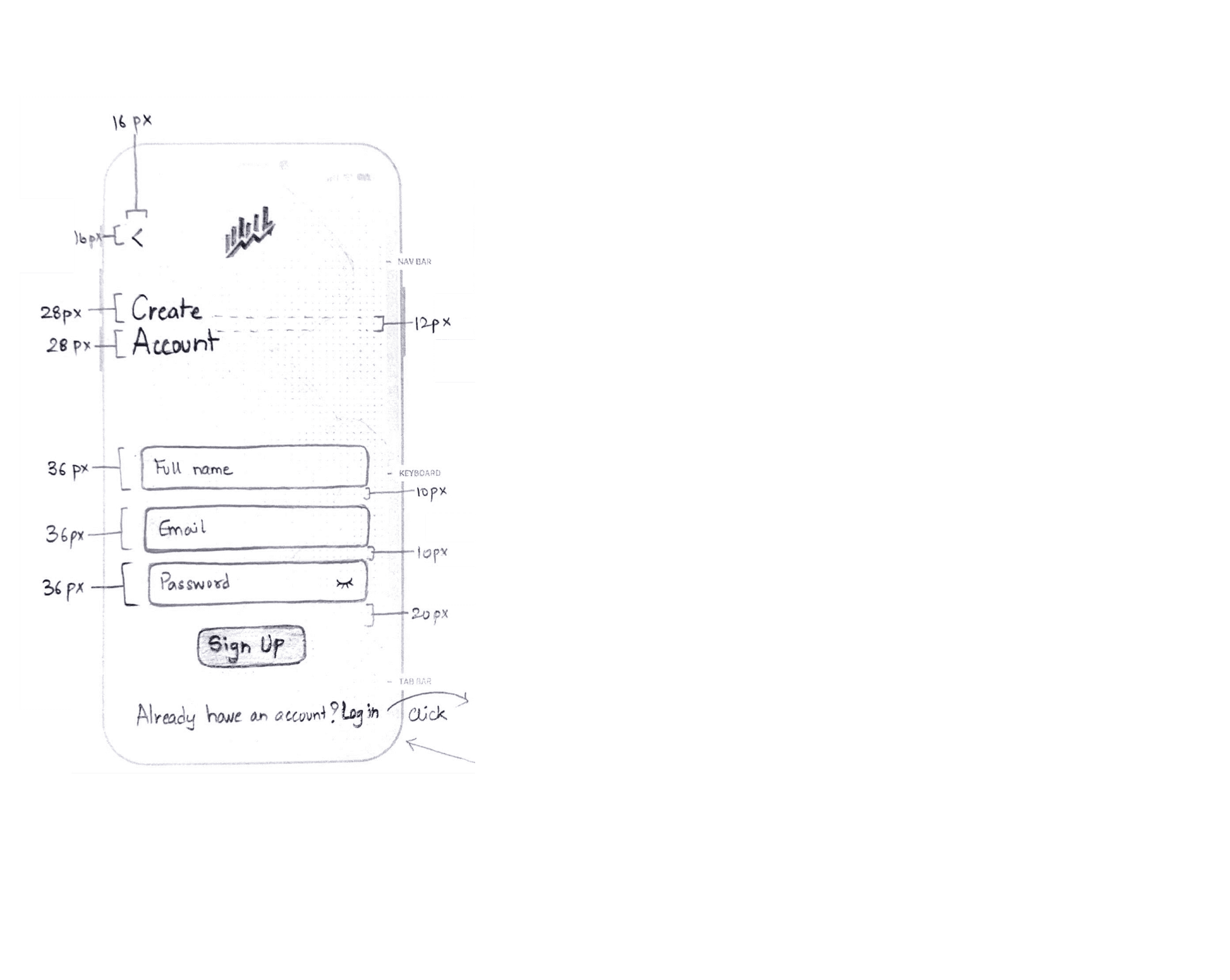

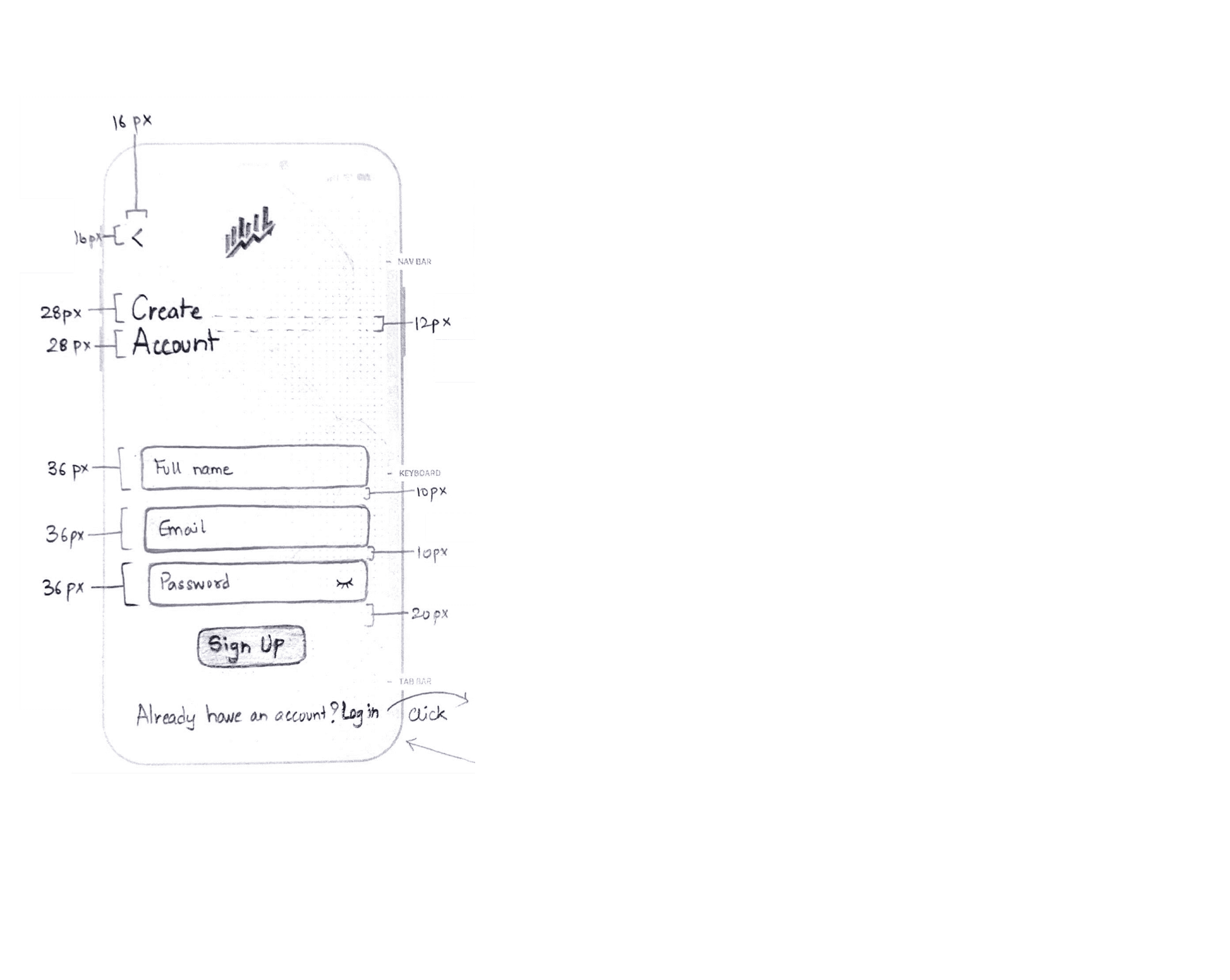

Sign Up

Onboarding Quiz

Sign Up

Onboarding Quiz

Sign Up

Onboarding Quiz

Sign Up

Onboarding Quiz

Sign Up

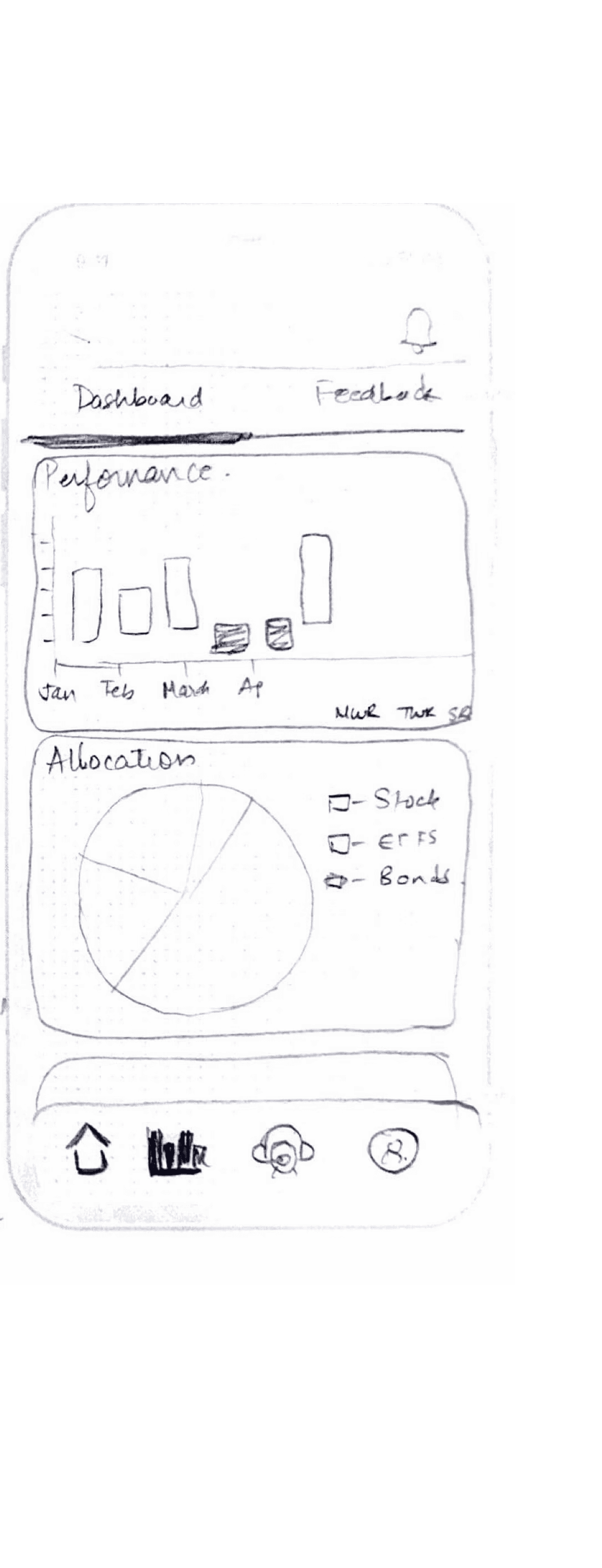

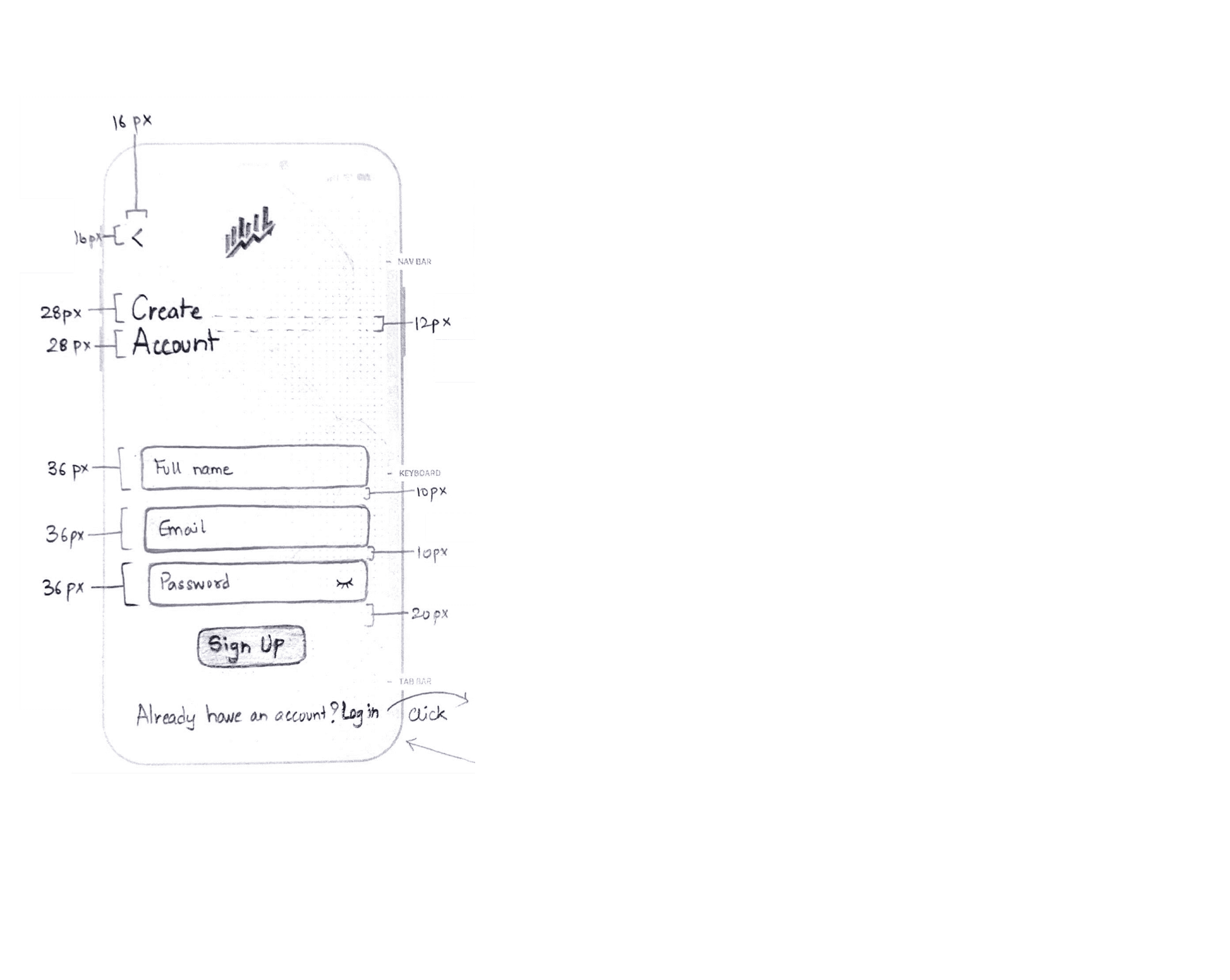

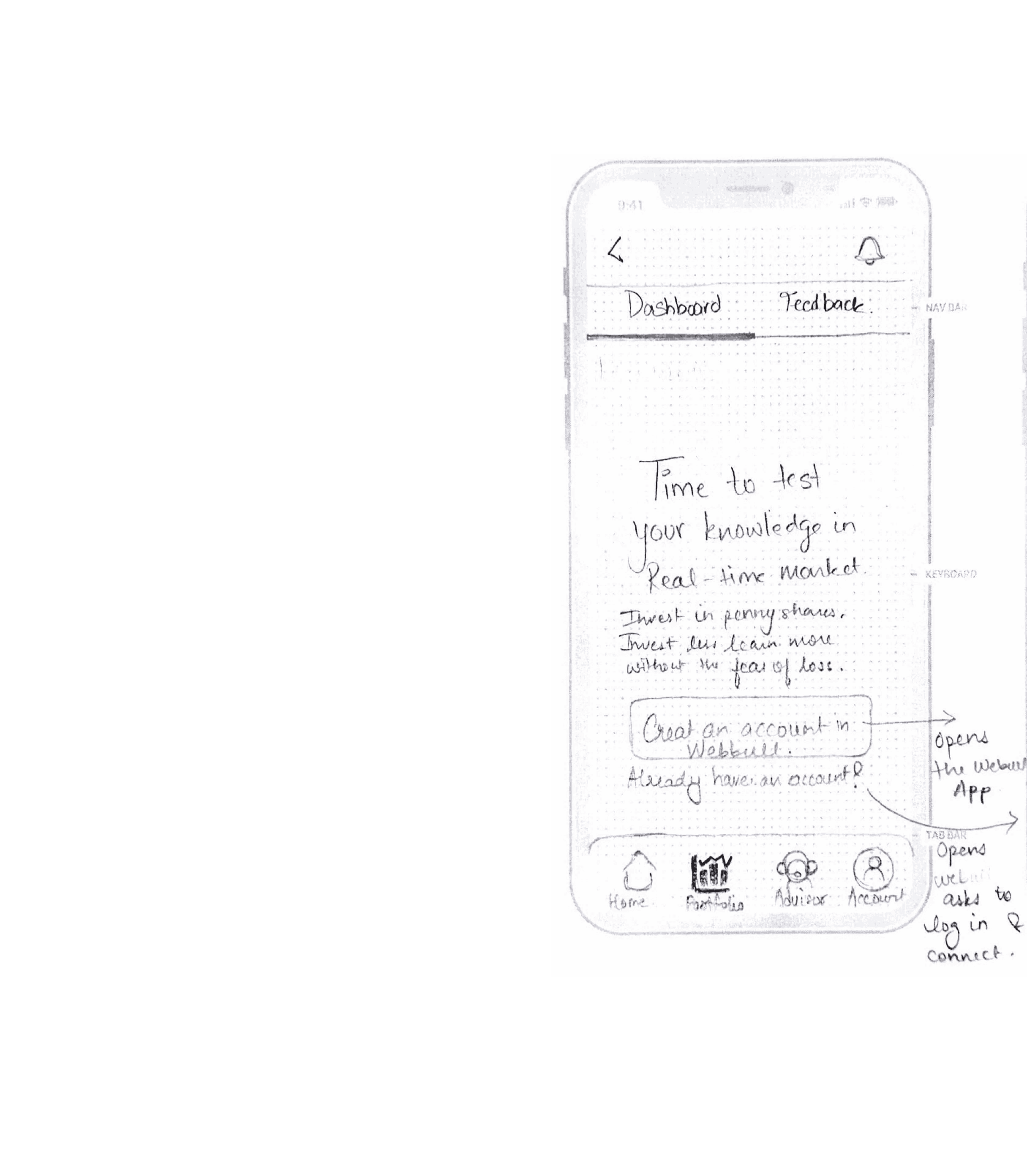

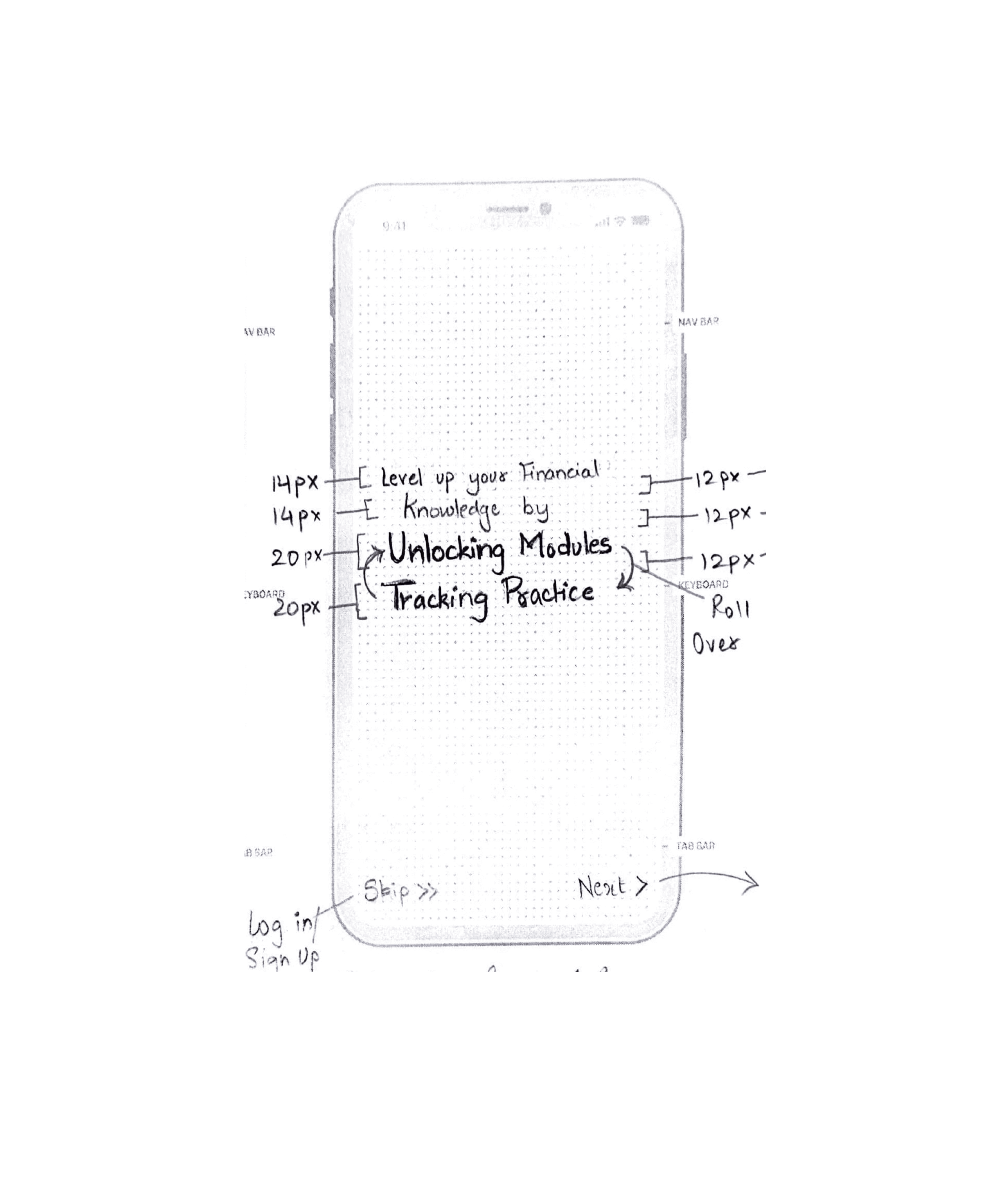

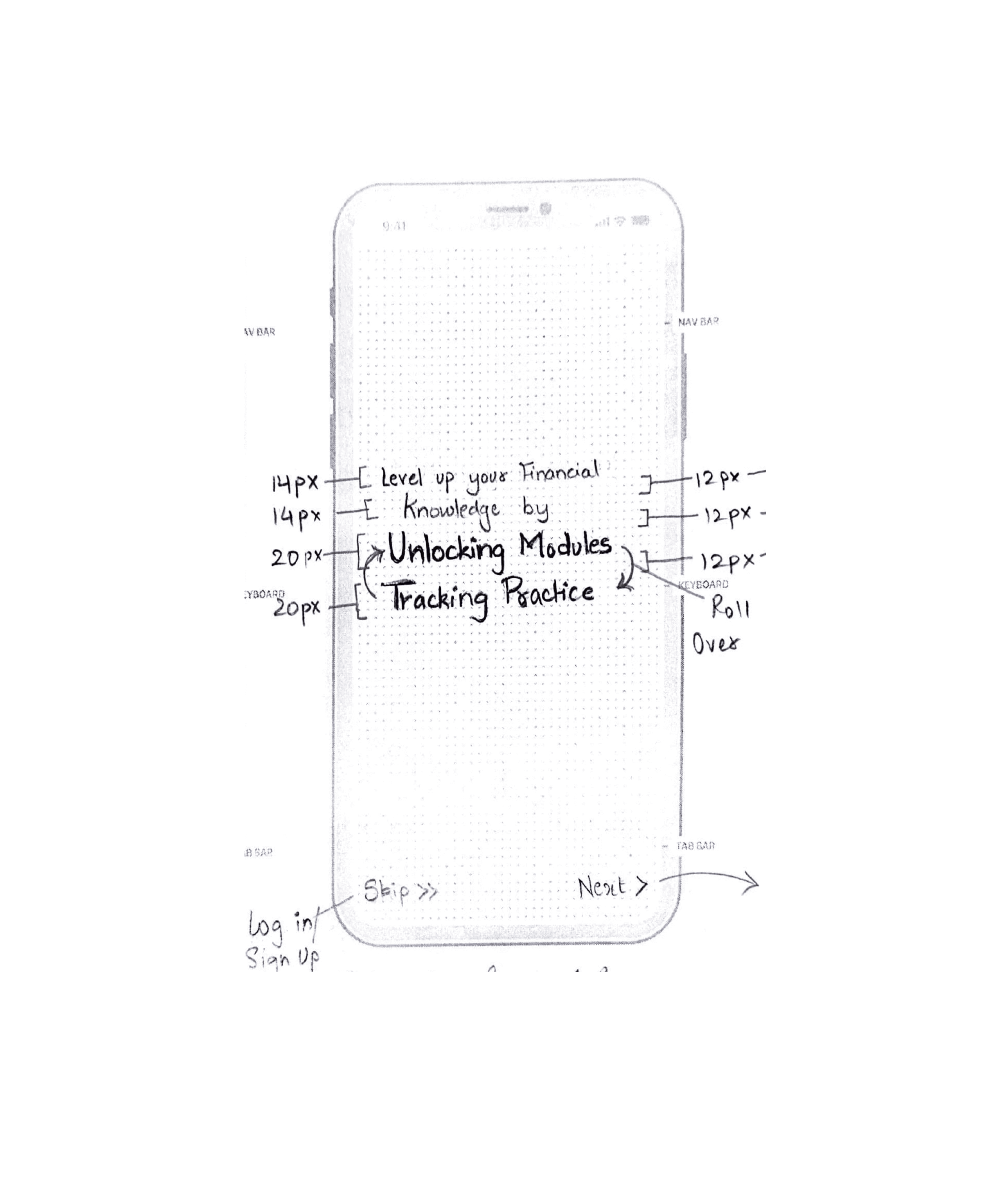

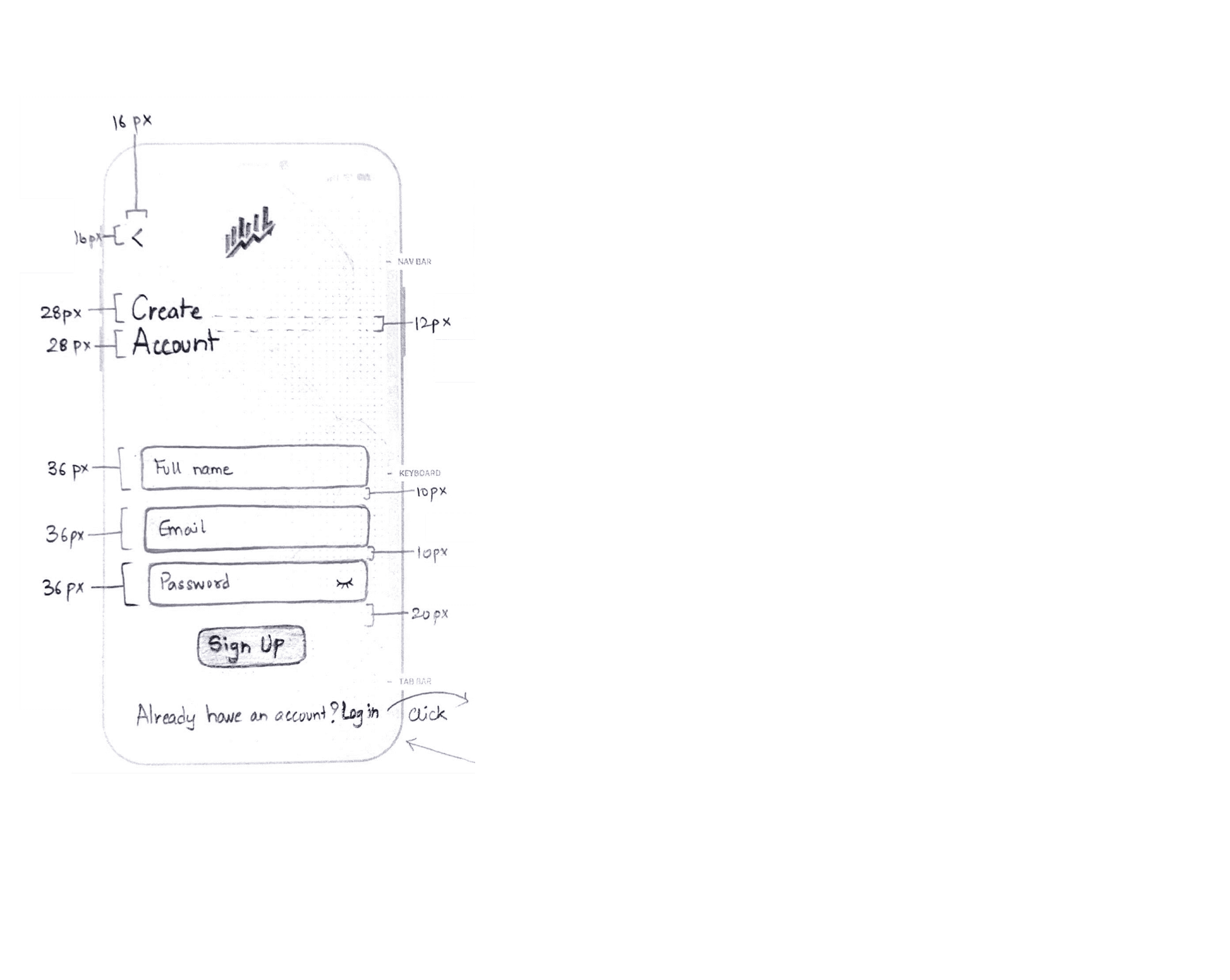

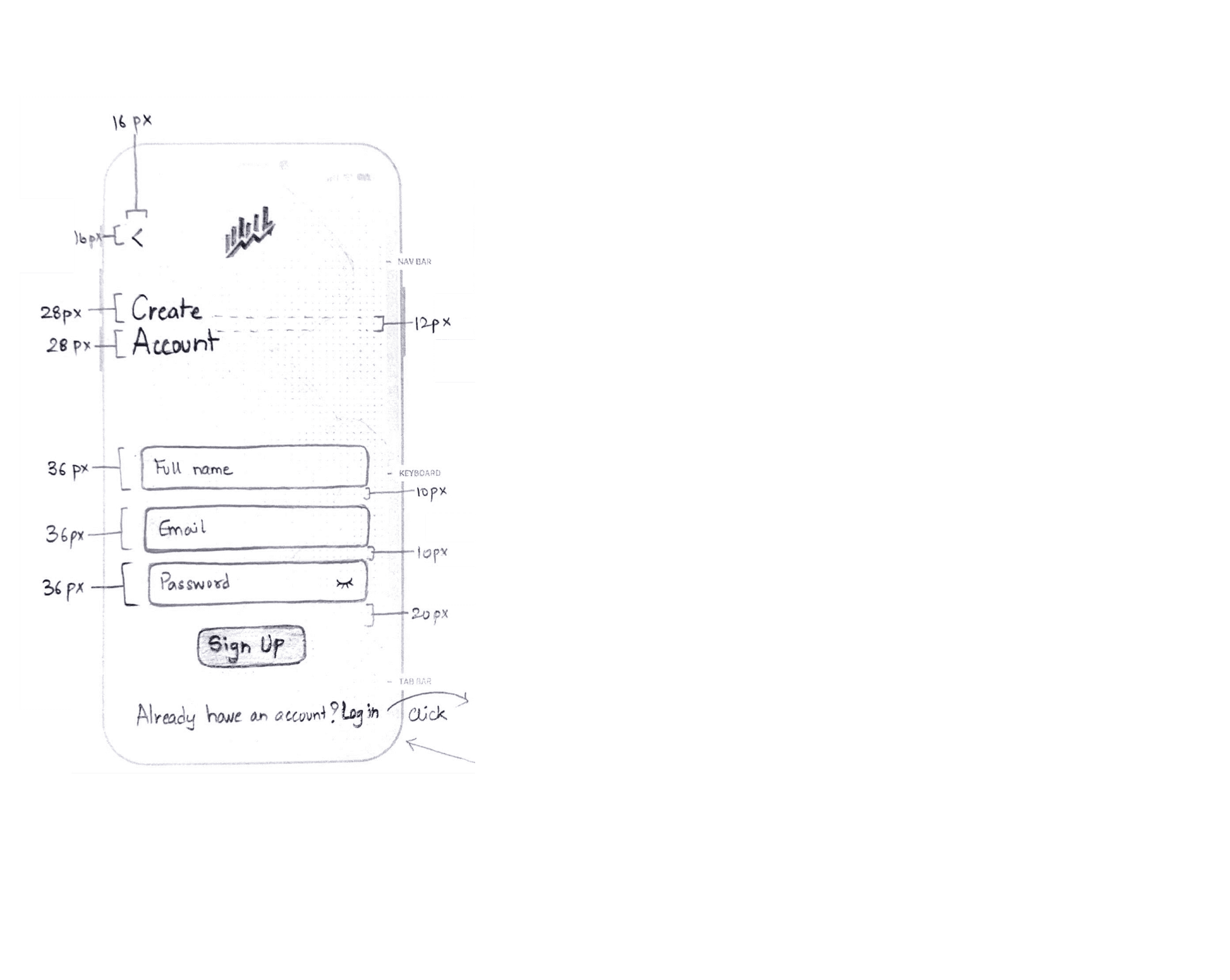

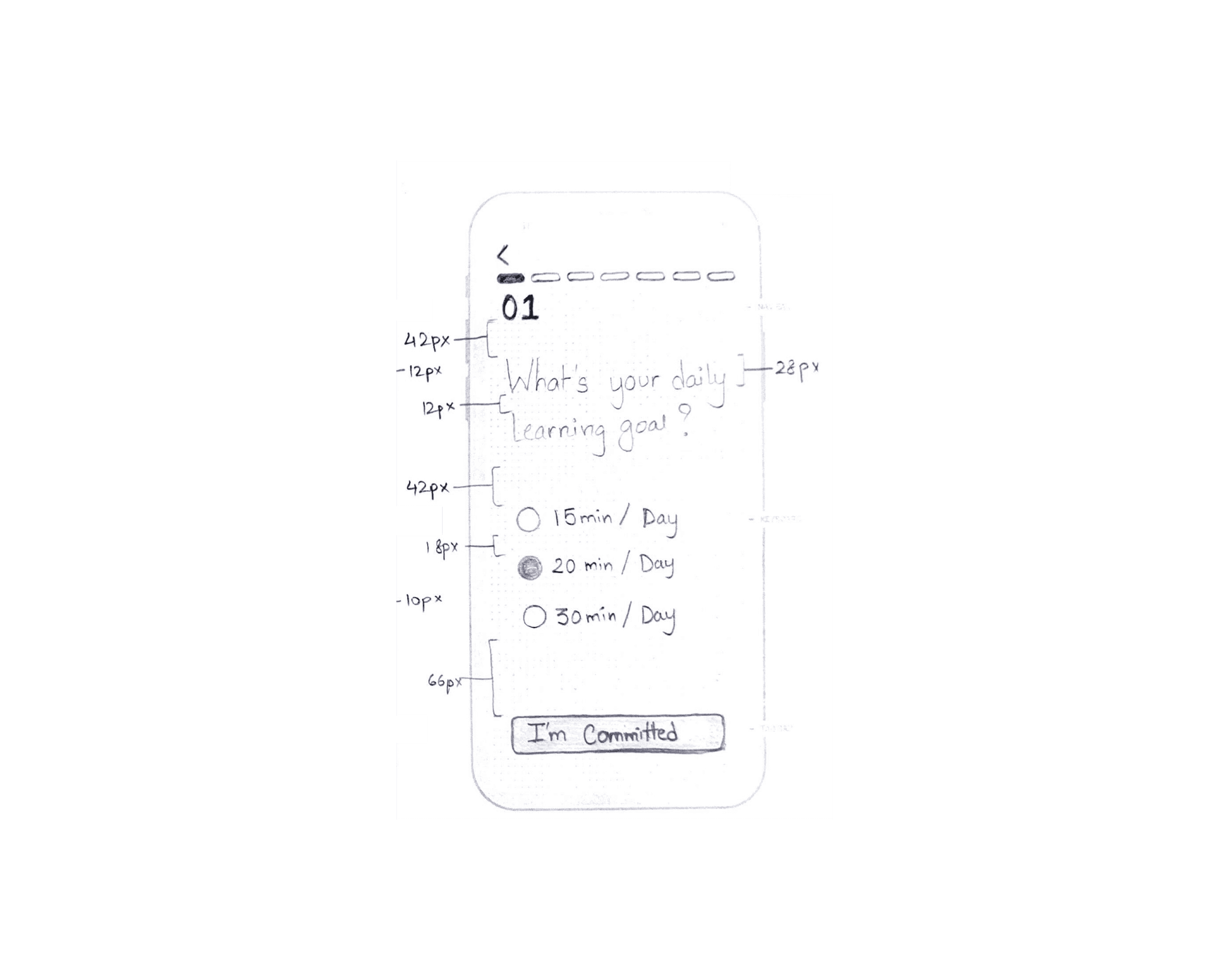

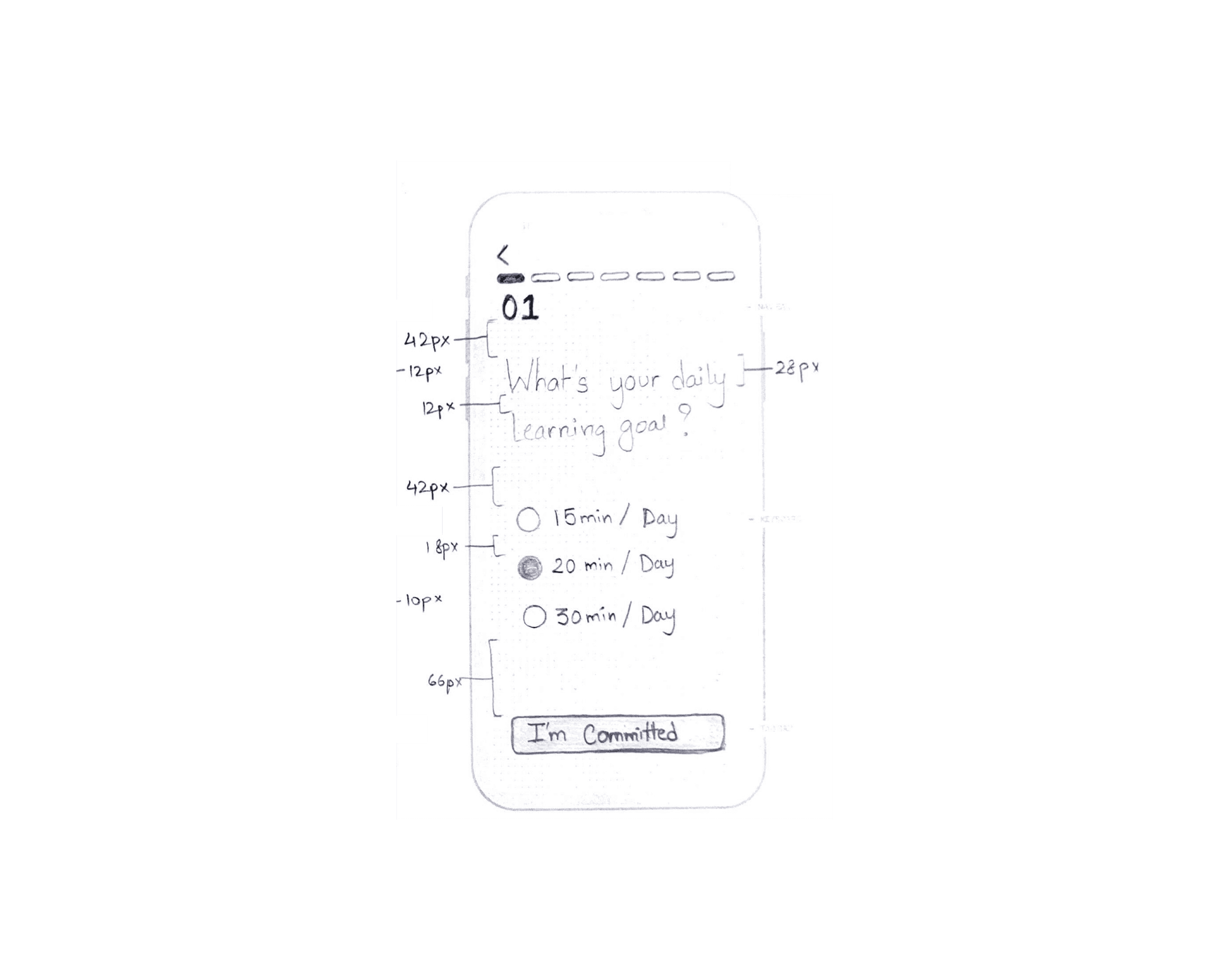

SKELETON

SKELETON

Sign Up

SURFACE

SURFACE

SURFACE

HI-FI WIREFRAMES

HI-FI WIREFRAMES

HI-FI WIREFRAMES

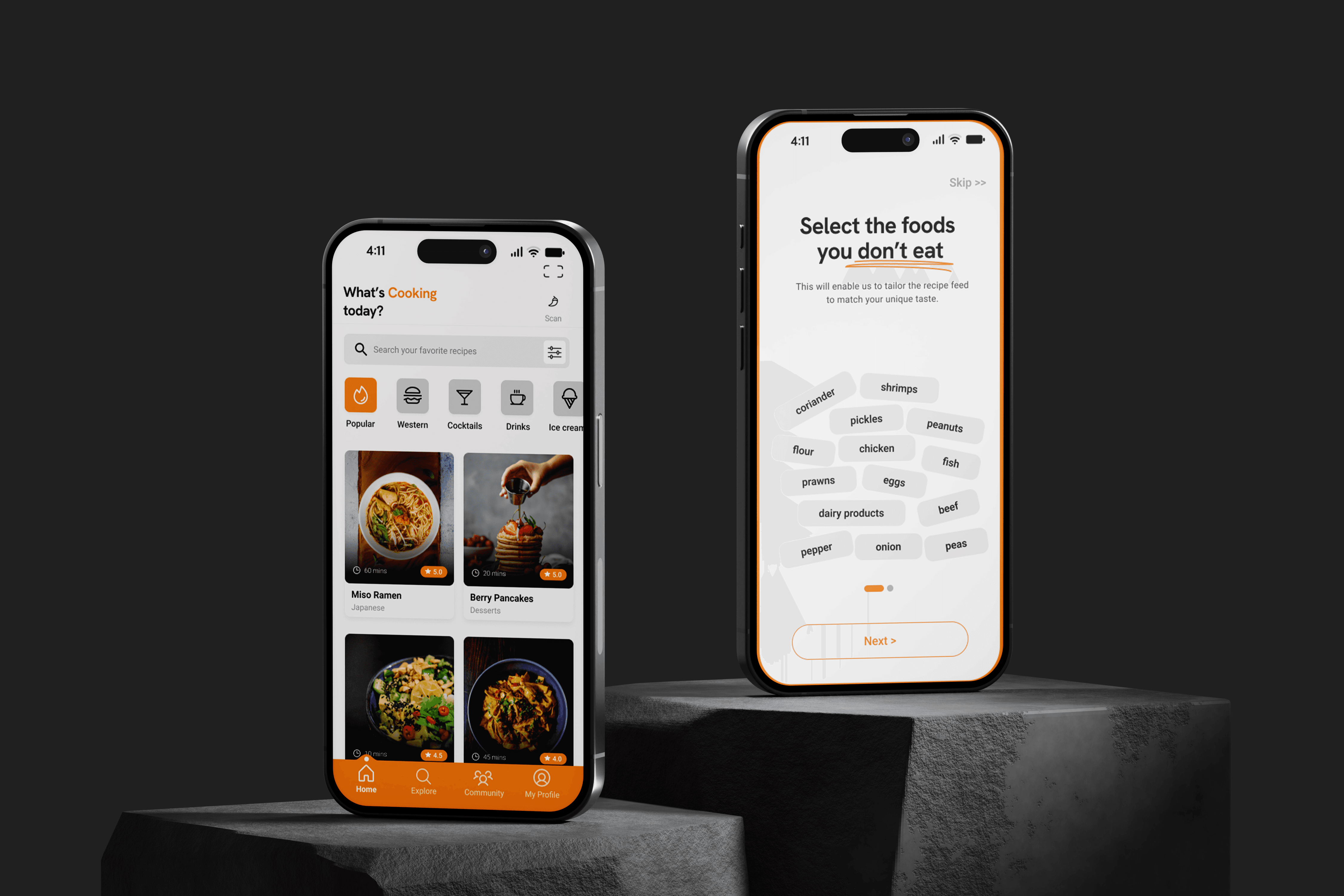

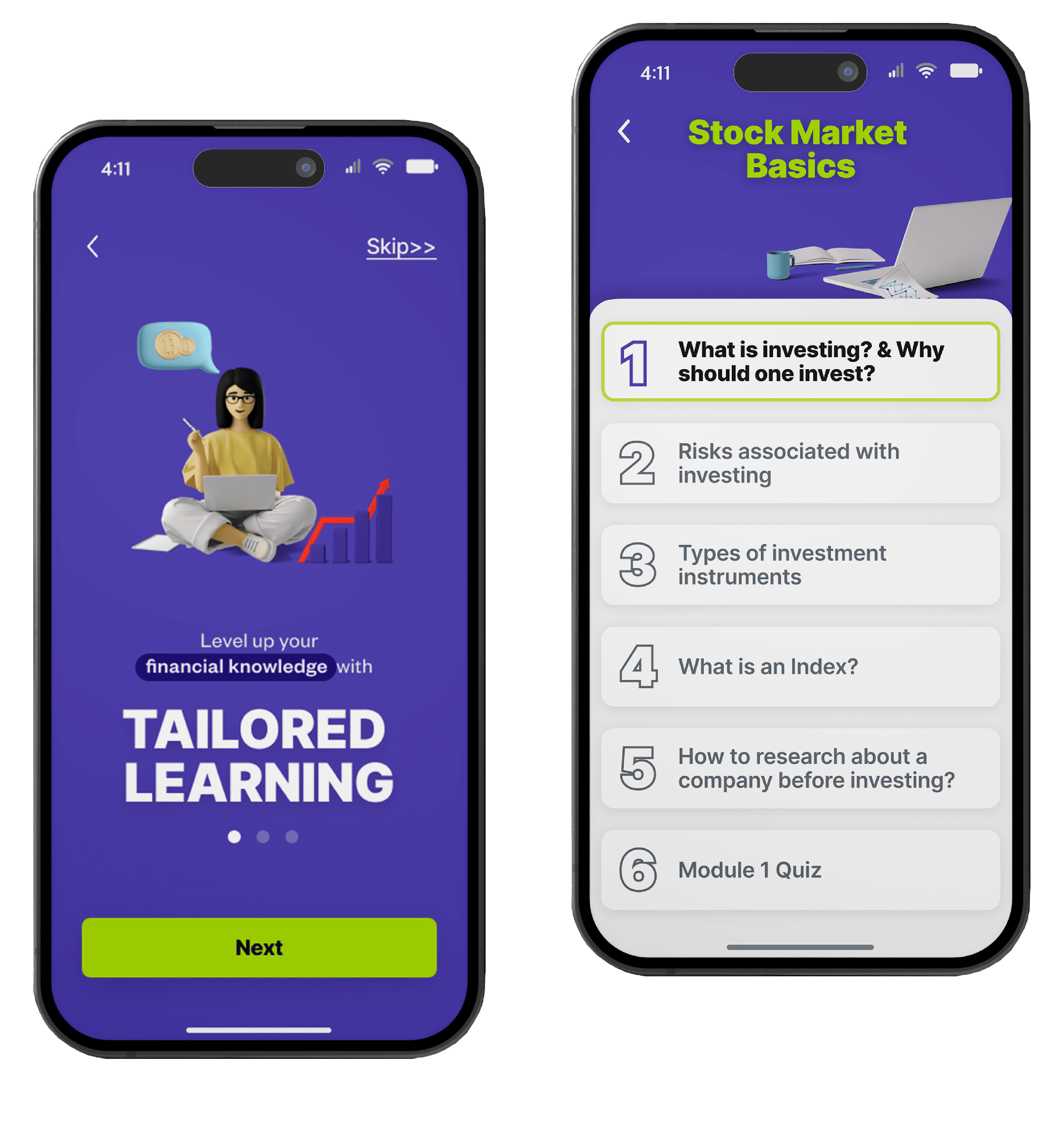

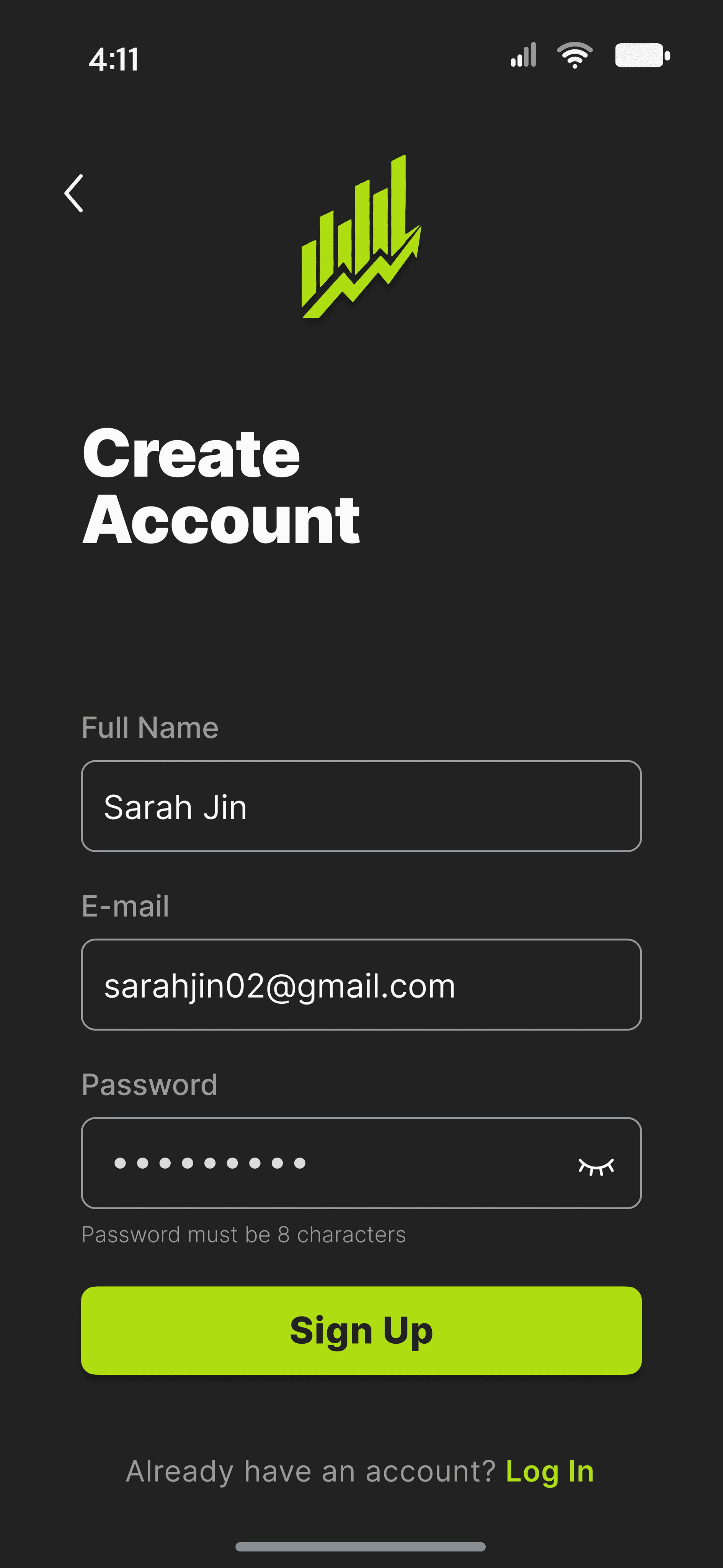

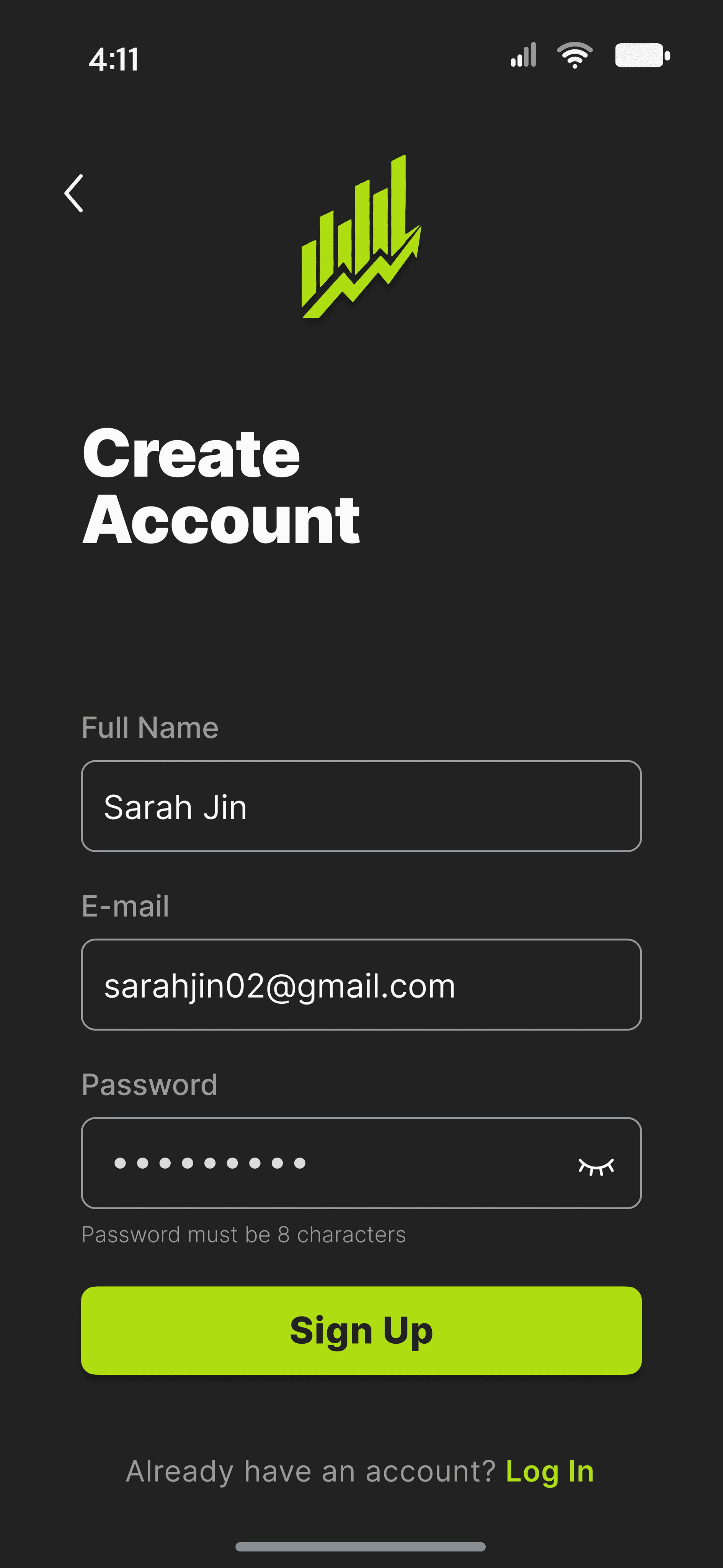

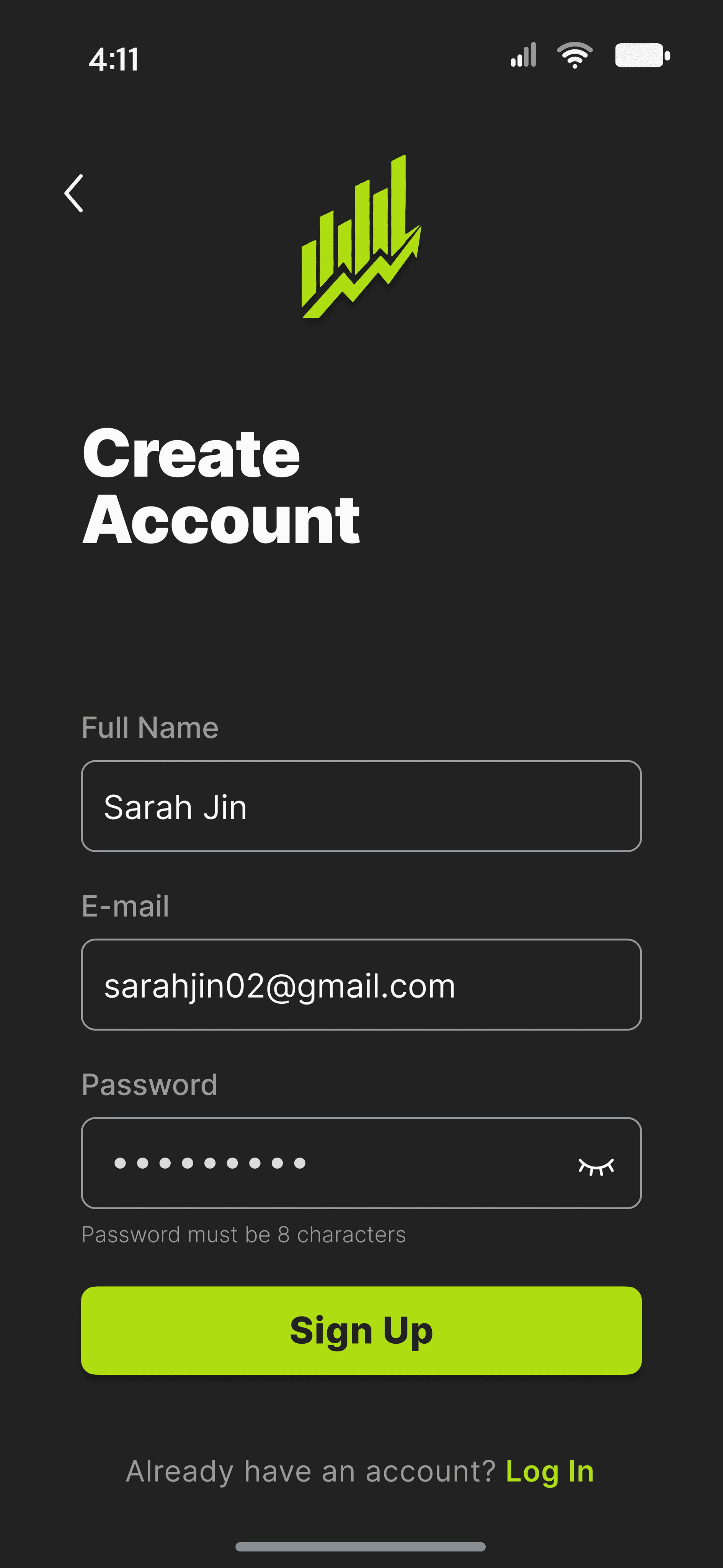

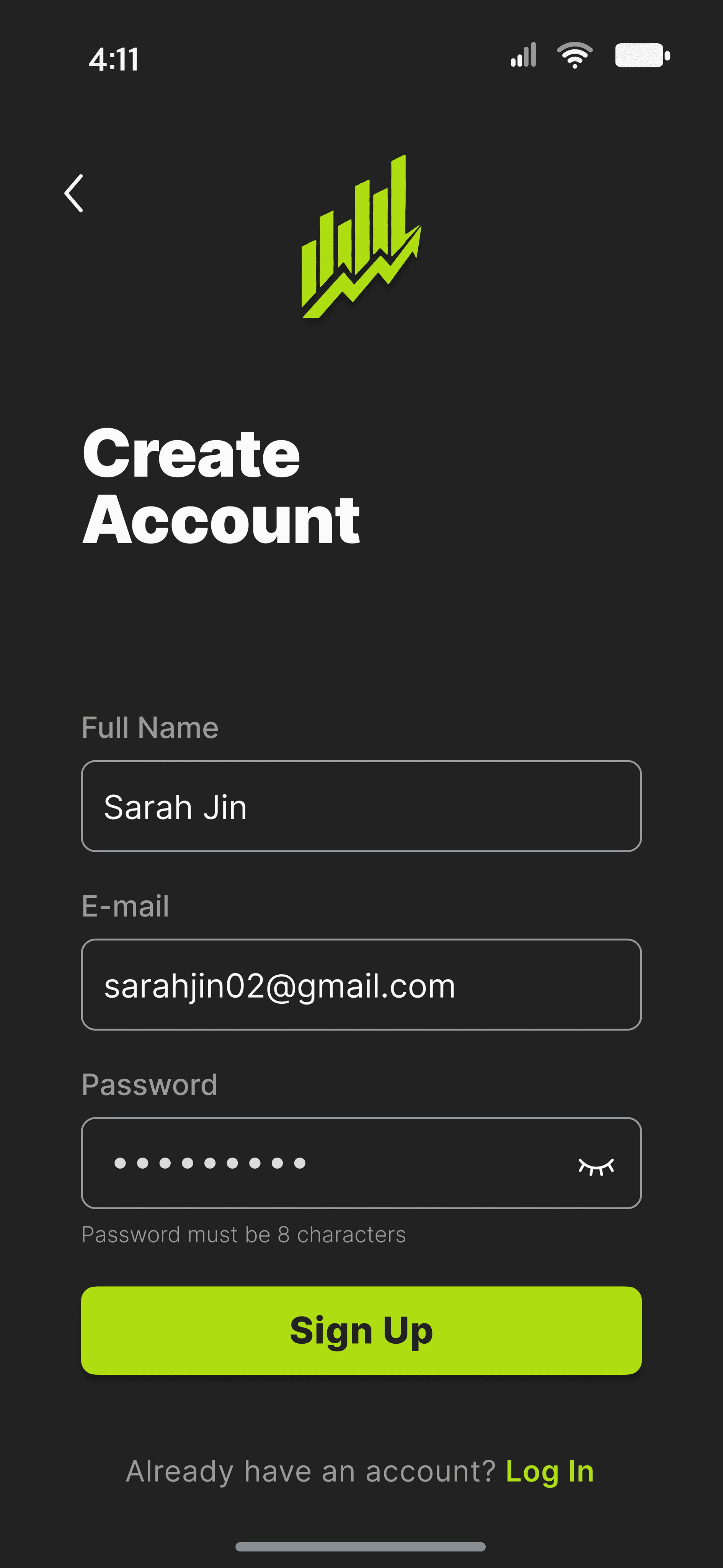

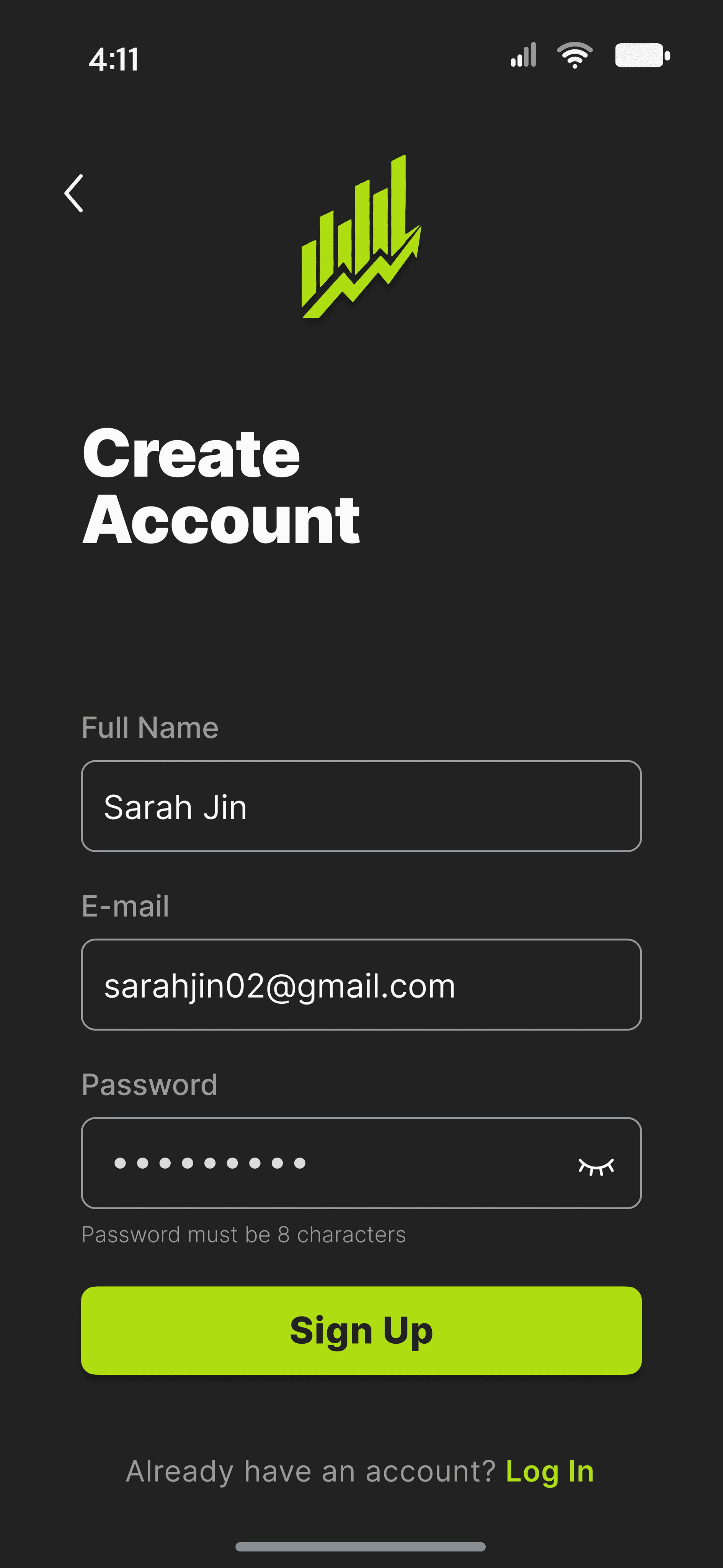

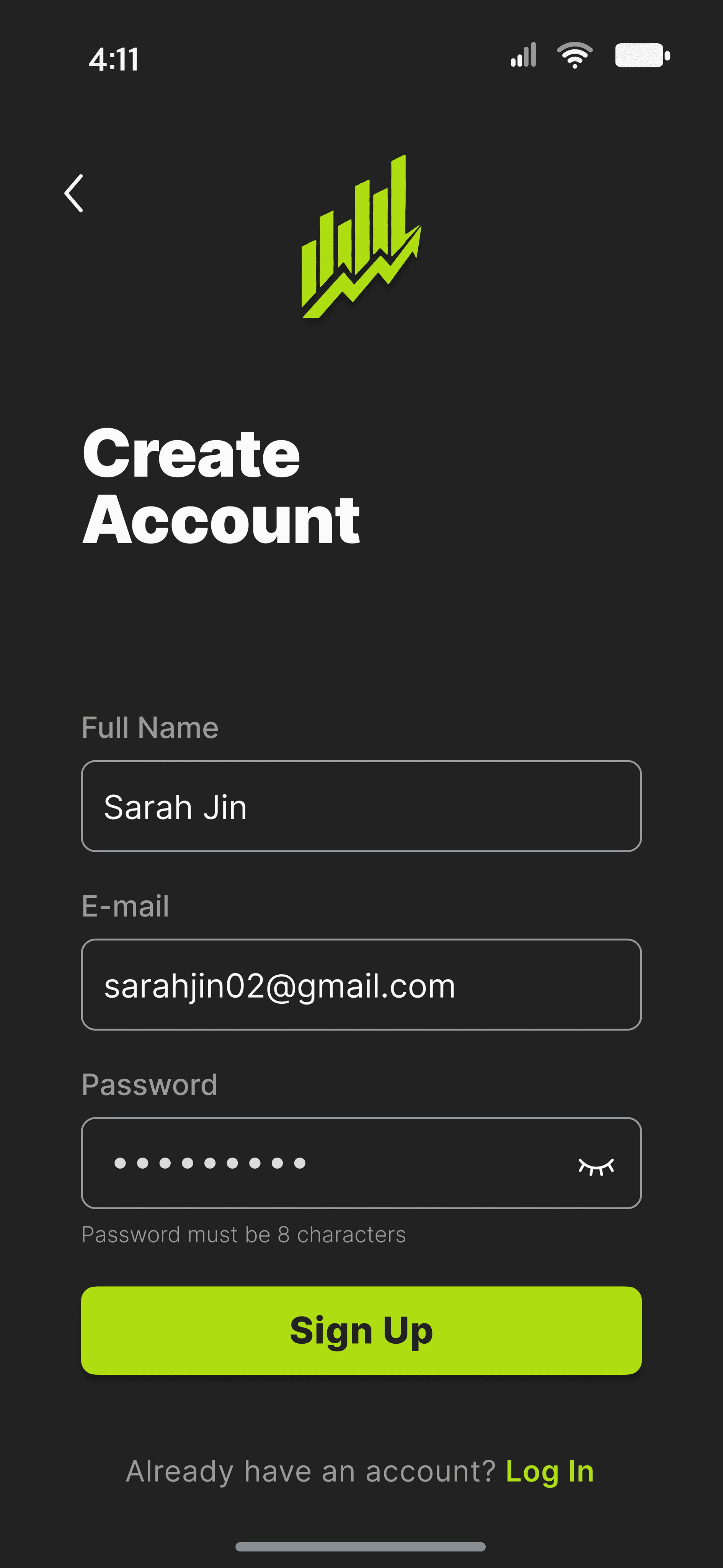

ONBOARDING SCREENS

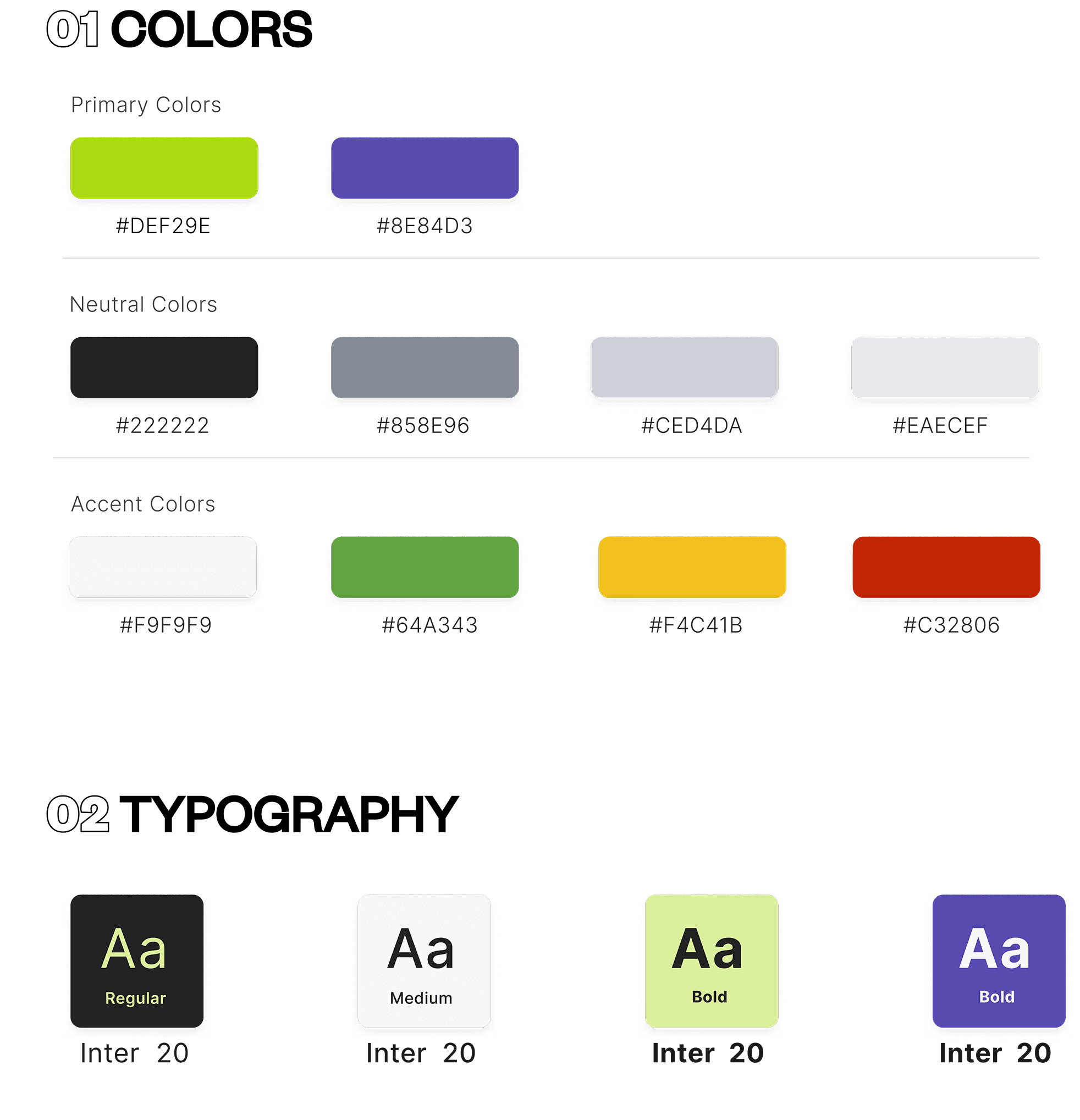

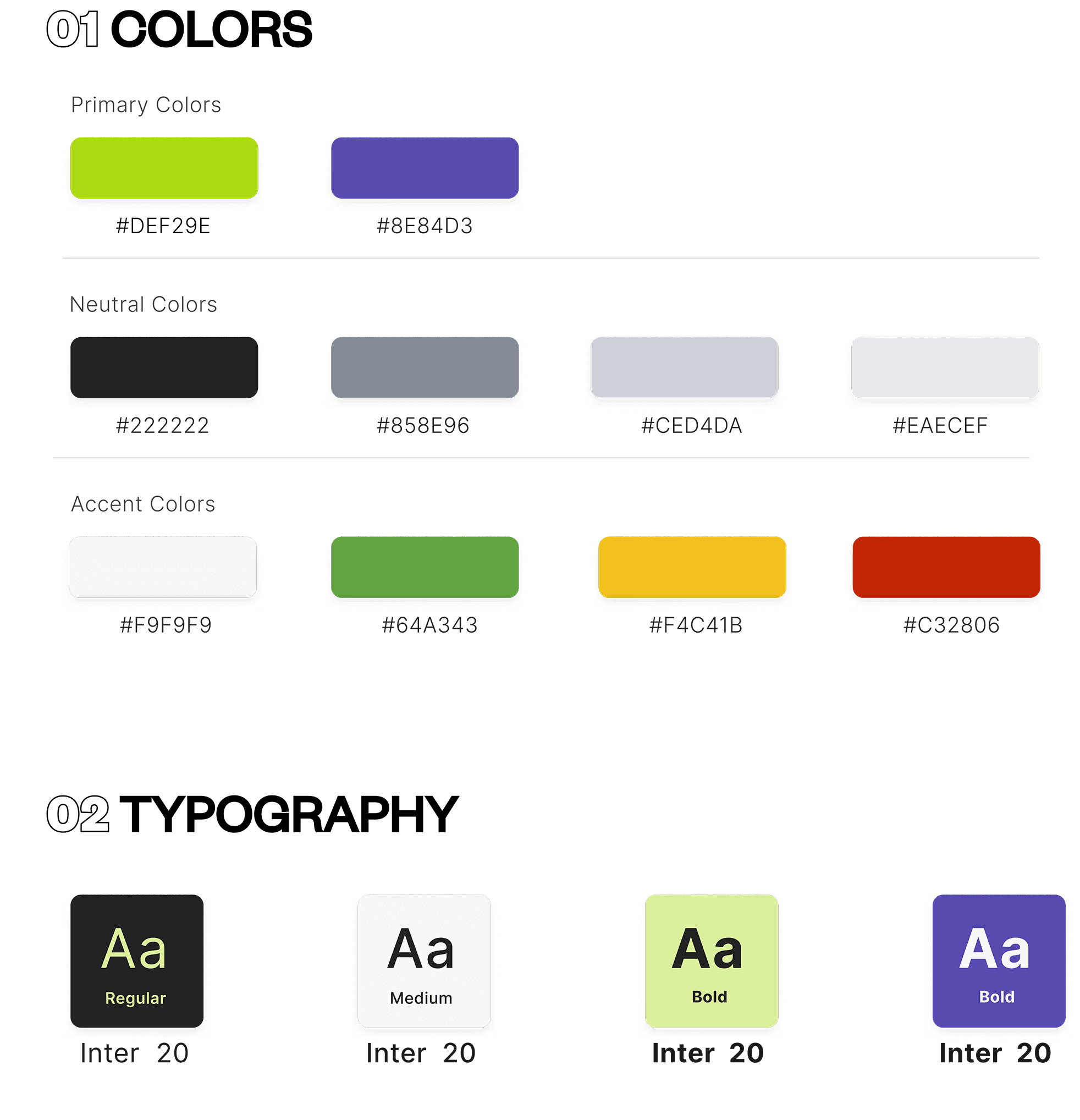

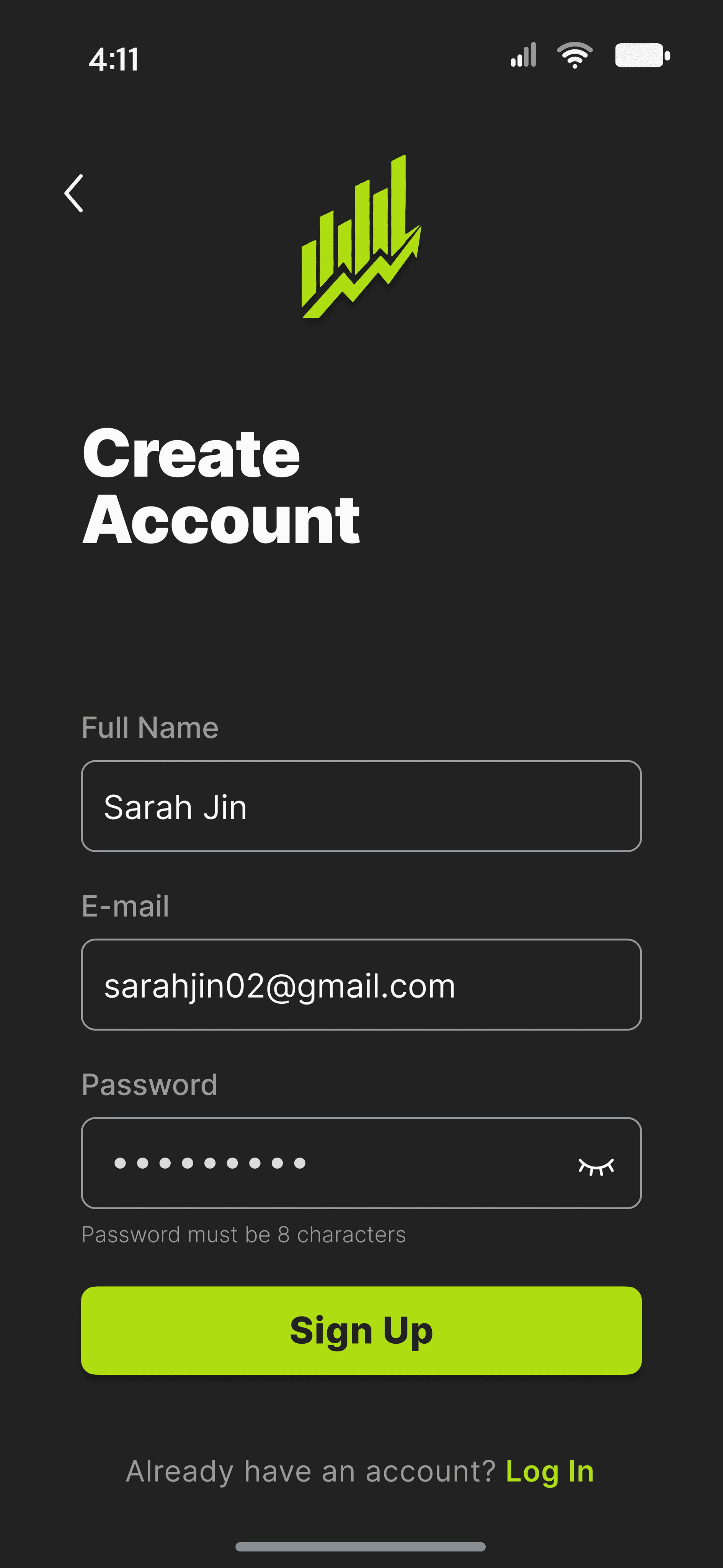

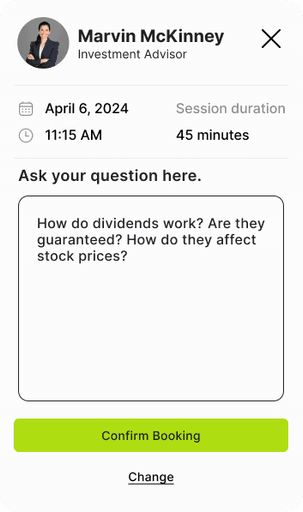

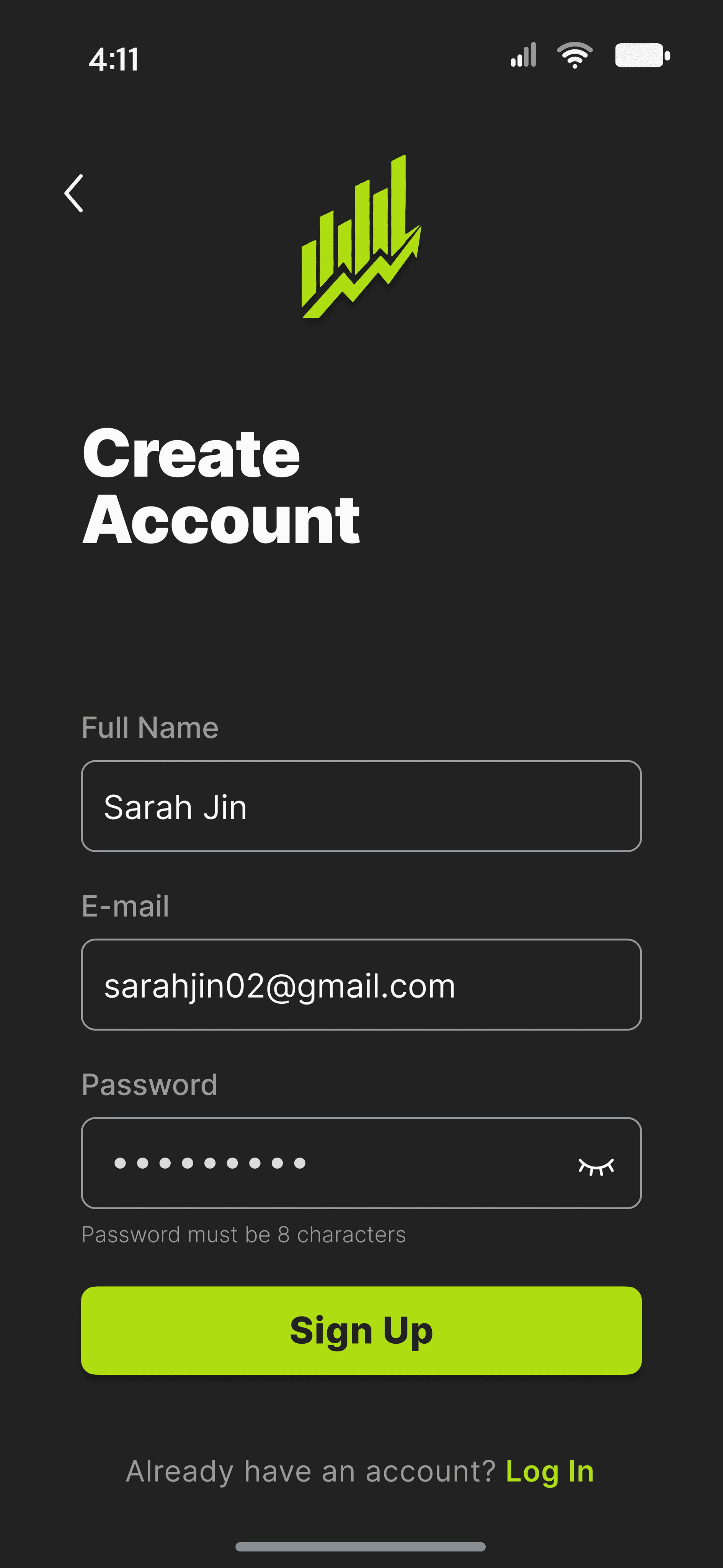

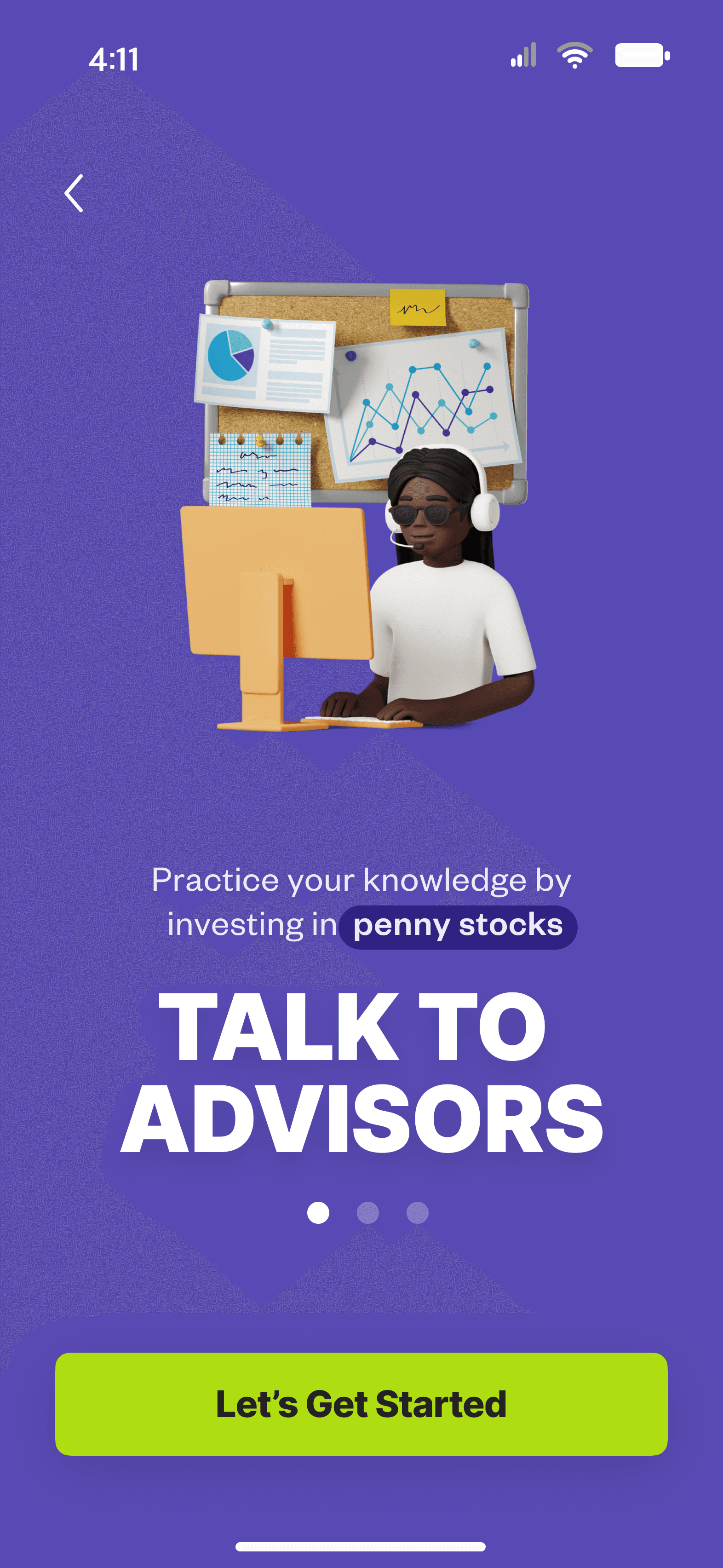

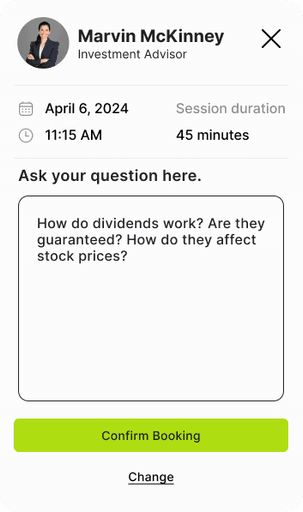

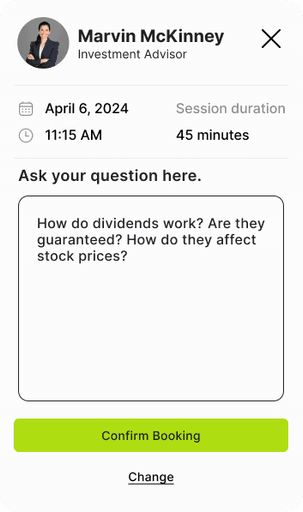

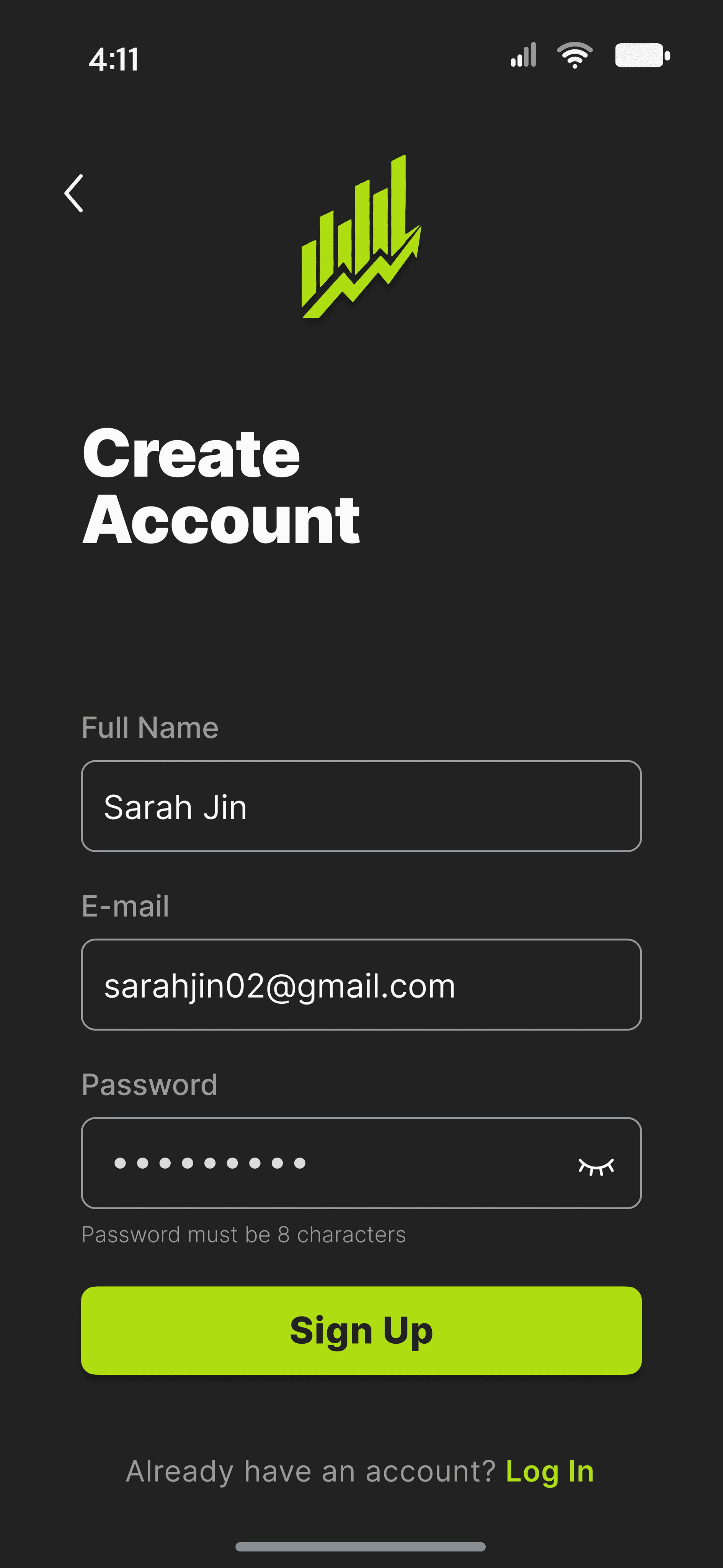

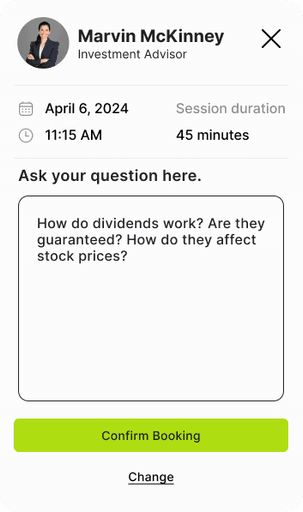

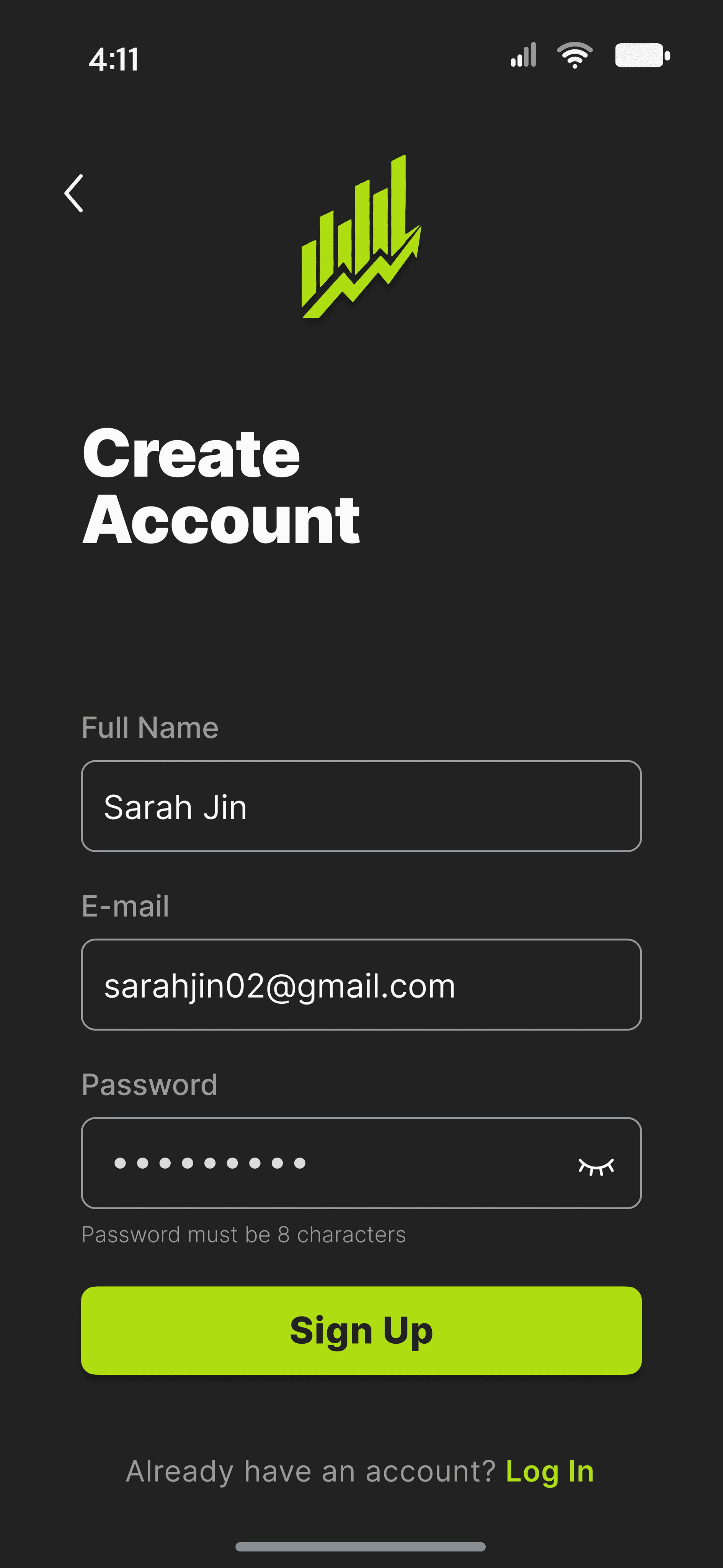

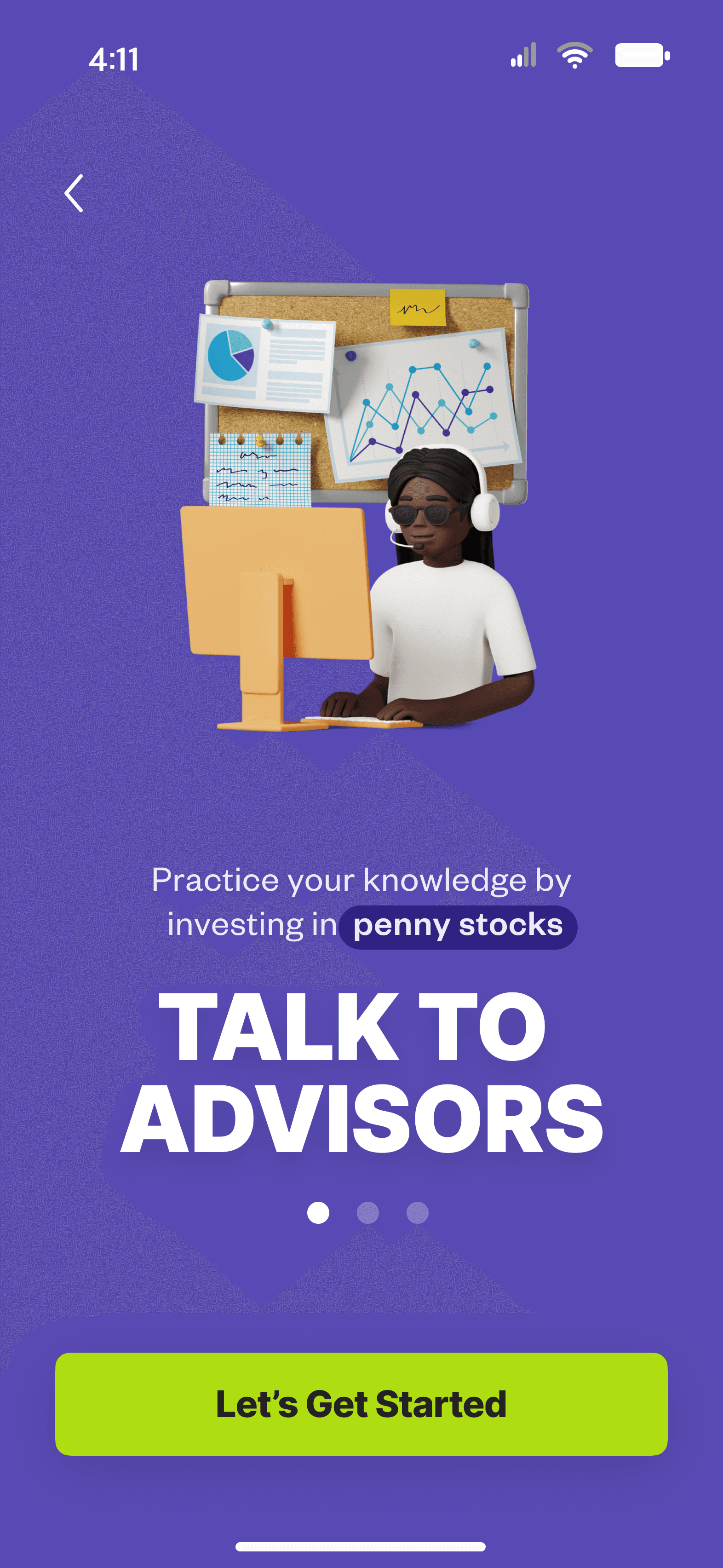

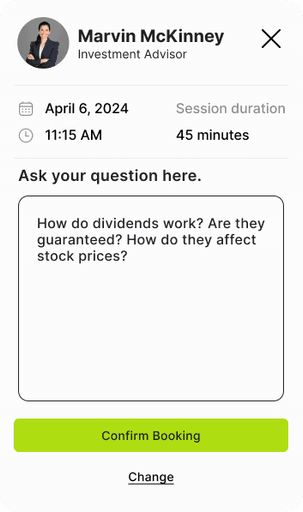

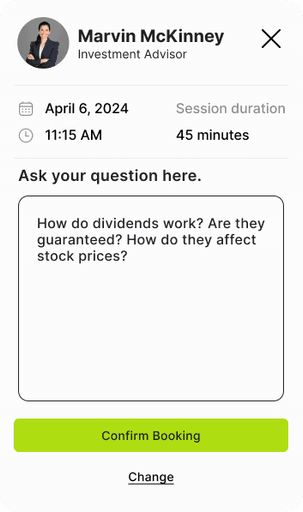

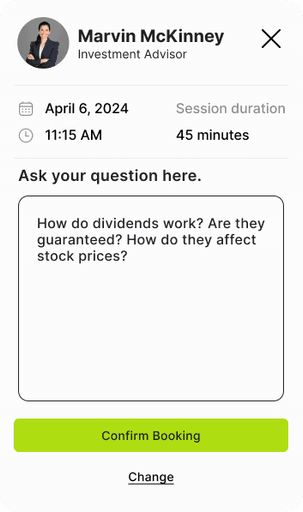

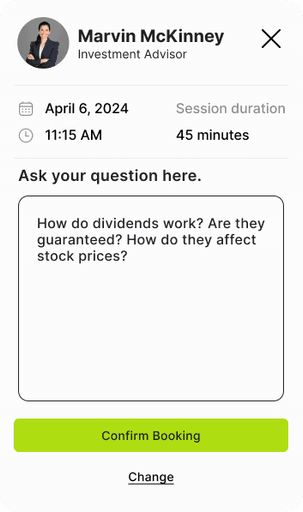

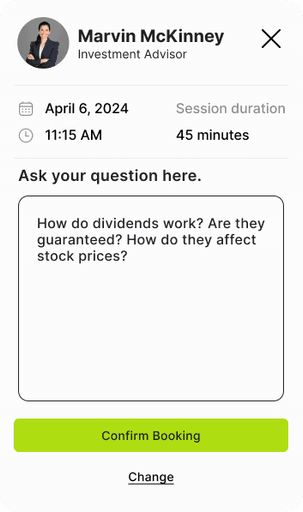

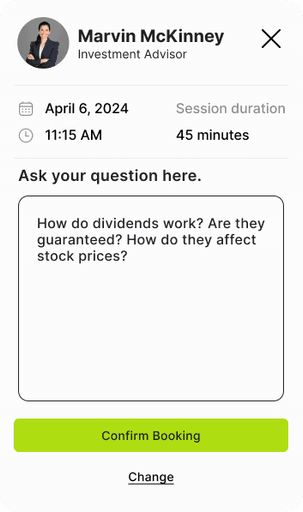

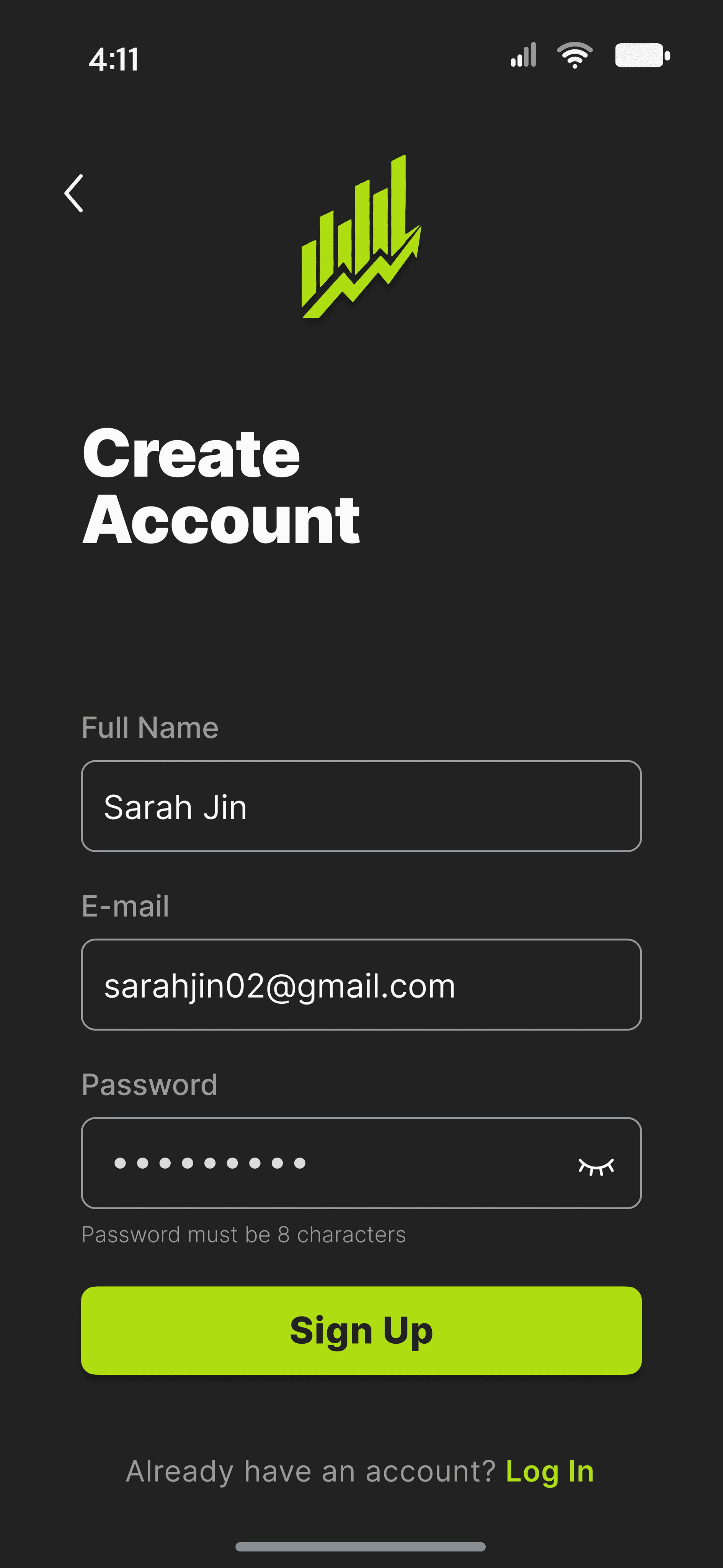

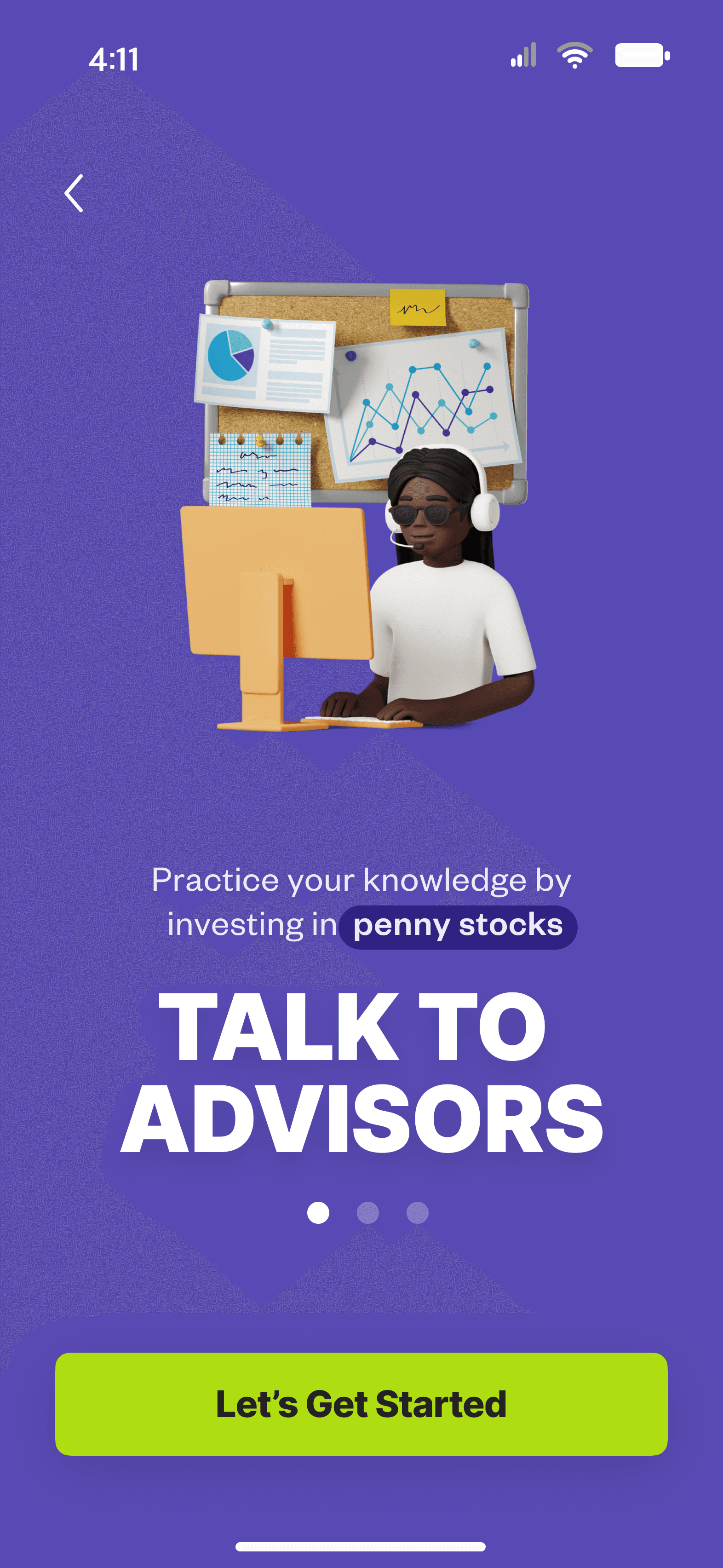

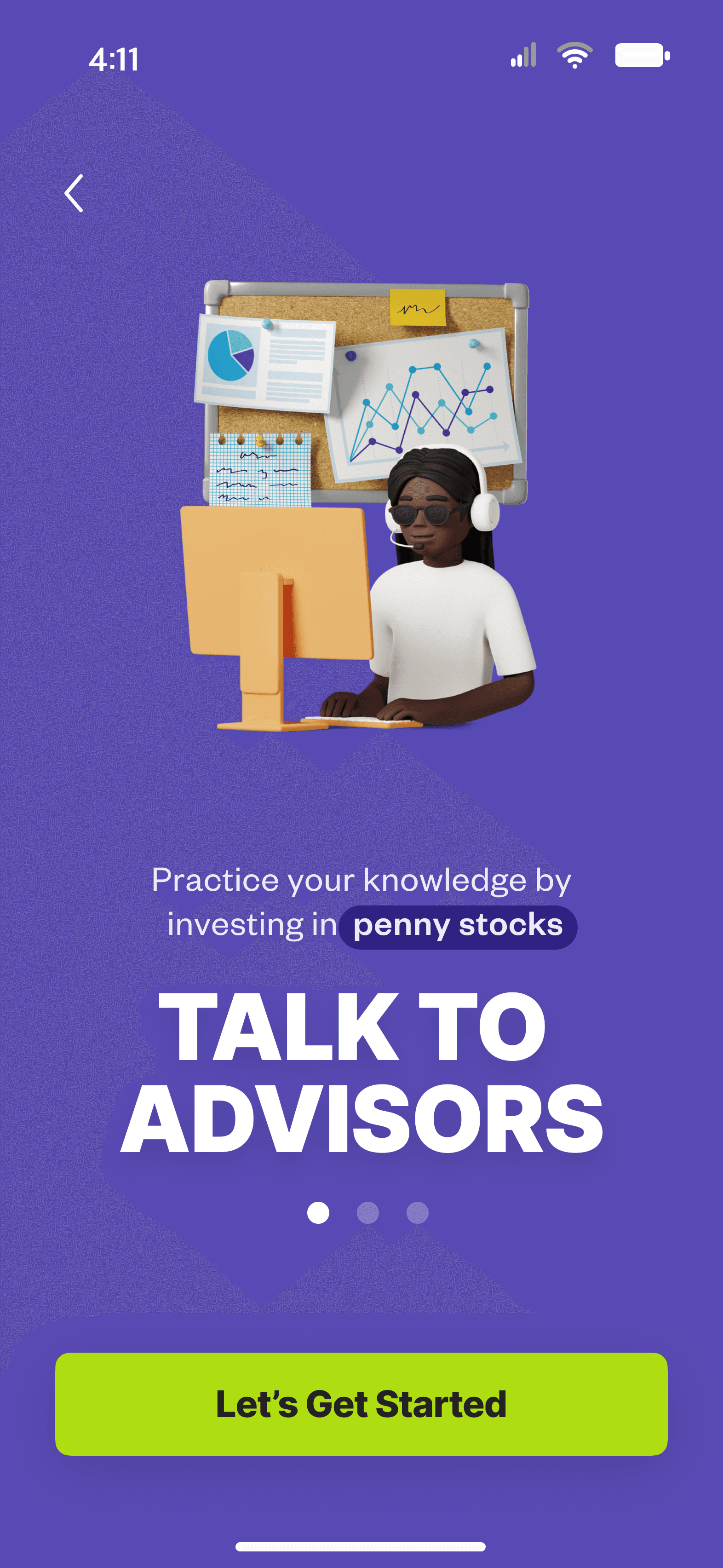

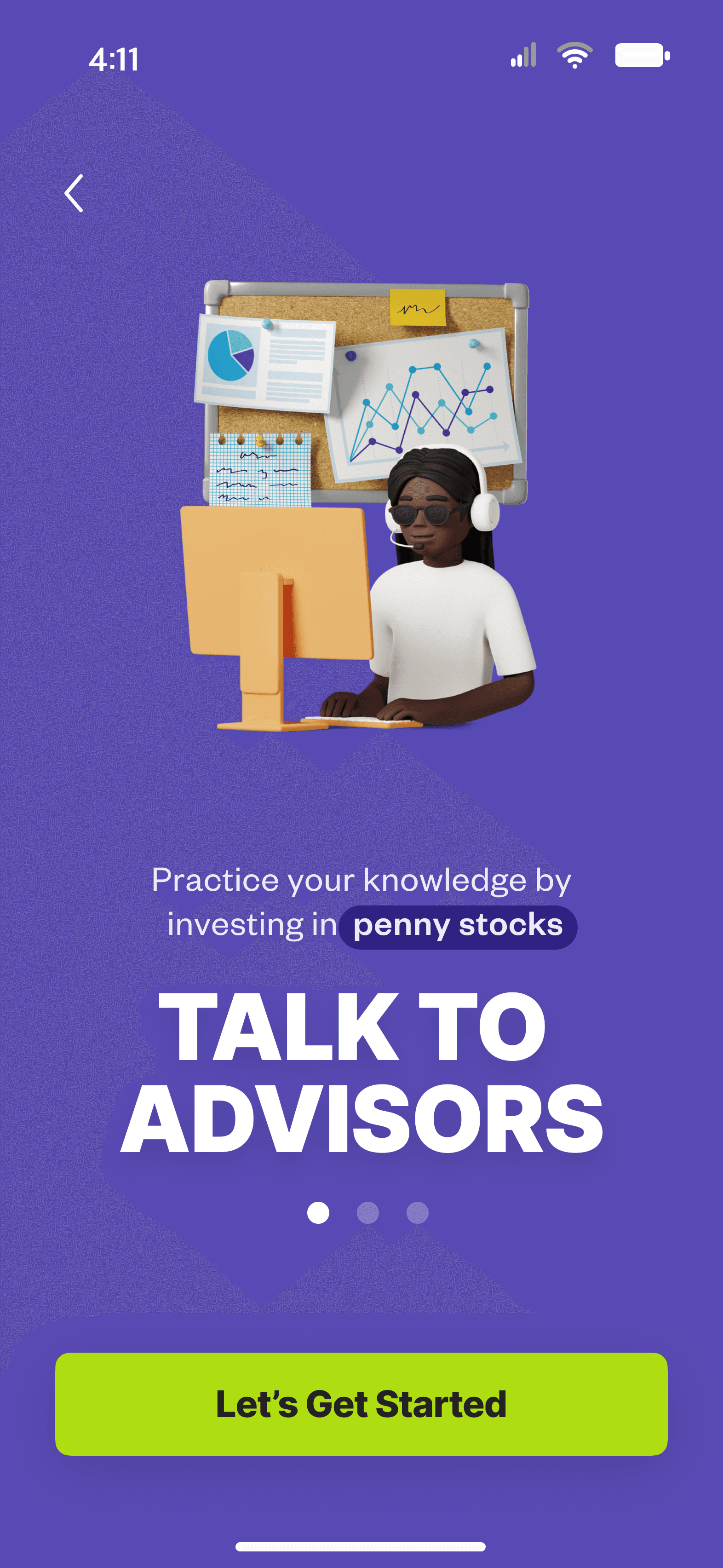

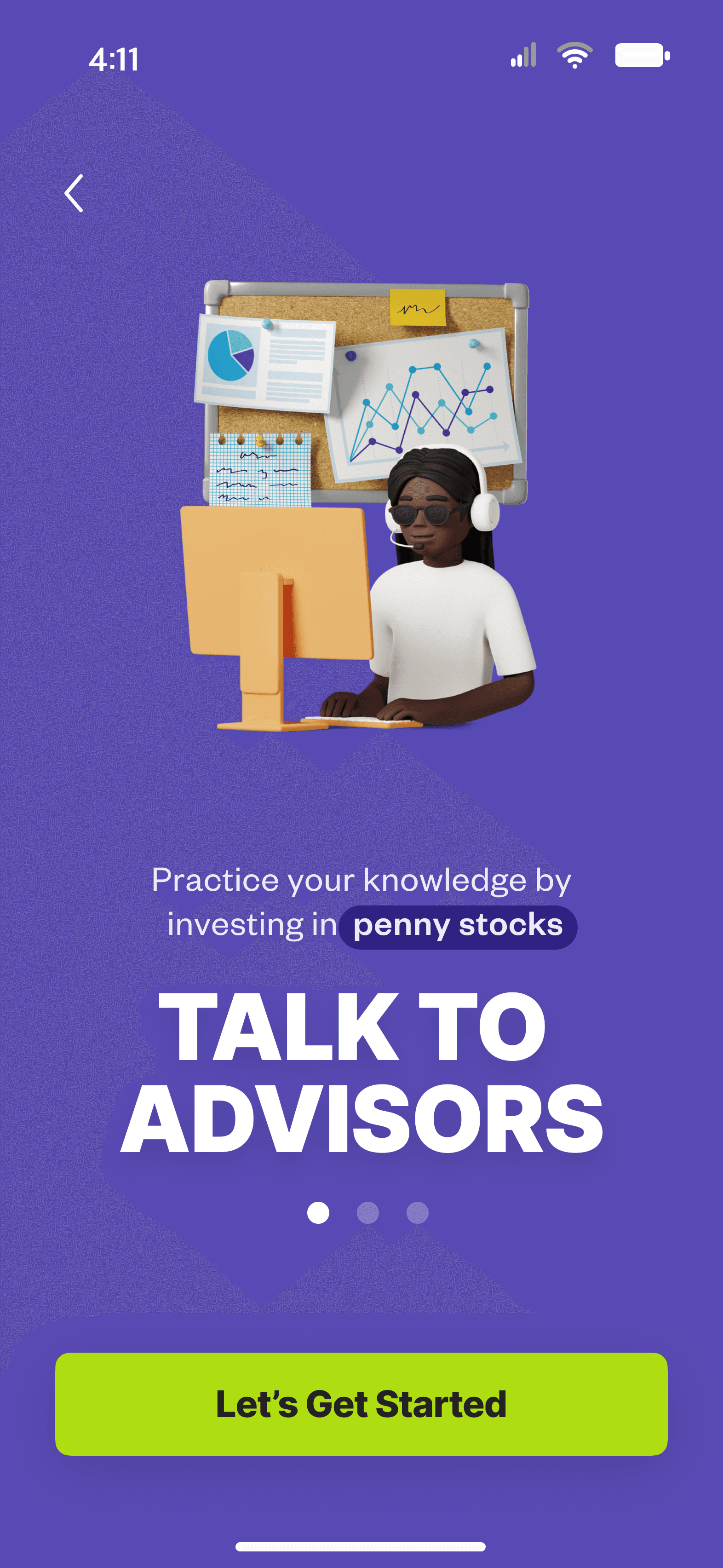

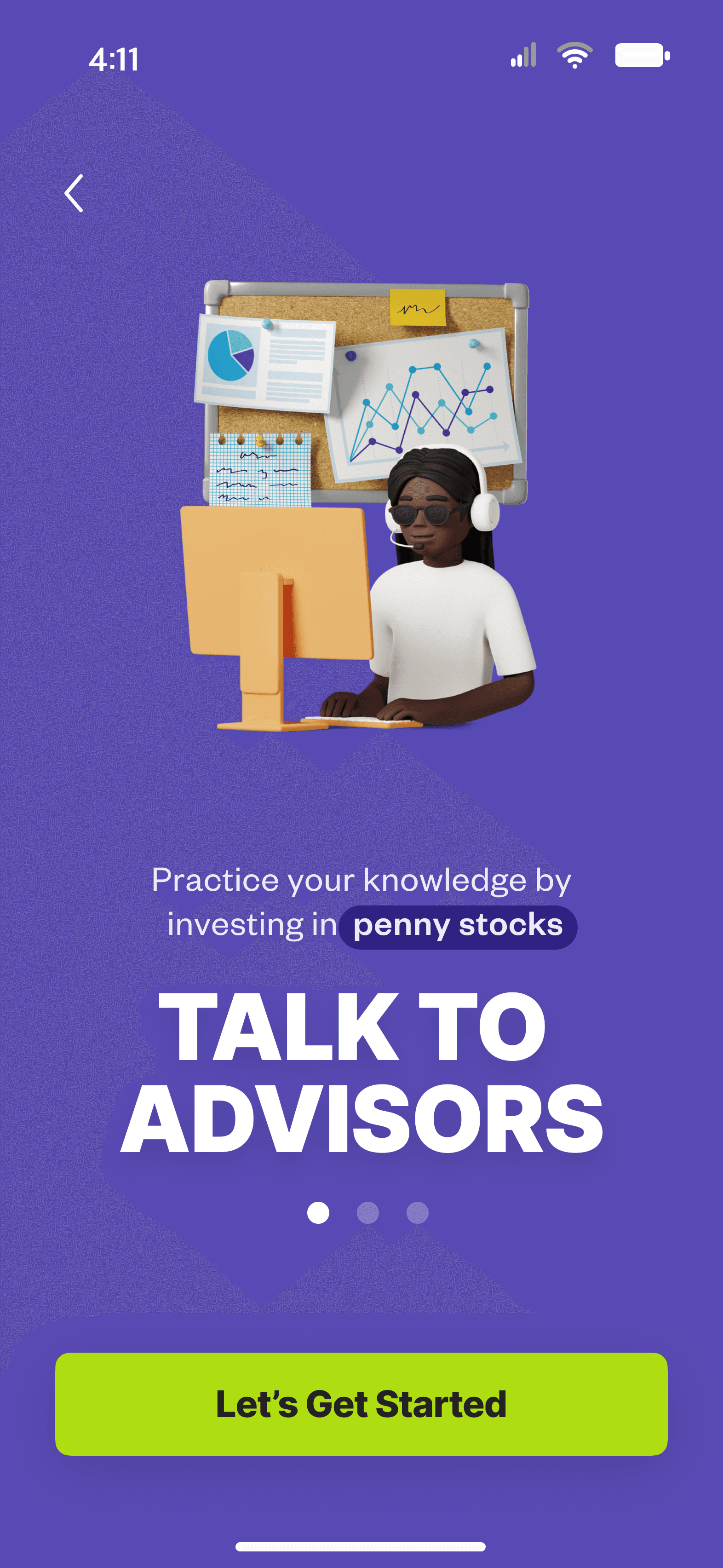

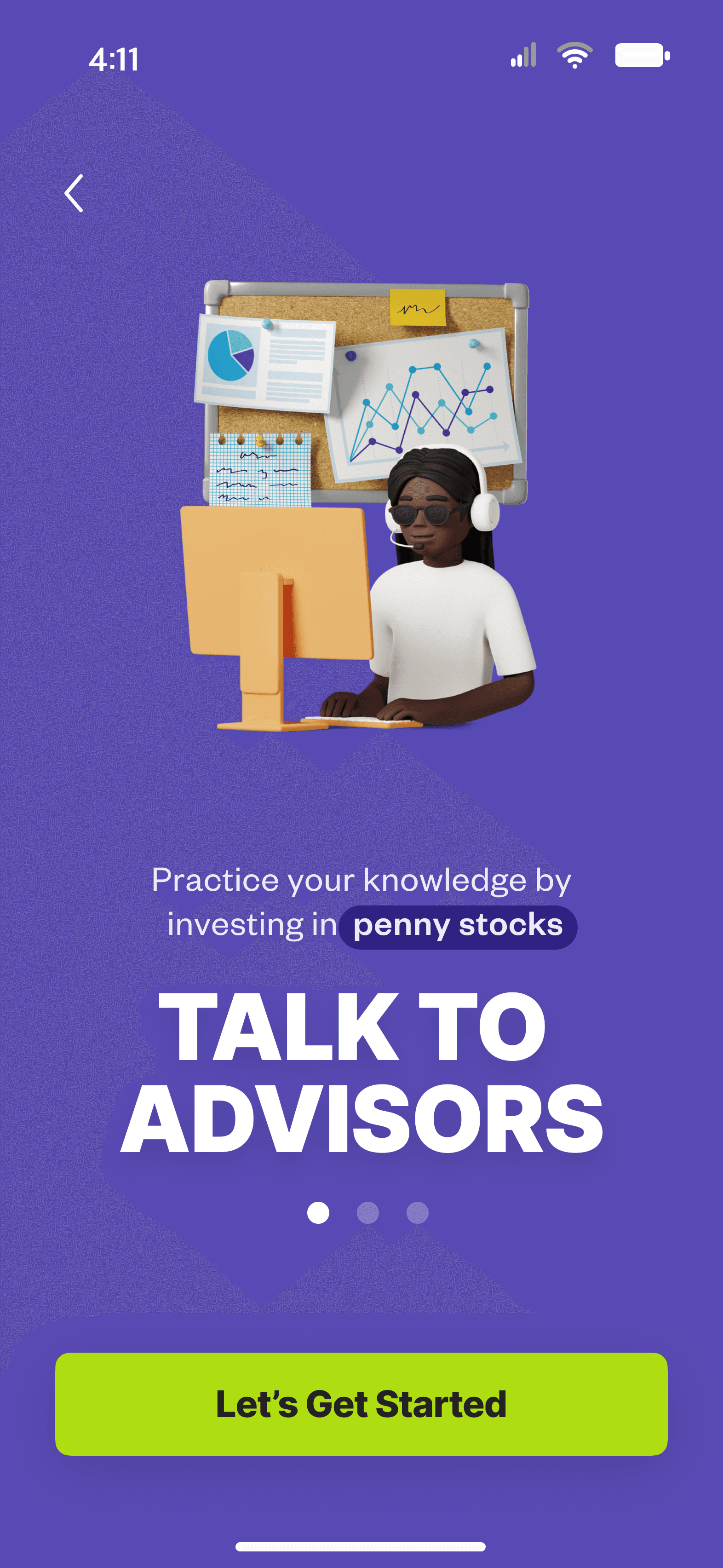

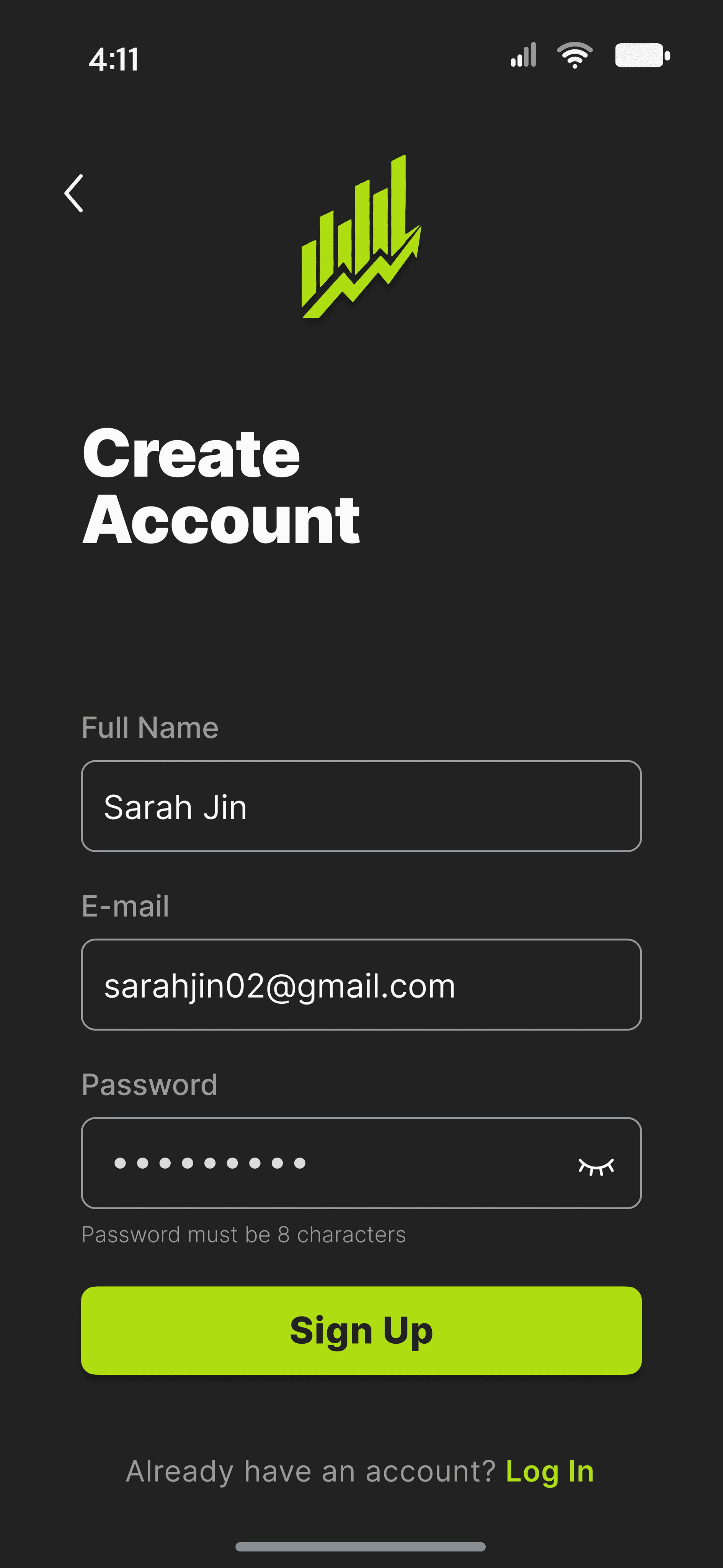

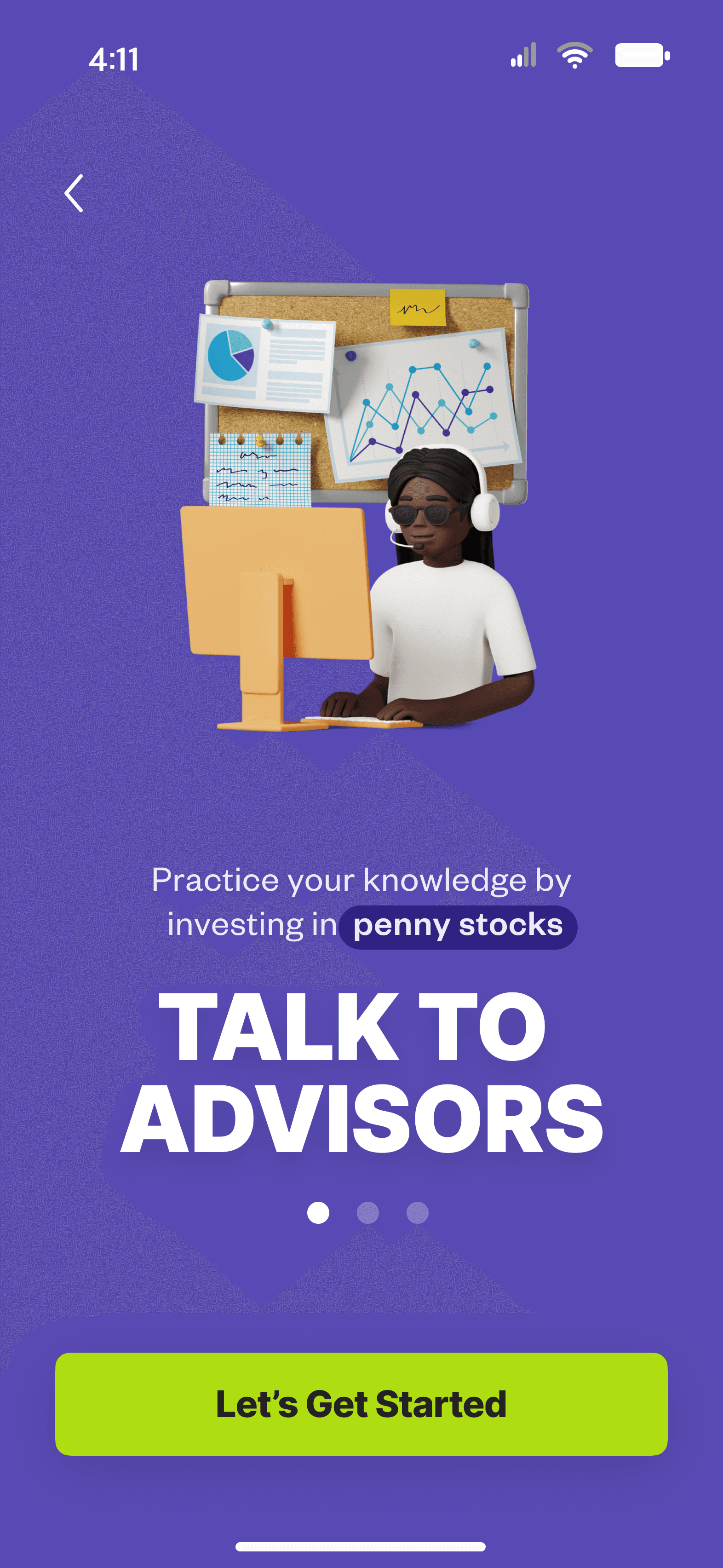

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

Sign Up

Onboarding Screen 1

Onboarding Screen 2

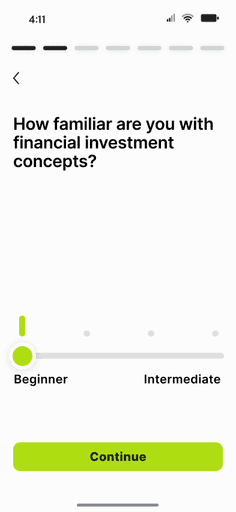

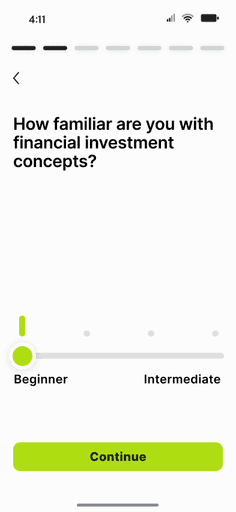

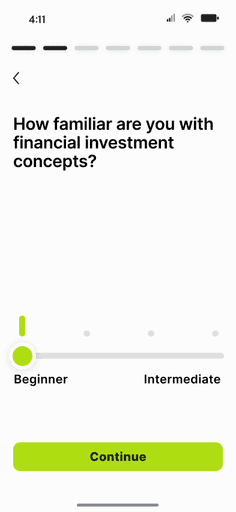

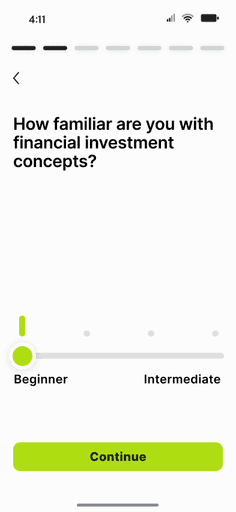

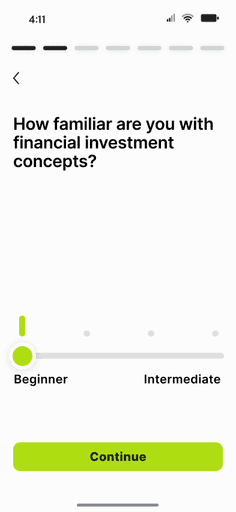

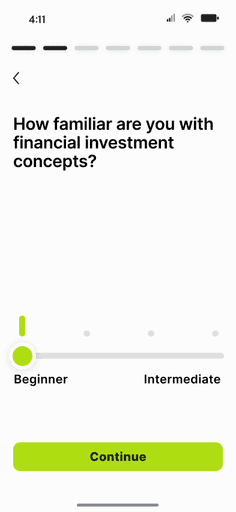

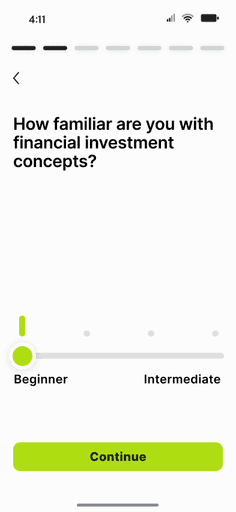

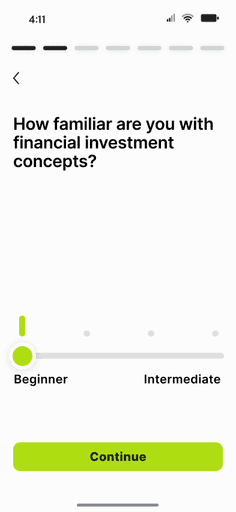

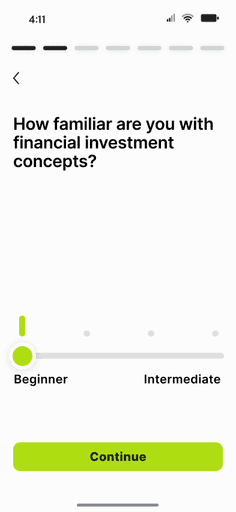

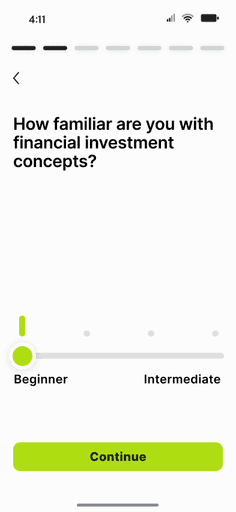

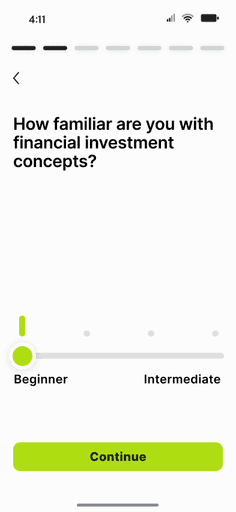

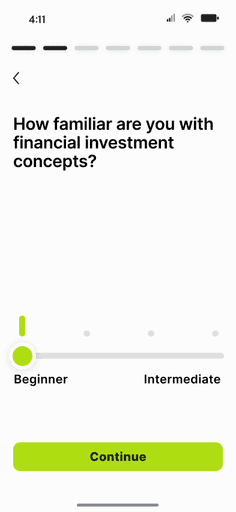

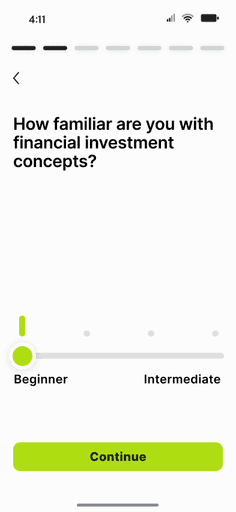

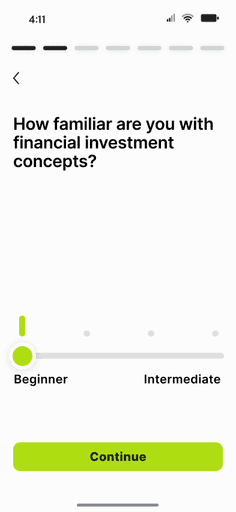

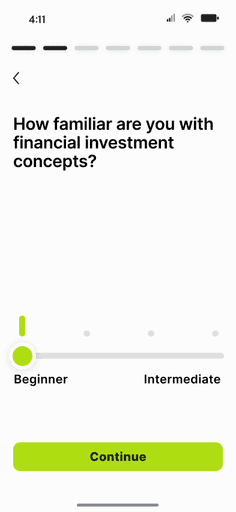

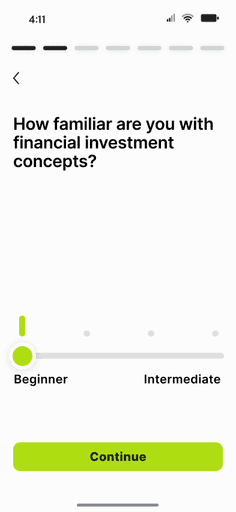

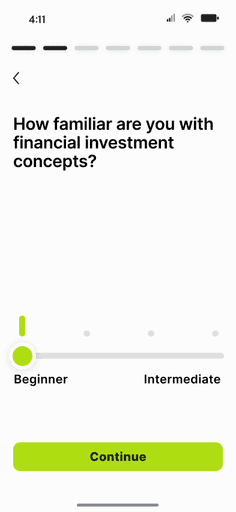

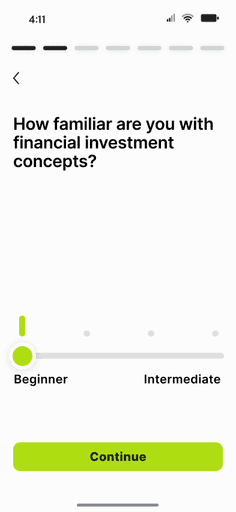

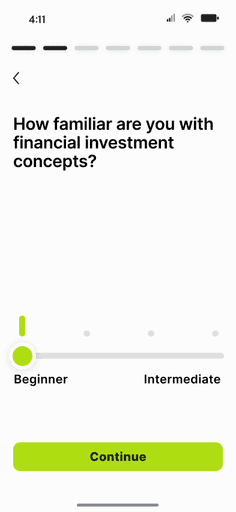

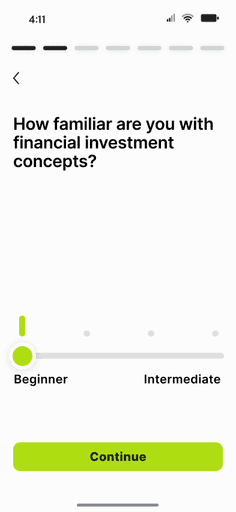

Onboarding Quiz

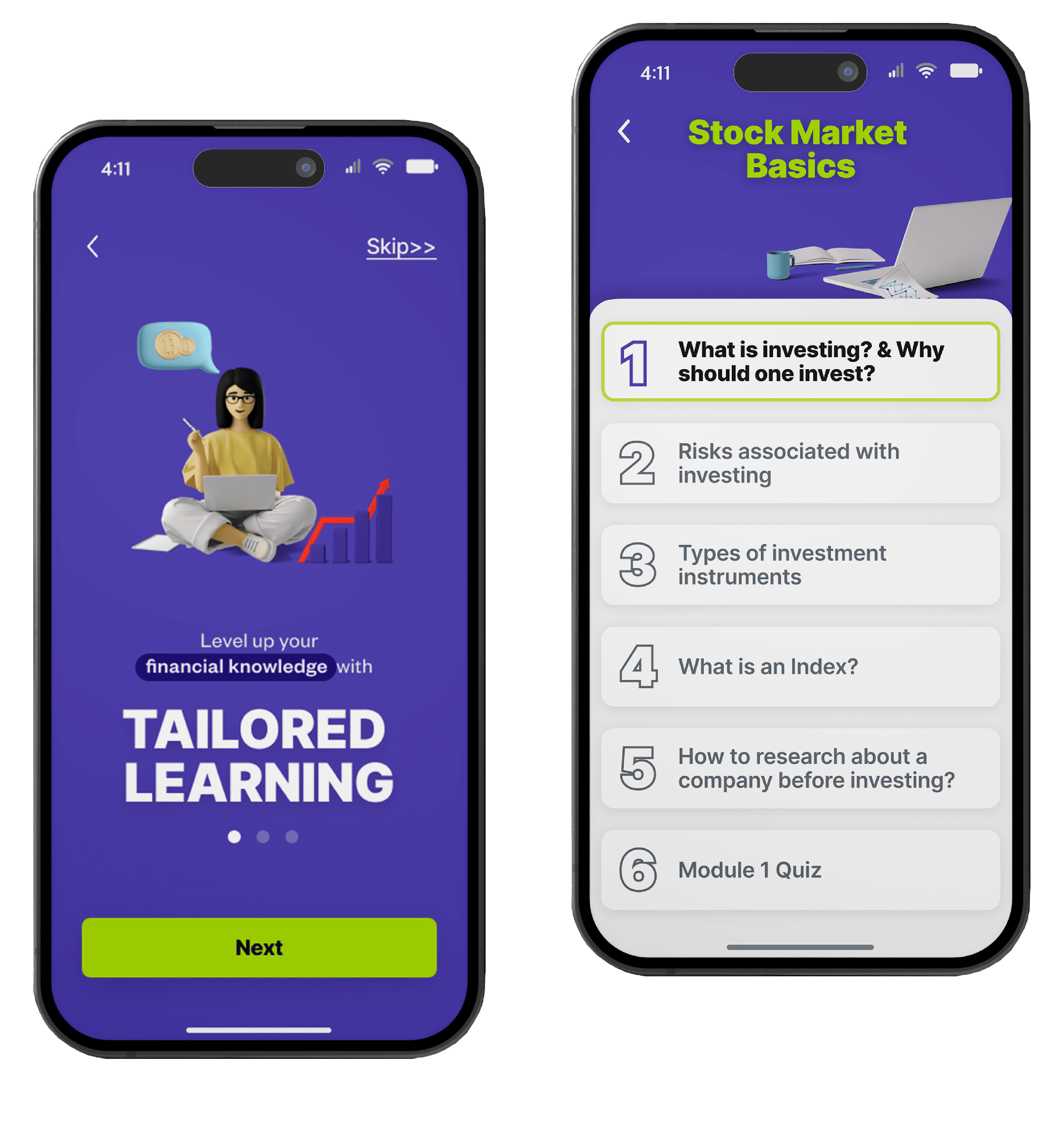

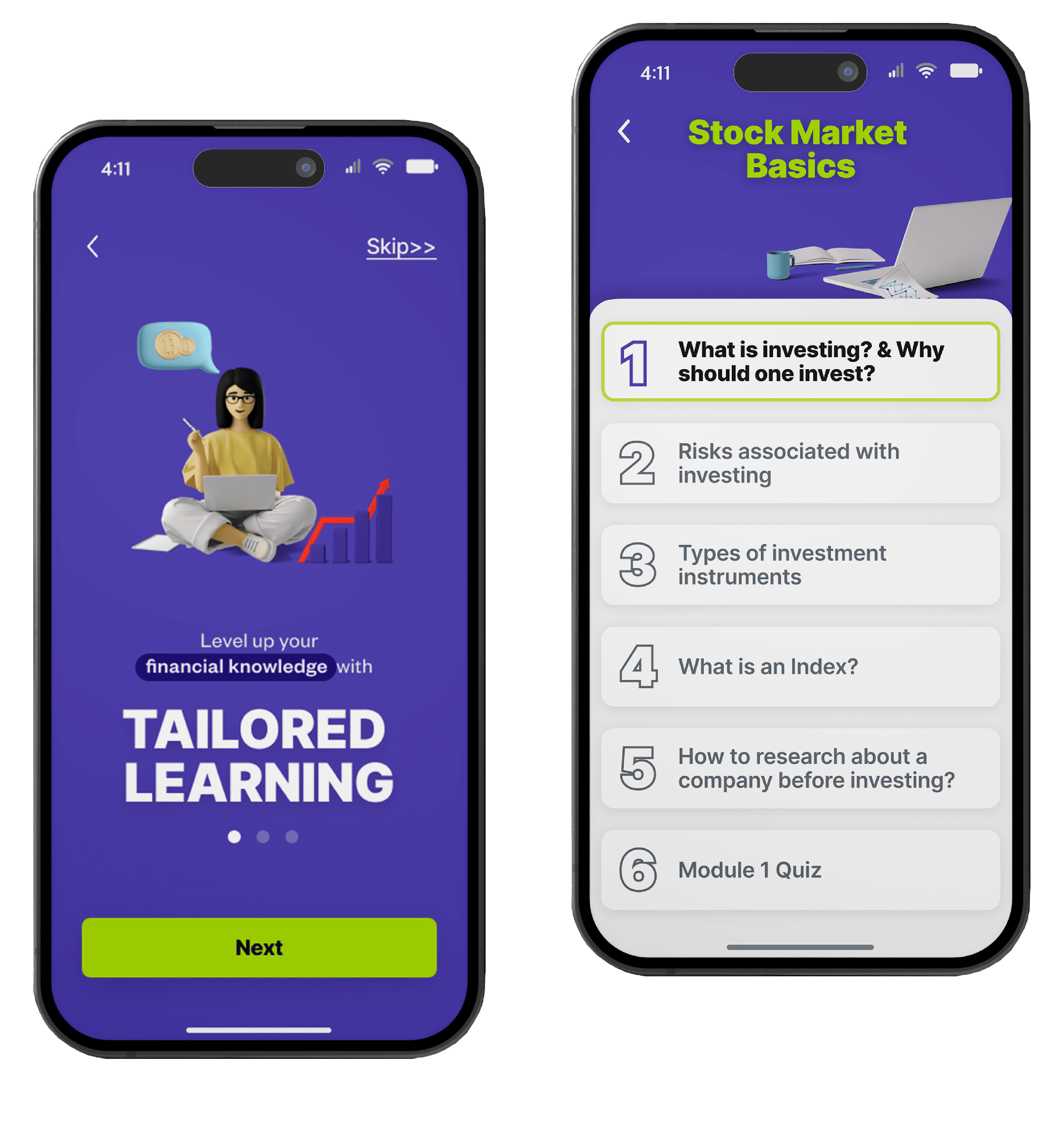

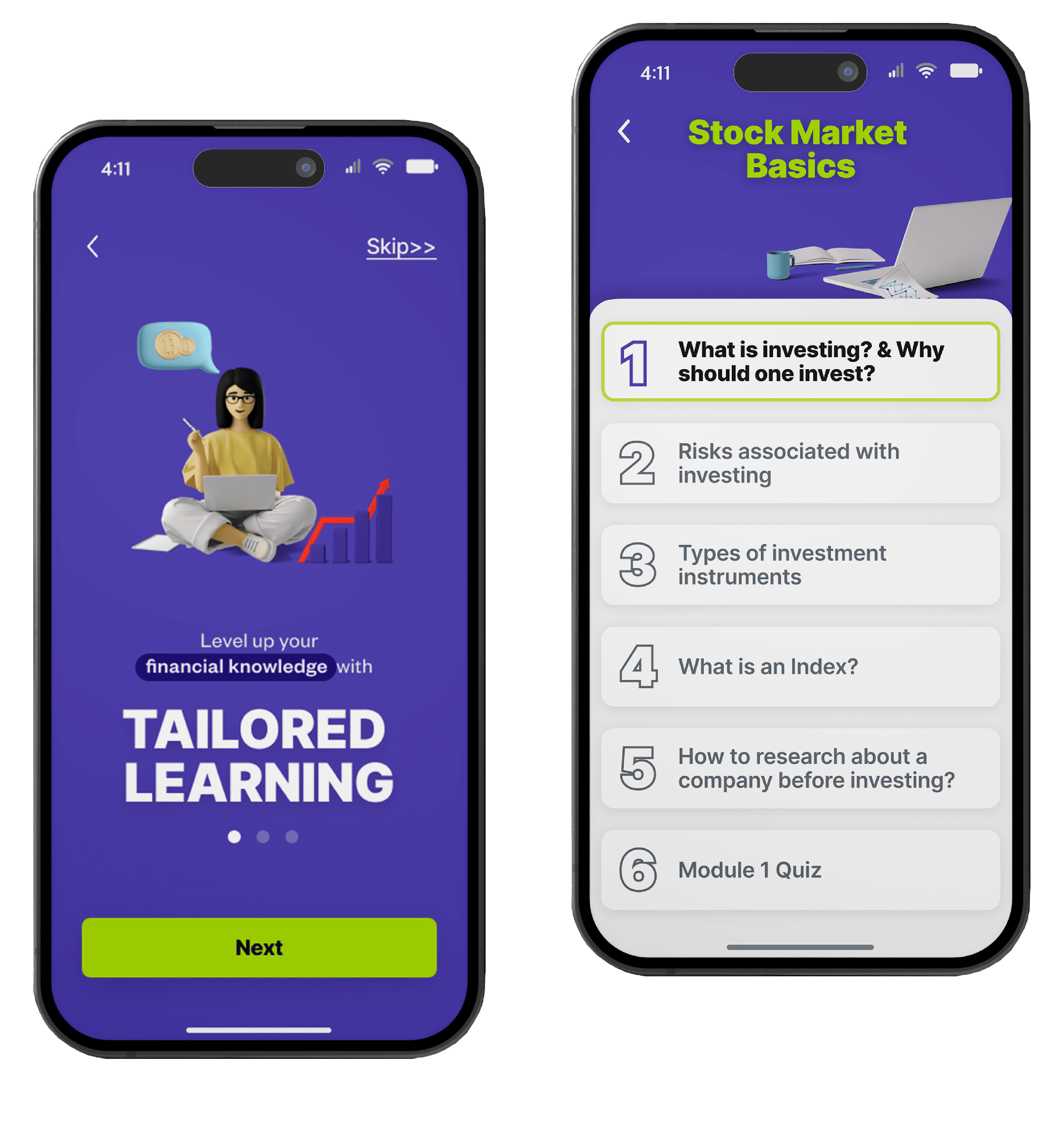

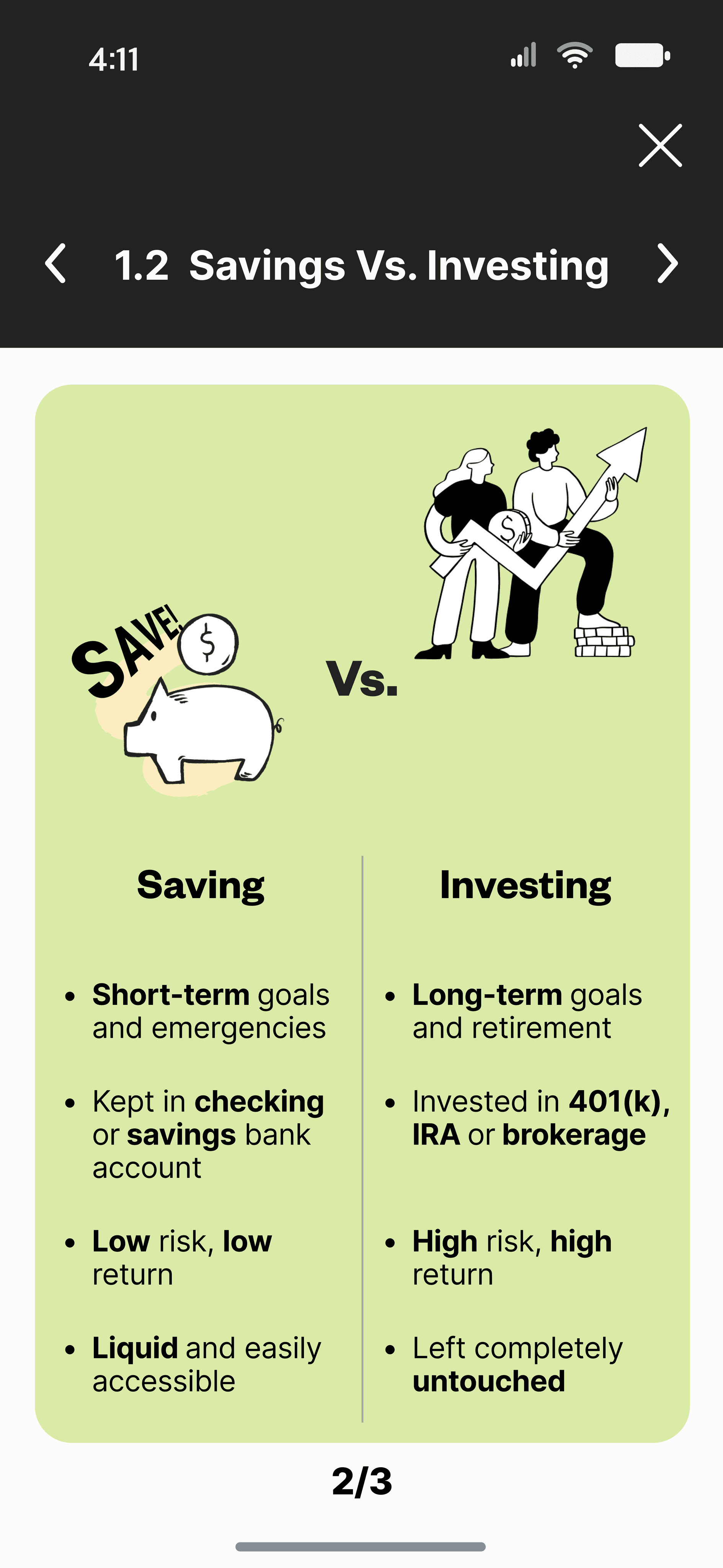

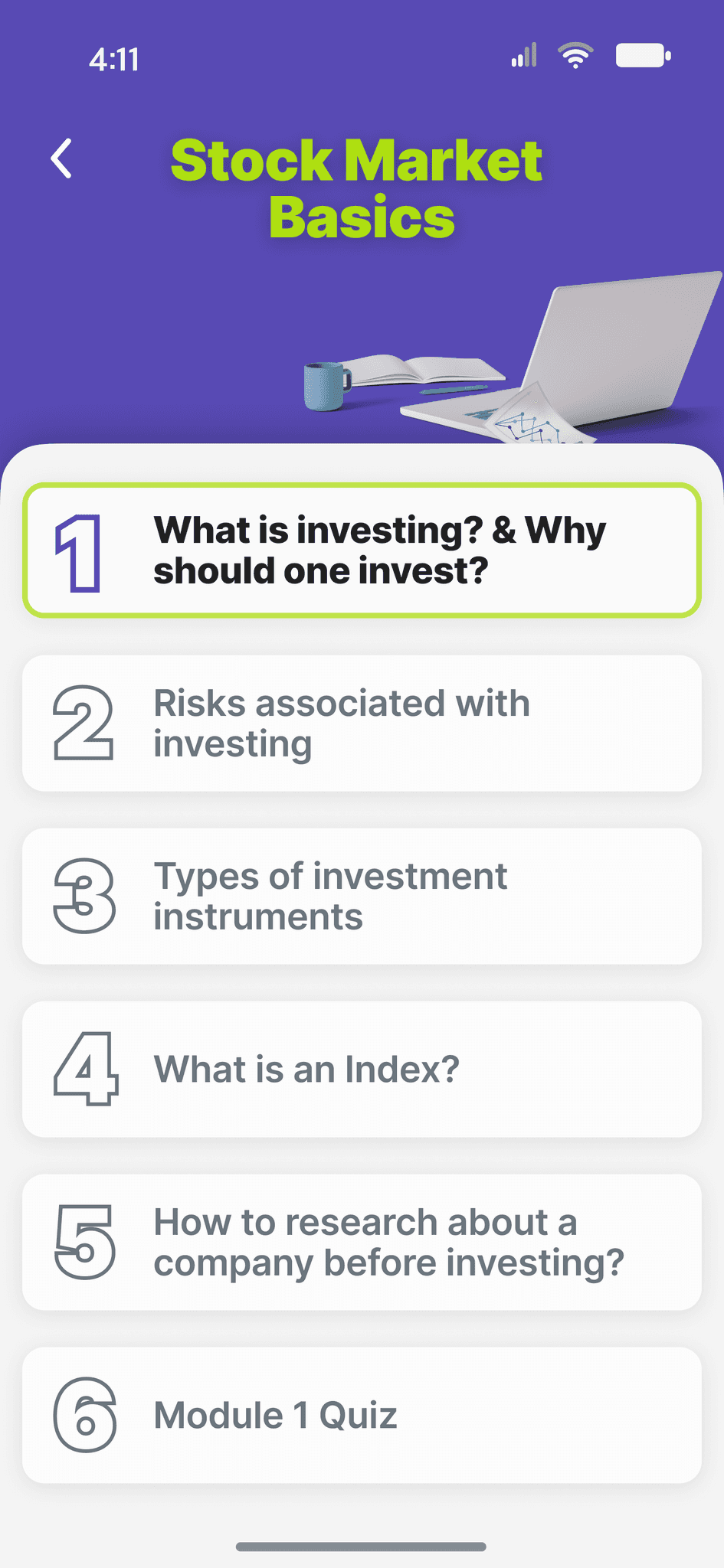

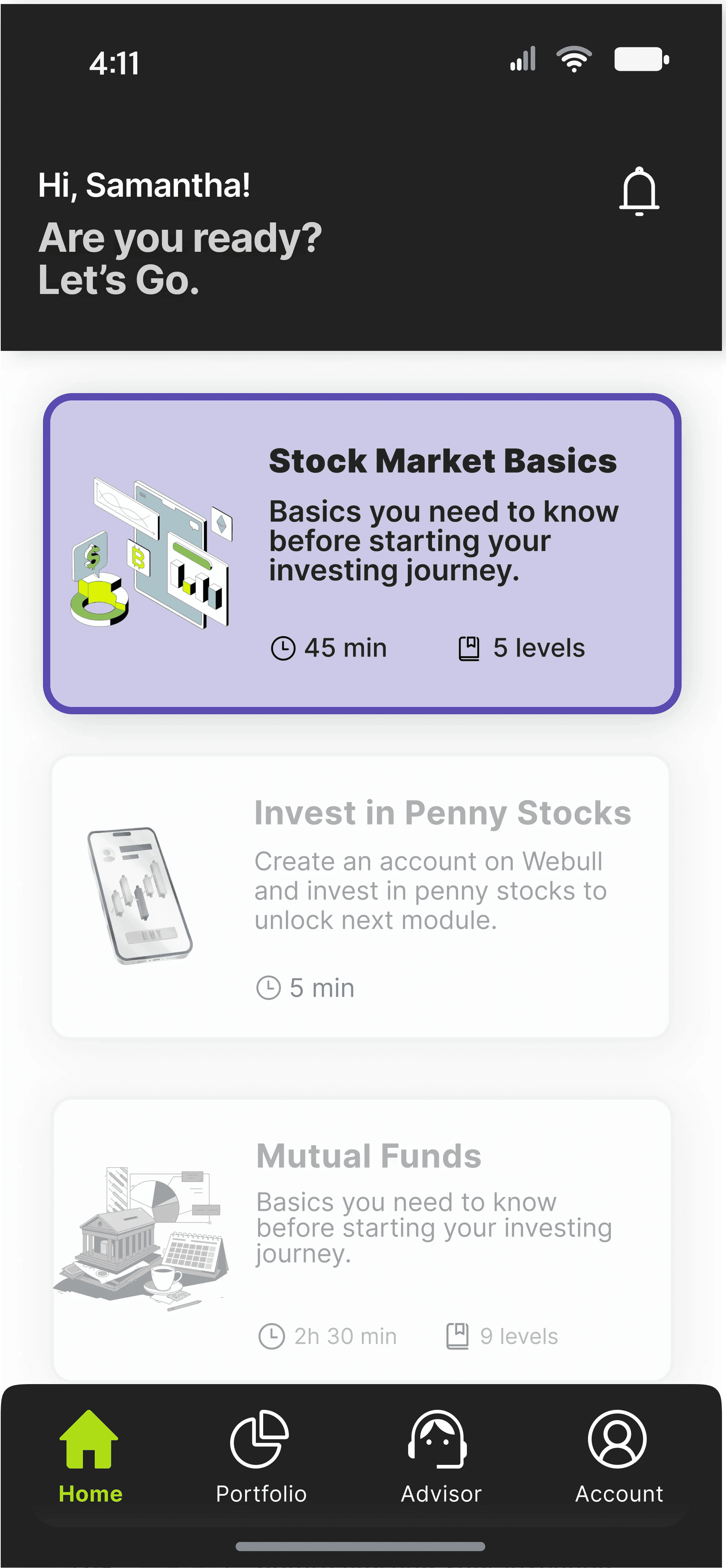

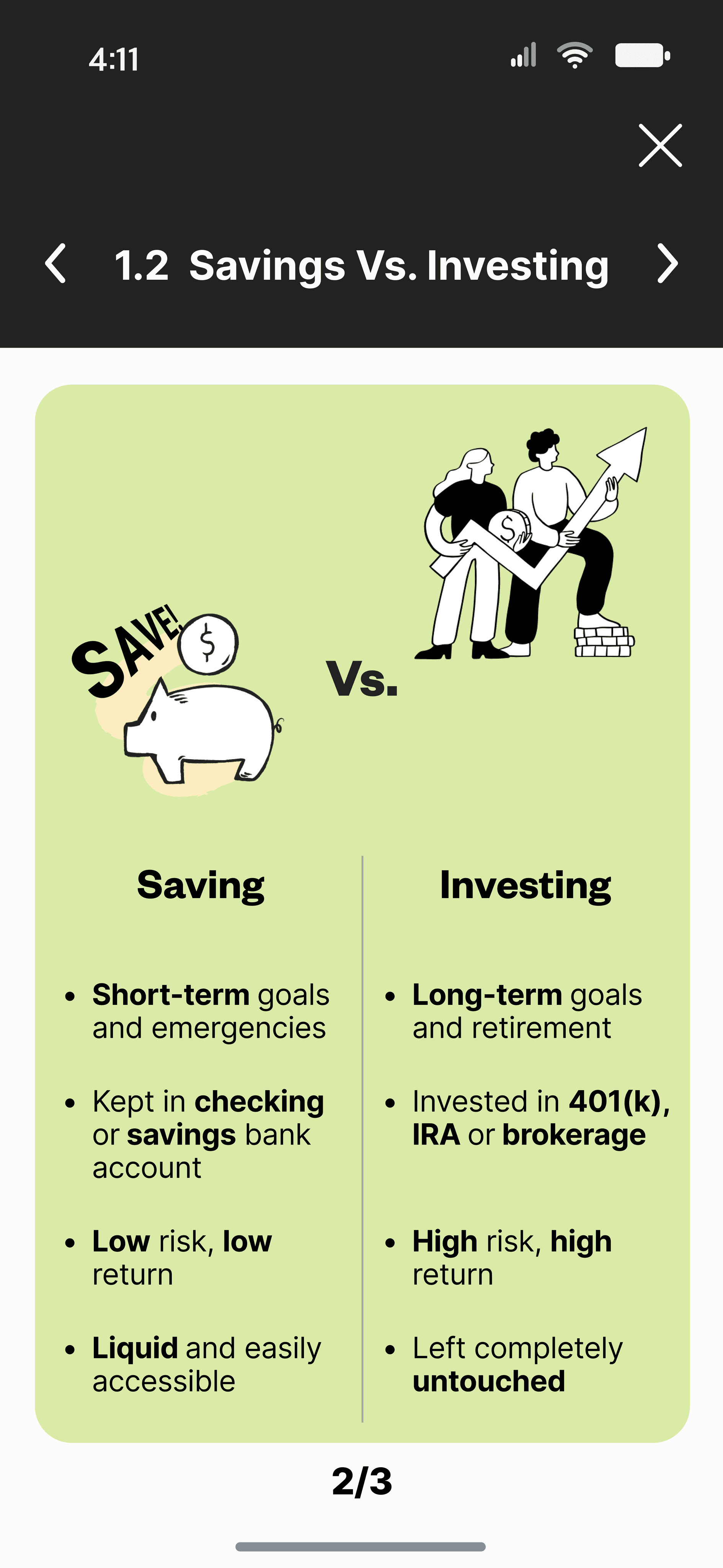

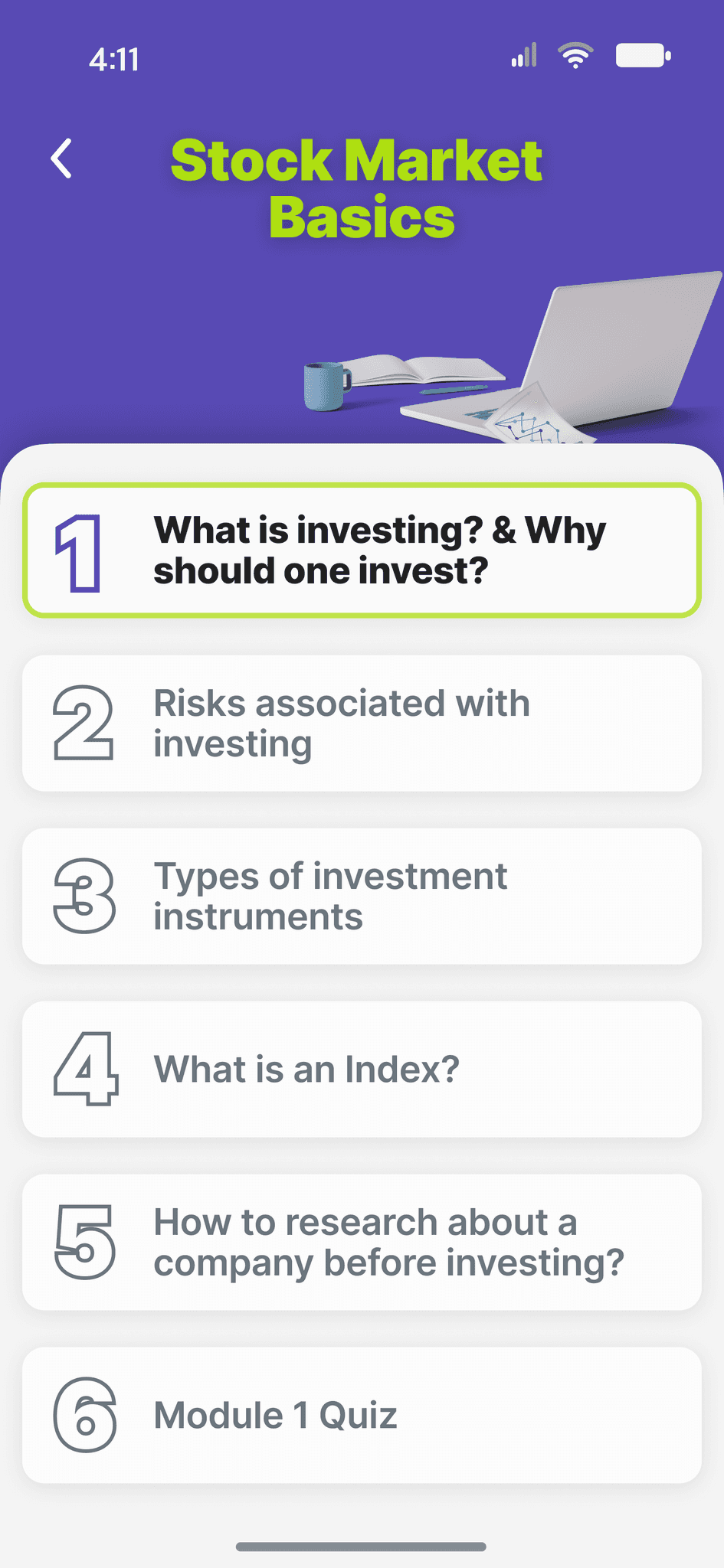

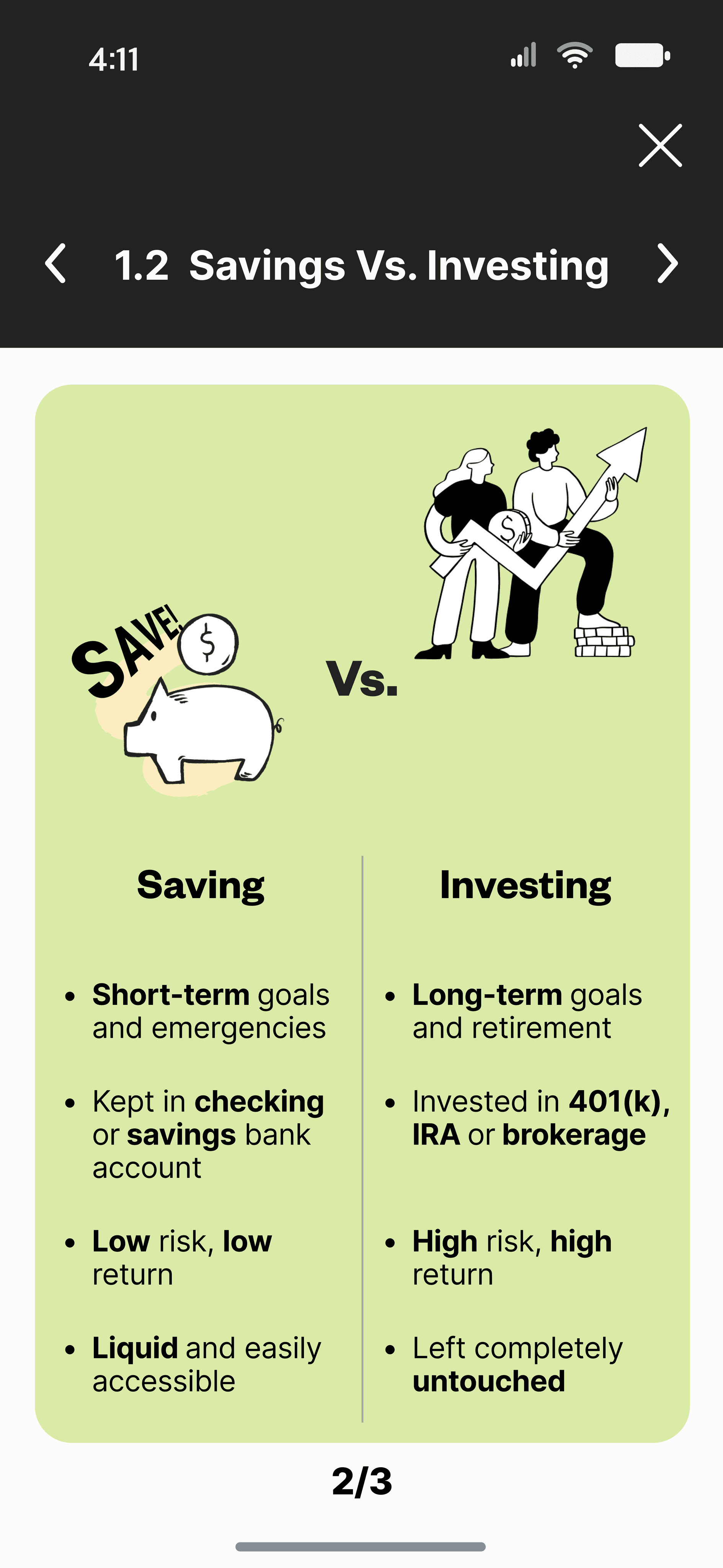

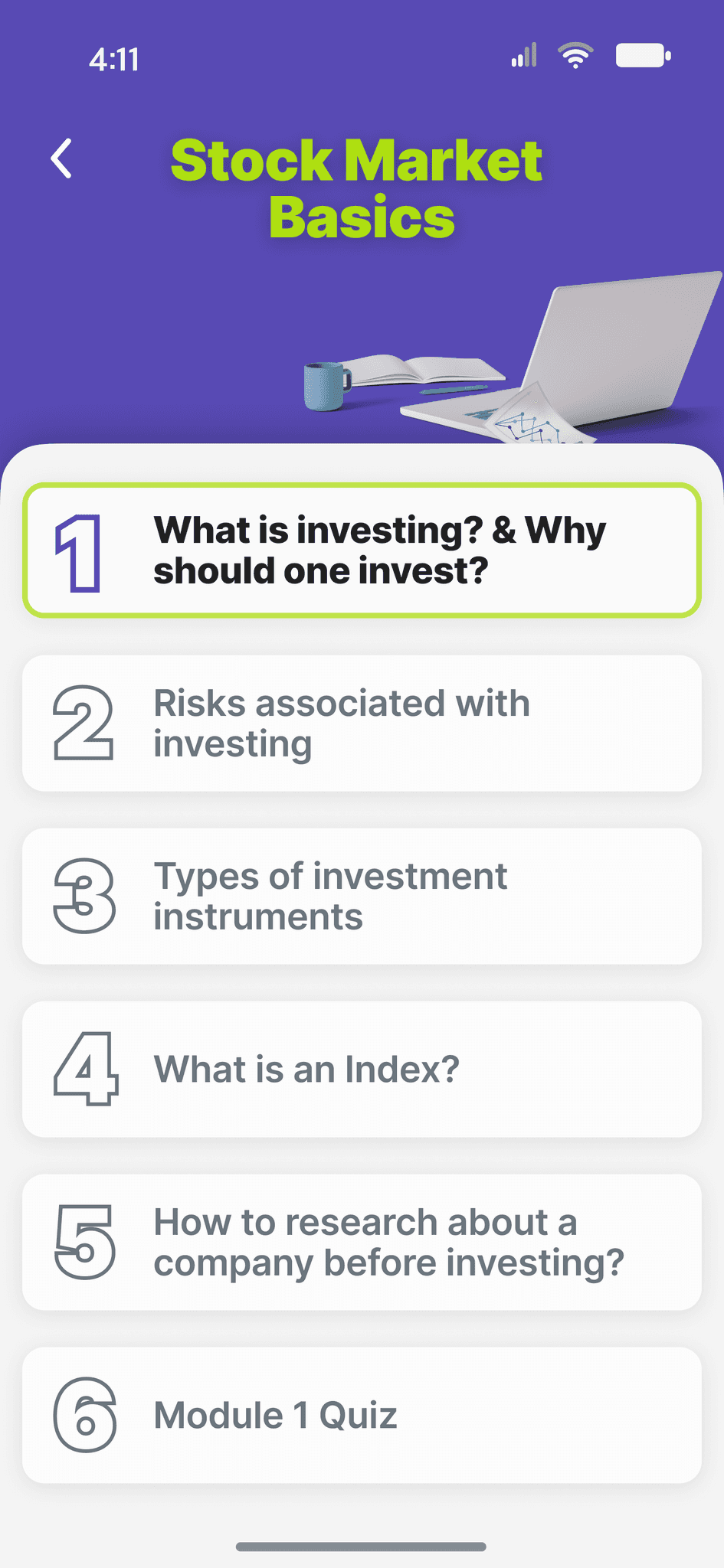

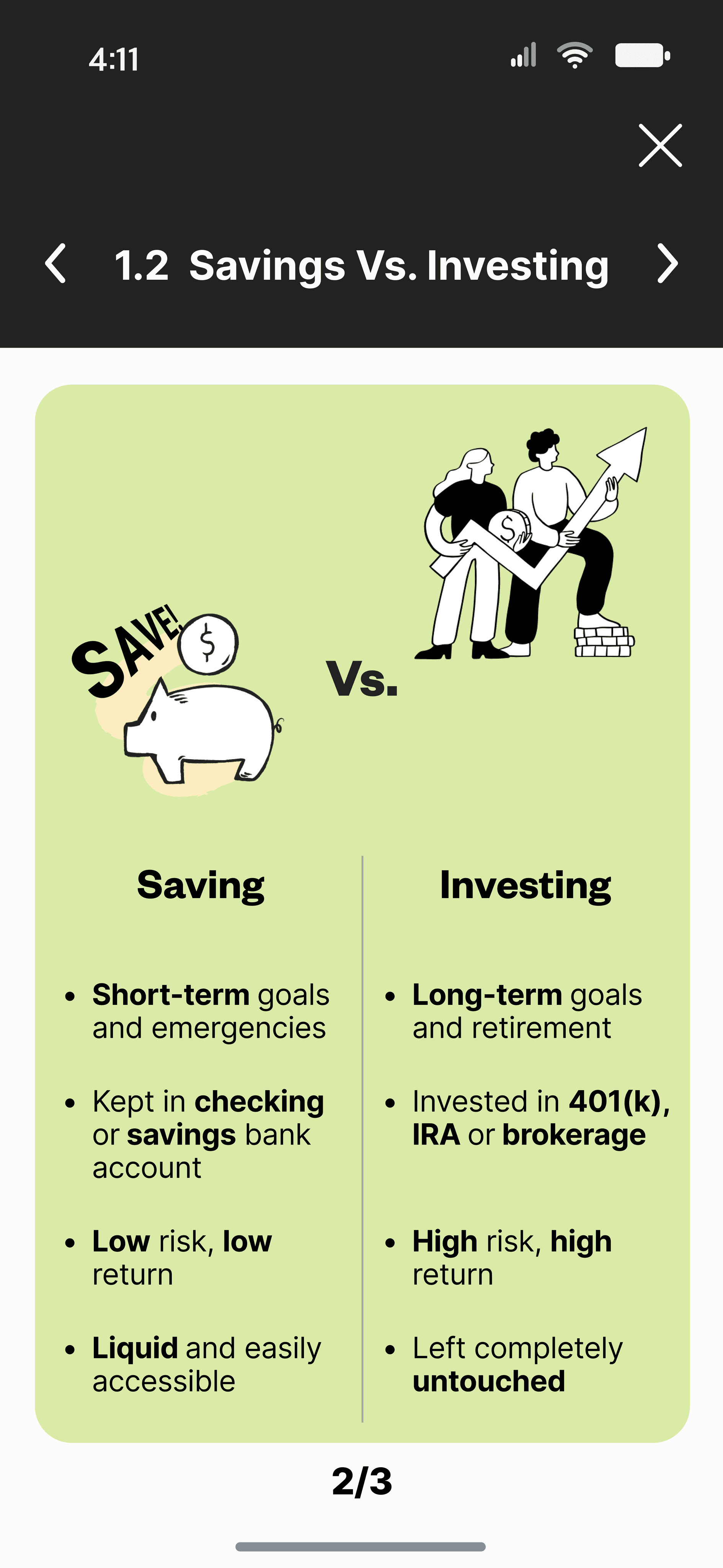

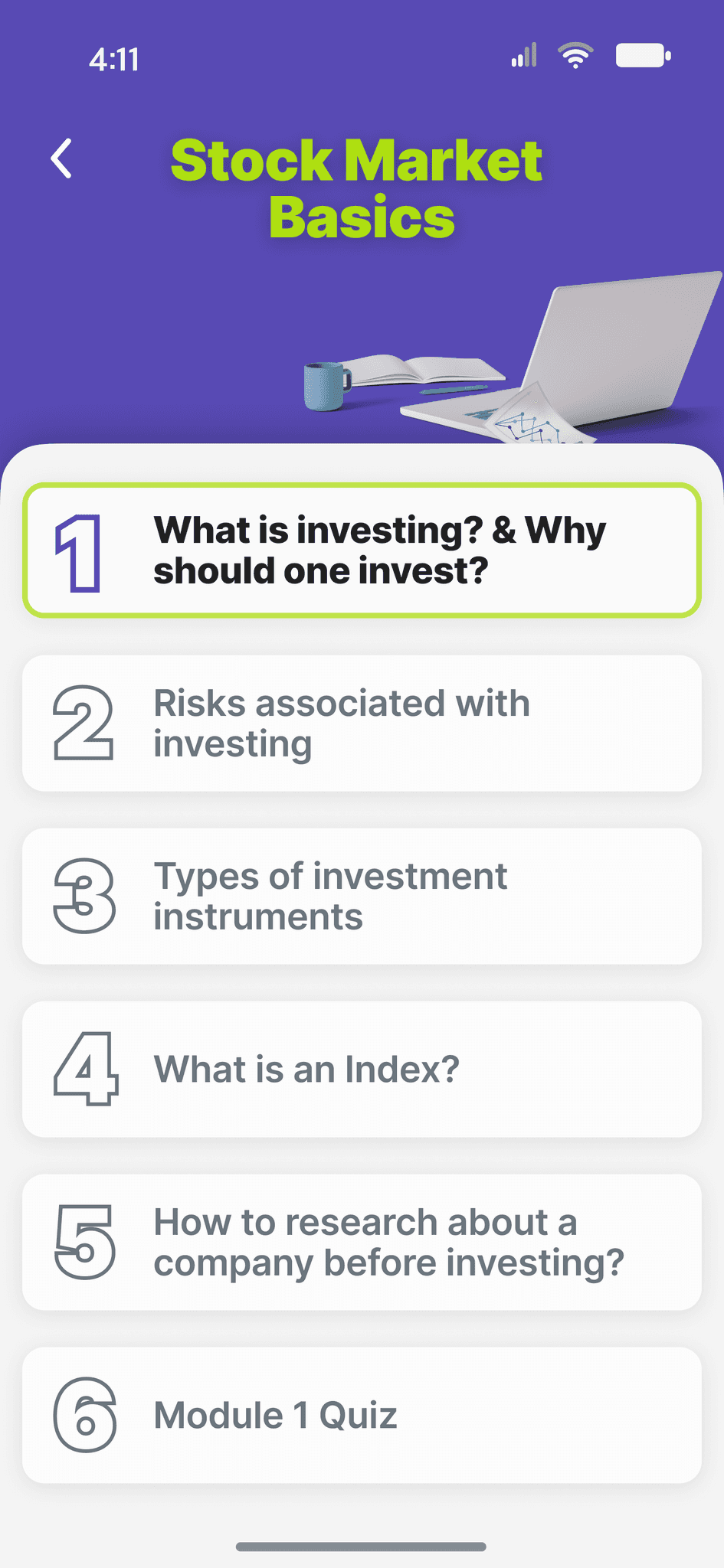

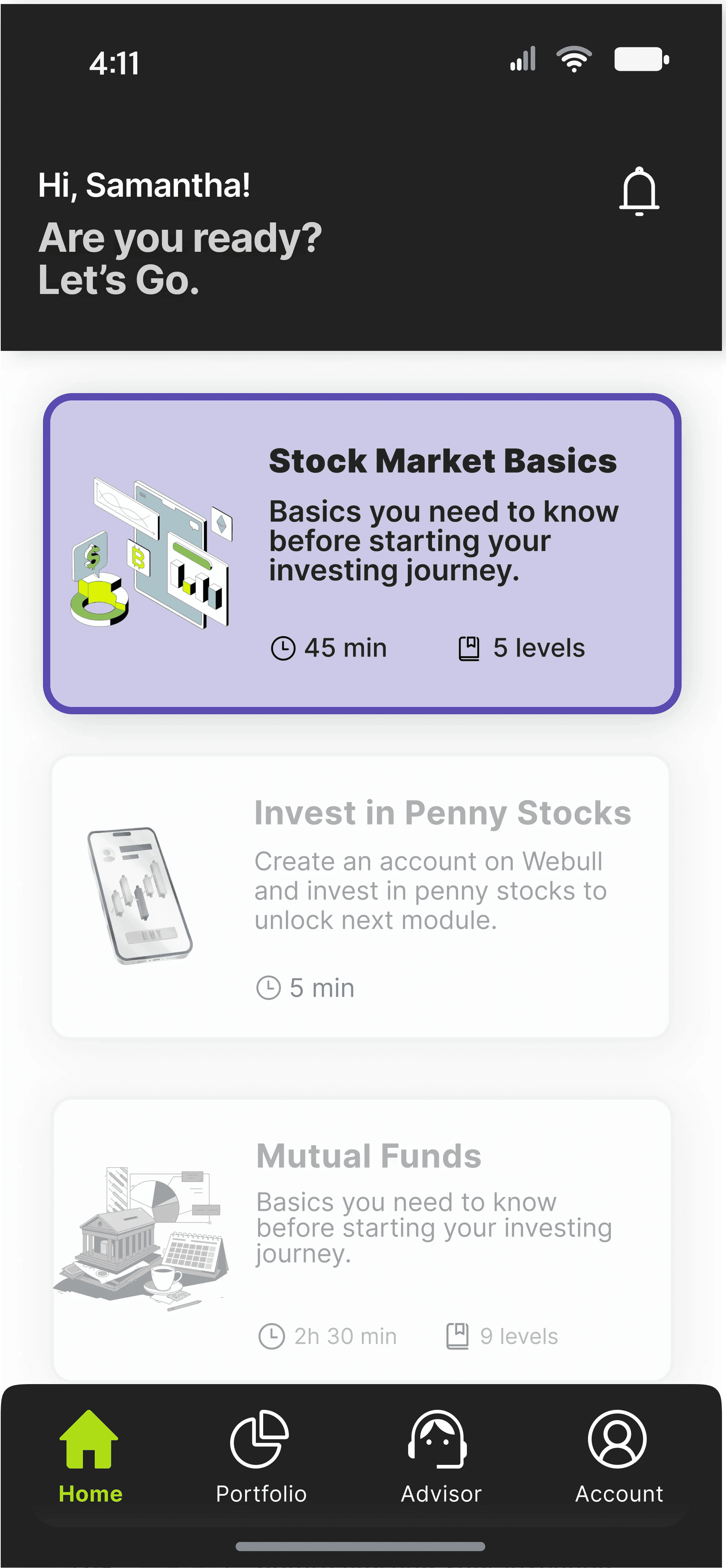

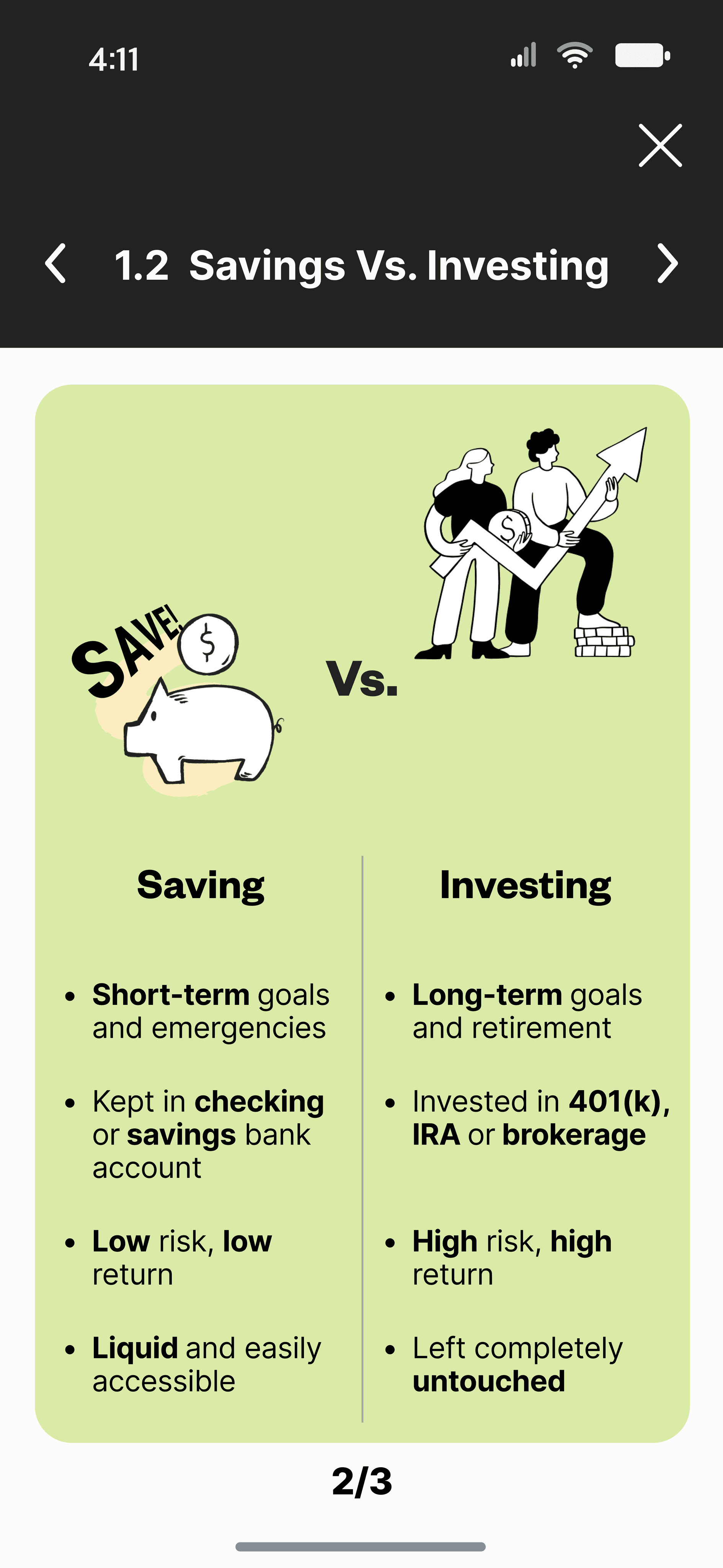

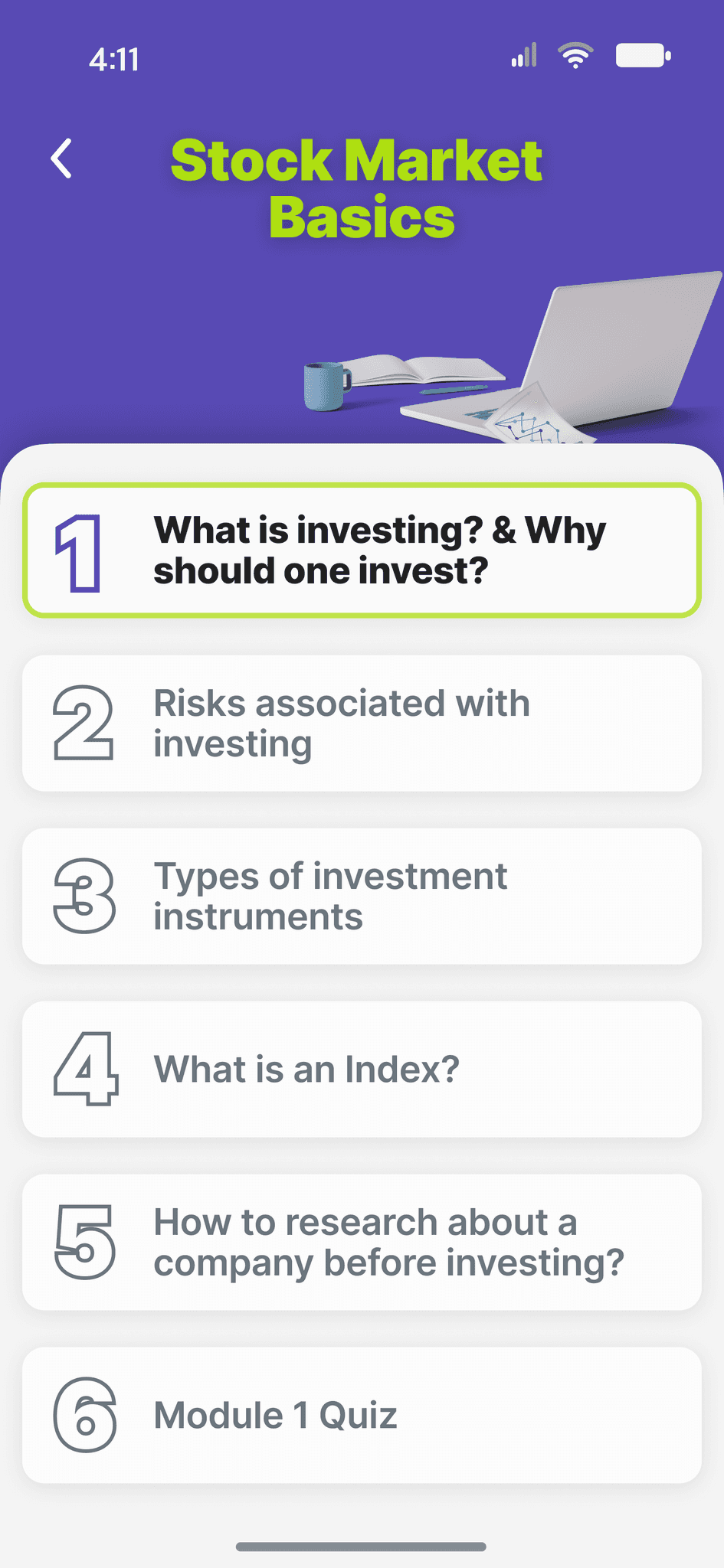

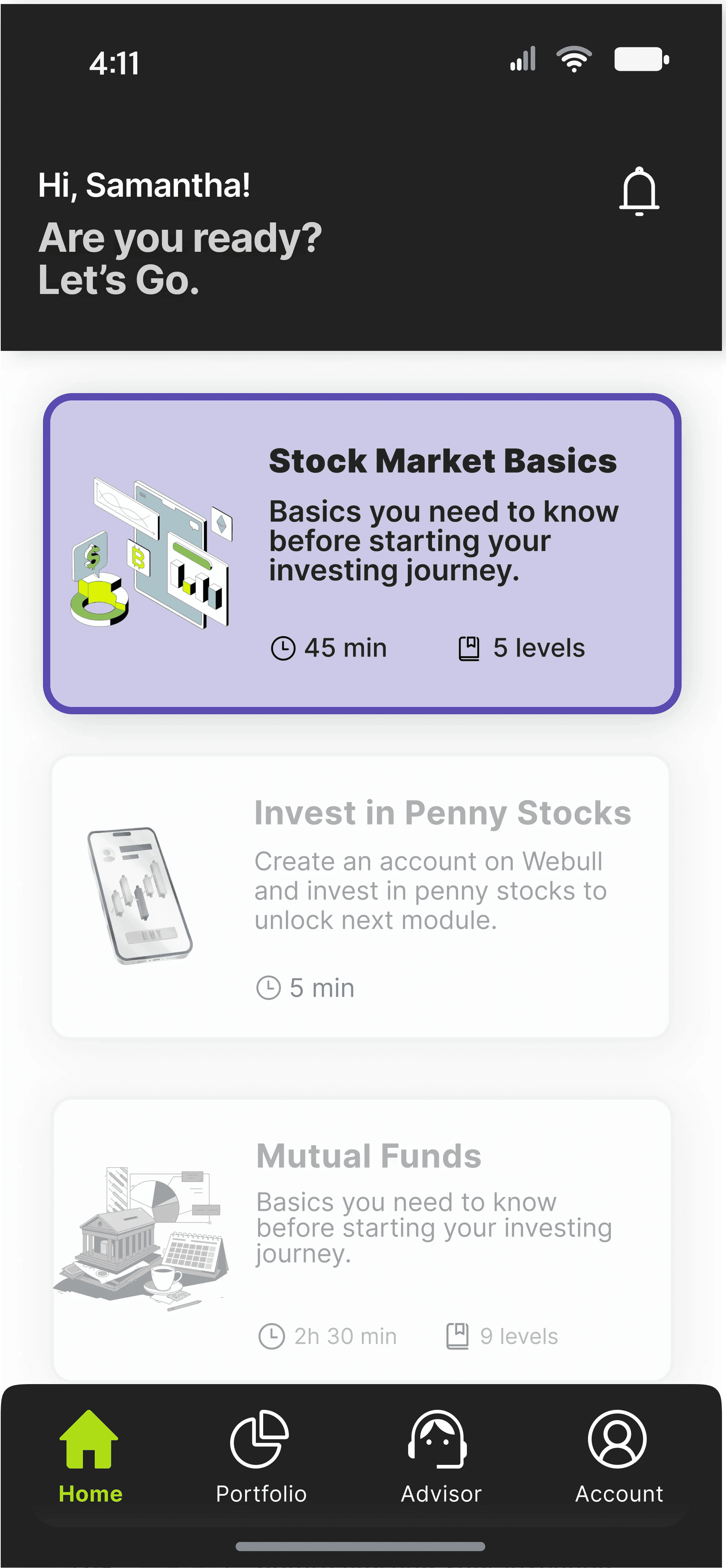

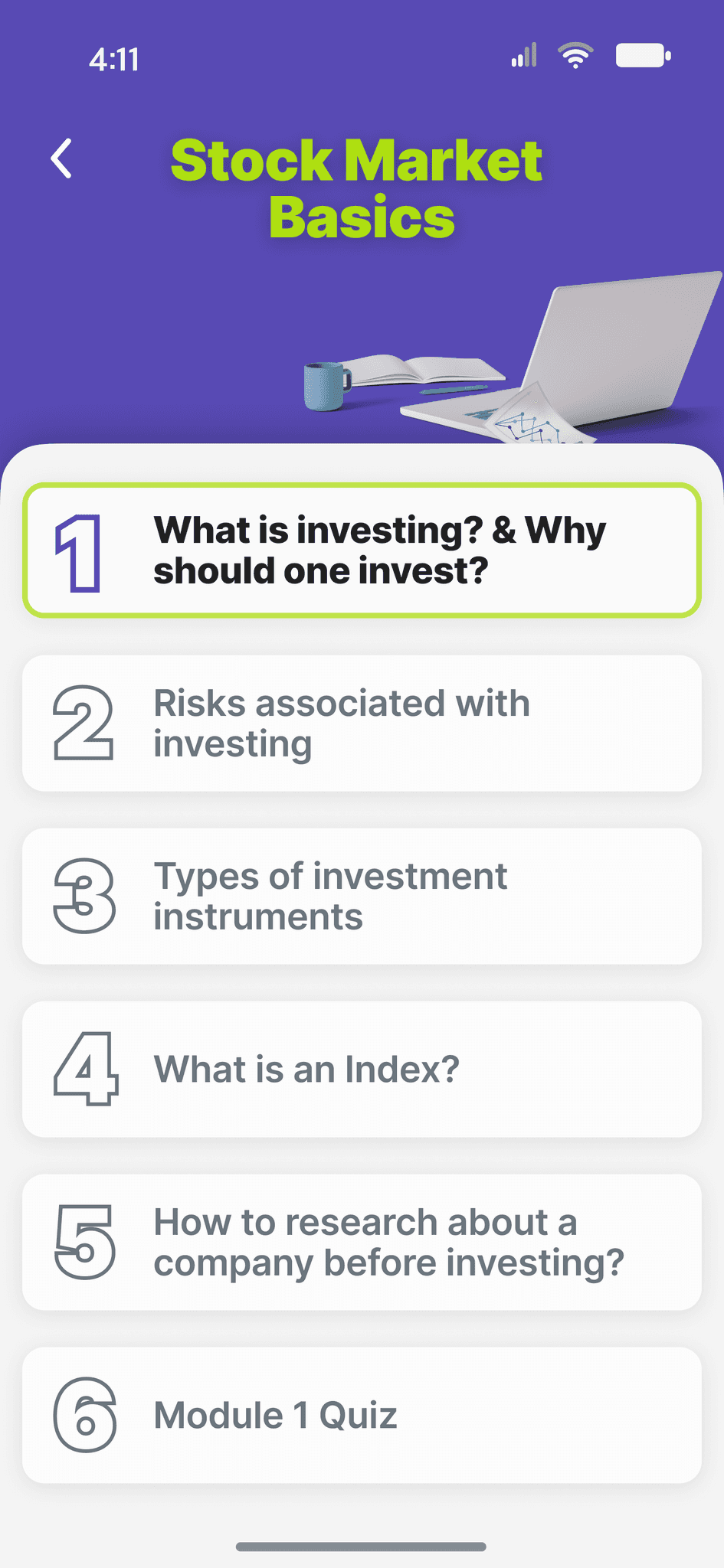

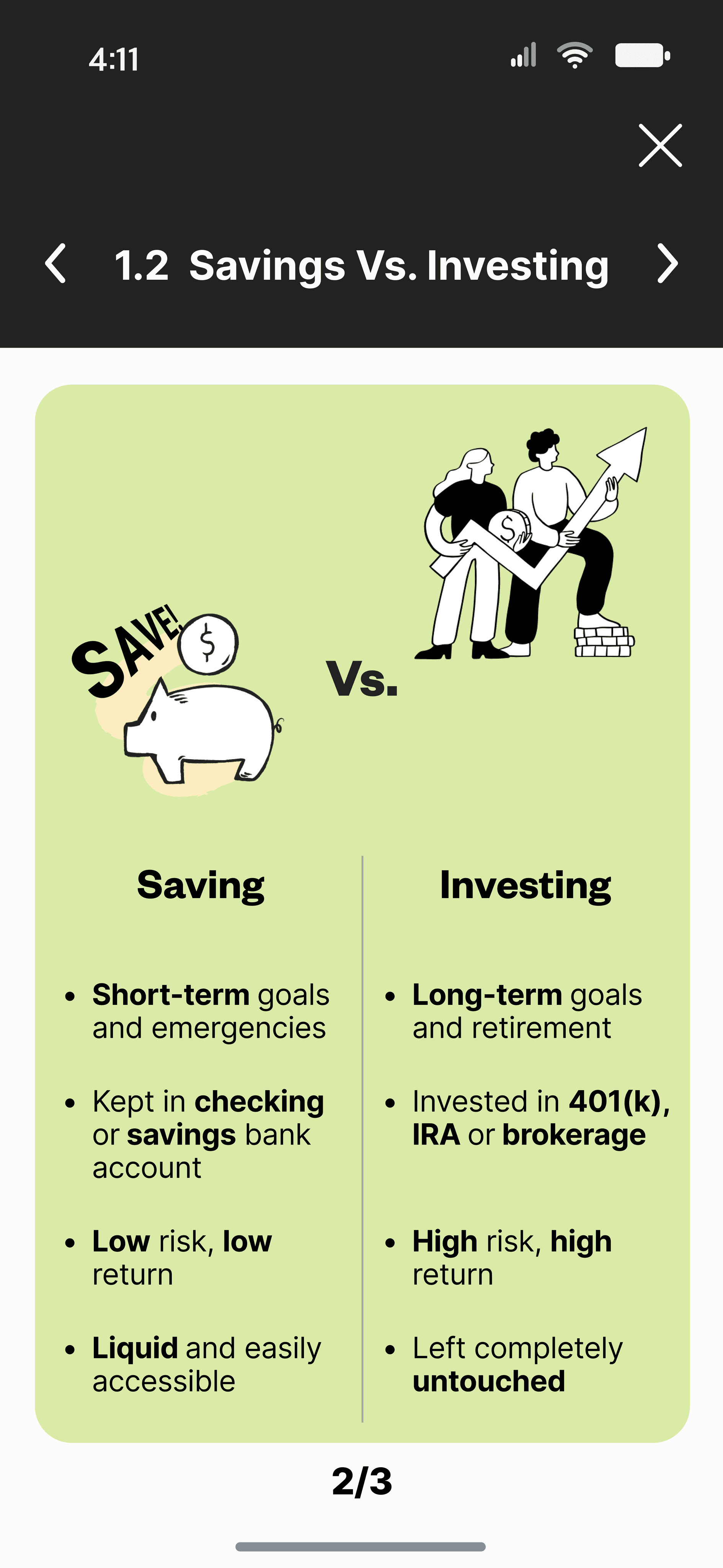

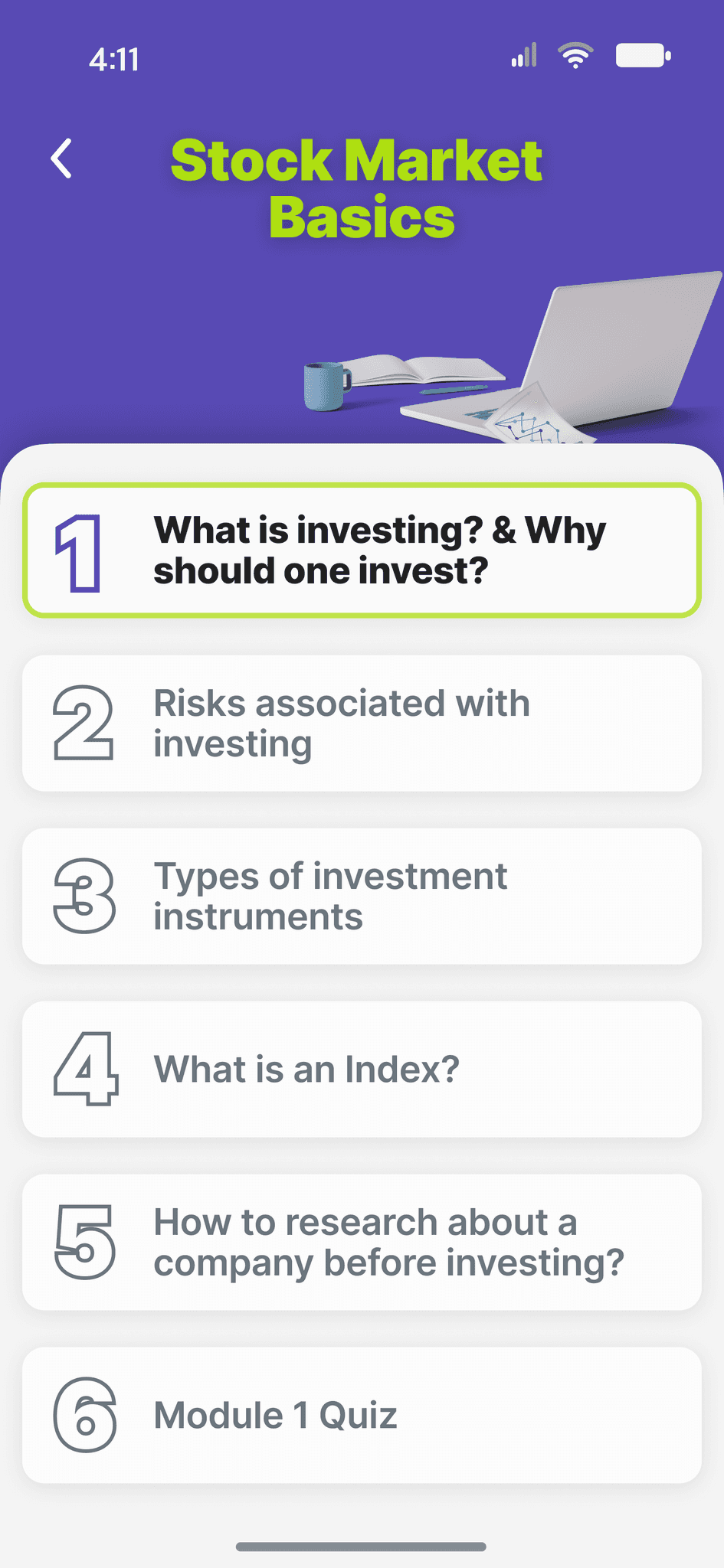

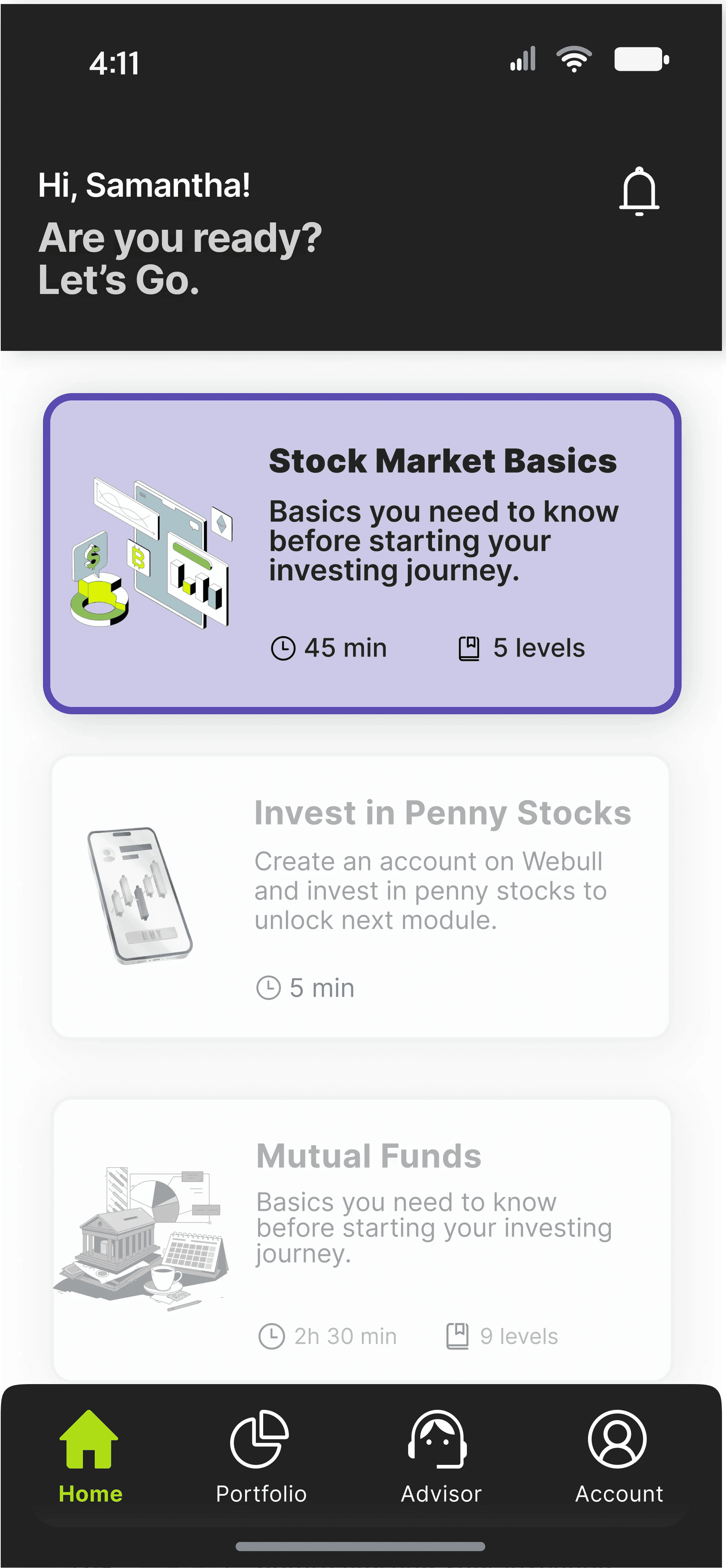

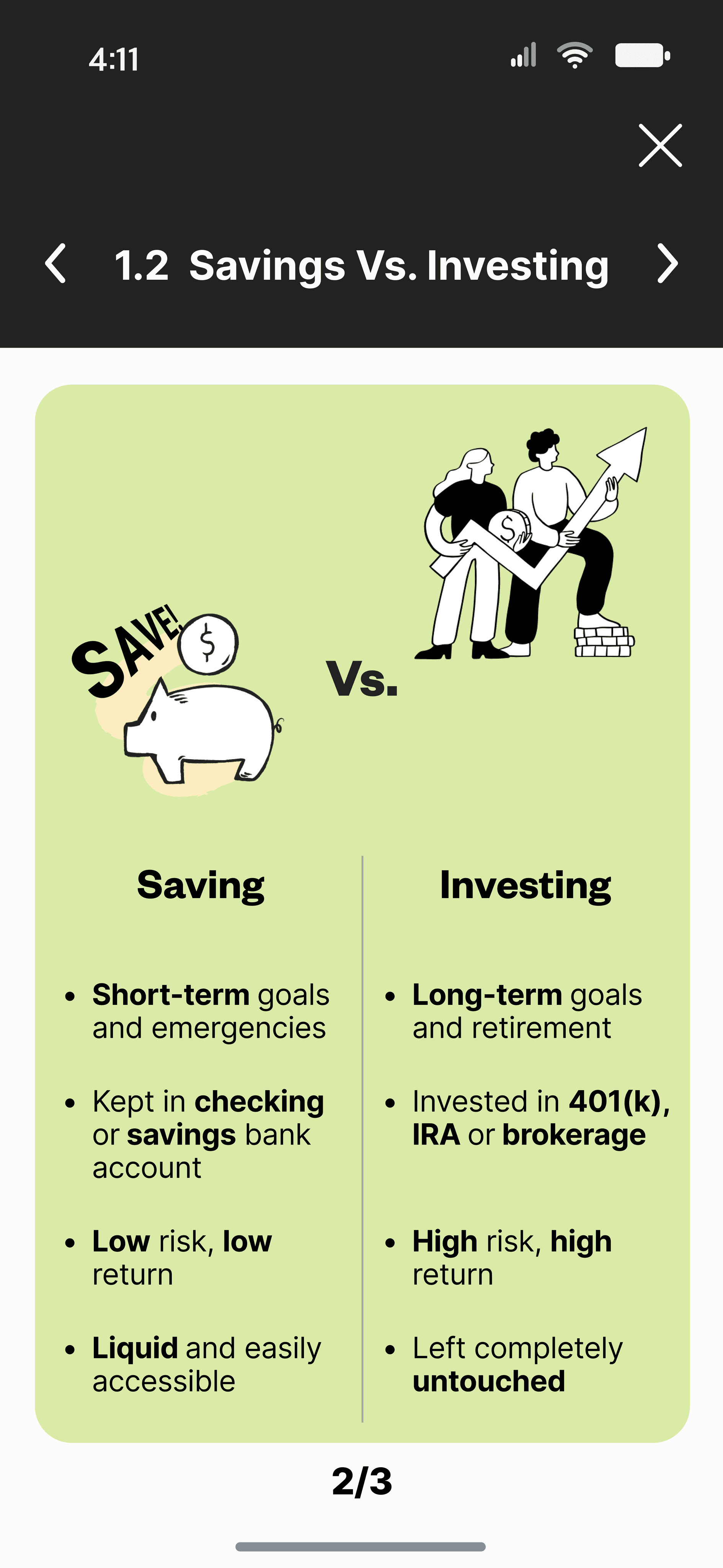

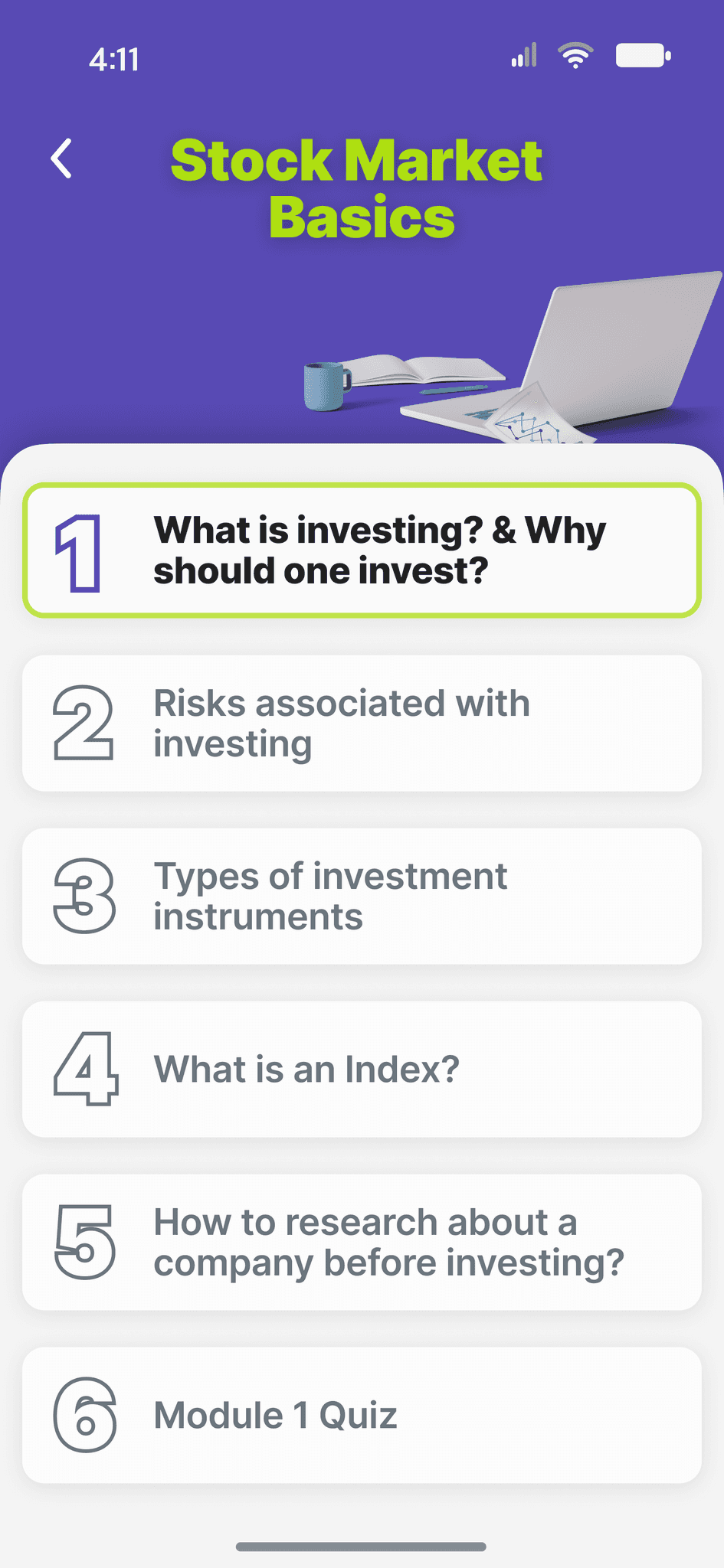

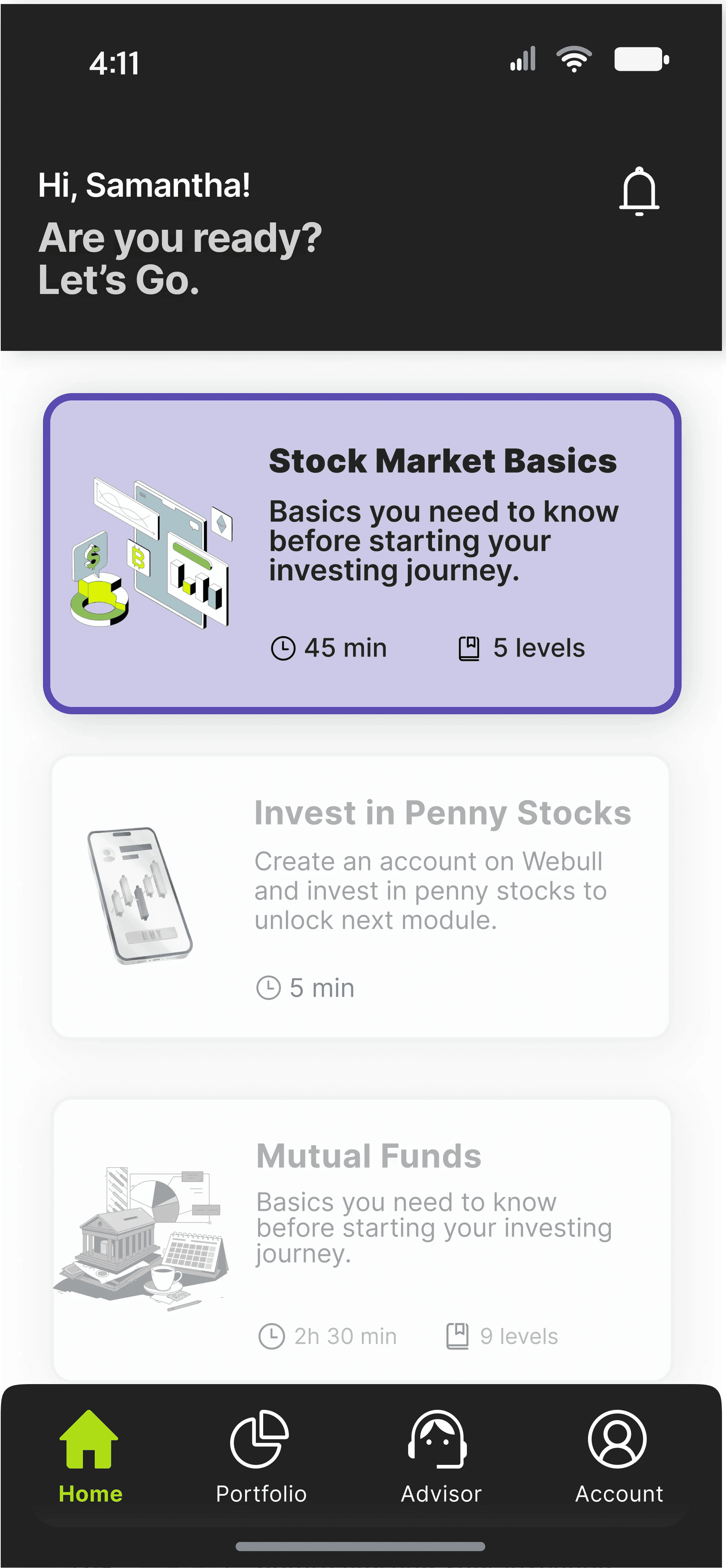

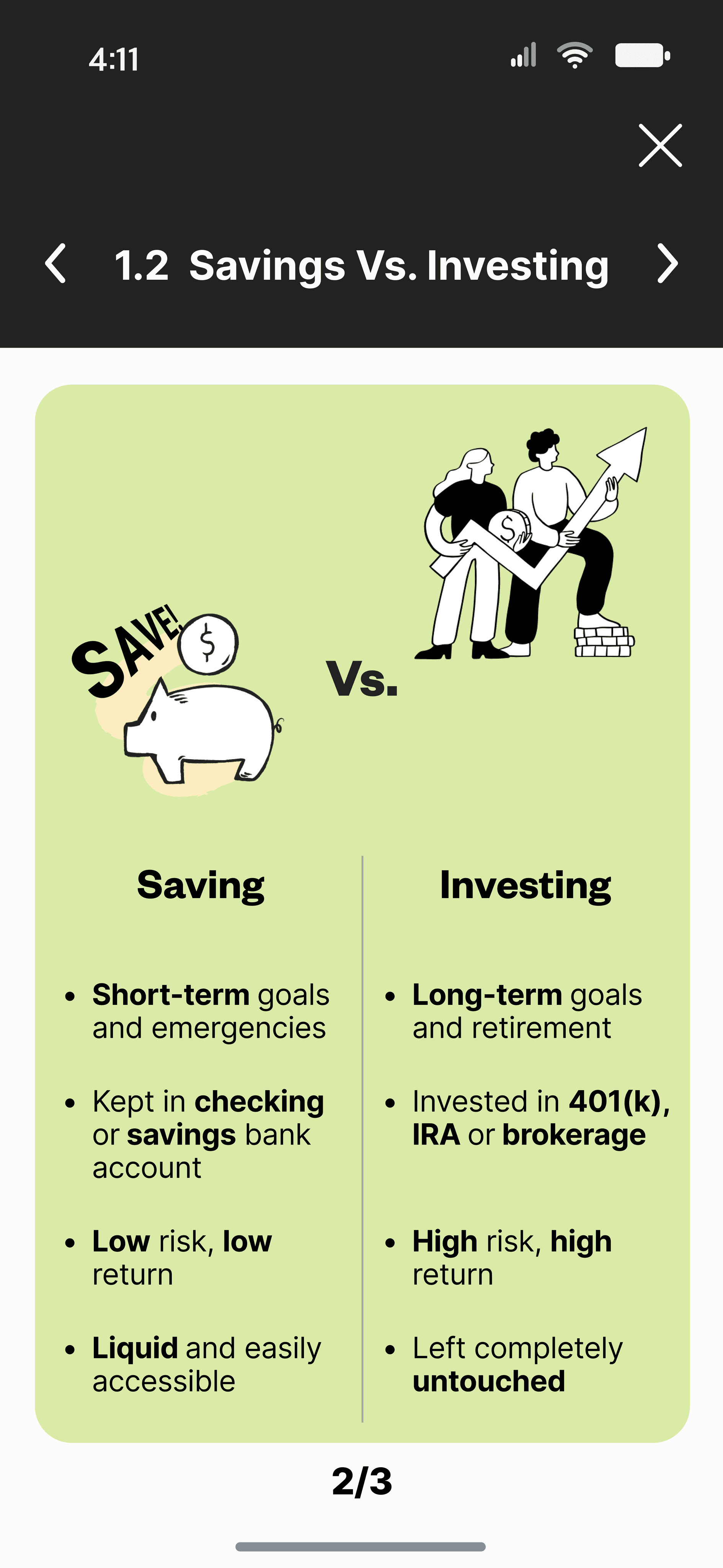

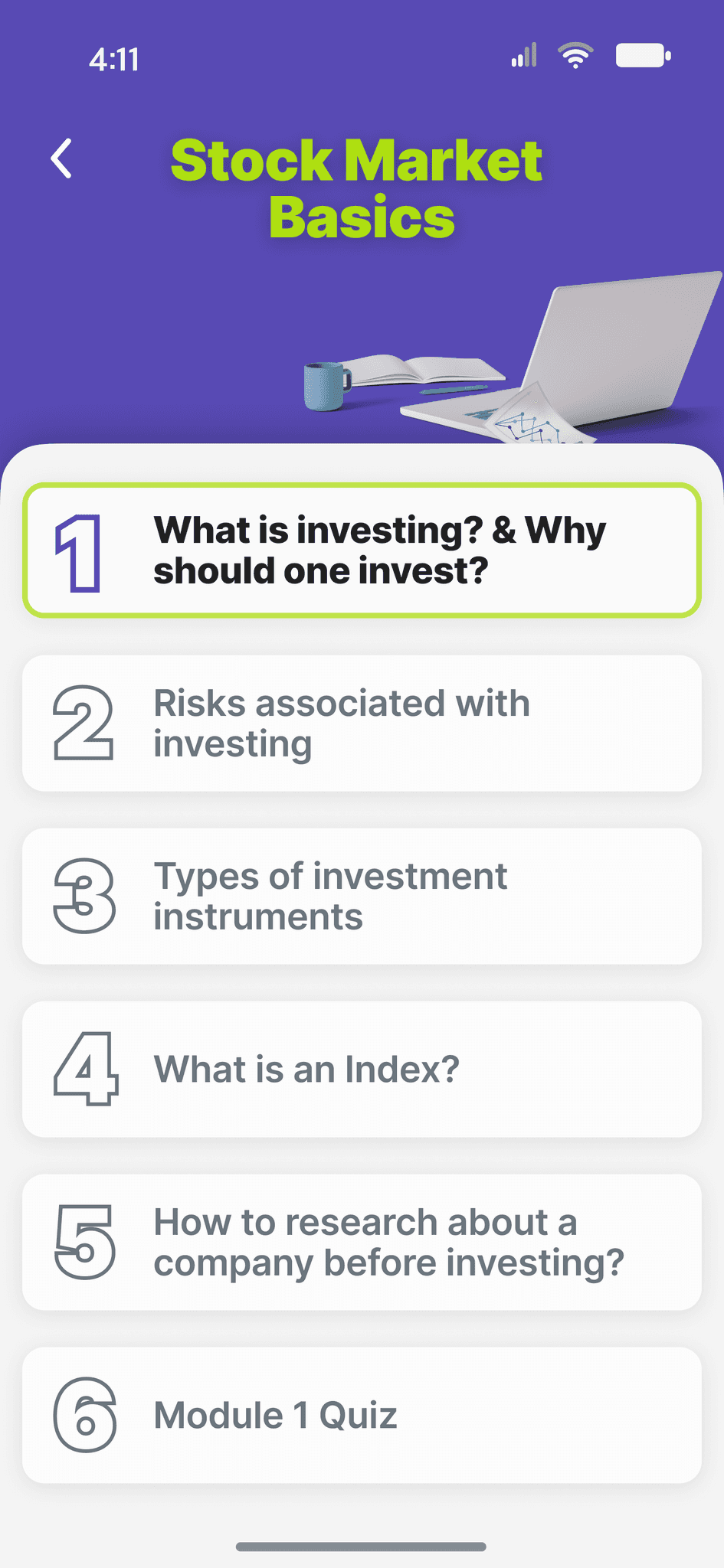

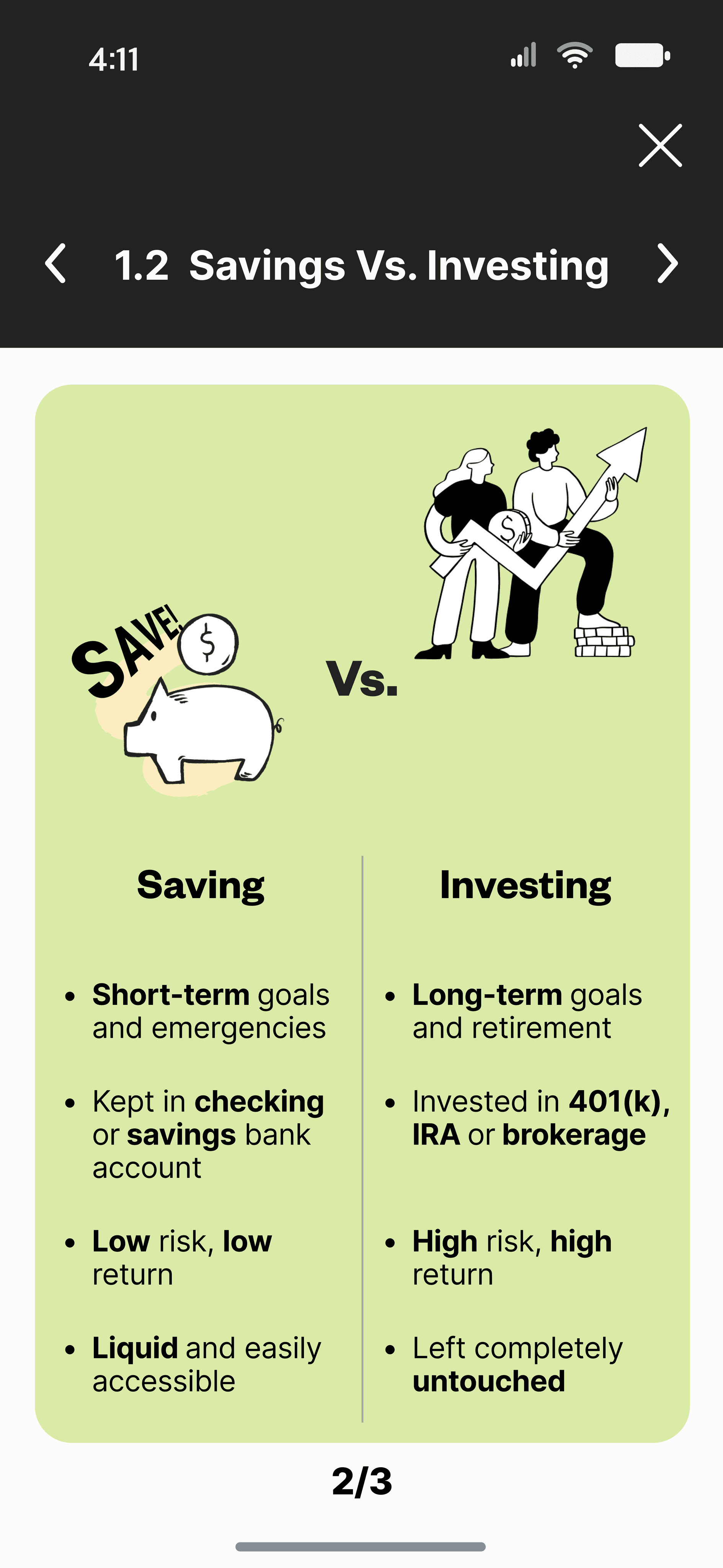

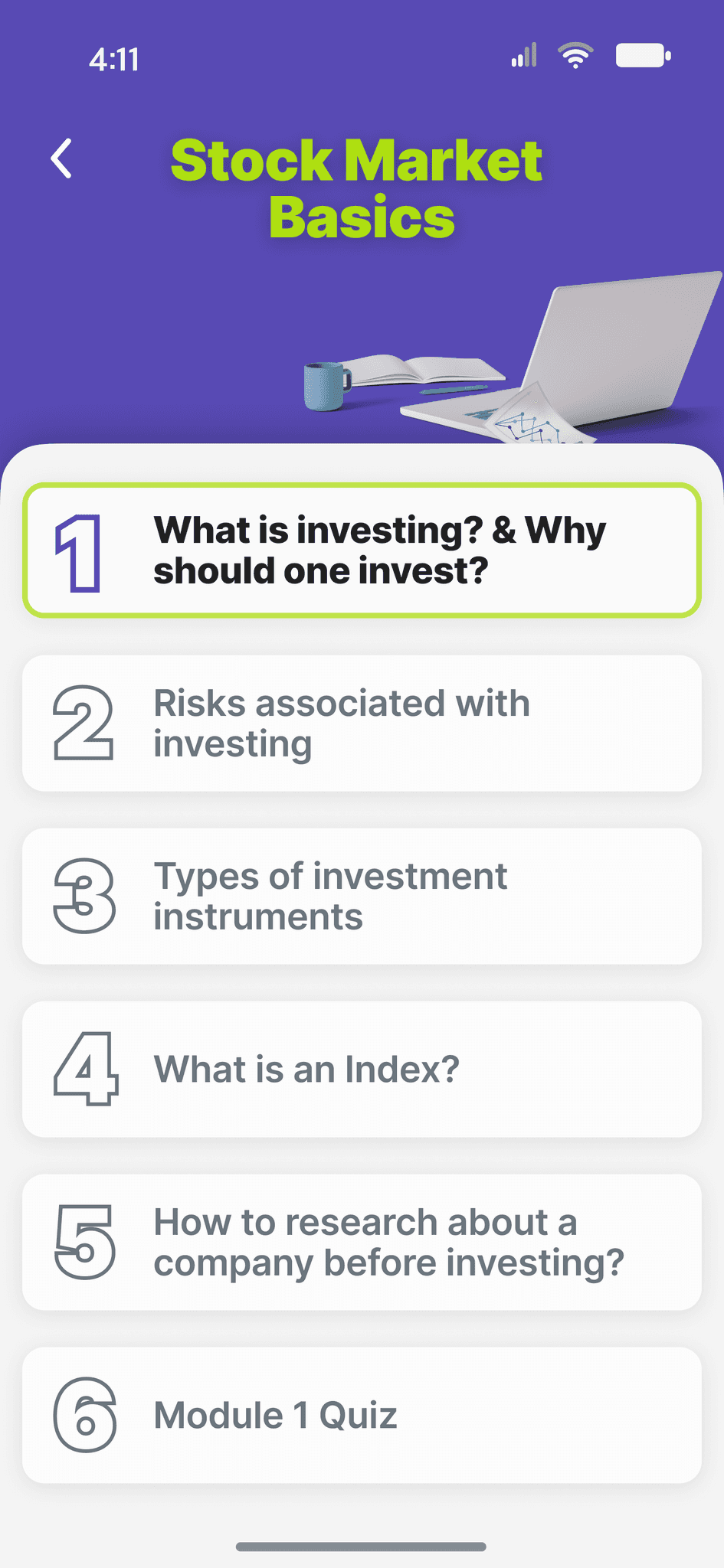

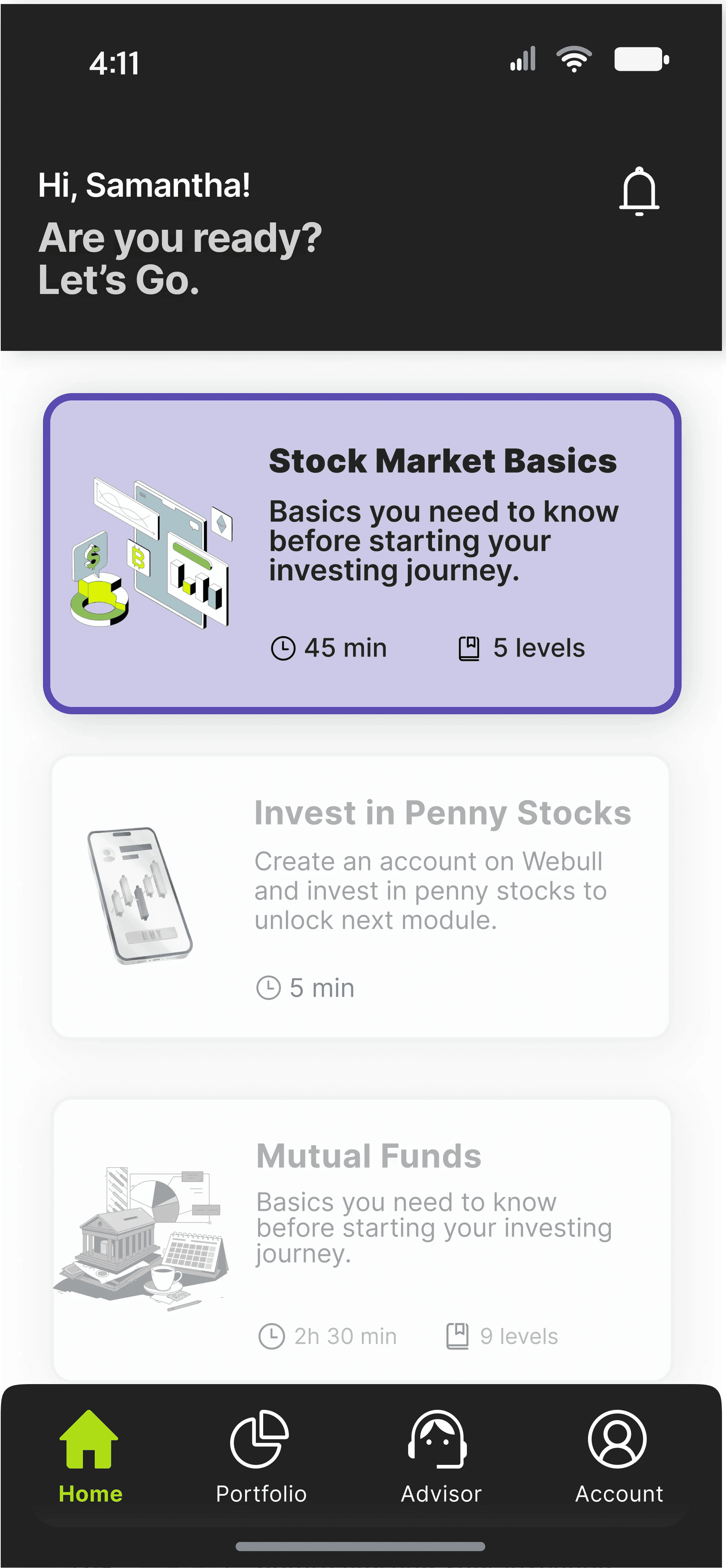

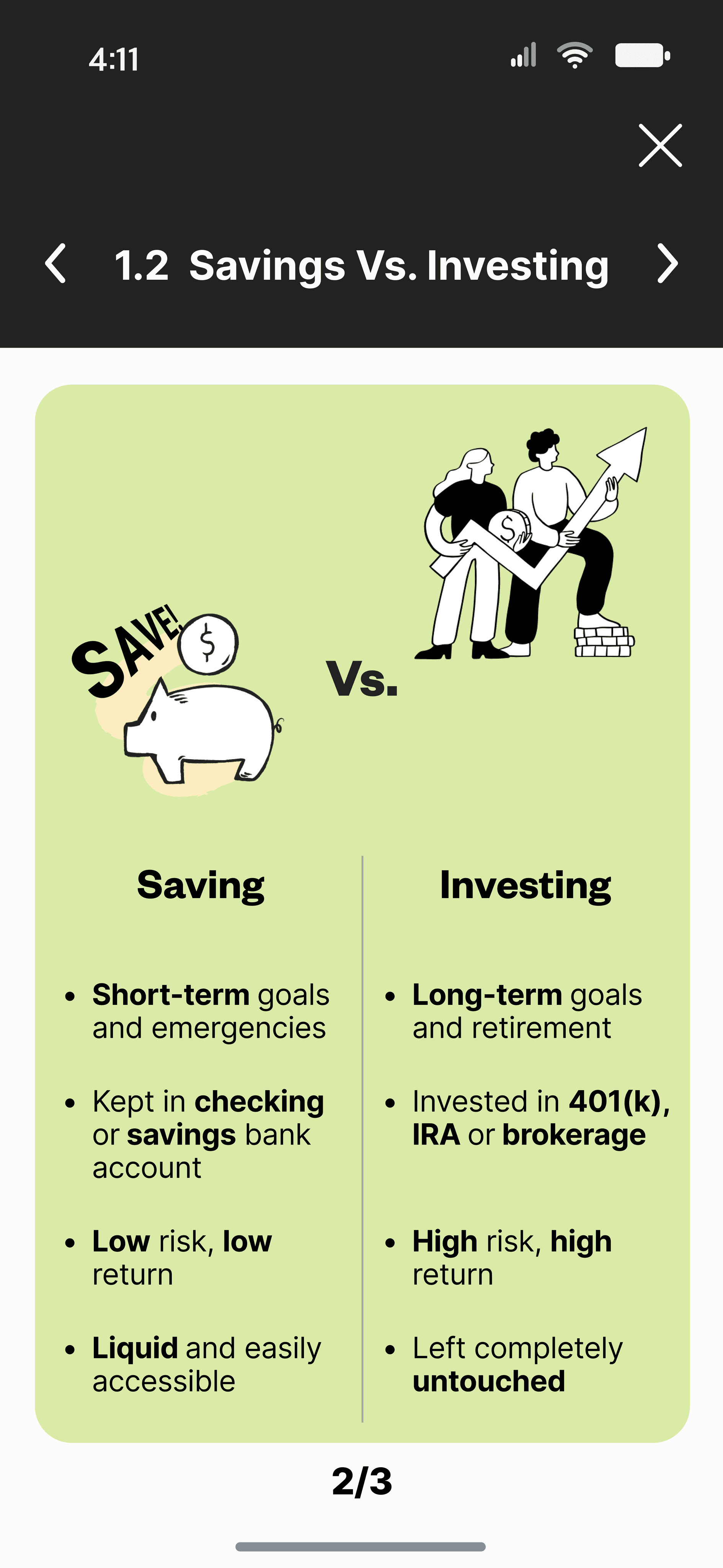

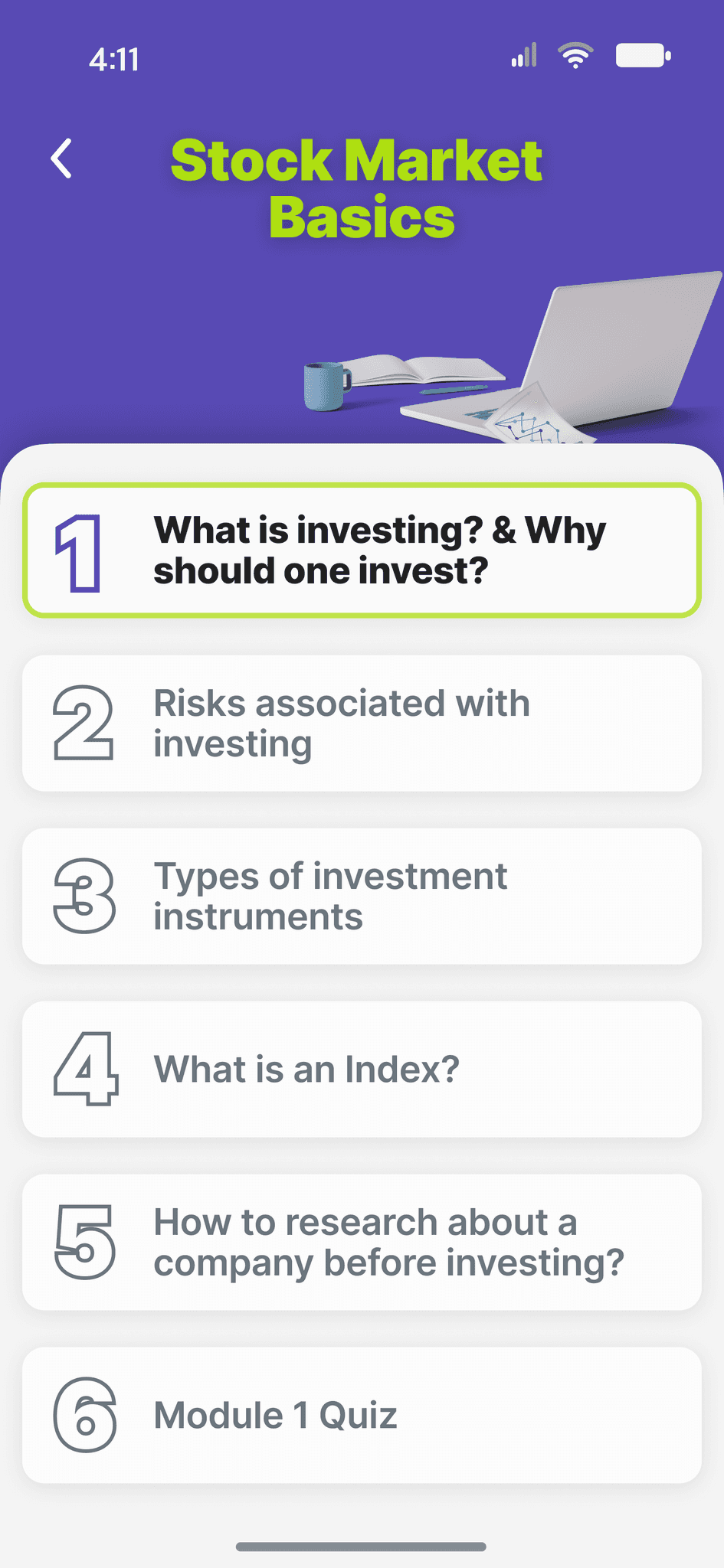

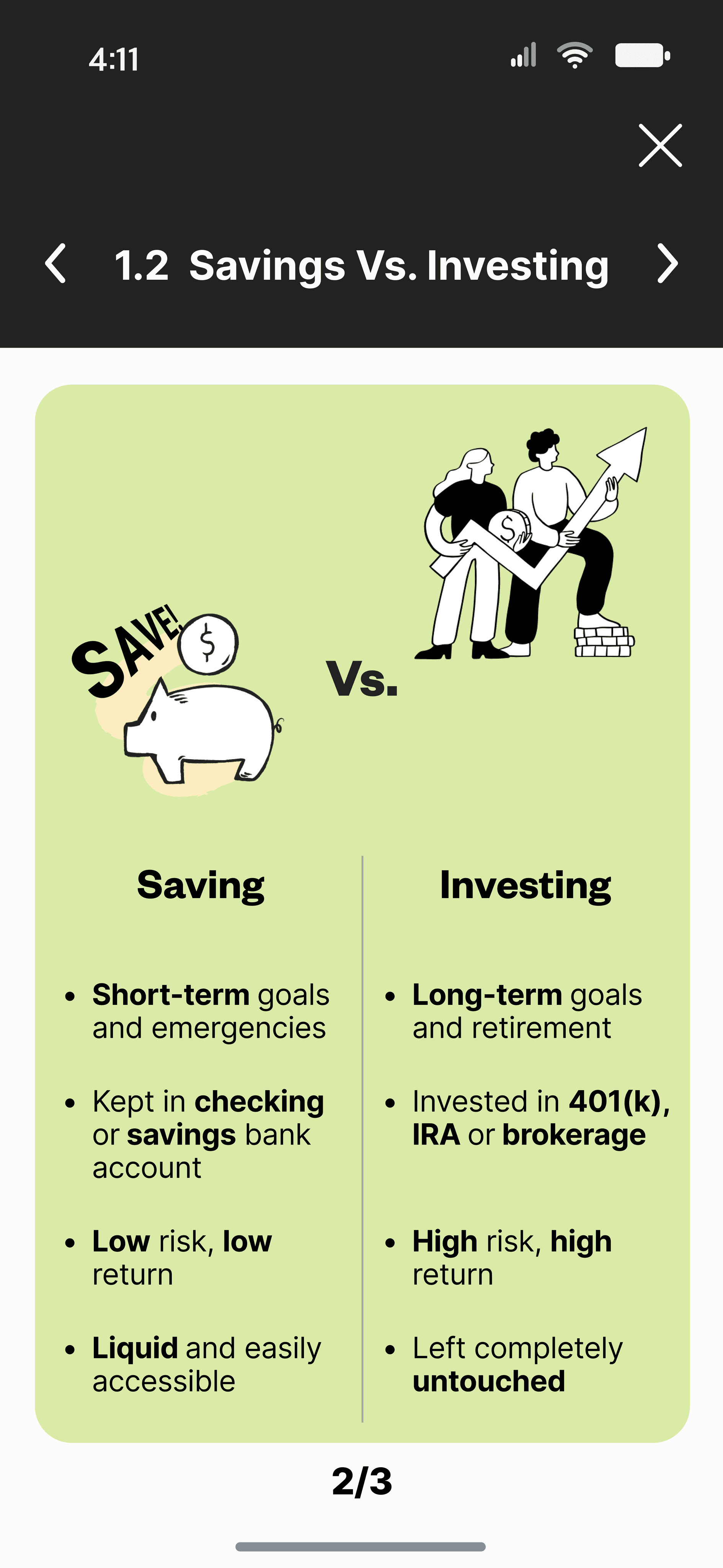

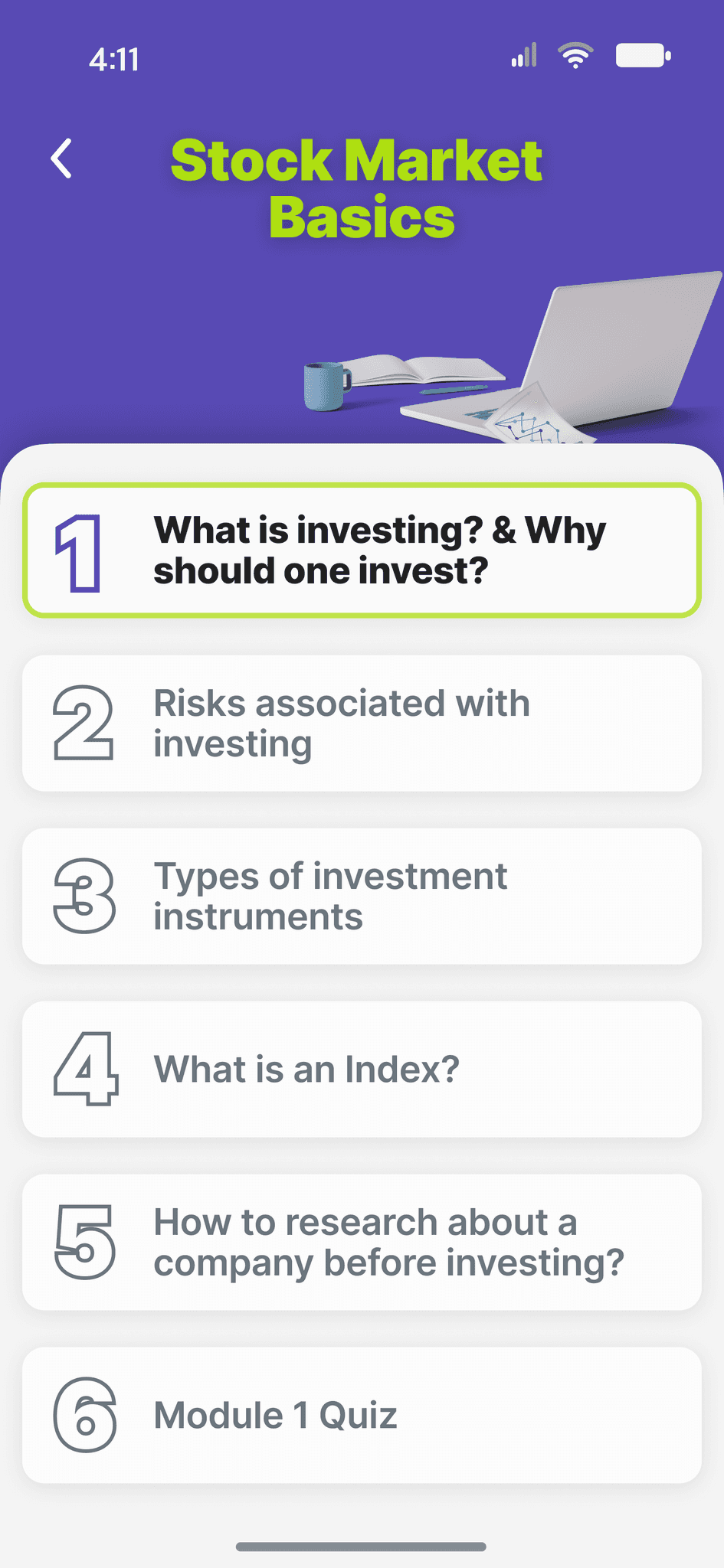

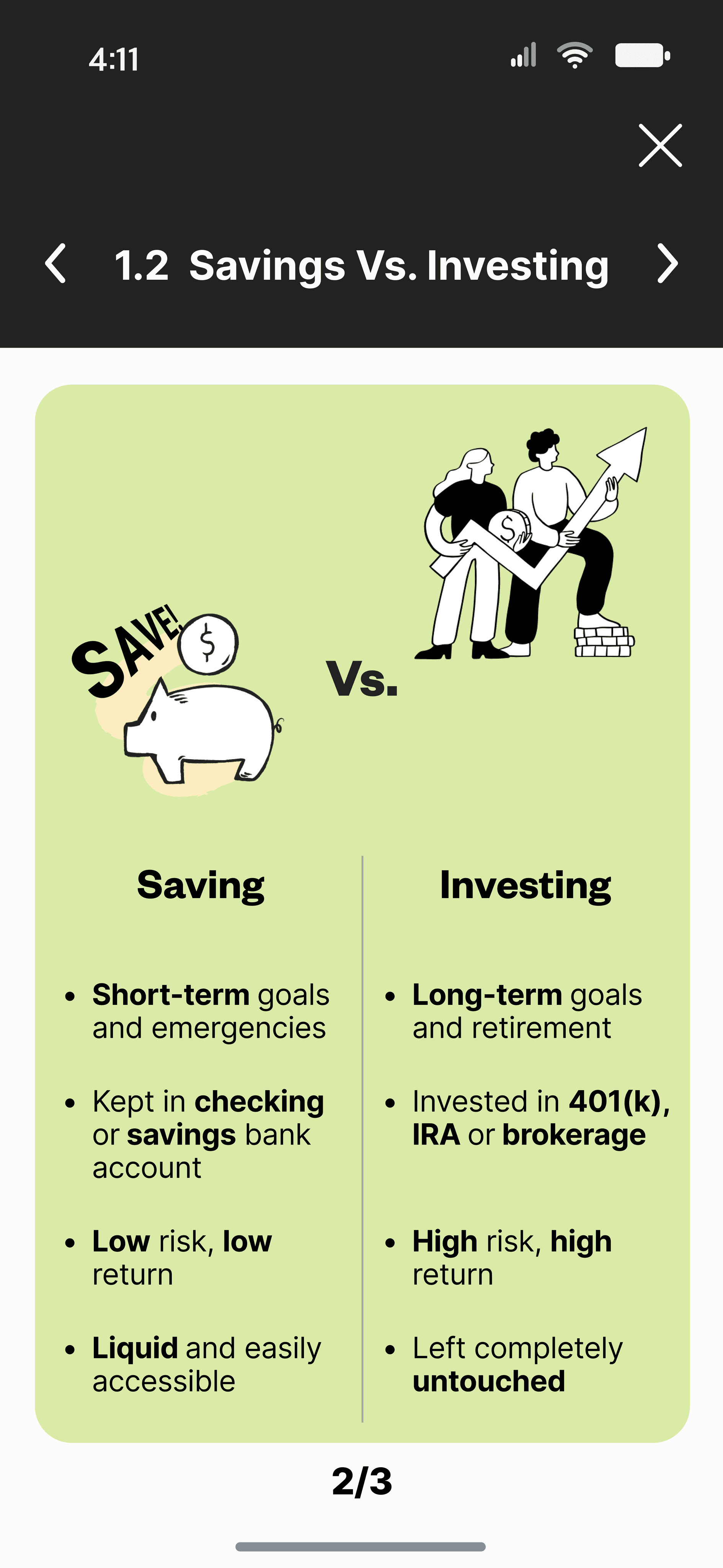

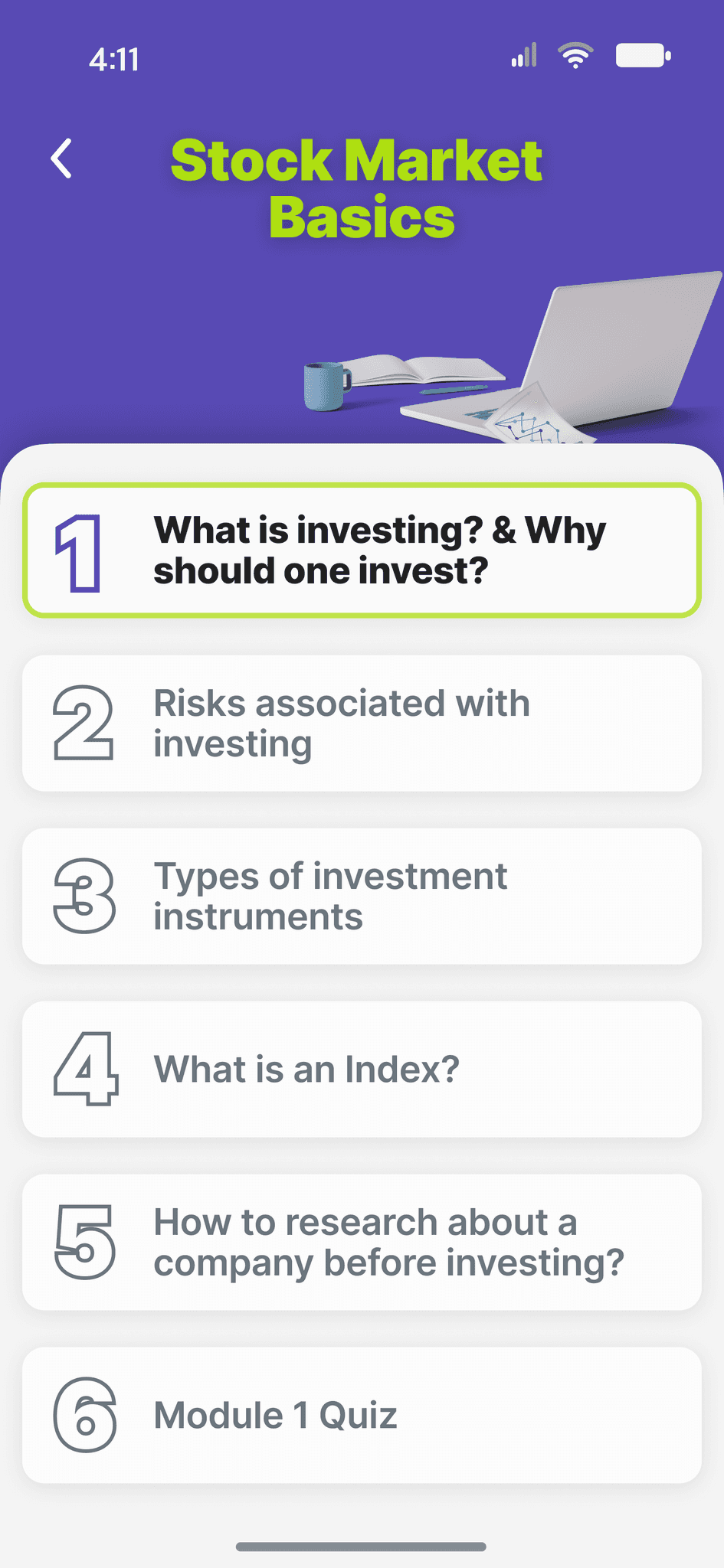

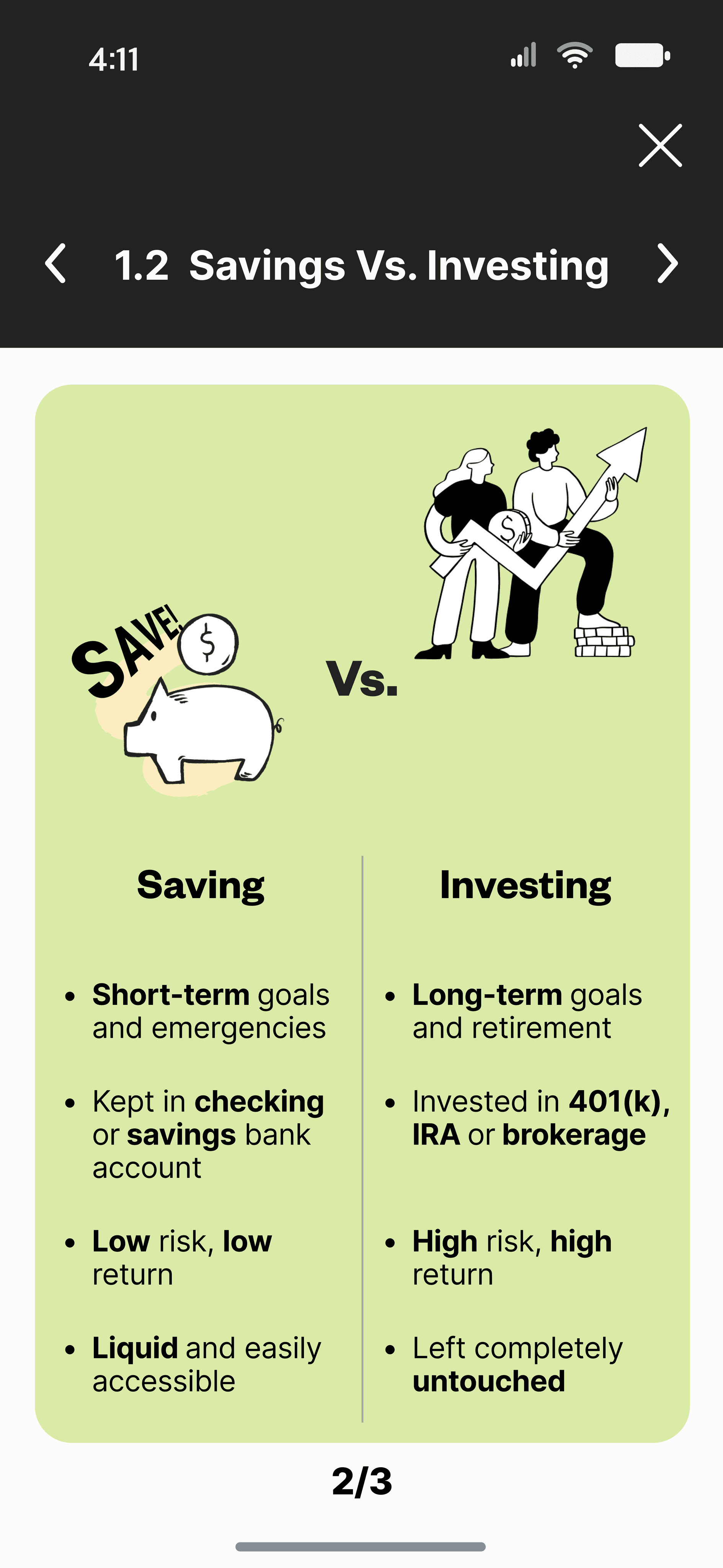

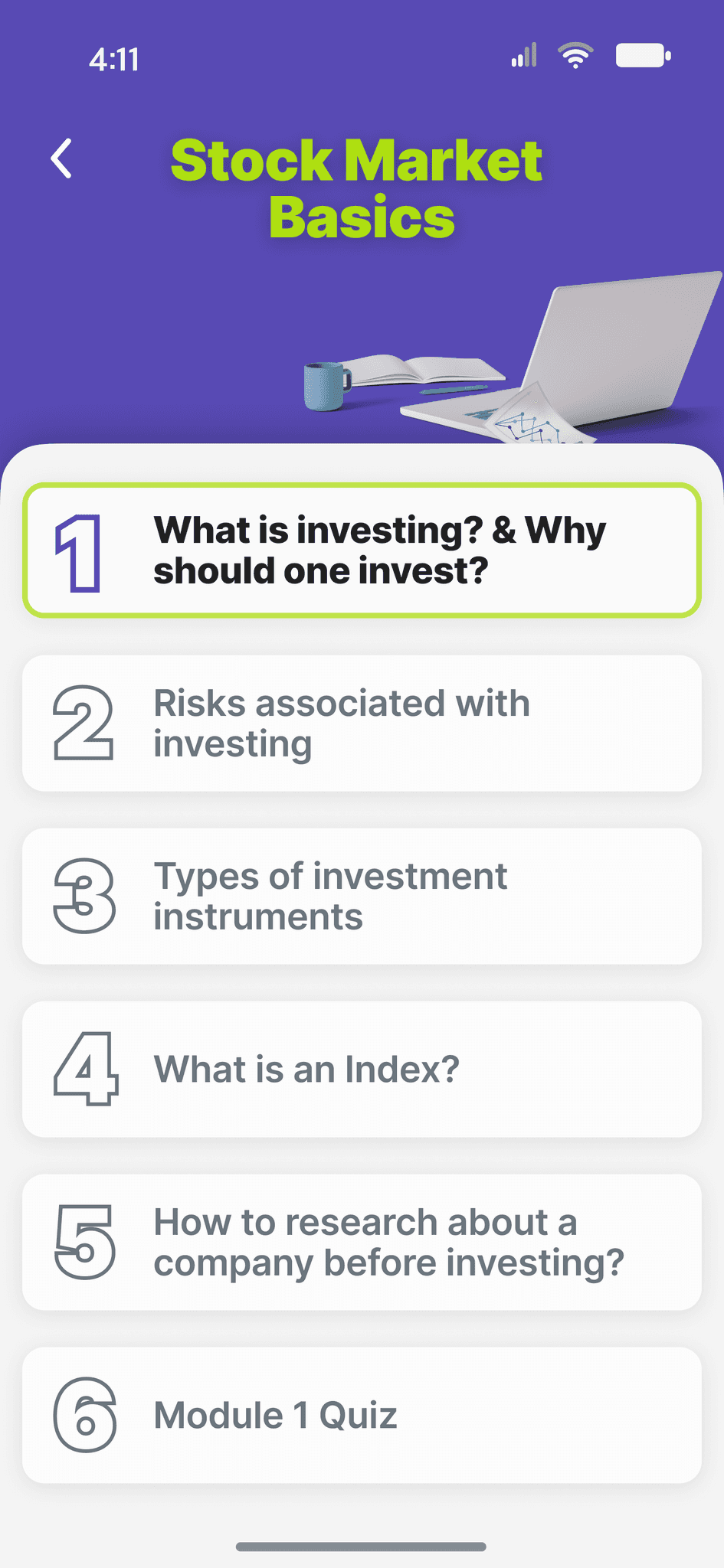

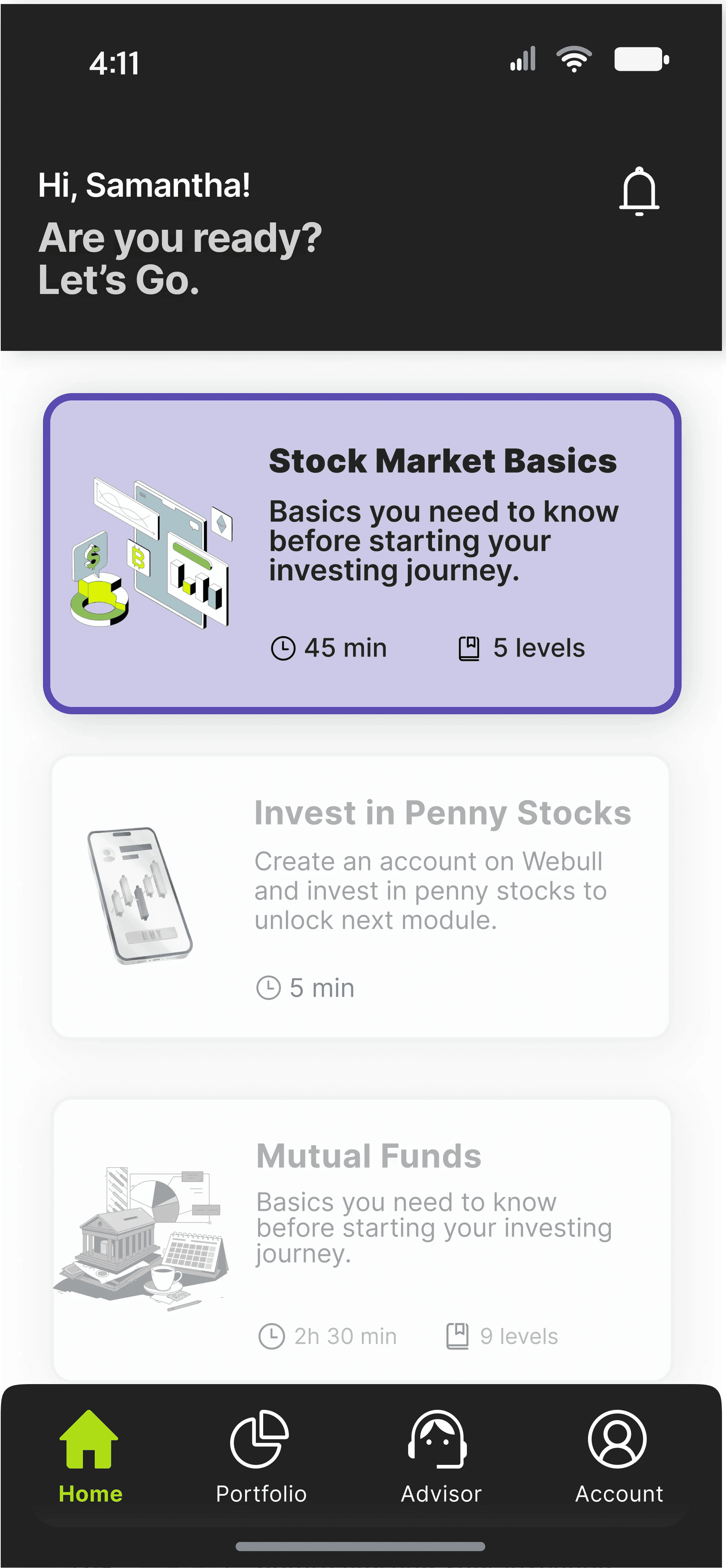

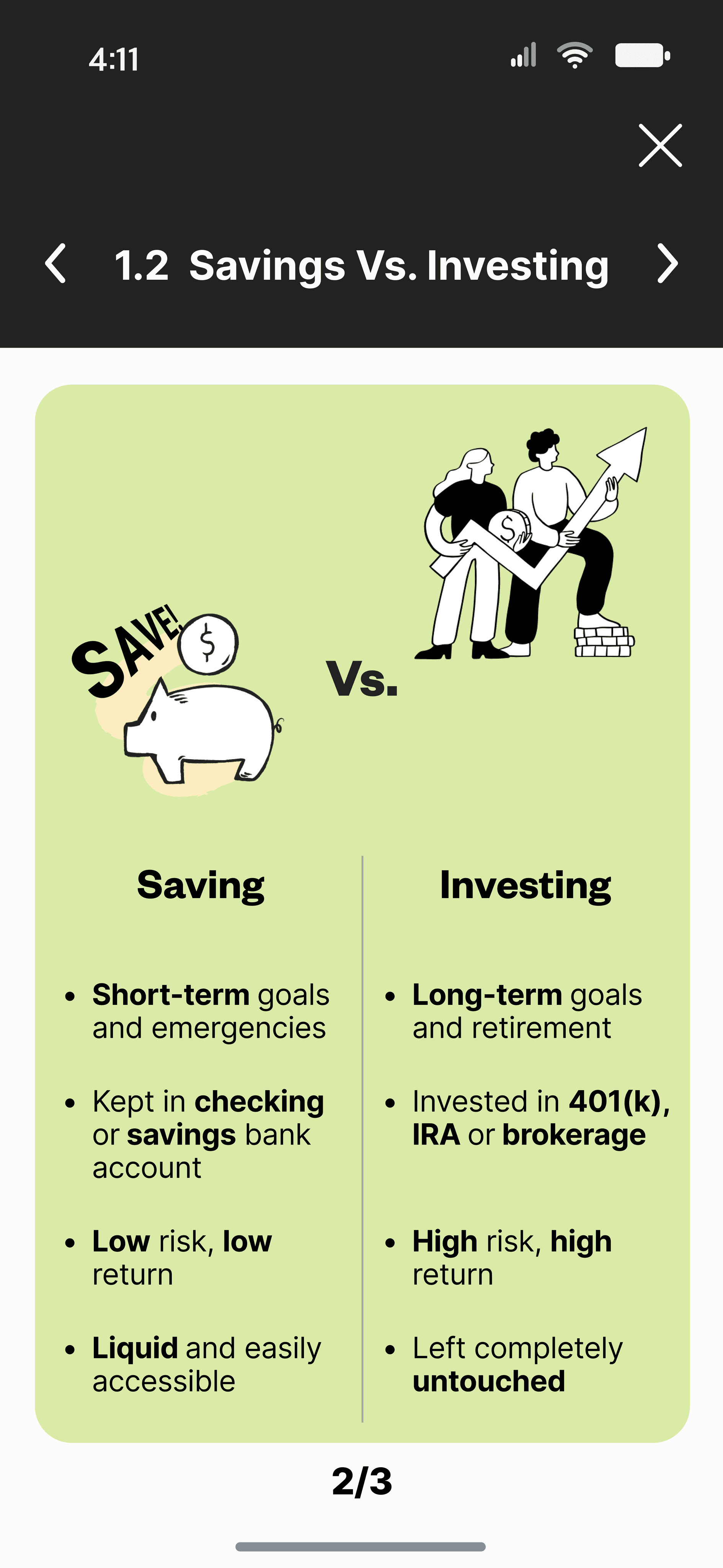

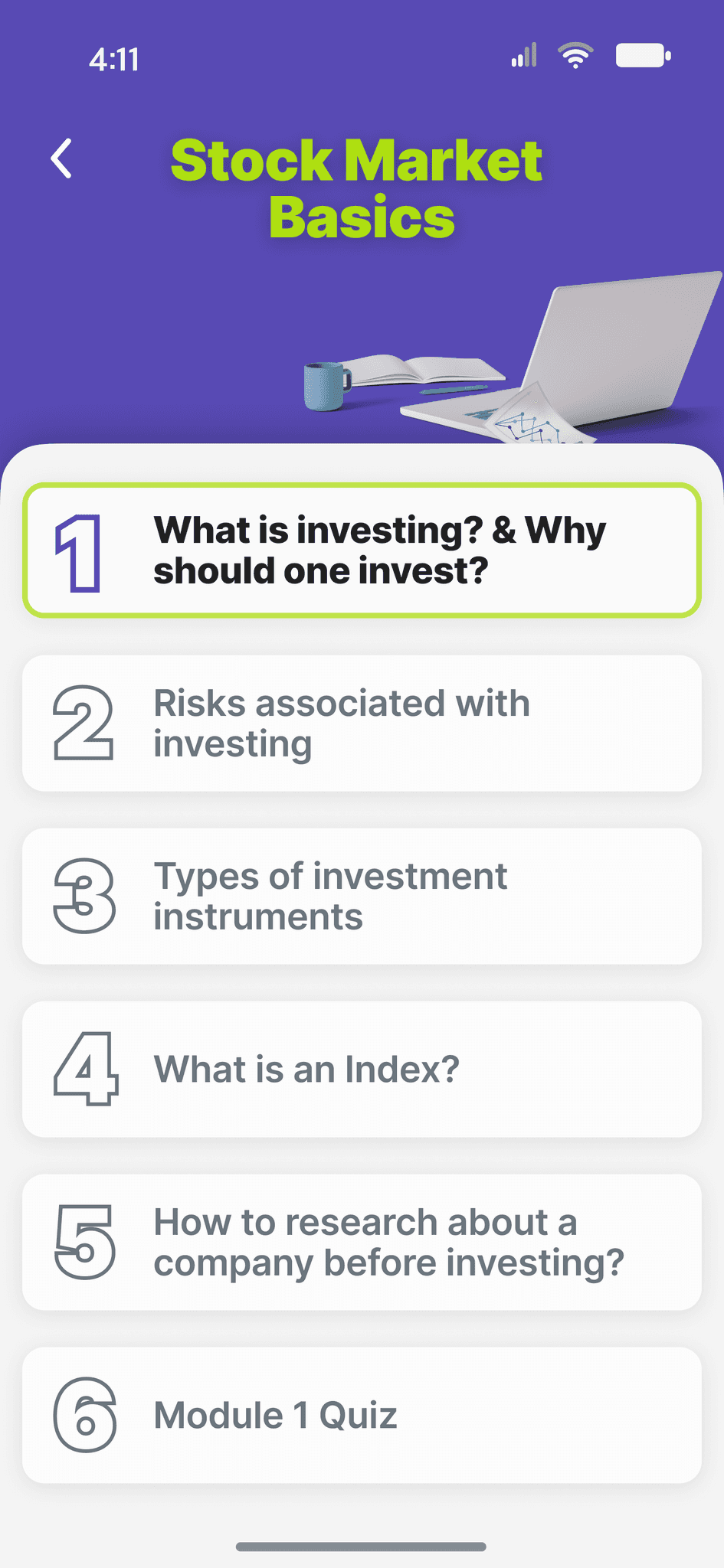

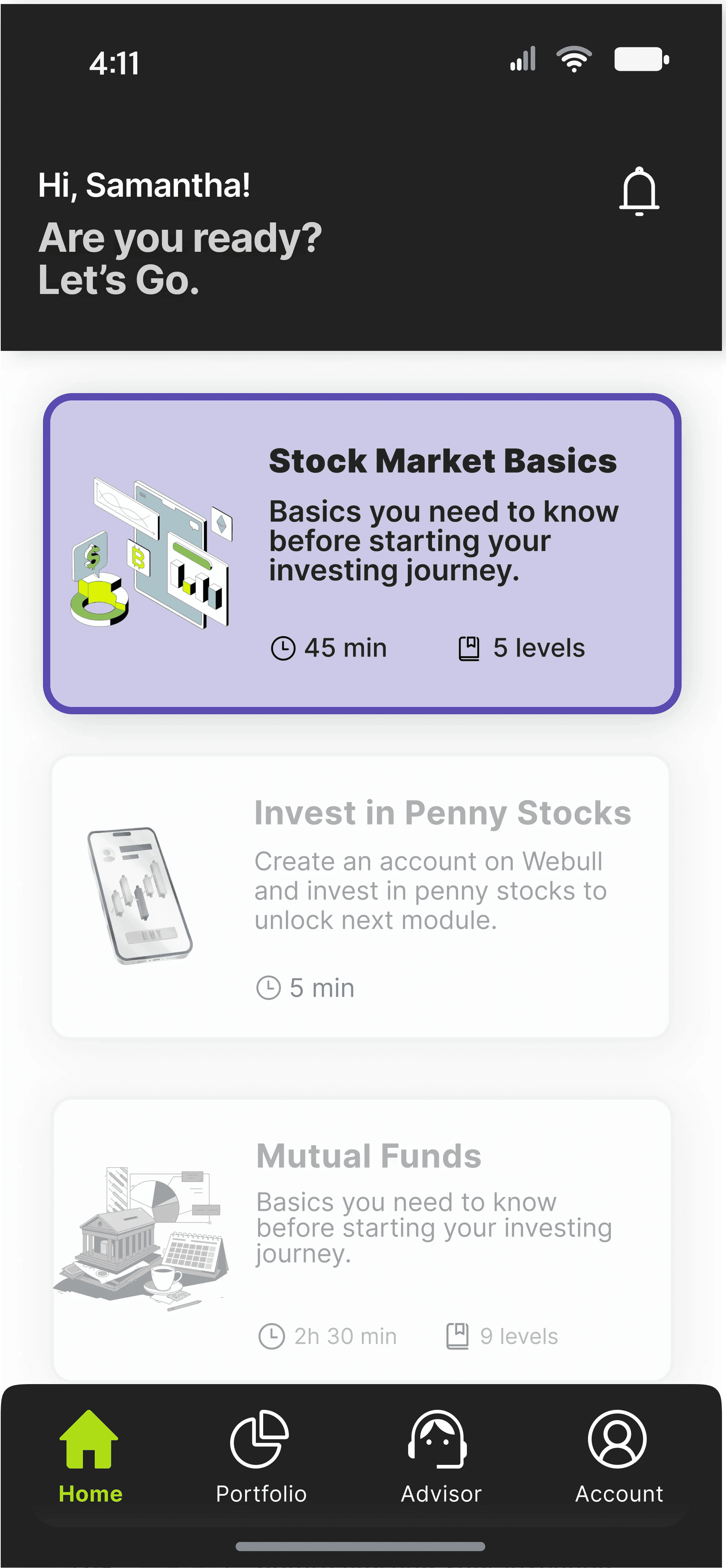

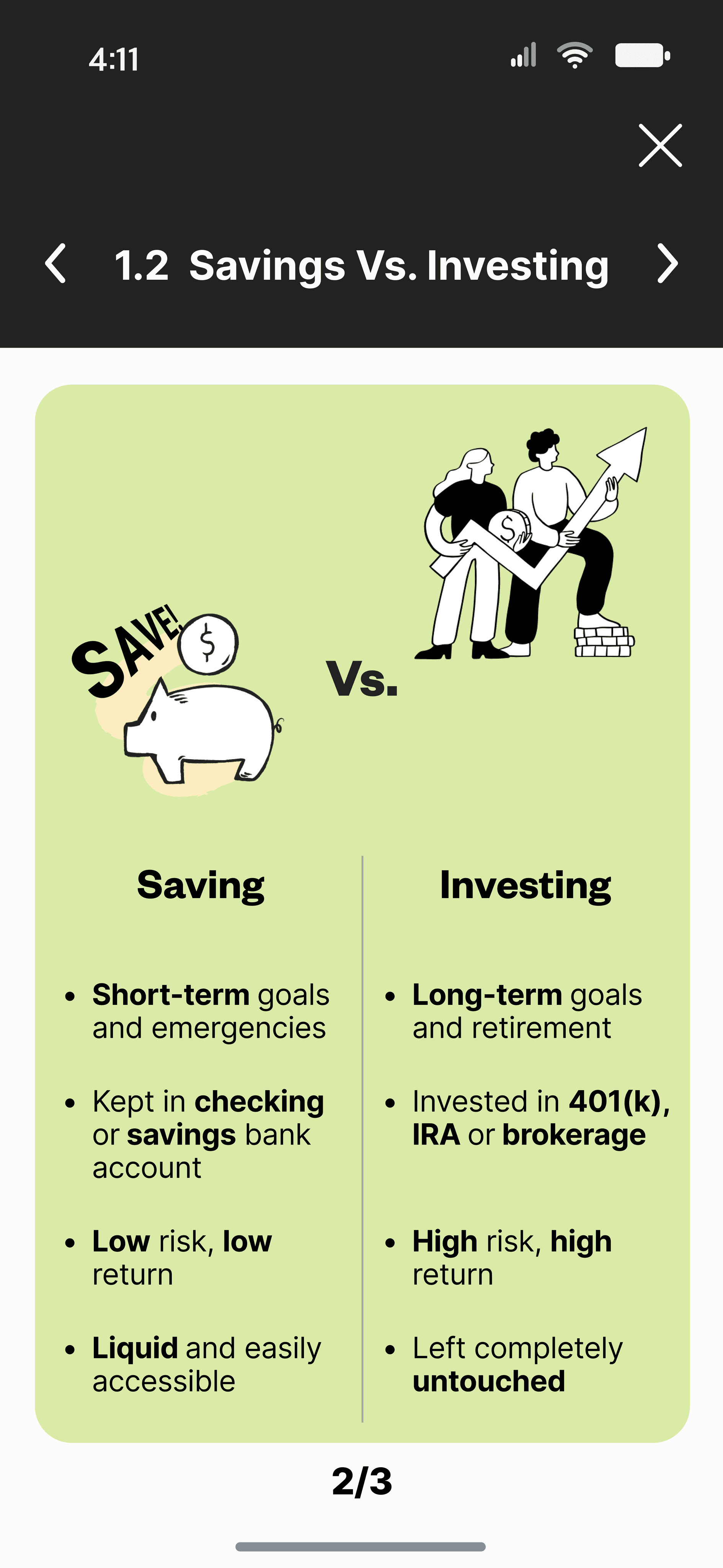

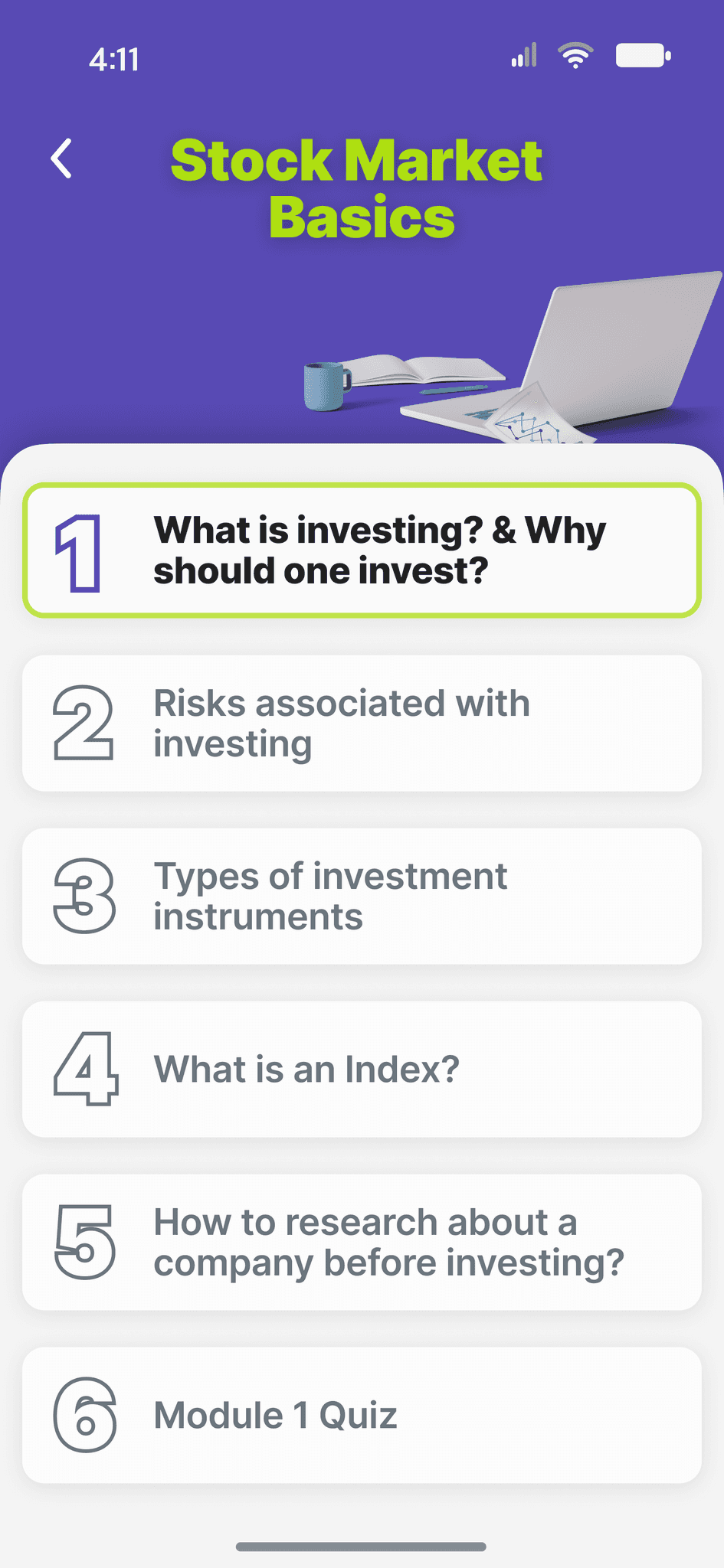

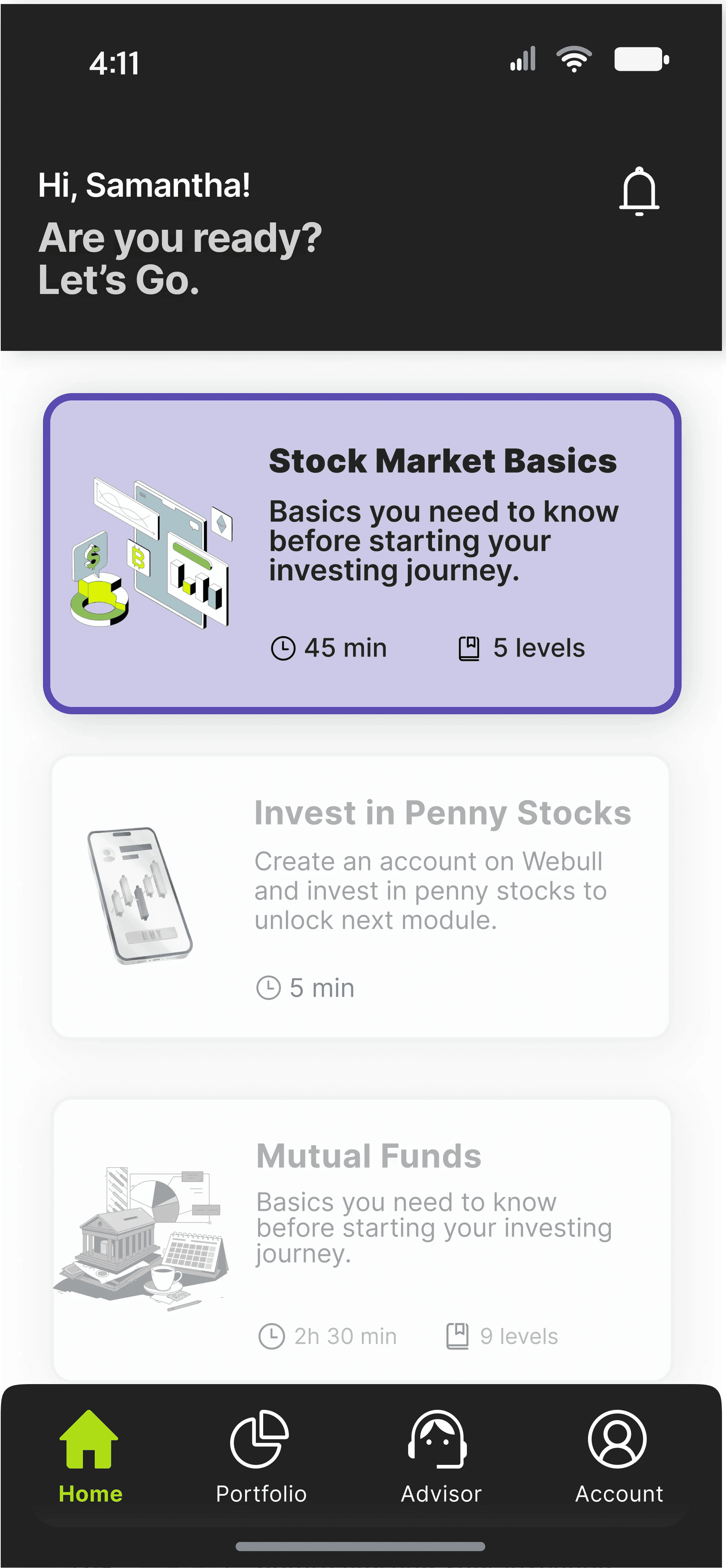

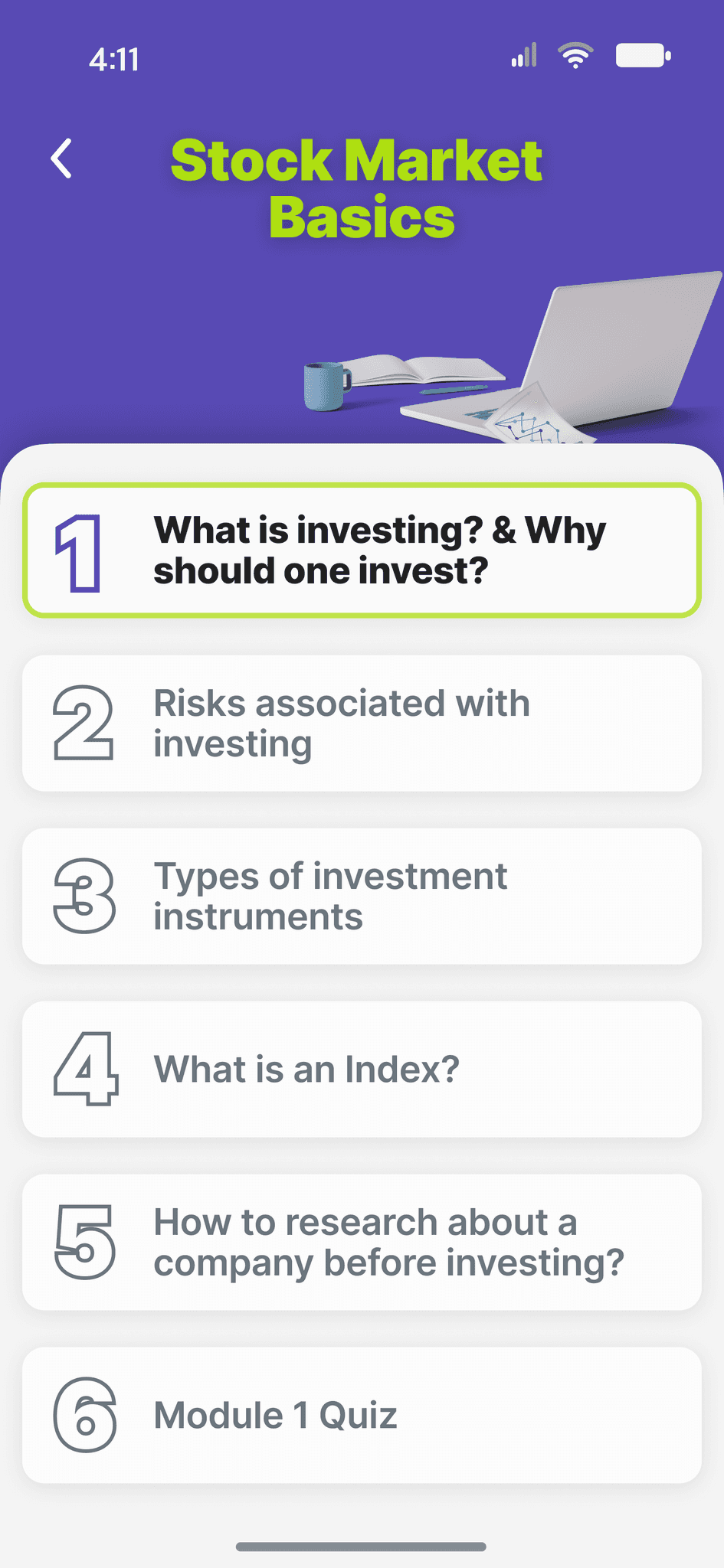

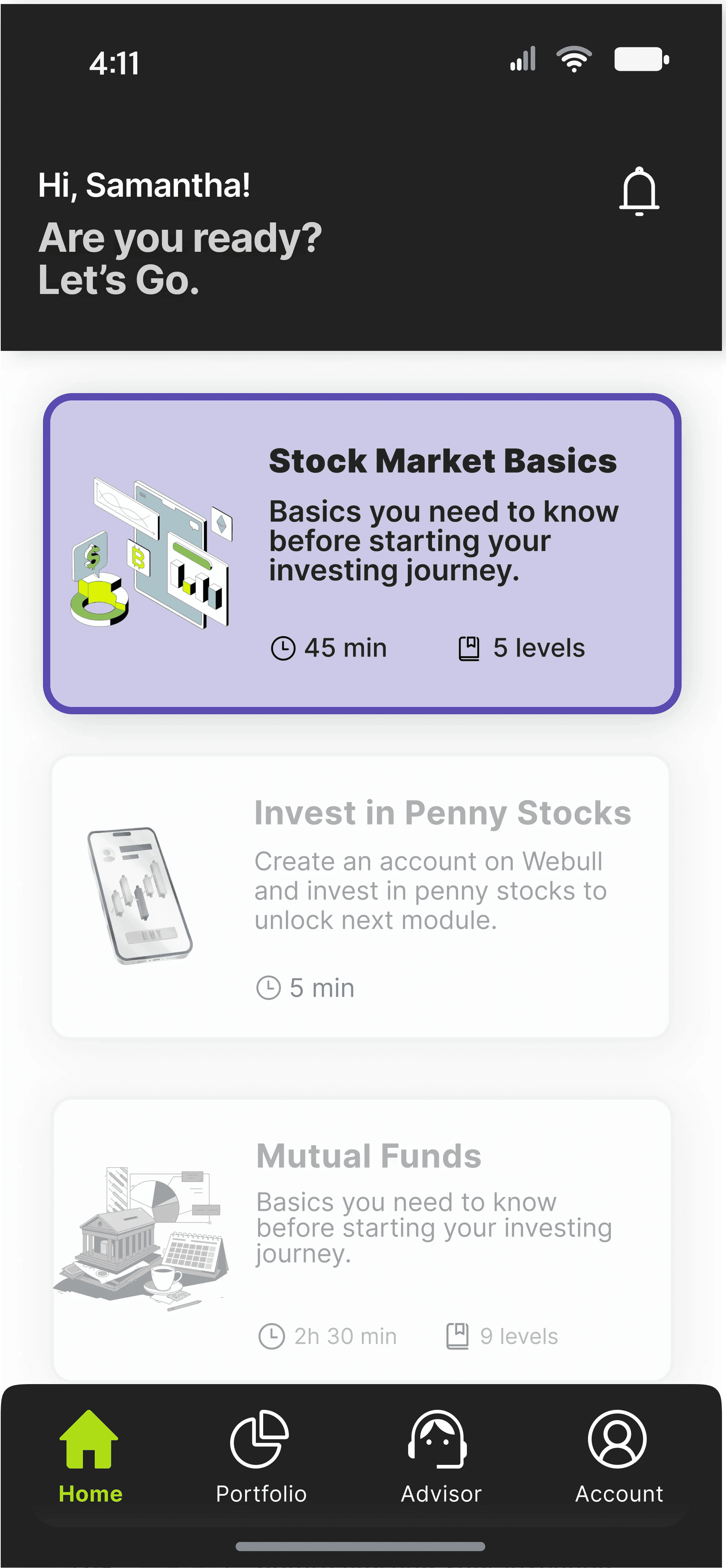

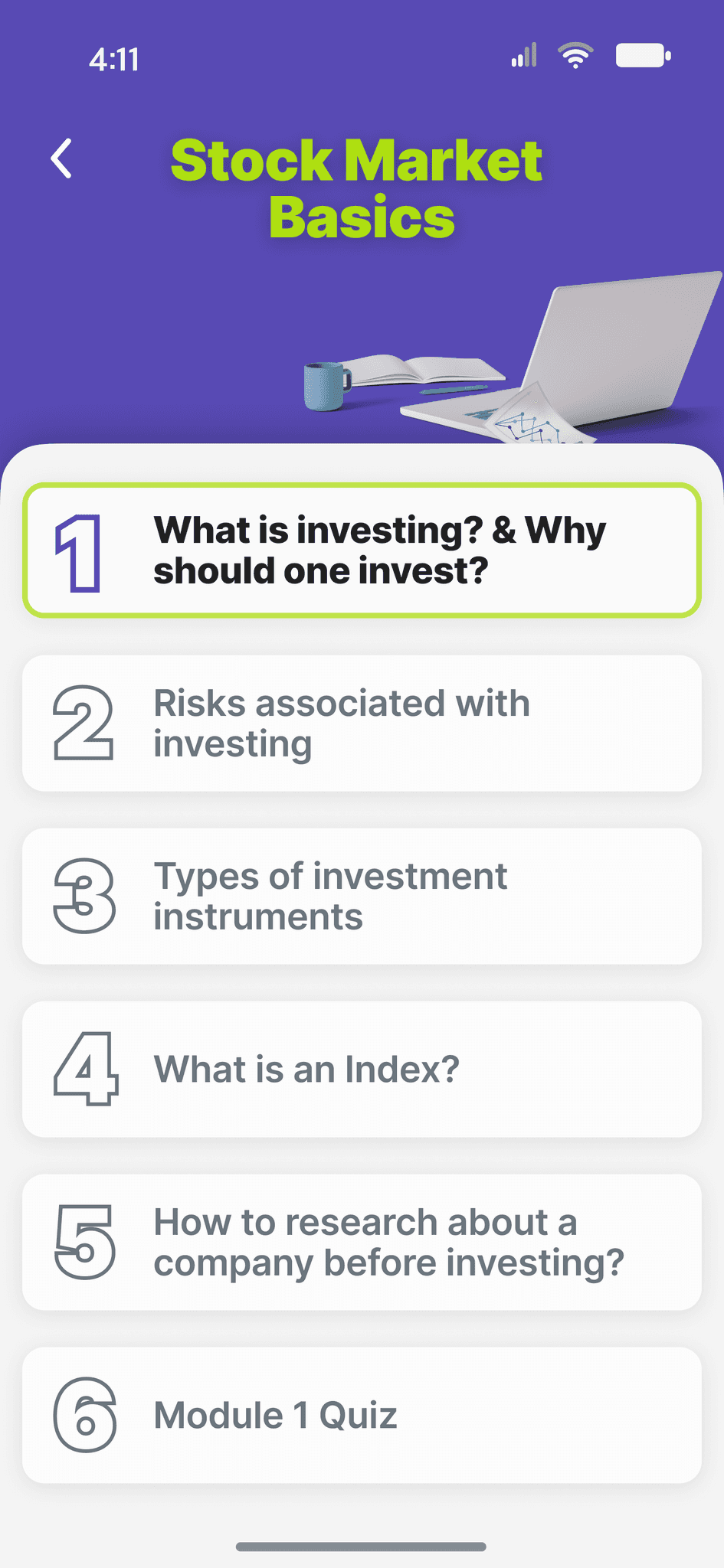

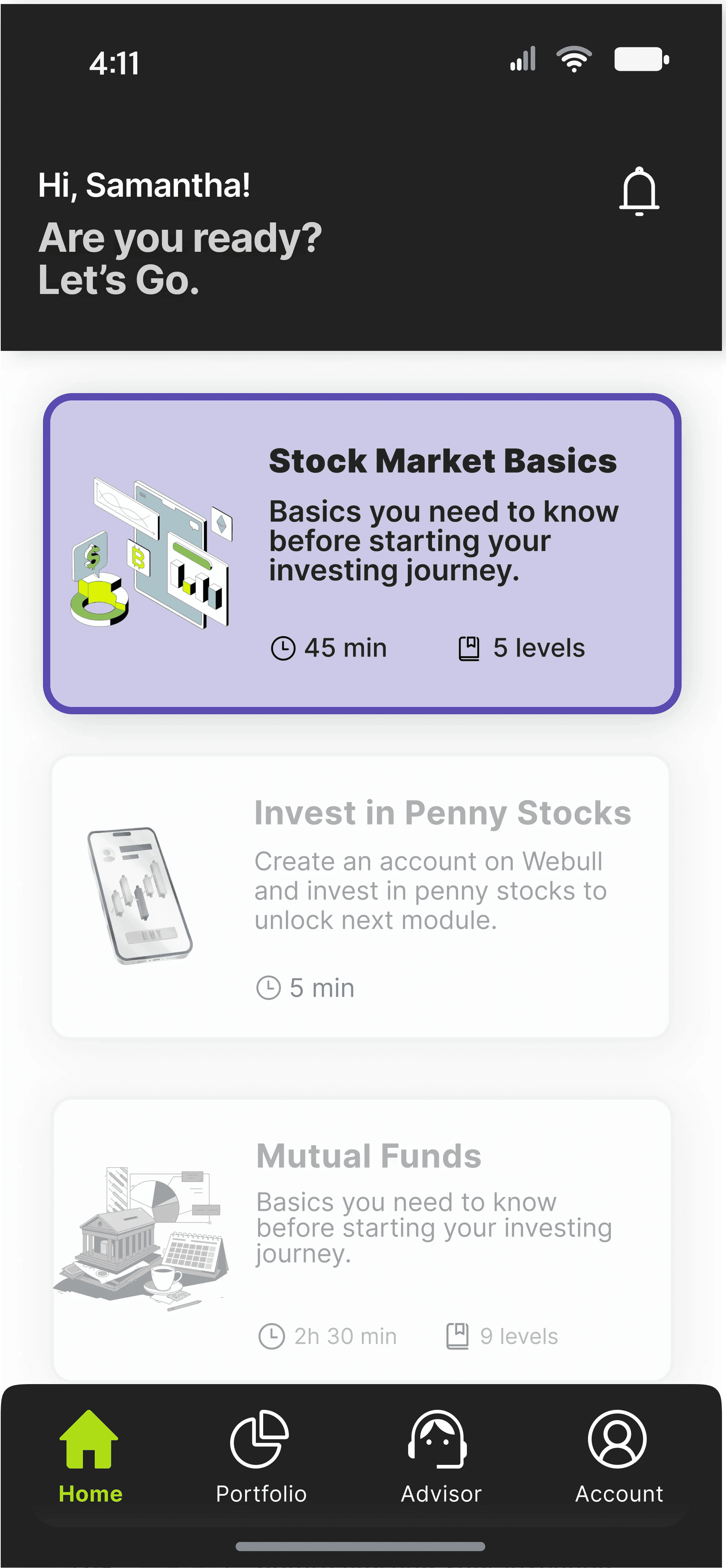

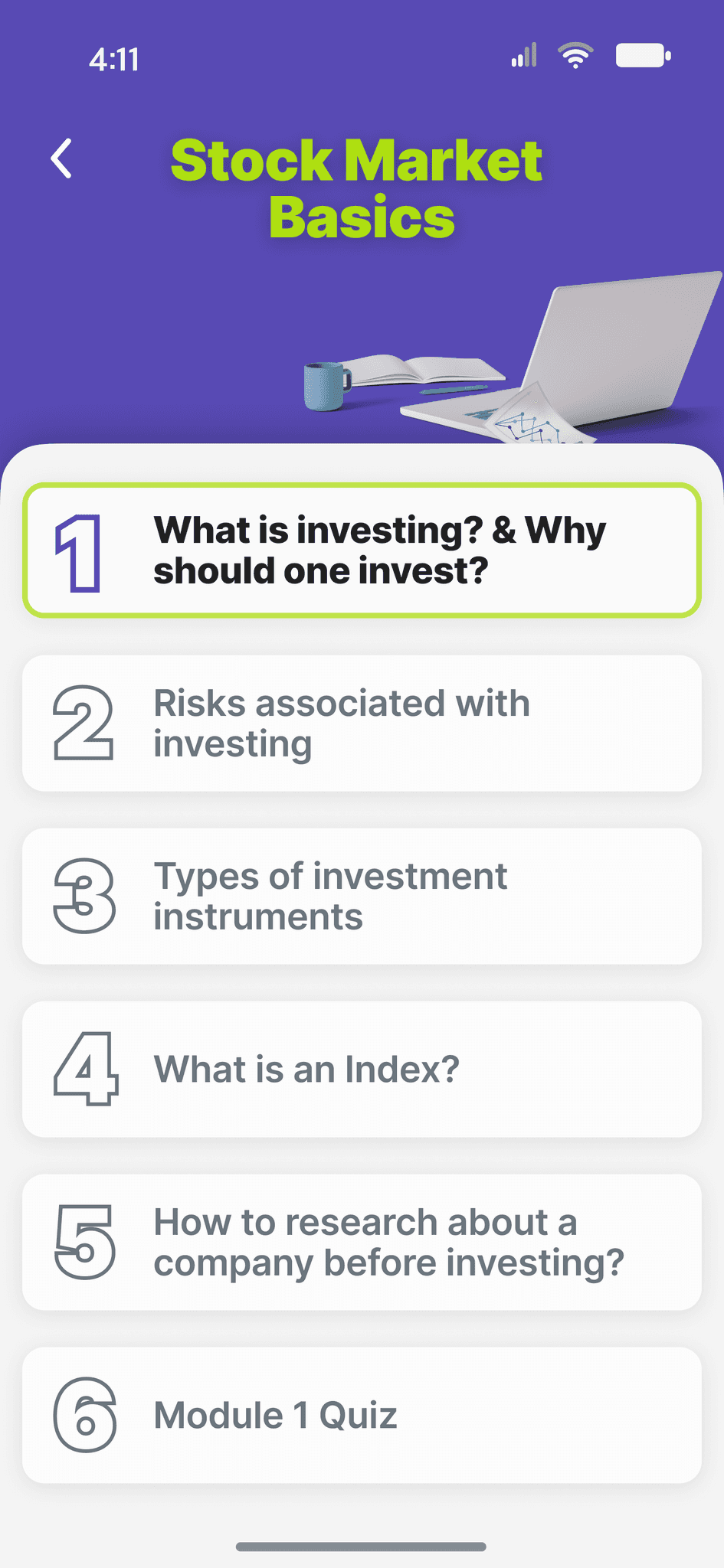

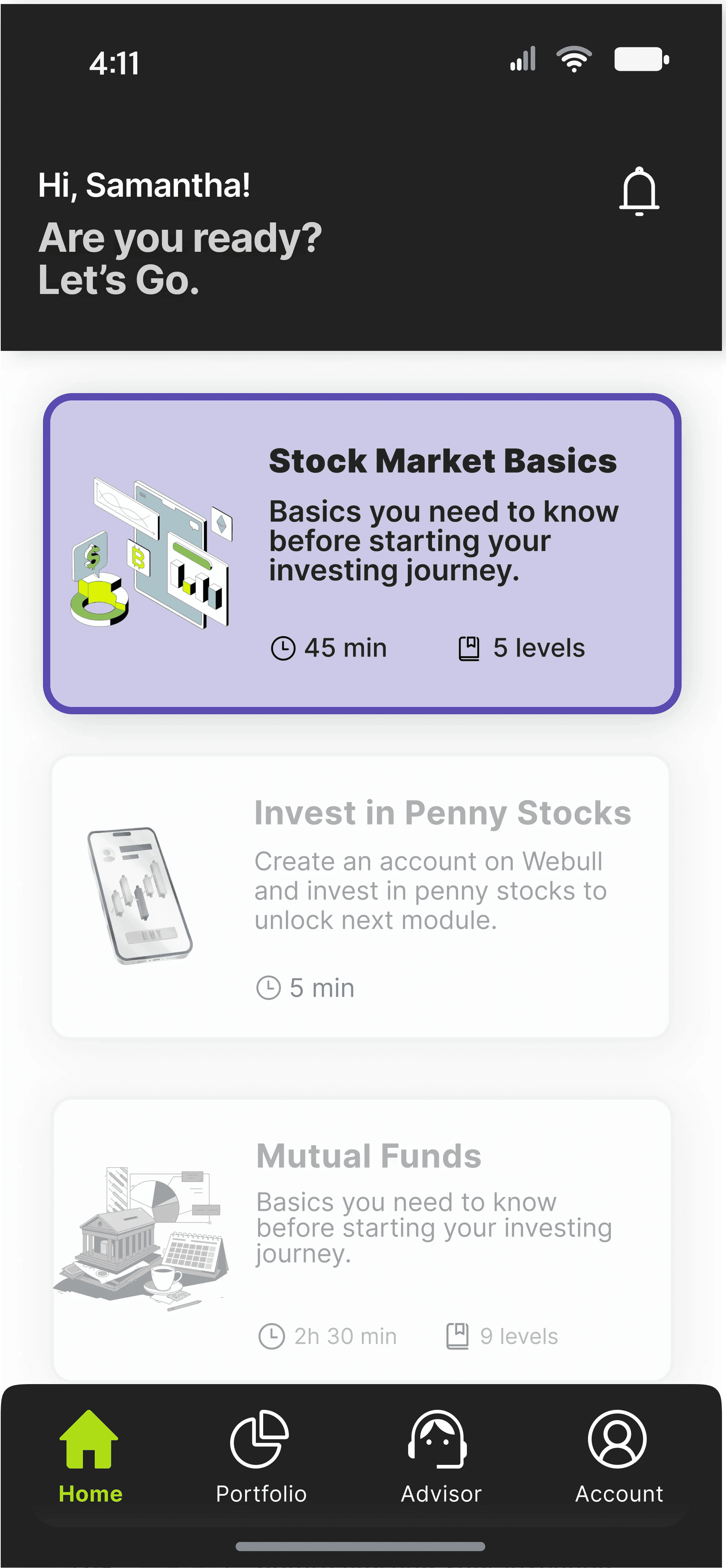

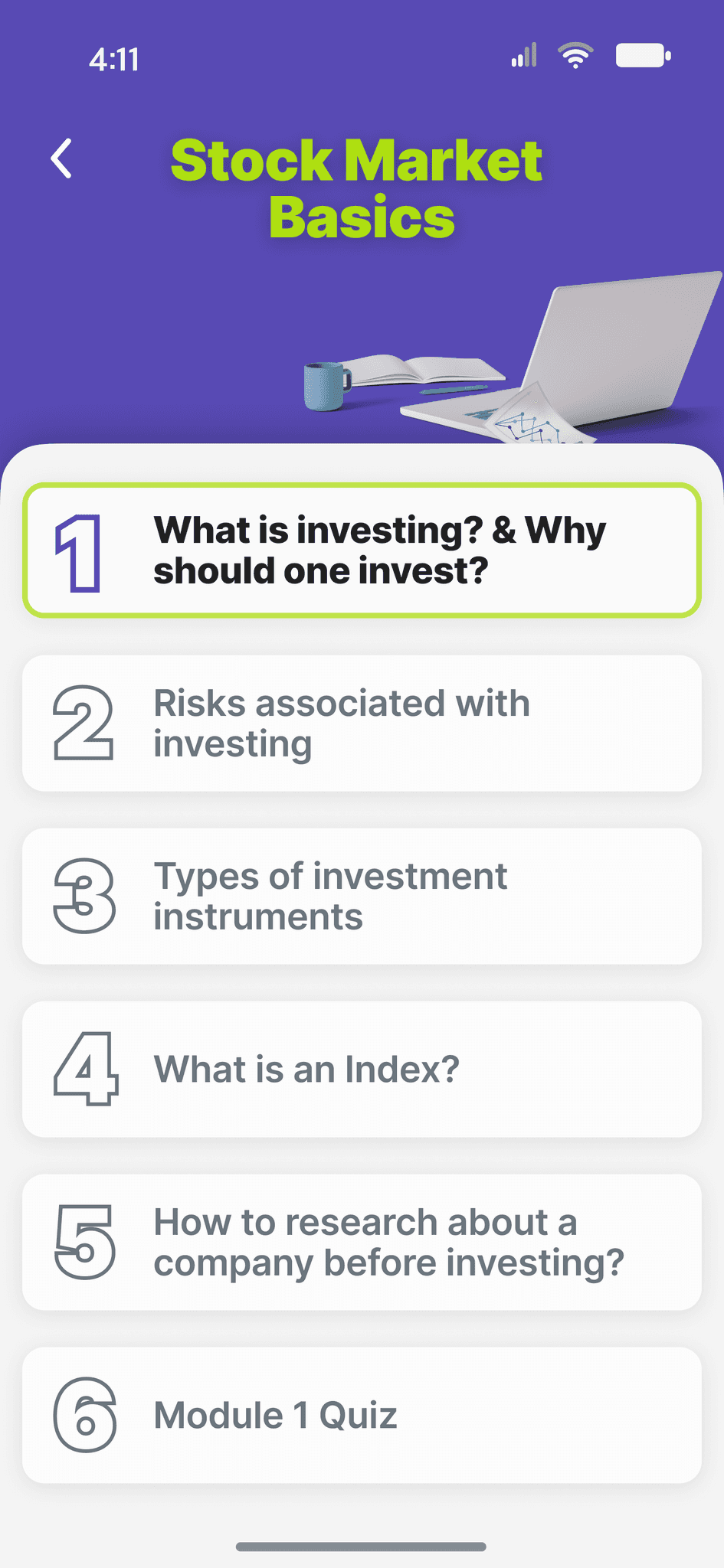

TAILORED MODULESThe high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

Placard Learning

Level List Screen

Module List

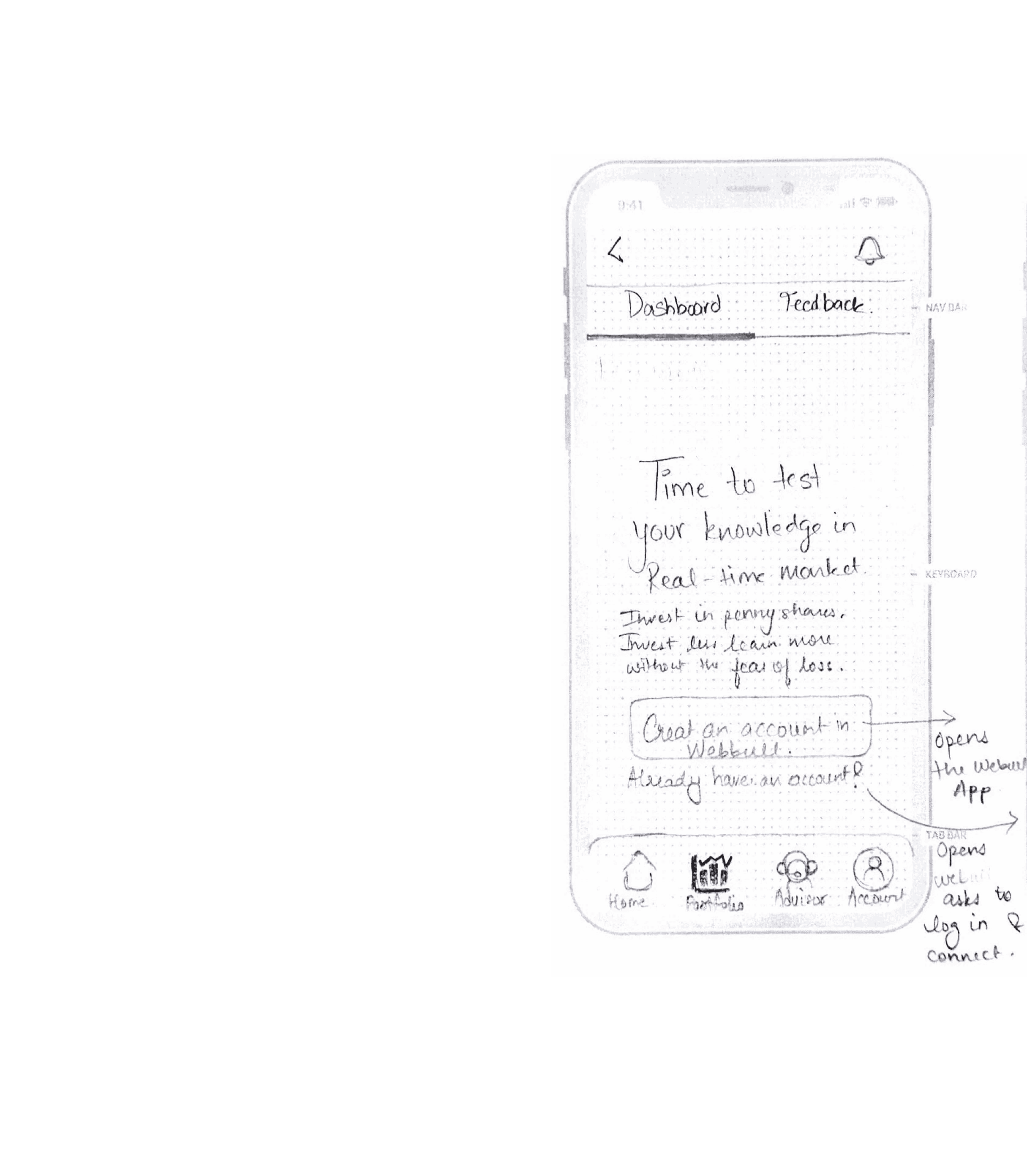

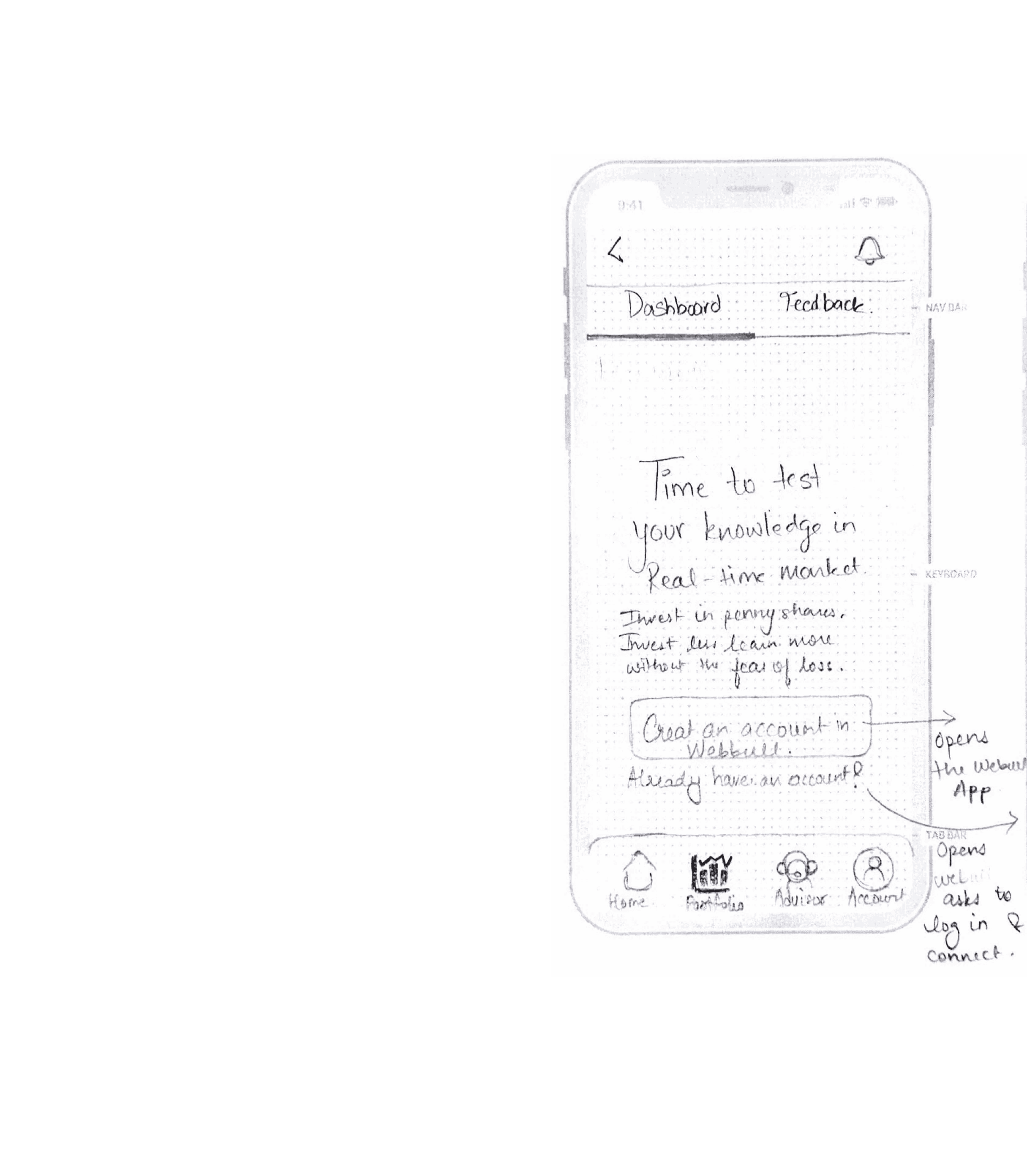

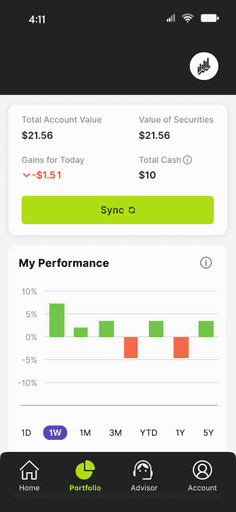

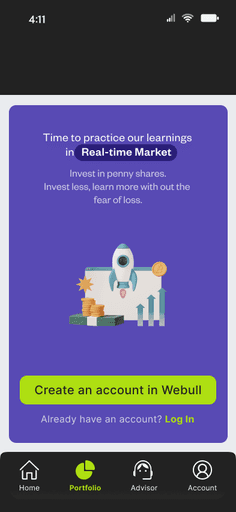

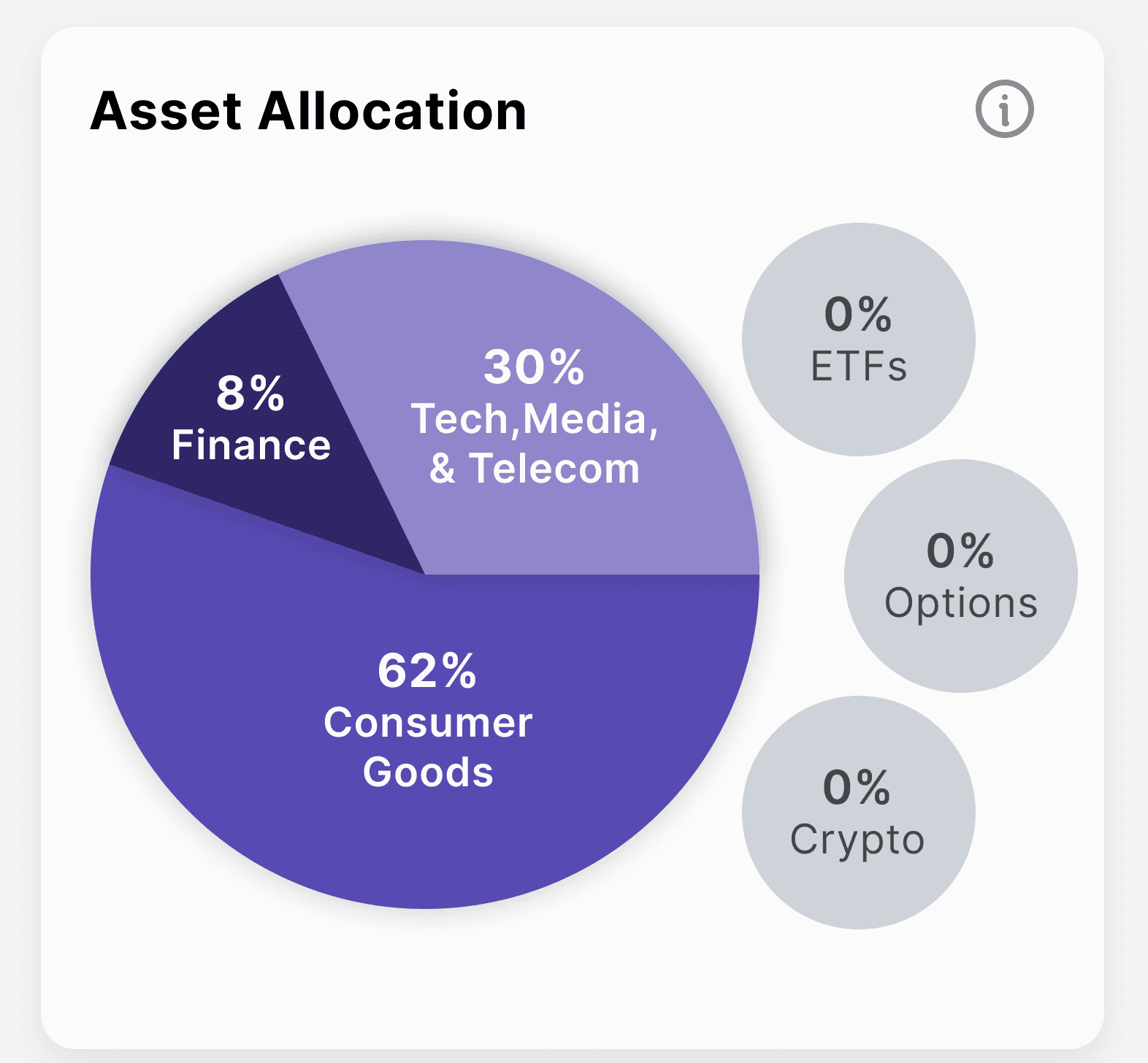

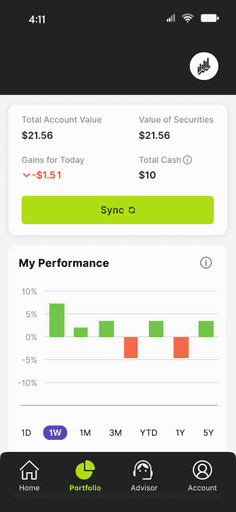

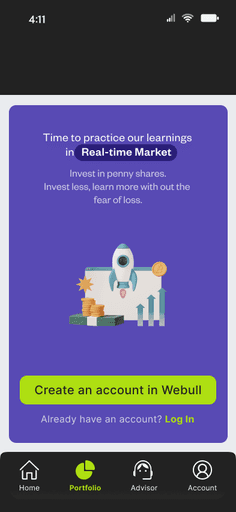

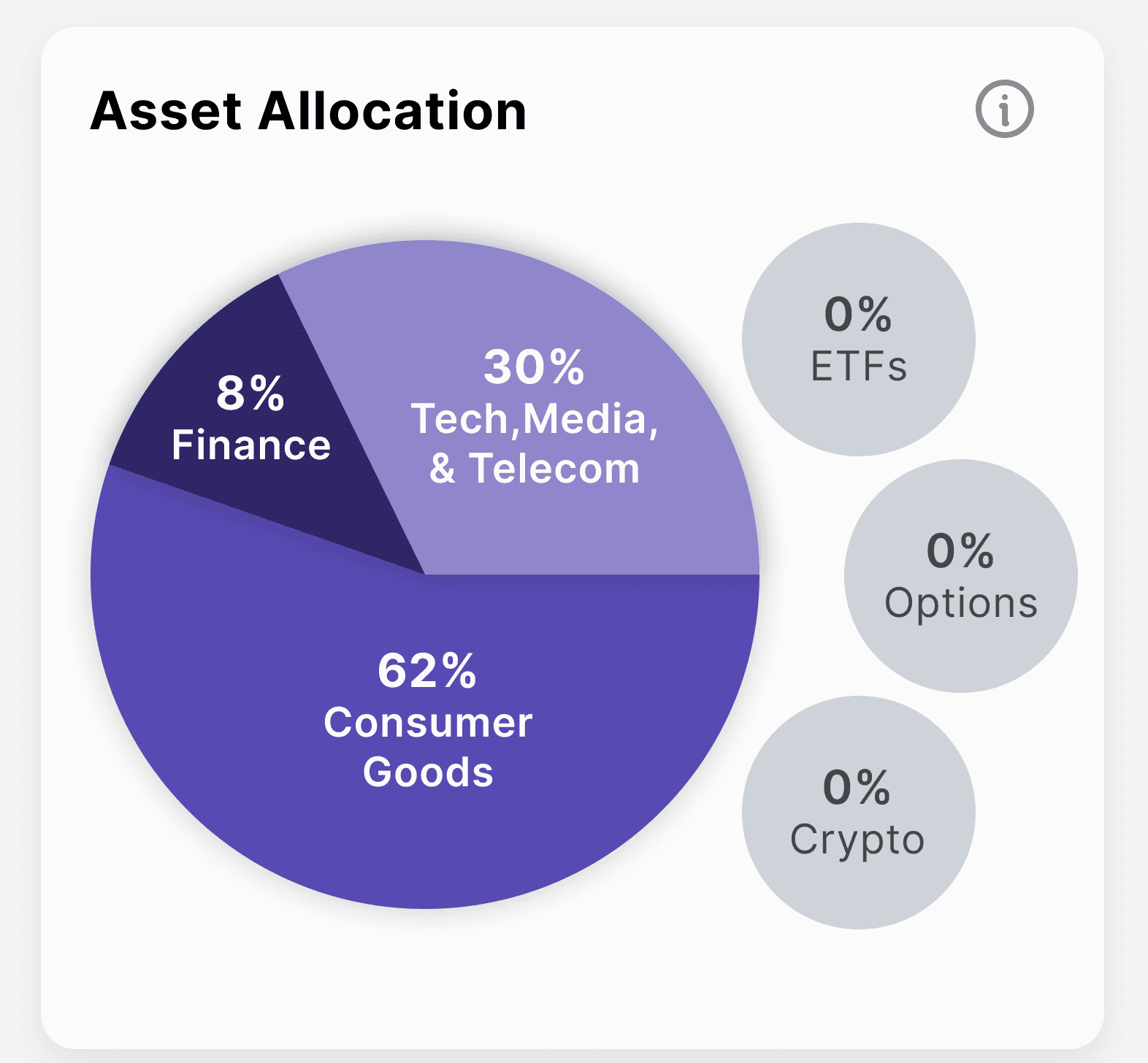

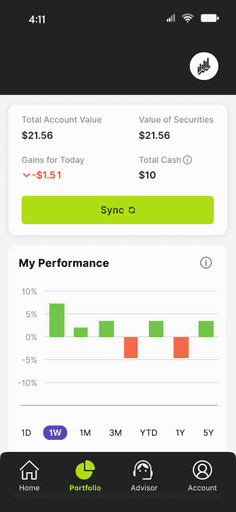

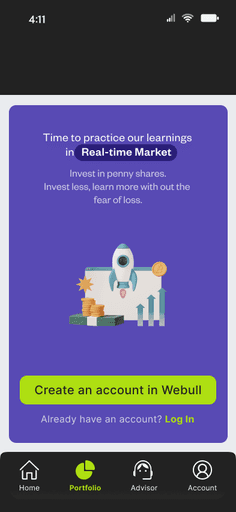

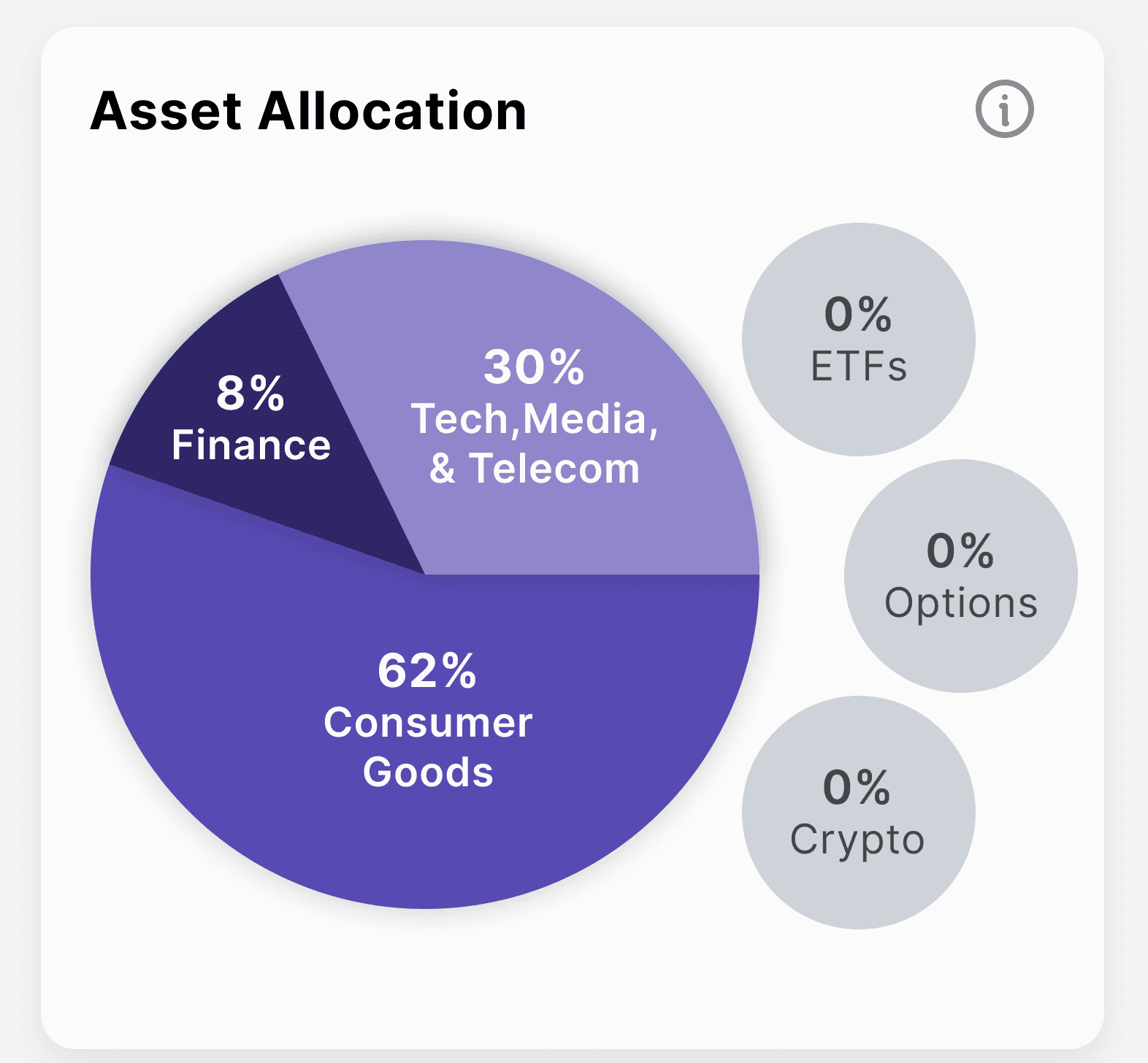

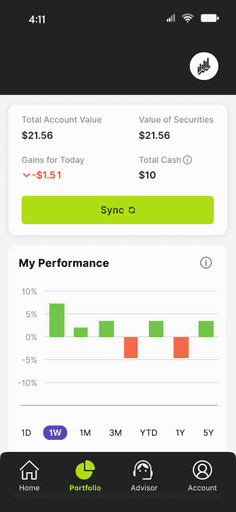

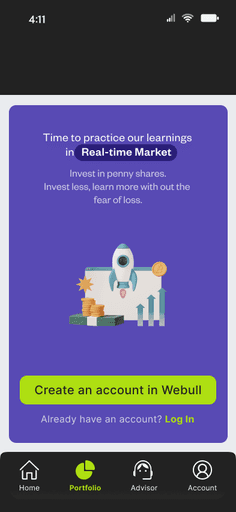

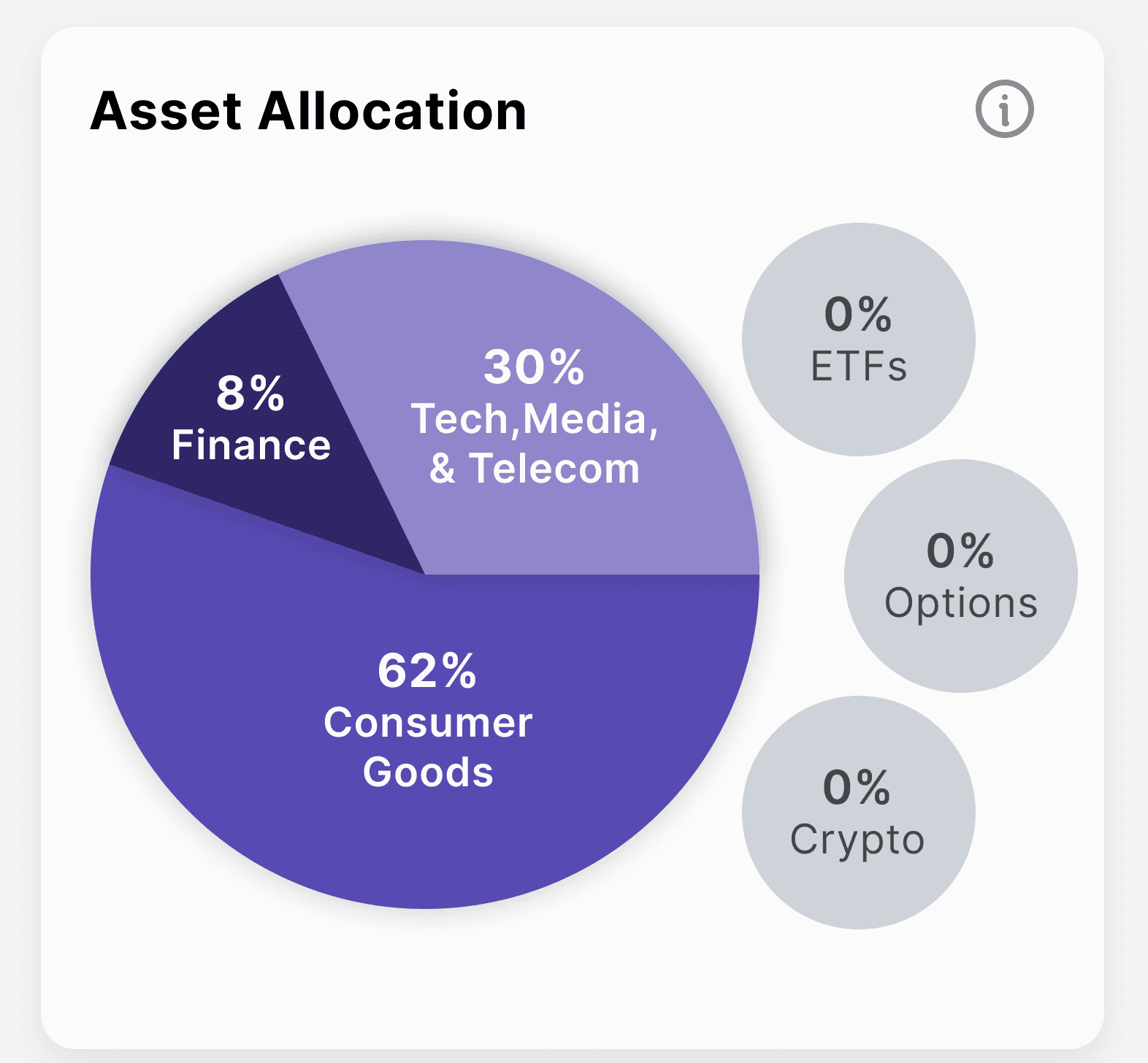

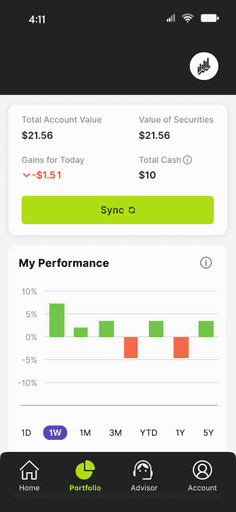

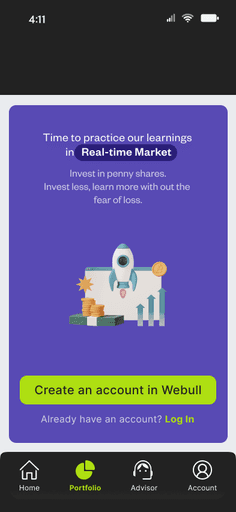

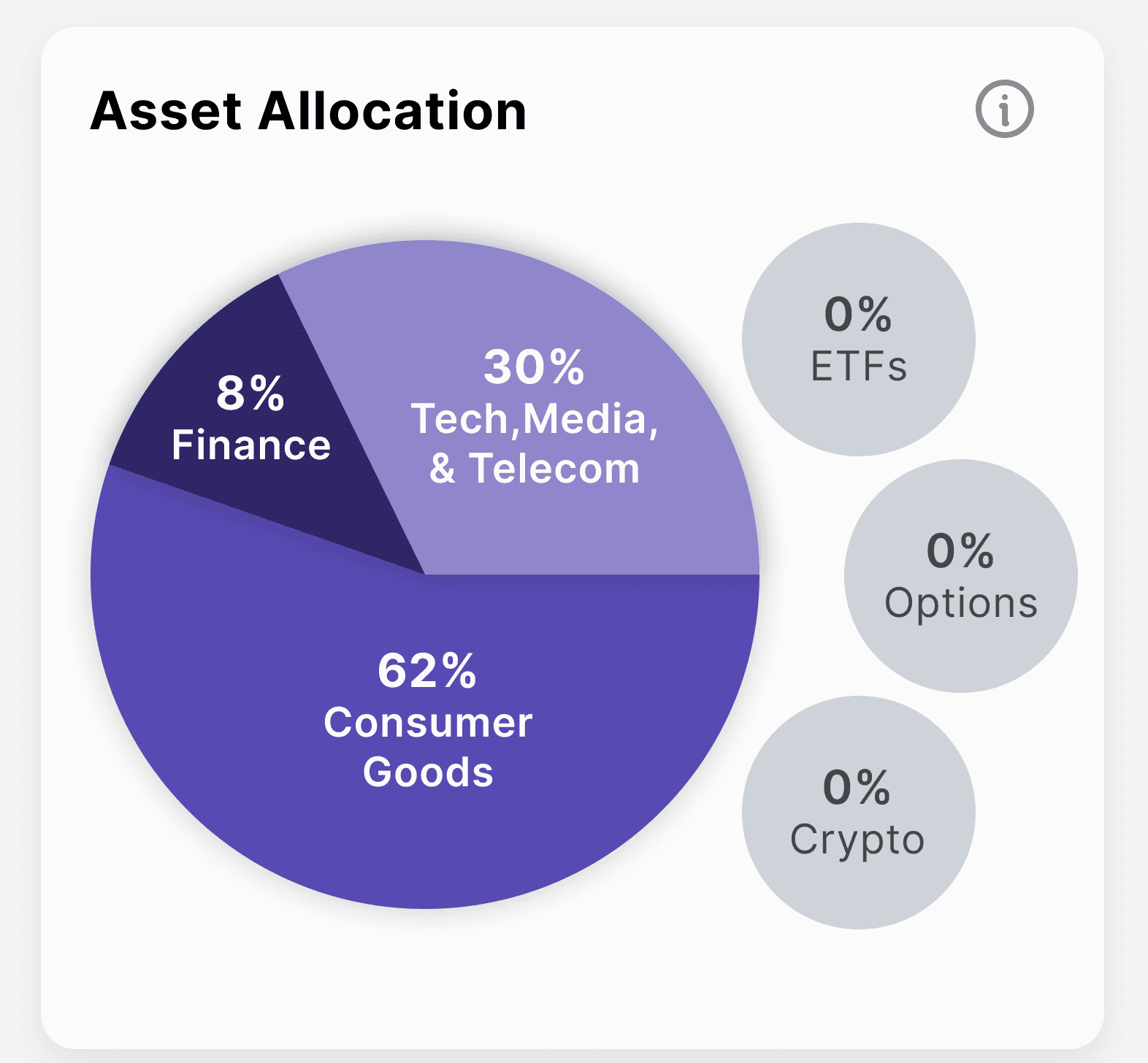

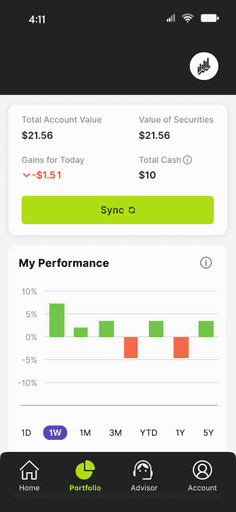

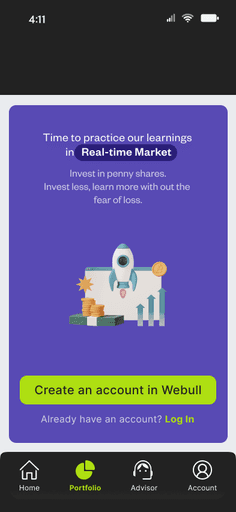

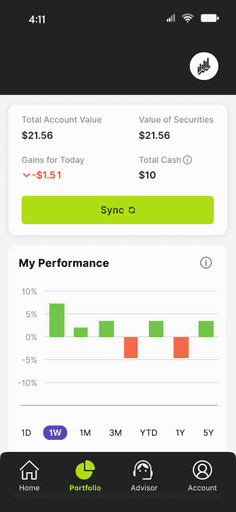

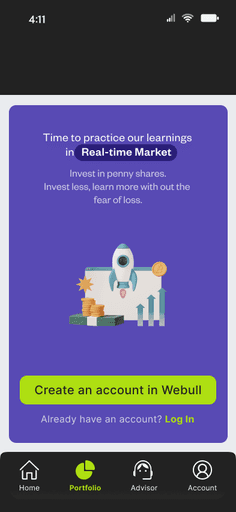

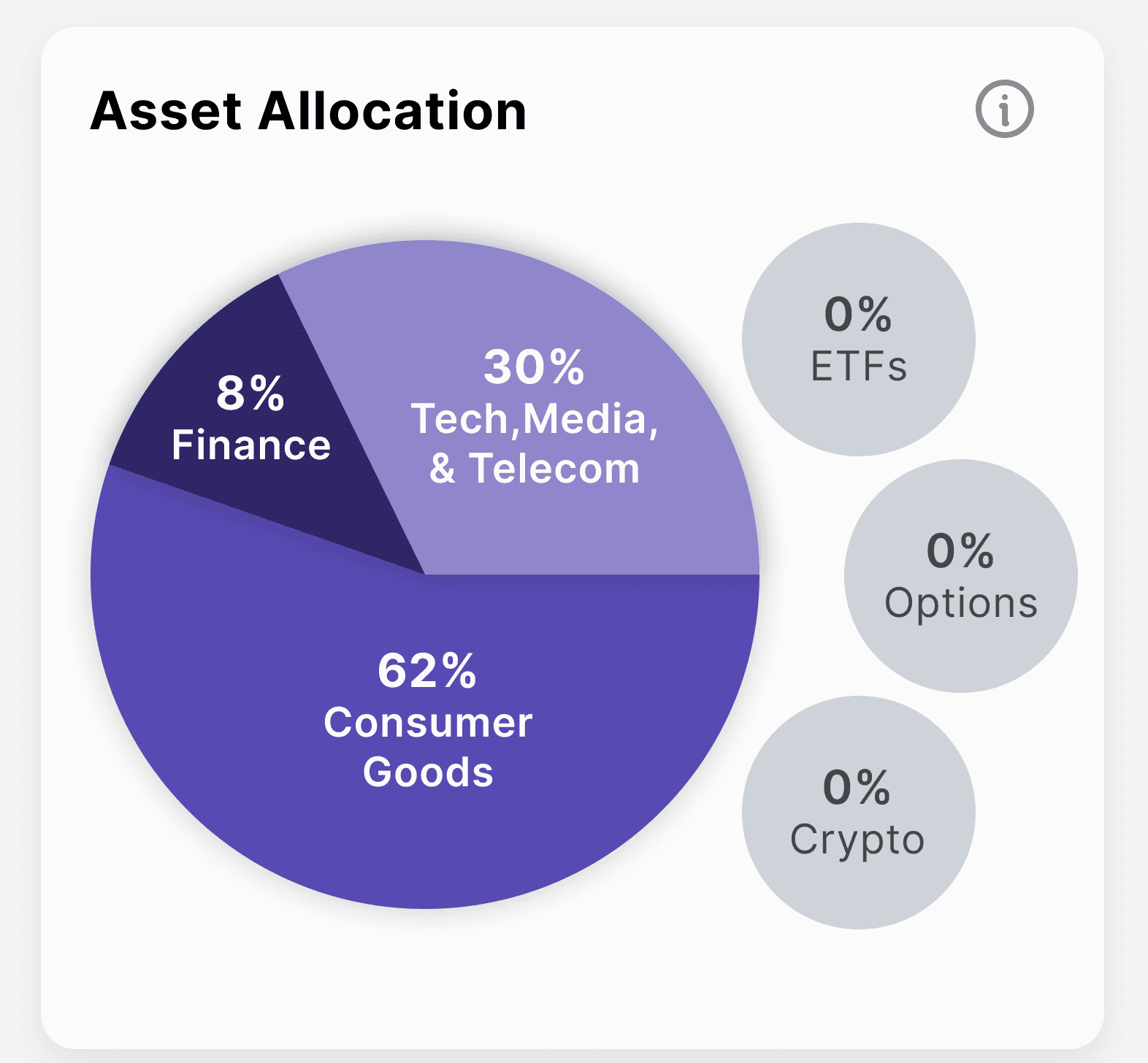

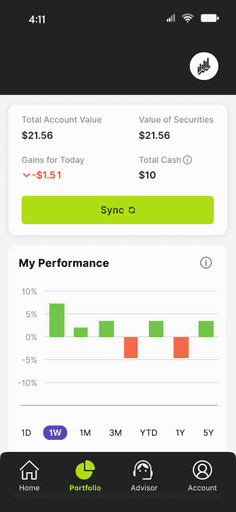

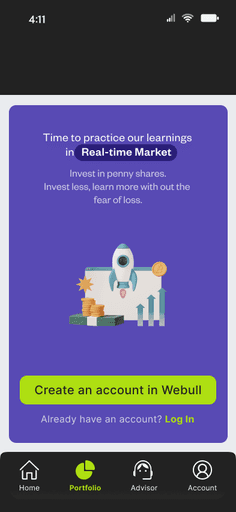

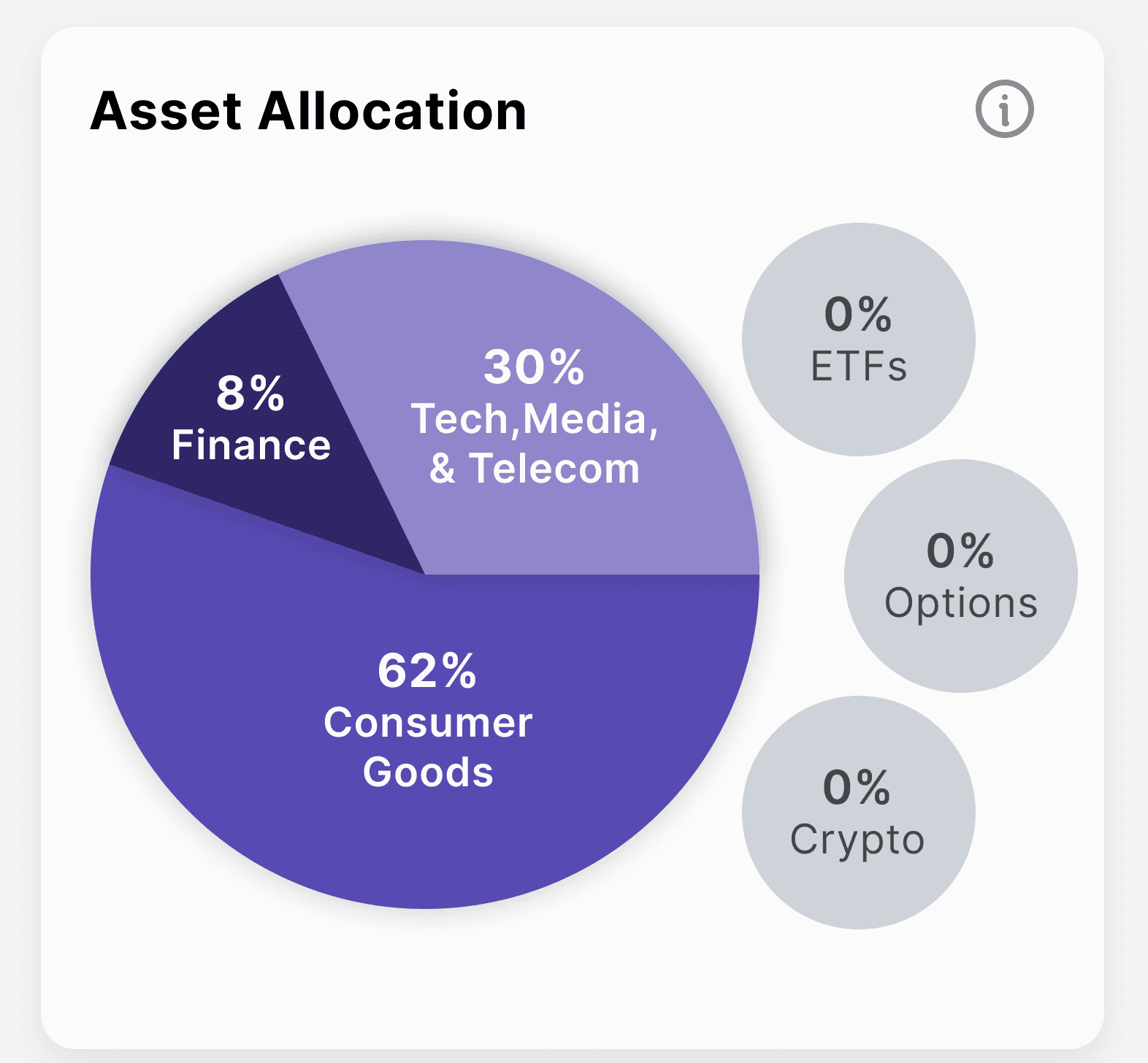

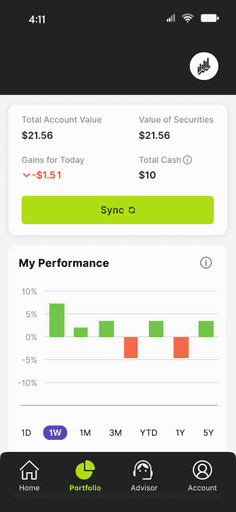

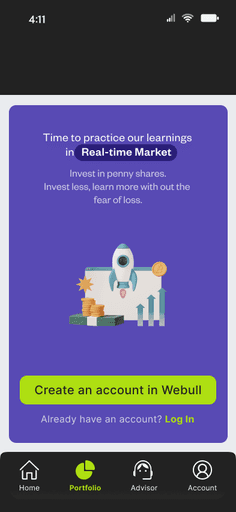

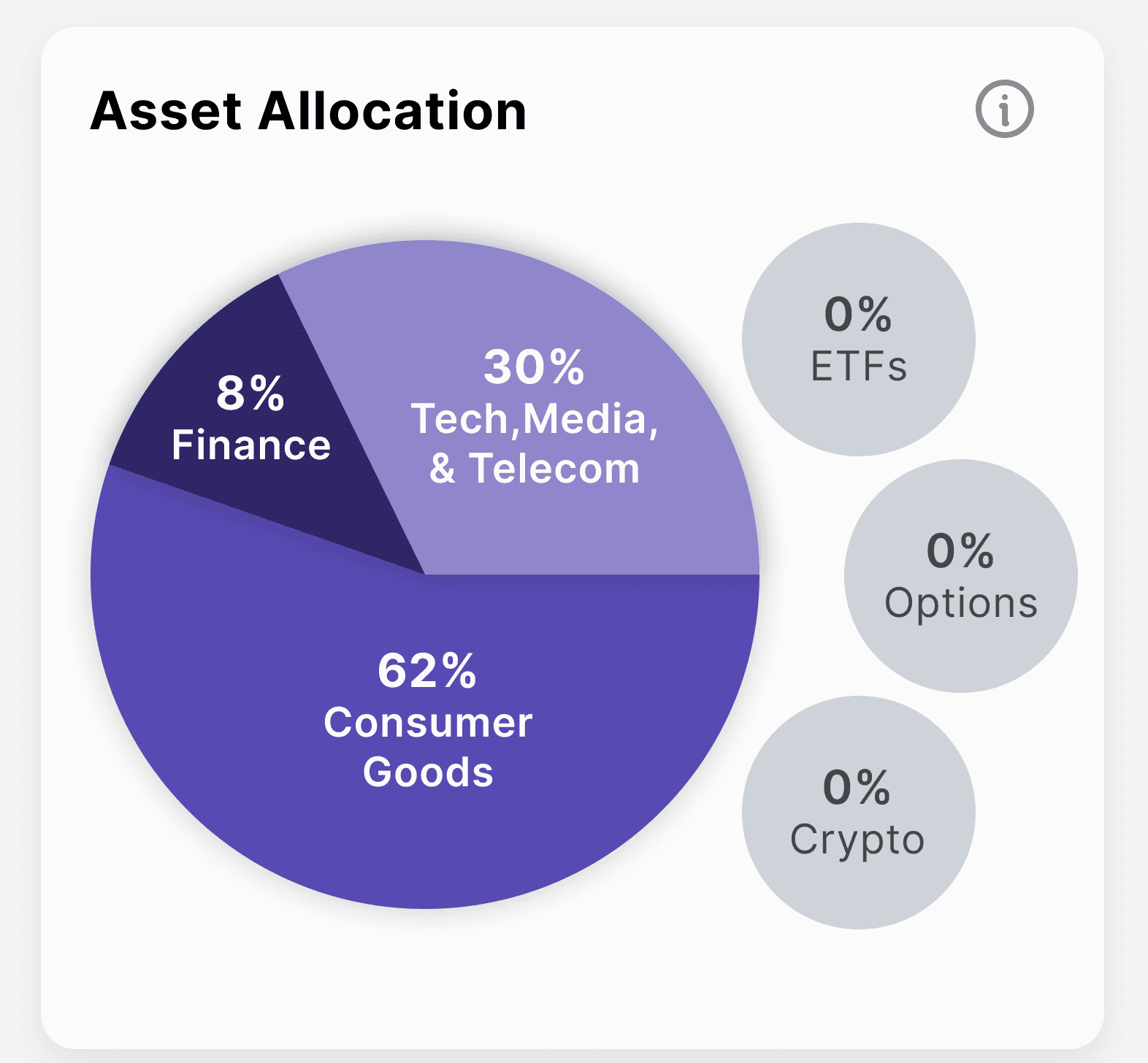

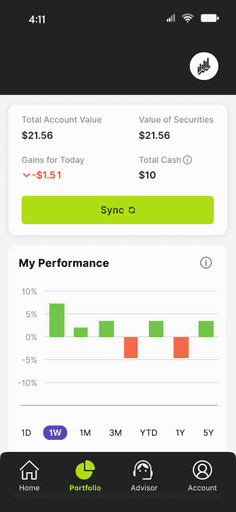

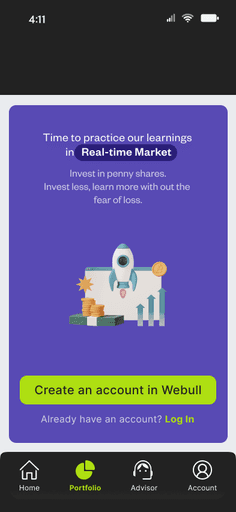

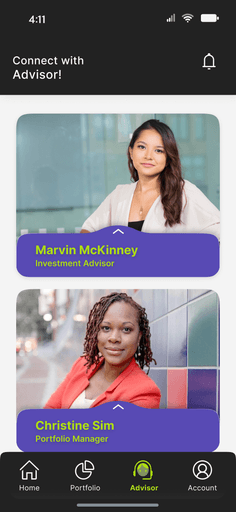

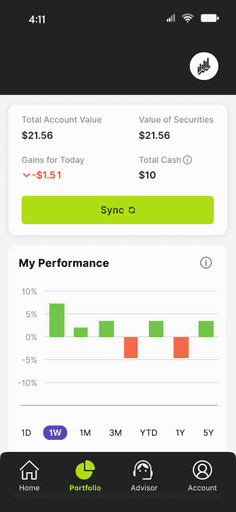

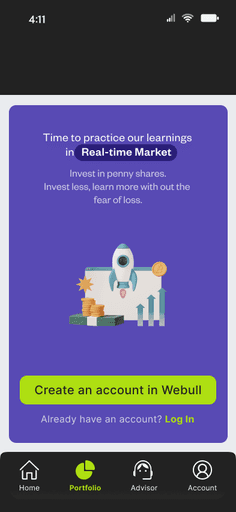

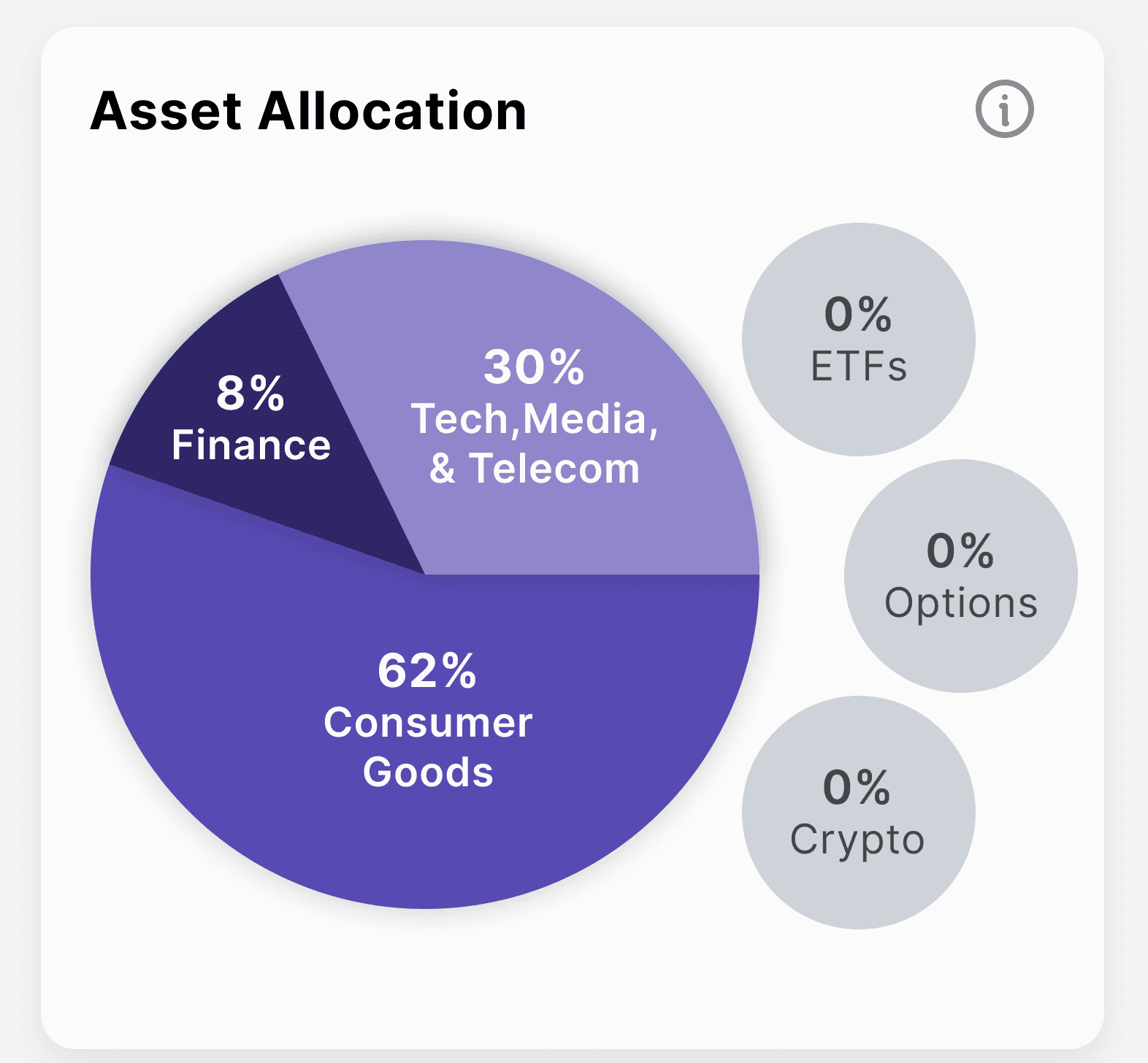

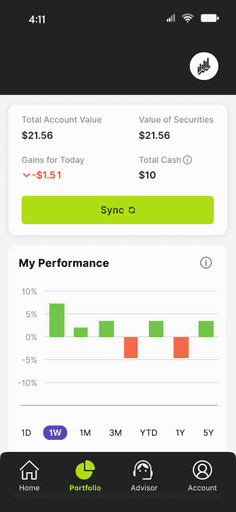

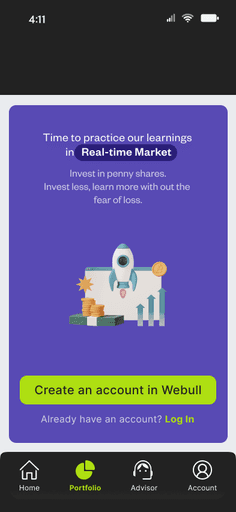

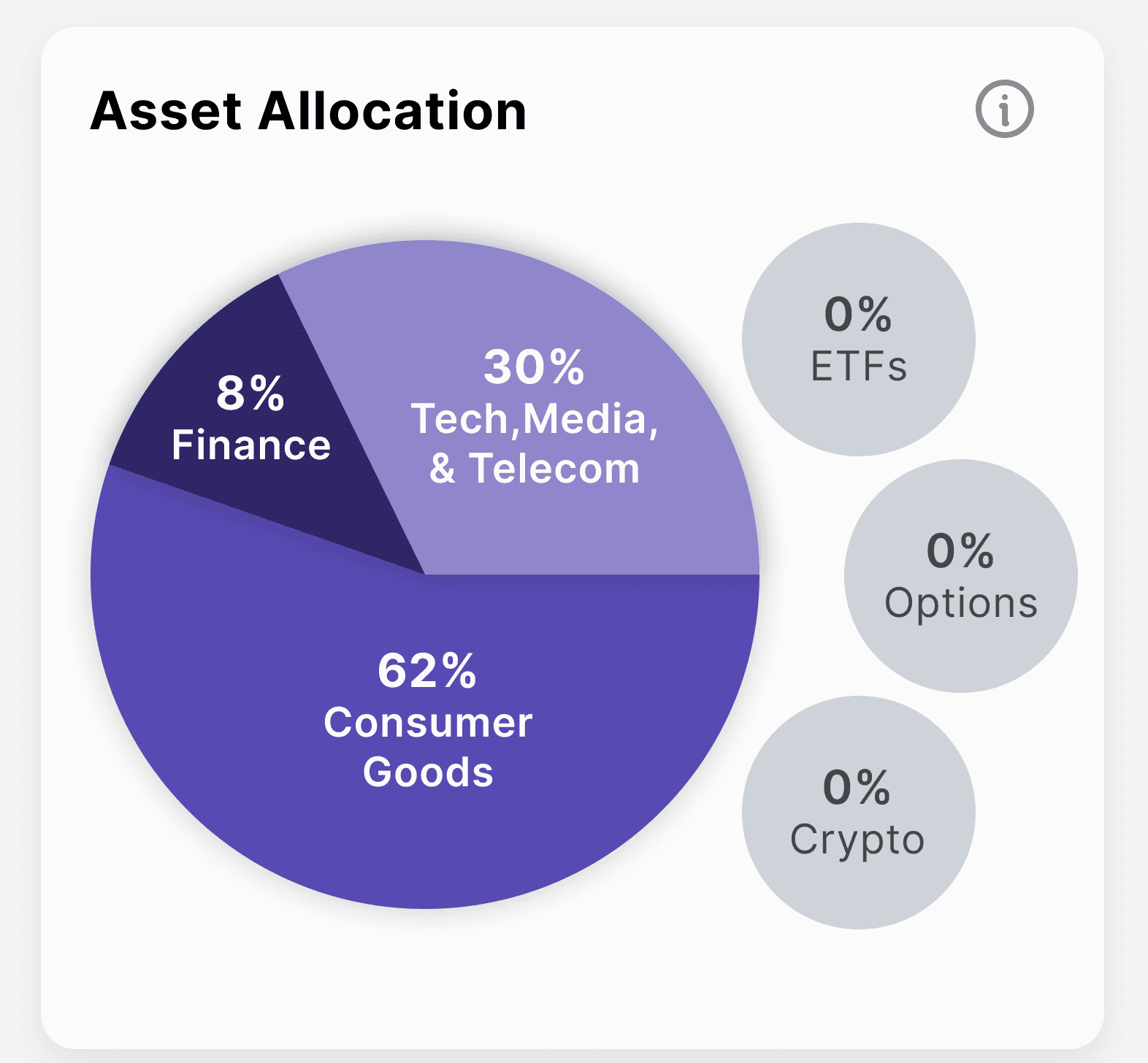

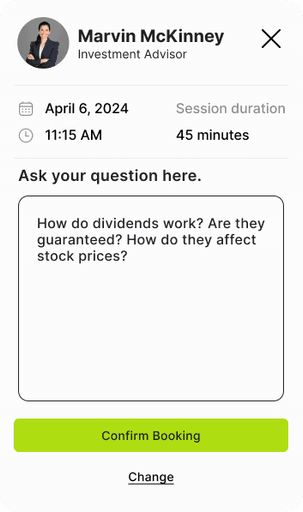

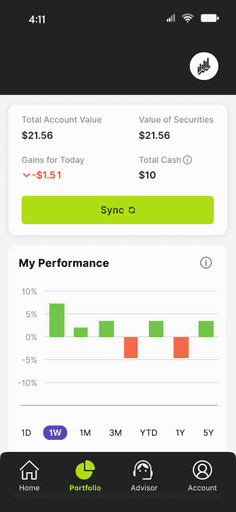

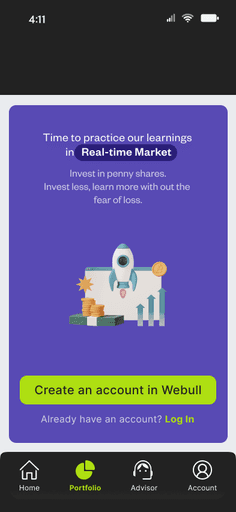

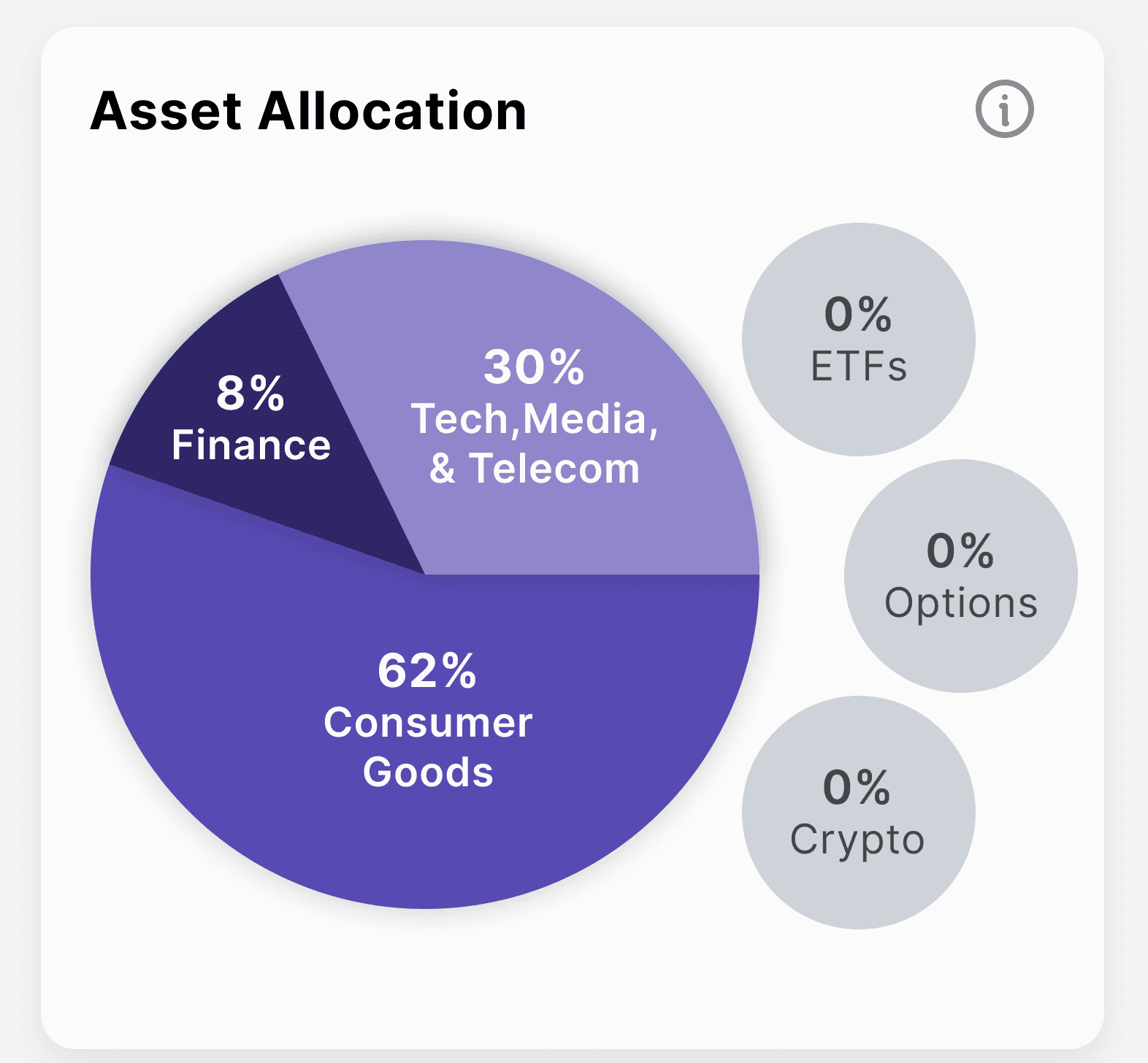

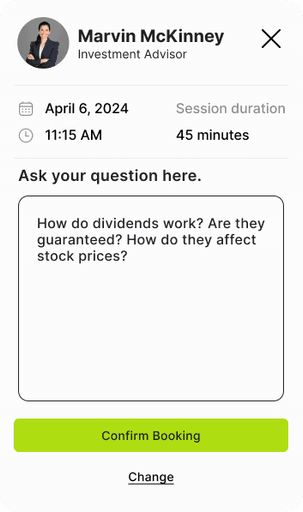

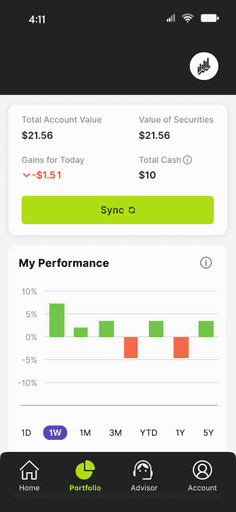

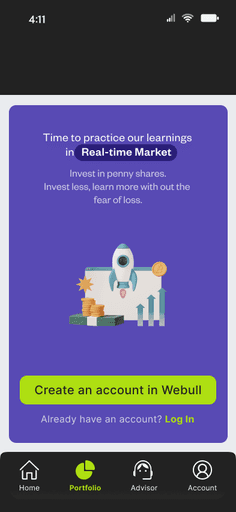

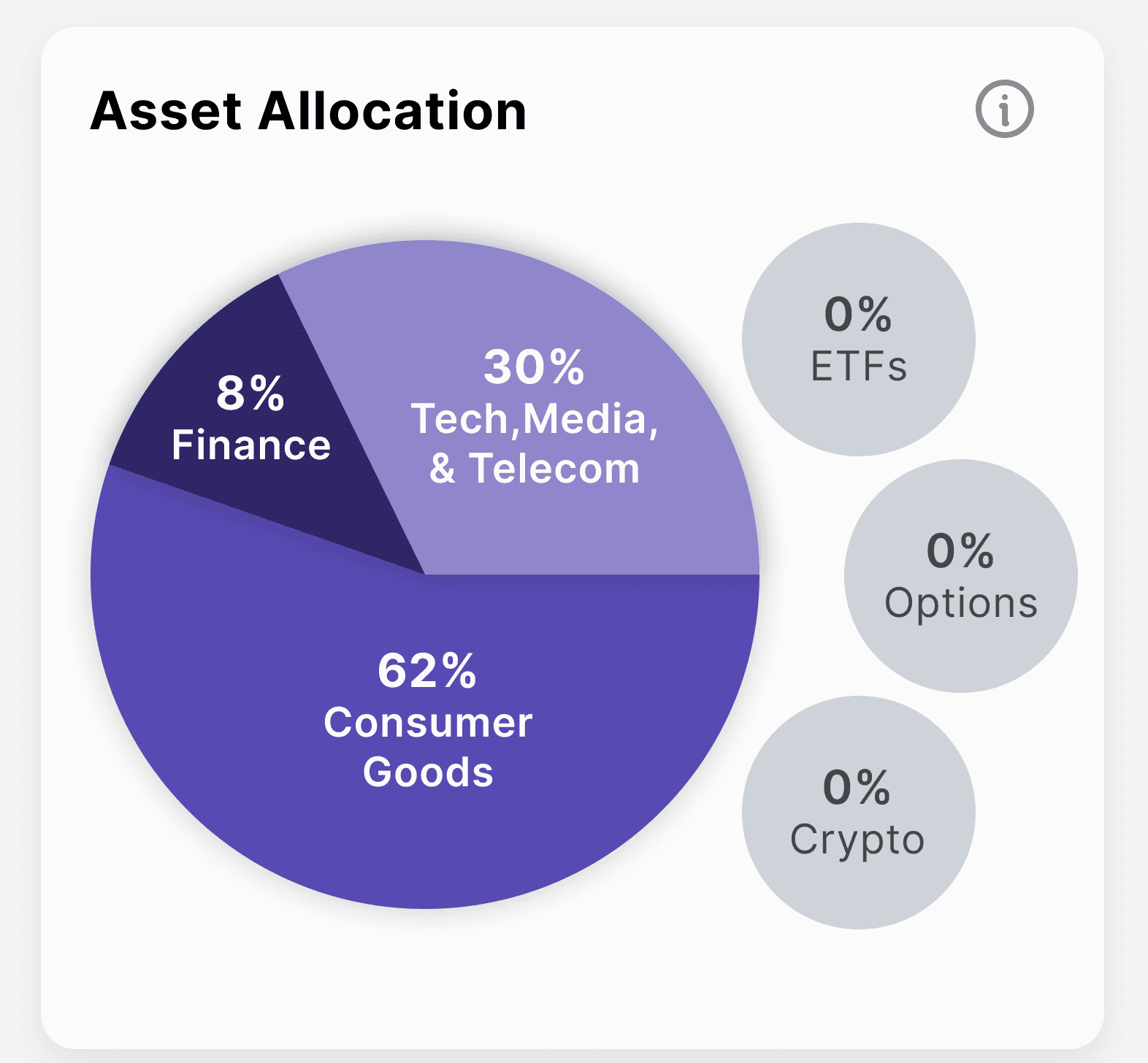

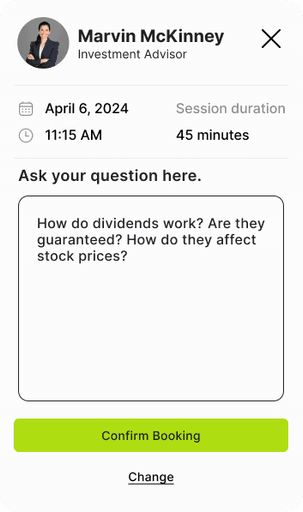

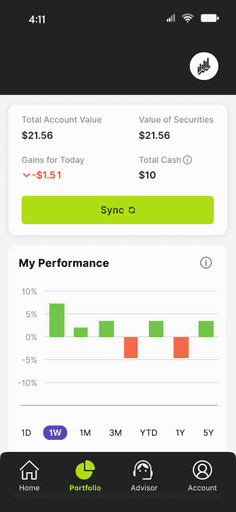

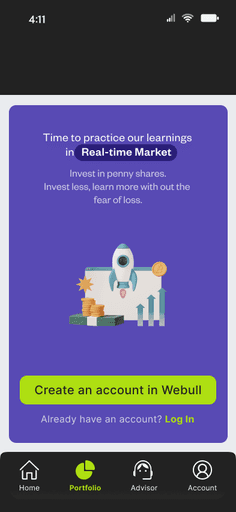

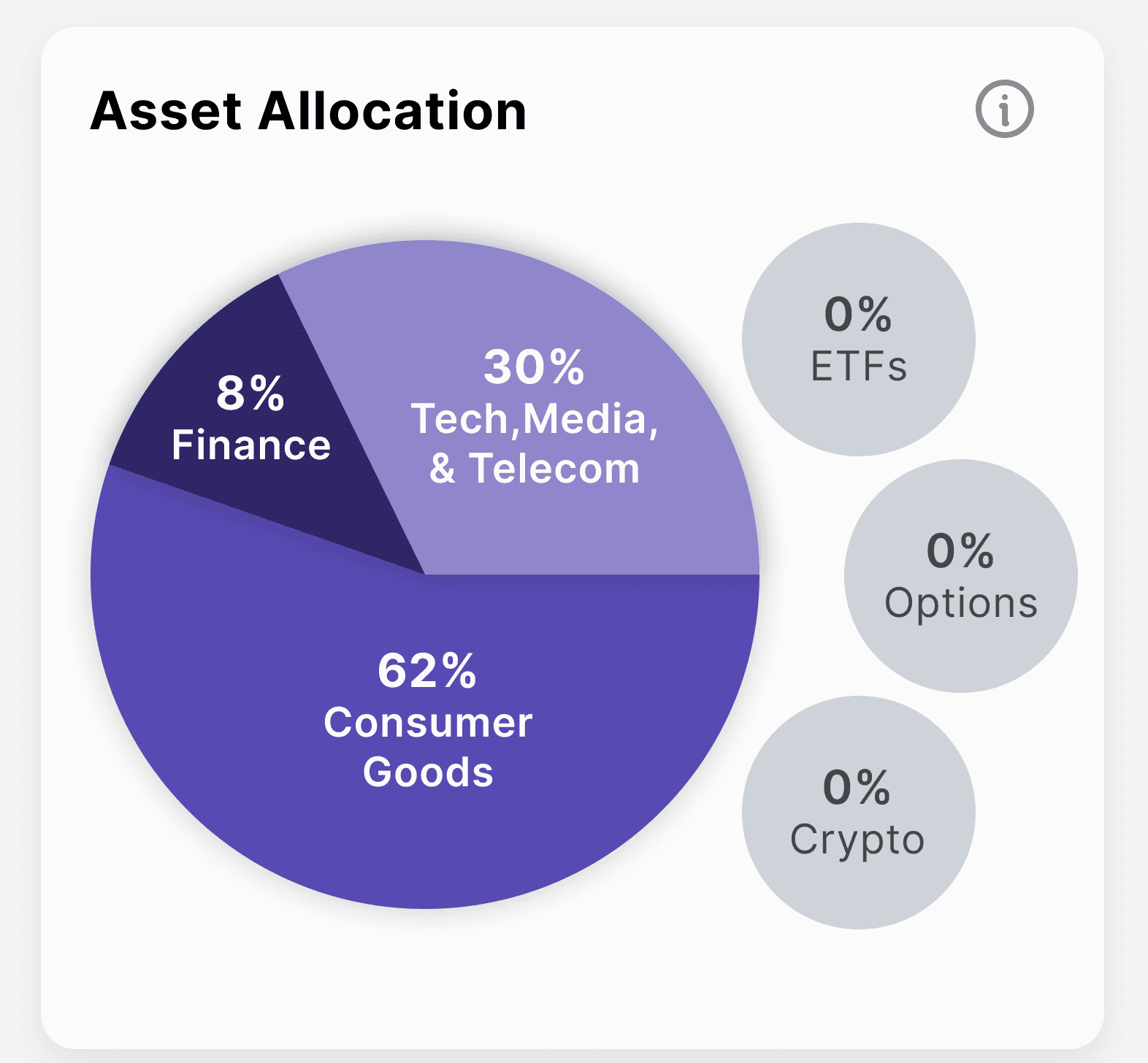

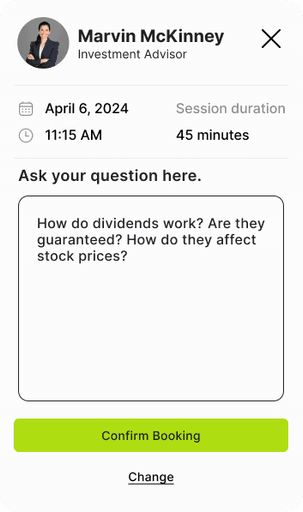

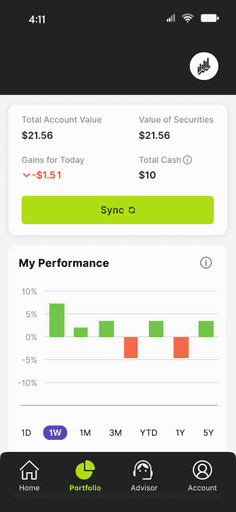

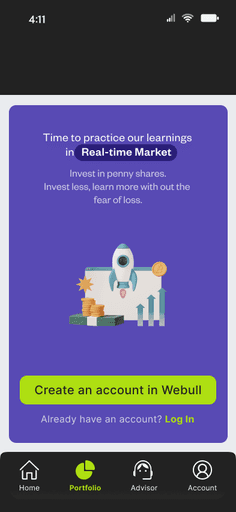

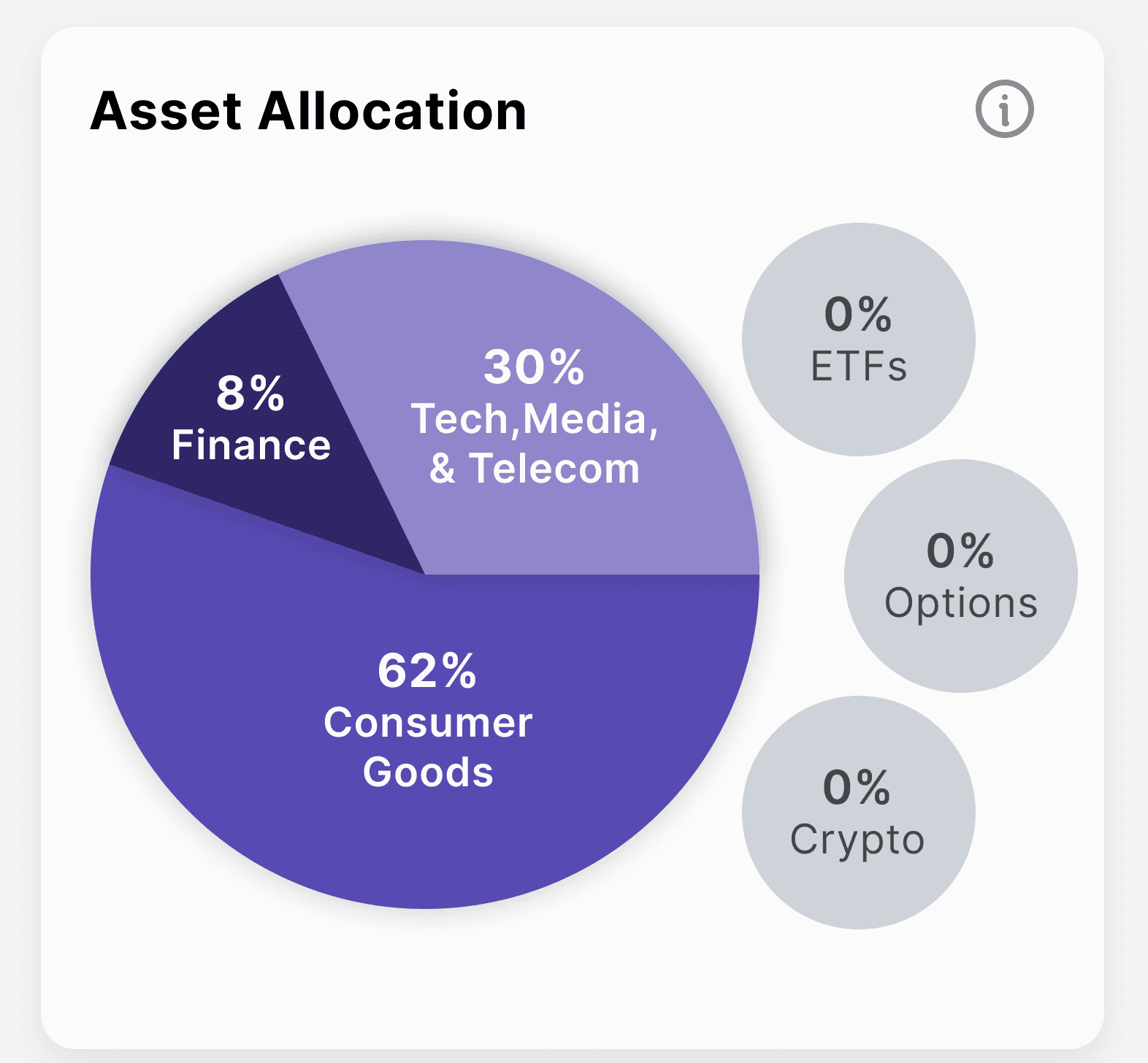

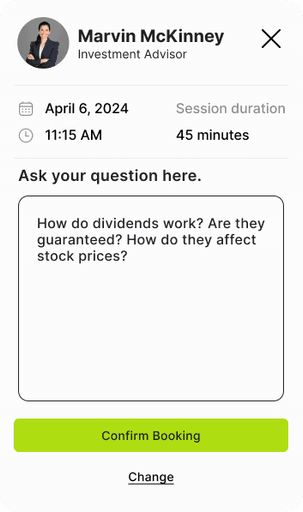

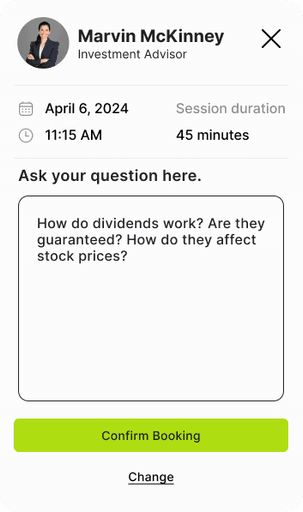

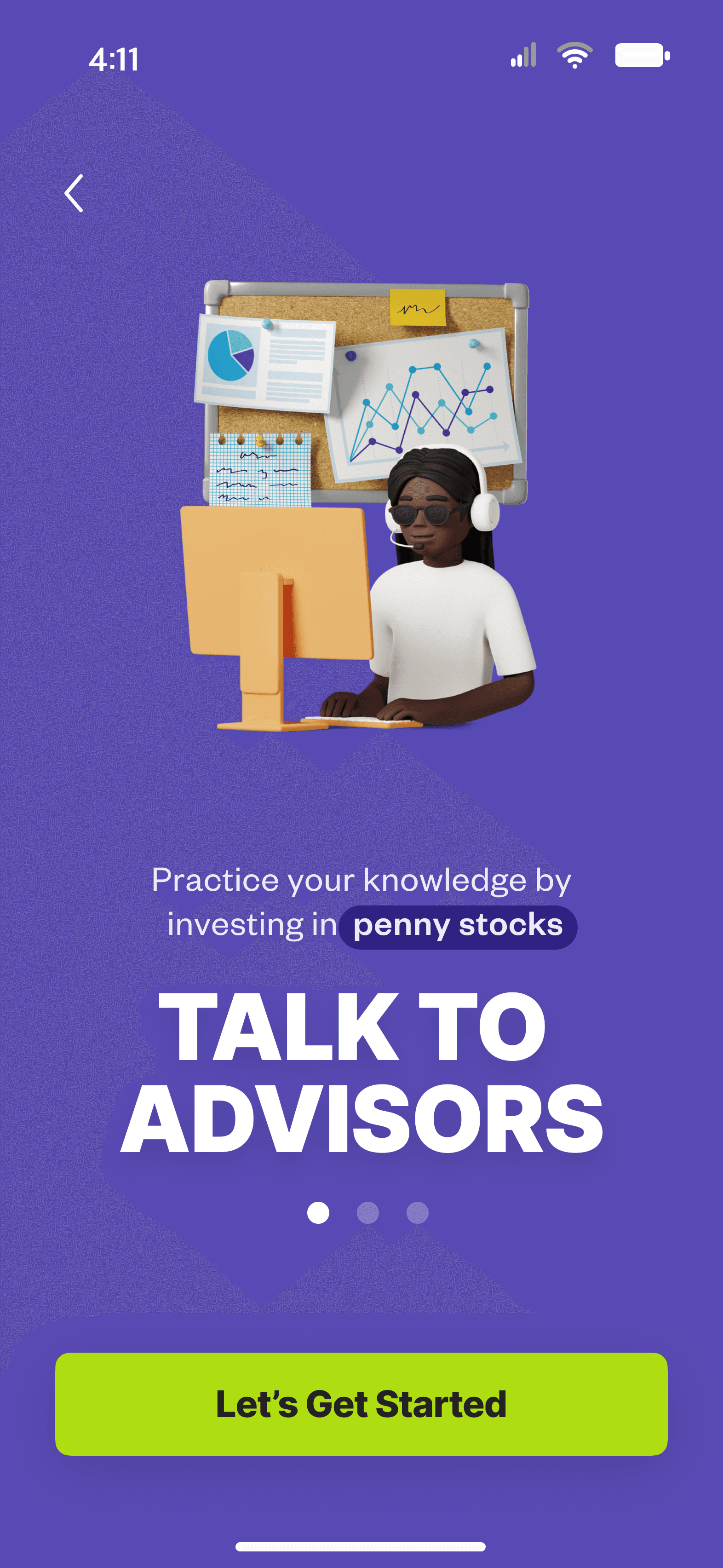

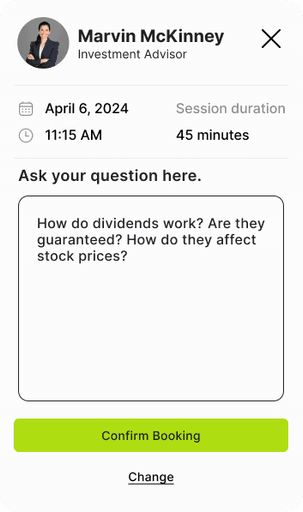

PRACTICE INVESTINGThe feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

Portfolio Dashboard

Webull Log in

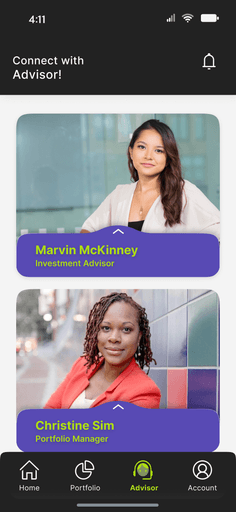

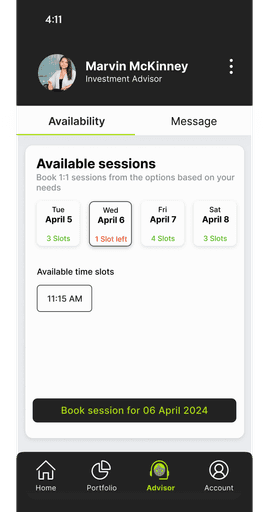

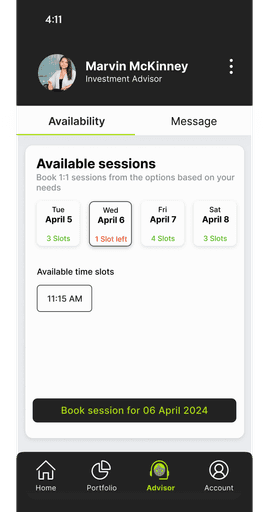

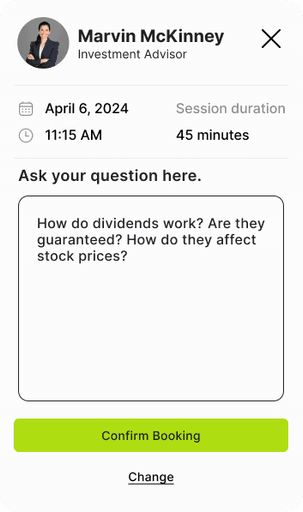

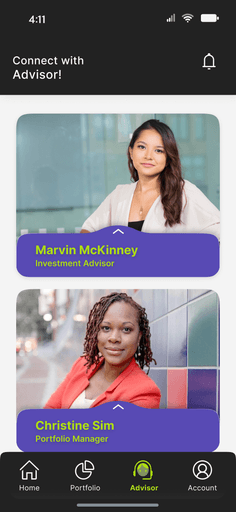

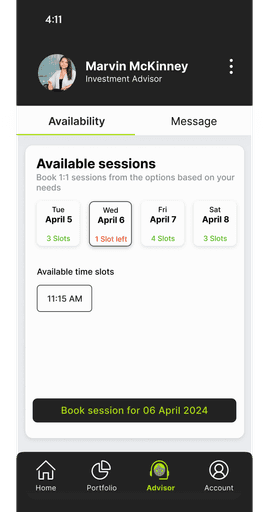

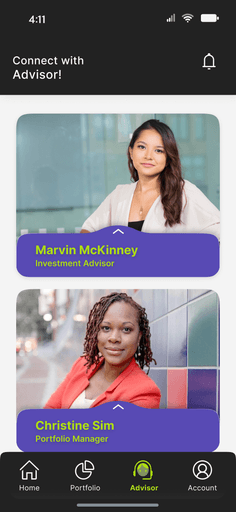

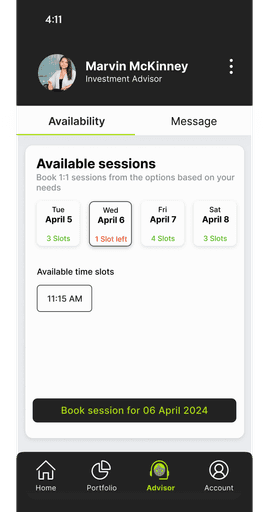

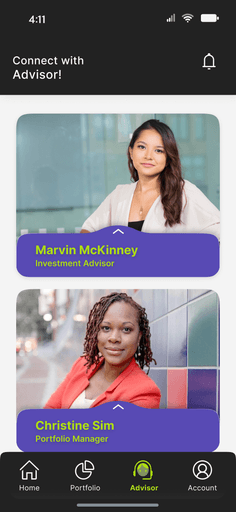

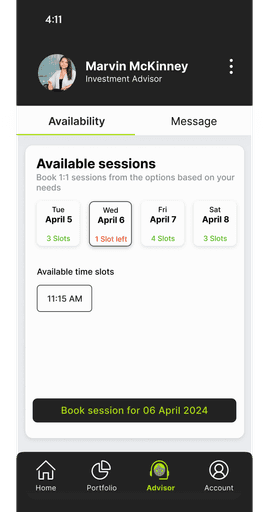

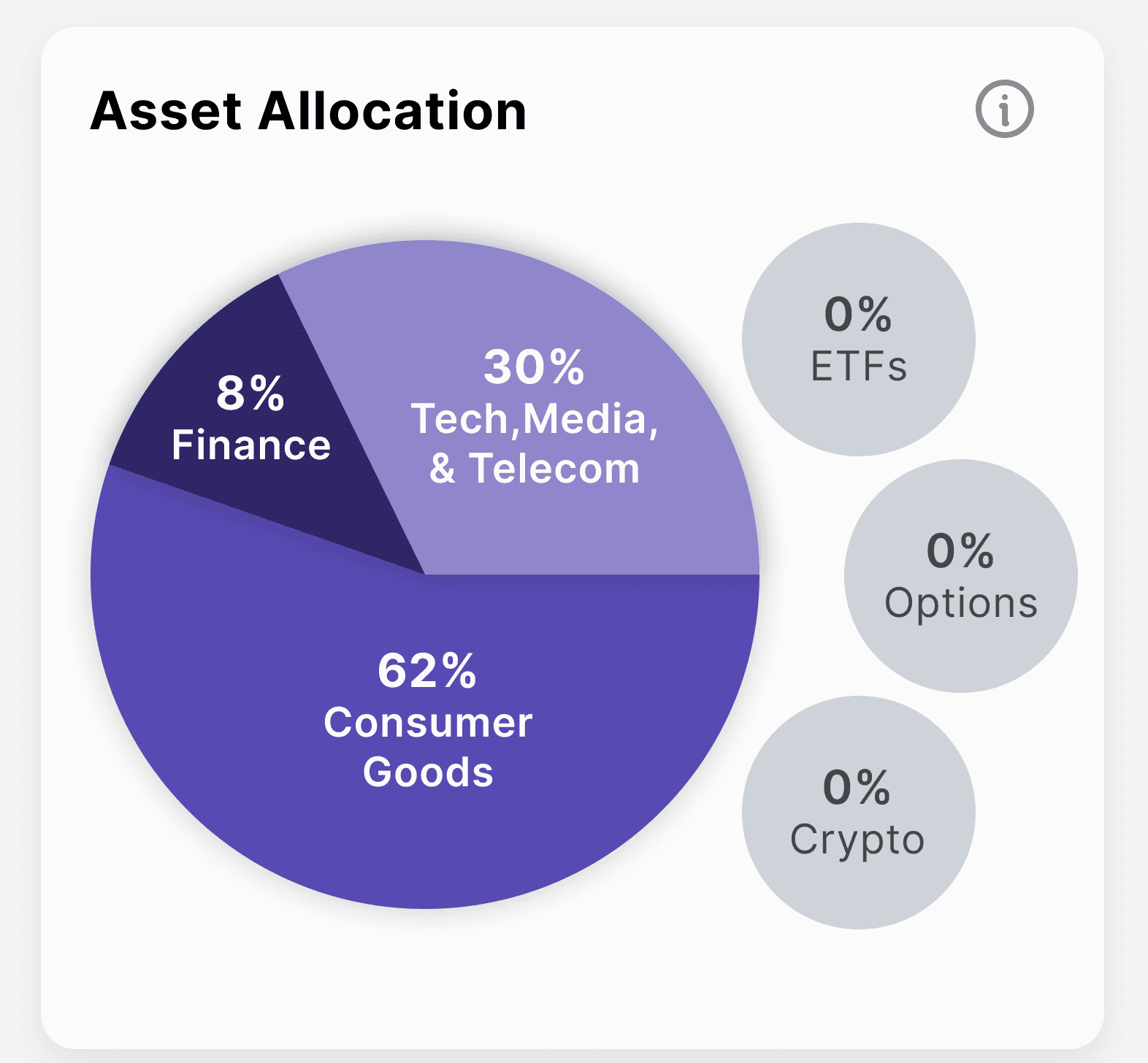

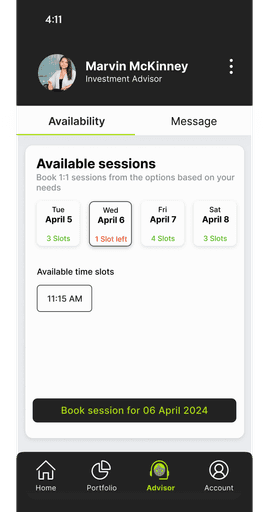

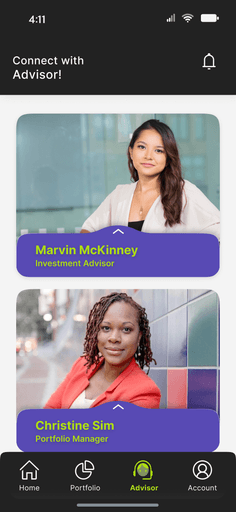

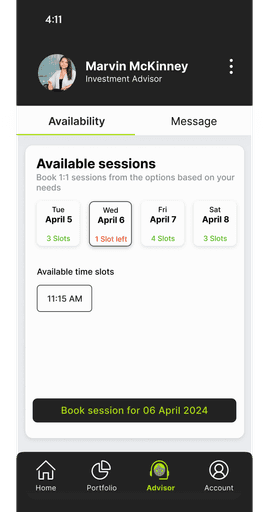

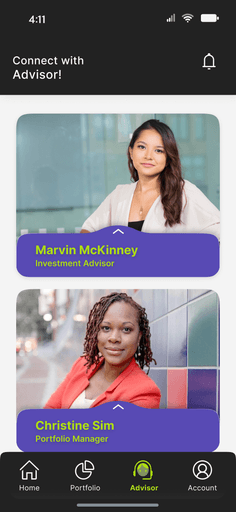

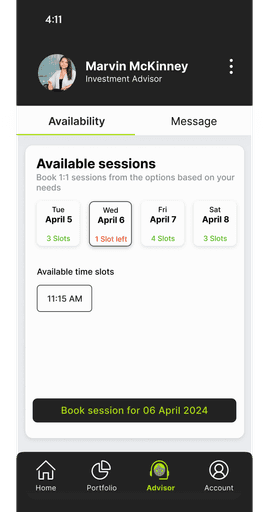

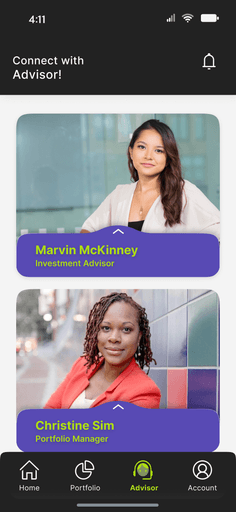

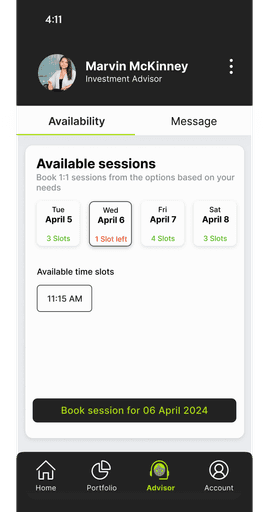

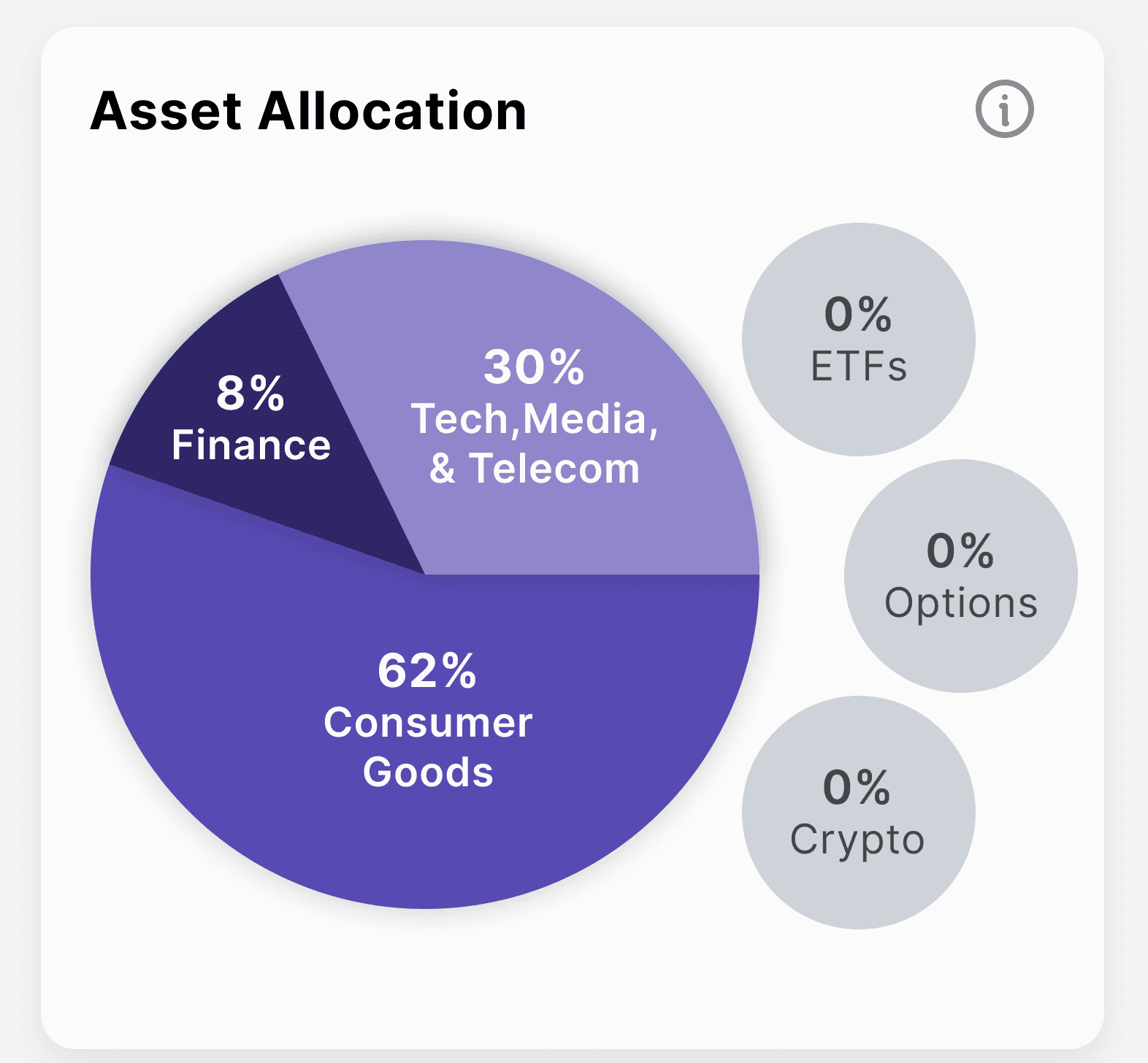

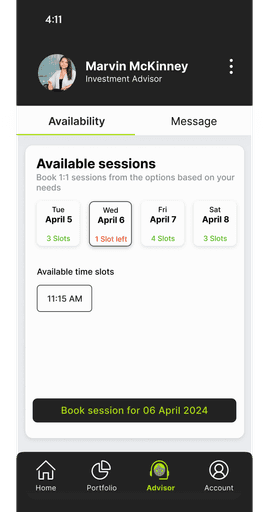

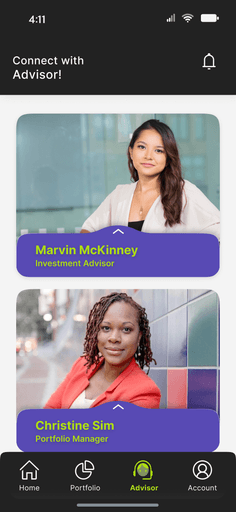

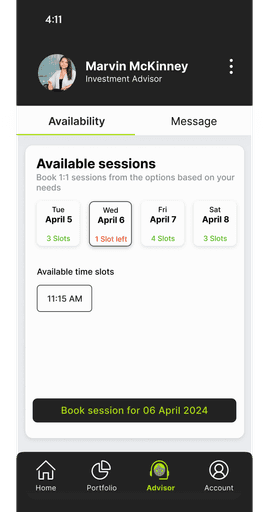

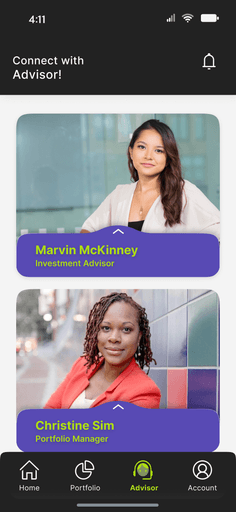

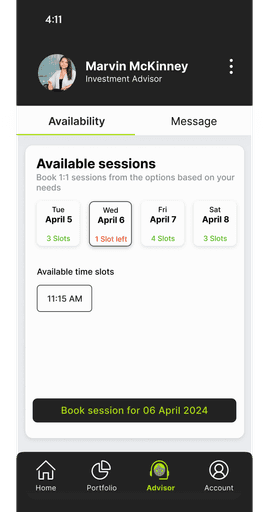

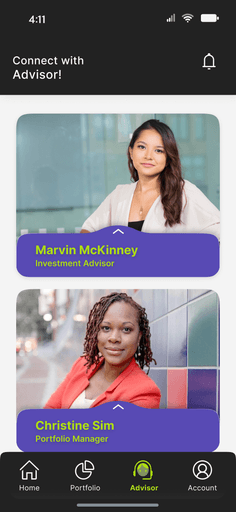

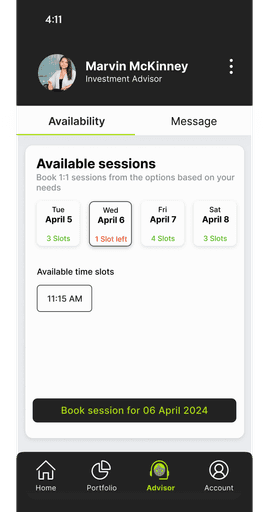

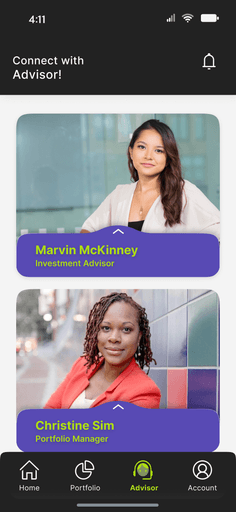

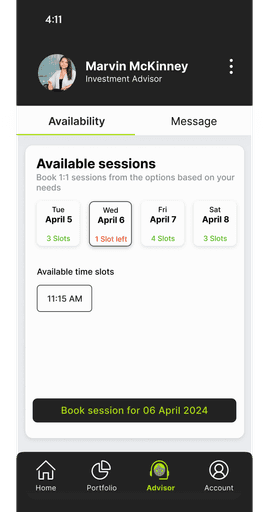

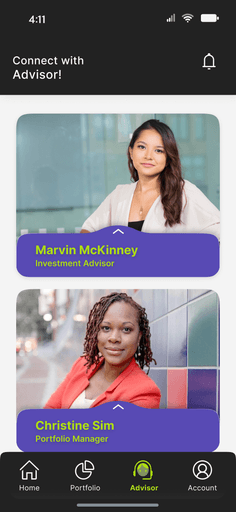

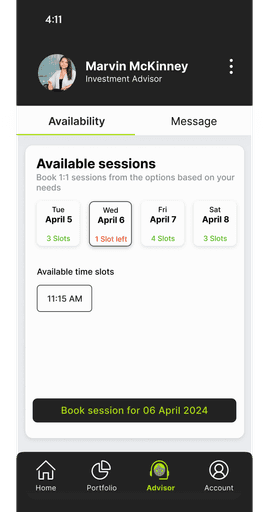

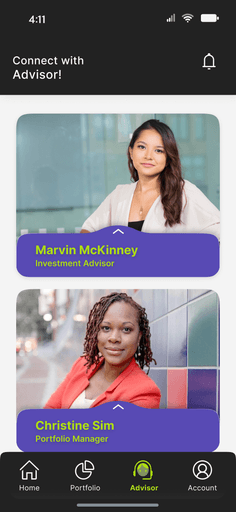

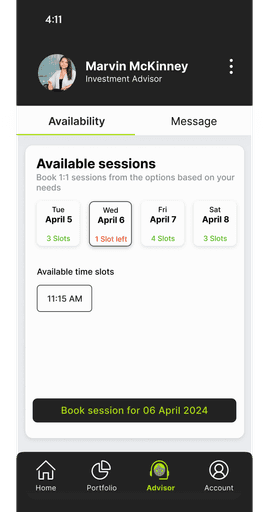

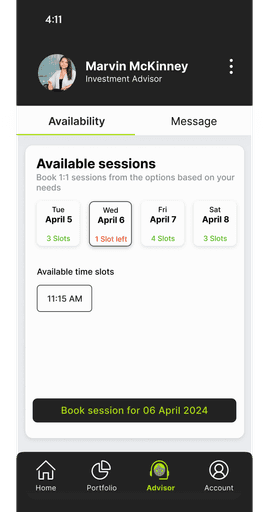

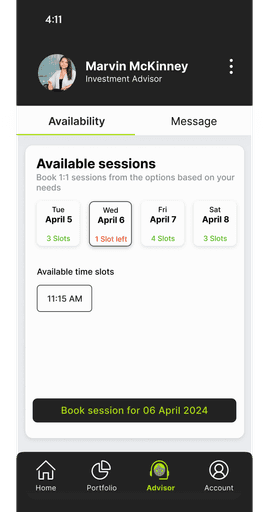

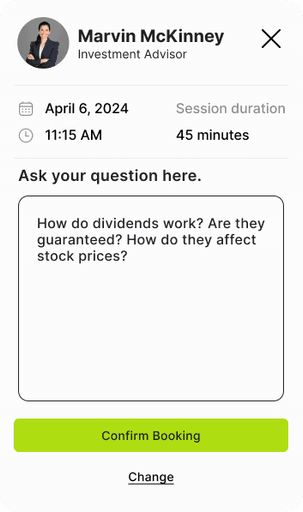

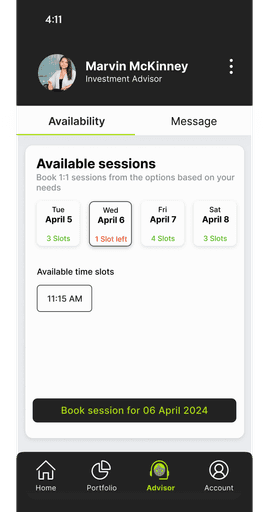

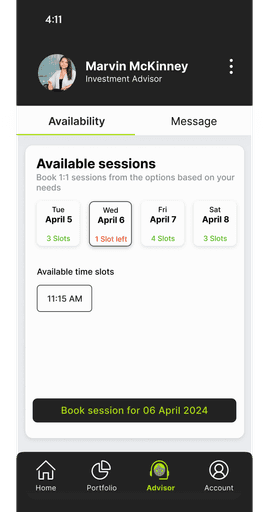

BOOK SESSIONS WITH ADVISOROnce connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

Advisor Profiles

Book Sessions

ONBOARDING SCREENS

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

Sign Up

Onboarding Screen 1

Onboarding Screen 2

Onboarding Quiz

TAILORED MODULESThe high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

Placard Learning

Level List Screen

Module List

PRACTICE INVESTINGThe feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

Portfolio Dashboard

Webull Log in

BOOK SESSIONS WITH ADVISOROnce connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

Advisor Profiles

Book Sessions

ONBOARDING SCREENS

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

Sign Up

Onboarding Screen 1

Onboarding Screen 2

Onboarding Quiz

TAILORED MODULESThe high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

Placard Learning

Level List Screen

Module List

PRACTICE INVESTINGThe feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

Portfolio Dashboard

Webull Log in

BOOK SESSIONS WITH ADVISOROnce connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

Advisor Profiles

Book Sessions

ONBOARDING SCREENS

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

Sign Up

Onboarding Screen 1

Onboarding Screen 2

Onboarding Quiz

TAILORED MODULESThe high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

Placard Learning

Level List Screen

Module List

PRACTICE INVESTINGThe feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

Portfolio Dashboard

Webull Log in

BOOK SESSIONS WITH ADVISOROnce connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

Advisor Profiles

Book Sessions

ONBOARDING SCREENS

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

Sign Up

Onboarding Screen 1

Onboarding Screen 2

Onboarding Quiz

TAILORED MODULESThe high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

Placard Learning

Level List Screen

Module List

PRACTICE INVESTINGThe feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

Portfolio Dashboard

Webull Log in

BOOK SESSIONS WITH ADVISOROnce connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

Advisor Profiles

Book Sessions

ONBOARDING SCREENS

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

Sign Up

Onboarding Screen 1

Onboarding Screen 2

Onboarding Quiz

TAILORED MODULESThe high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

Placard Learning

Level List Screen

Module List

PRACTICE INVESTINGThe feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

Portfolio Dashboard

Webull Log in

BOOK SESSIONS WITH ADVISOROnce connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

Advisor Profiles

Book Sessions

ONBOARDING SCREENS

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

Sign Up

Onboarding Screen 1

Onboarding Screen 2

Onboarding Quiz

TAILORED MODULESThe high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

Placard Learning

Level List Screen

Module List

PRACTICE INVESTINGThe feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

Portfolio Dashboard

Webull Log in

BOOK SESSIONS WITH ADVISOROnce connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

Advisor Profiles

Book Sessions

ONBOARDING SCREENS

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

Sign Up

Onboarding Screen 1

Onboarding Screen 2

Onboarding Quiz

TAILORED MODULESThe high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

Placard Learning

Level List Screen

Module List

PRACTICE INVESTINGThe feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

Portfolio Dashboard

Webull Log in

BOOK SESSIONS WITH ADVISOROnce connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

Advisor Profiles

Book Sessions

ONBOARDING SCREENS

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

Sign Up

Onboarding Screen 1

Onboarding Screen 2

Onboarding Quiz

TAILORED MODULESThe high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

Placard Learning

Level List Screen

Module List

PRACTICE INVESTINGThe feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

Portfolio Dashboard

Webull Log in

BOOK SESSIONS WITH ADVISOROnce connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

Advisor Profiles

Book Sessions

ONBOARDING SCREENS

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

Sign Up

Onboarding Screen 1

Onboarding Screen 2

Onboarding Quiz

TAILORED MODULESThe high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

Placard Learning

Level List Screen

Module List

PRACTICE INVESTINGThe feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

Portfolio Dashboard

Webull Log in

BOOK SESSIONS WITH ADVISOROnce connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

Advisor Profiles

Book Sessions

ONBOARDING SCREENS

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

Sign Up

Onboarding Screen 1

Onboarding Screen 2

Onboarding Quiz

TAILORED MODULESThe high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

Placard Learning

Level List Screen

Module List

PRACTICE INVESTINGThe feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

Portfolio Dashboard

Webull Log in

BOOK SESSIONS WITH ADVISOROnce connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

Advisor Profiles

Book Sessions

ONBOARDING SCREENS

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

Sign Up

Onboarding Screen 1

Onboarding Screen 2

Onboarding Quiz

TAILORED MODULESThe high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

Placard Learning

Level List Screen

Module List

PRACTICE INVESTINGThe feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

Portfolio Dashboard

Webull Log in

BOOK SESSIONS WITH ADVISOROnce connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

Advisor Profiles

Book Sessions

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

Sign Up

Onboarding Screen 1

Onboarding Screen 2

Onboarding Quiz

ONBOARDING SCREENS

The high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

TAILORED MODULES

Placard Learning

Level List Screen

Module List

The feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

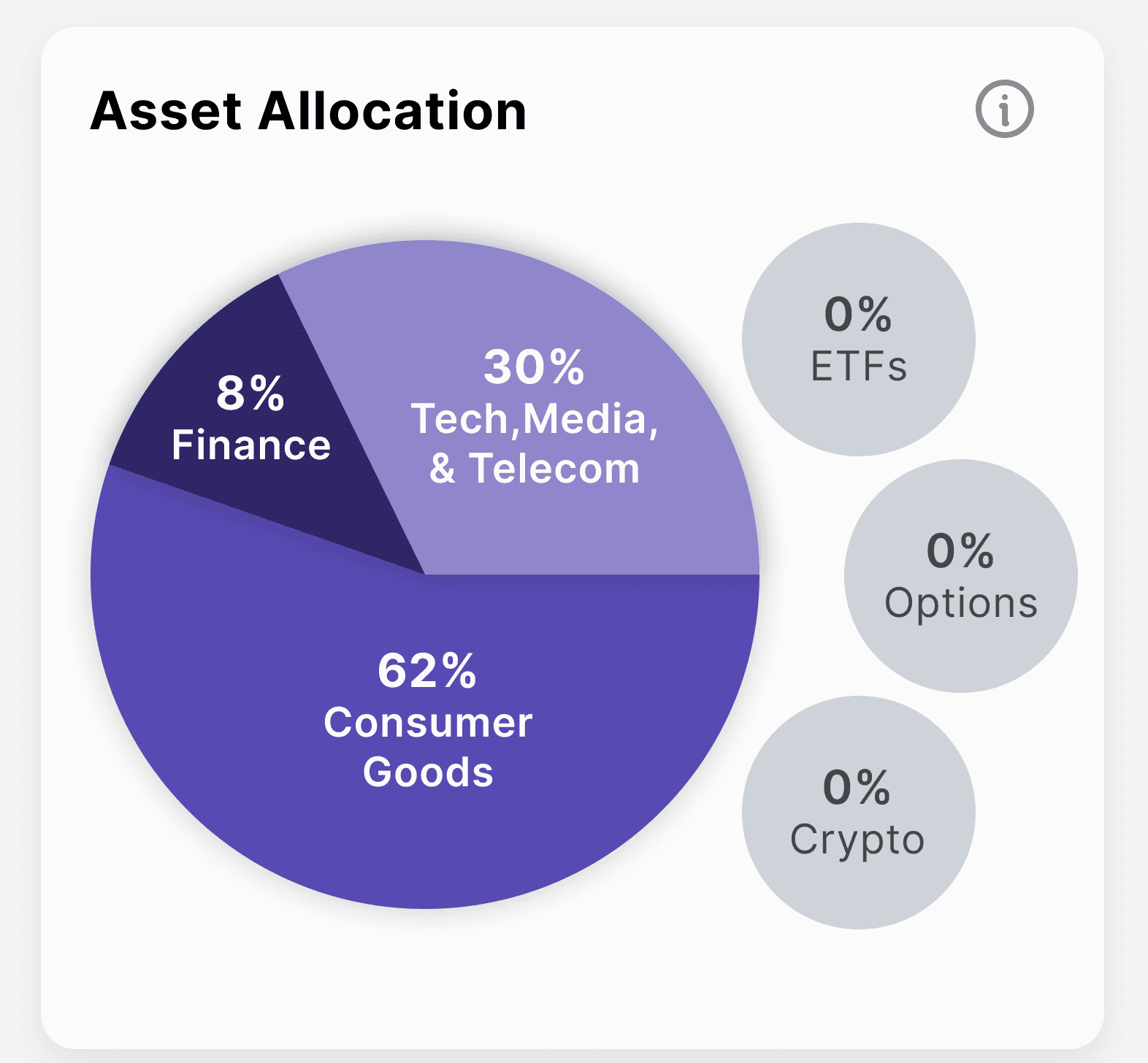

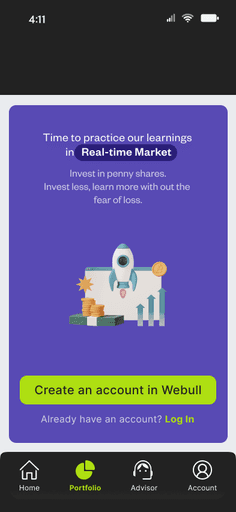

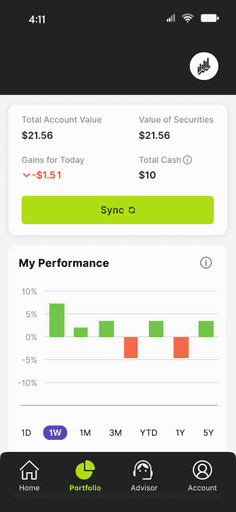

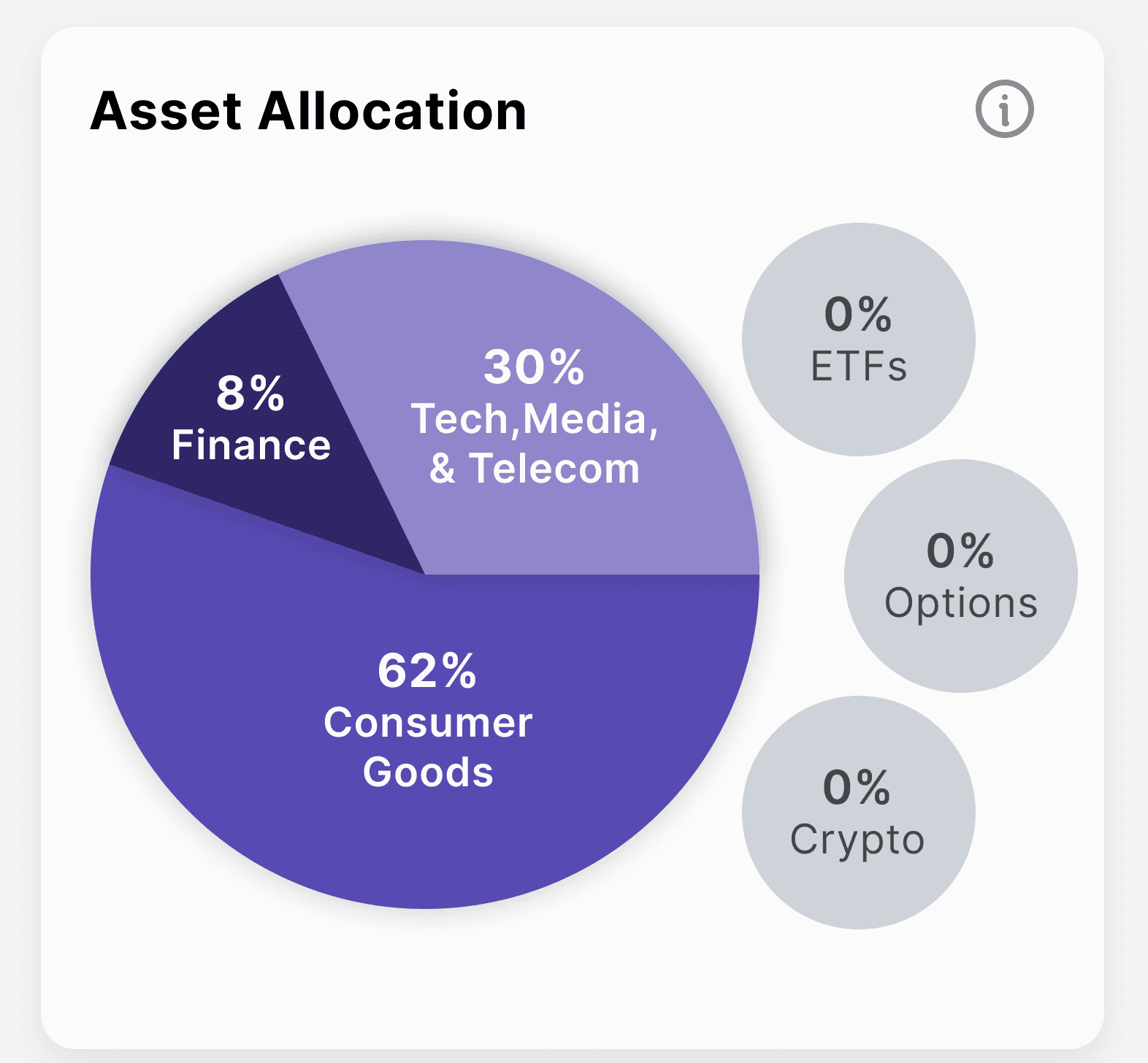

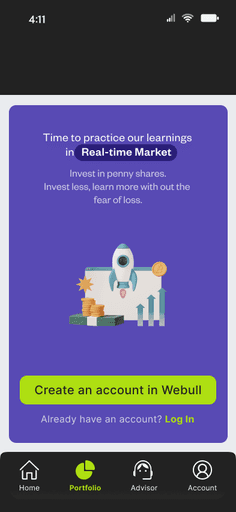

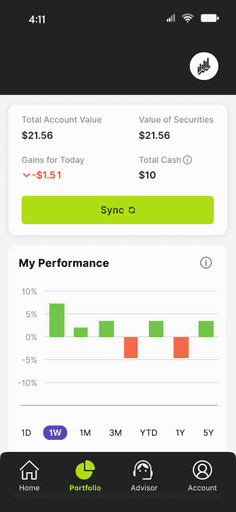

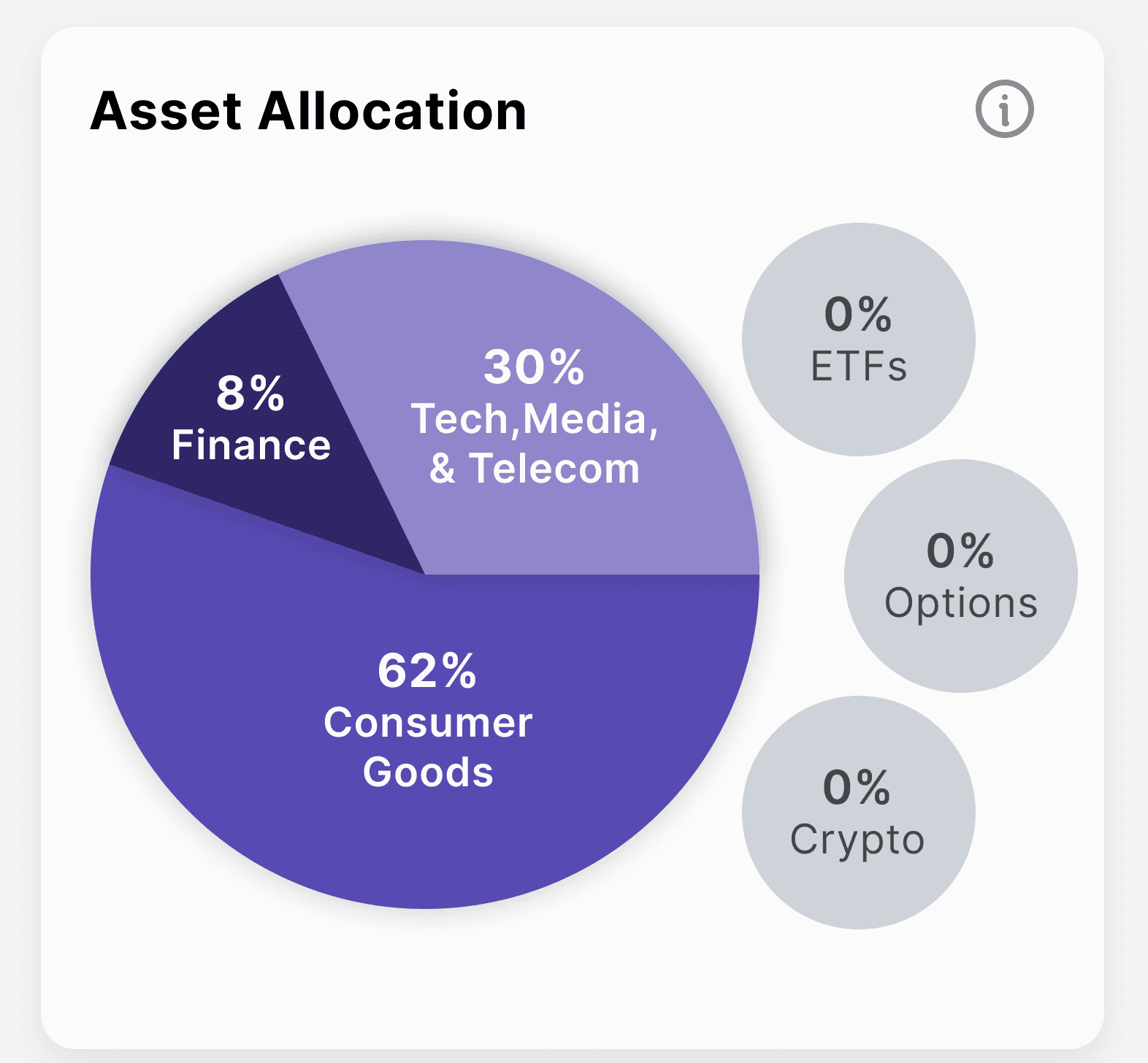

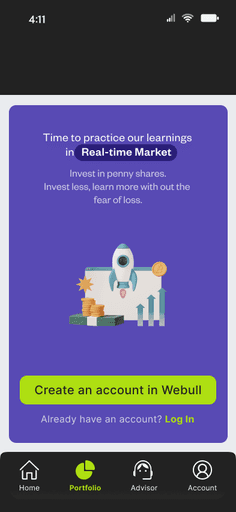

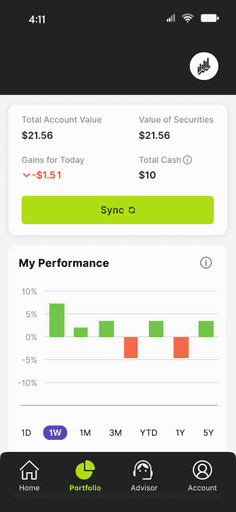

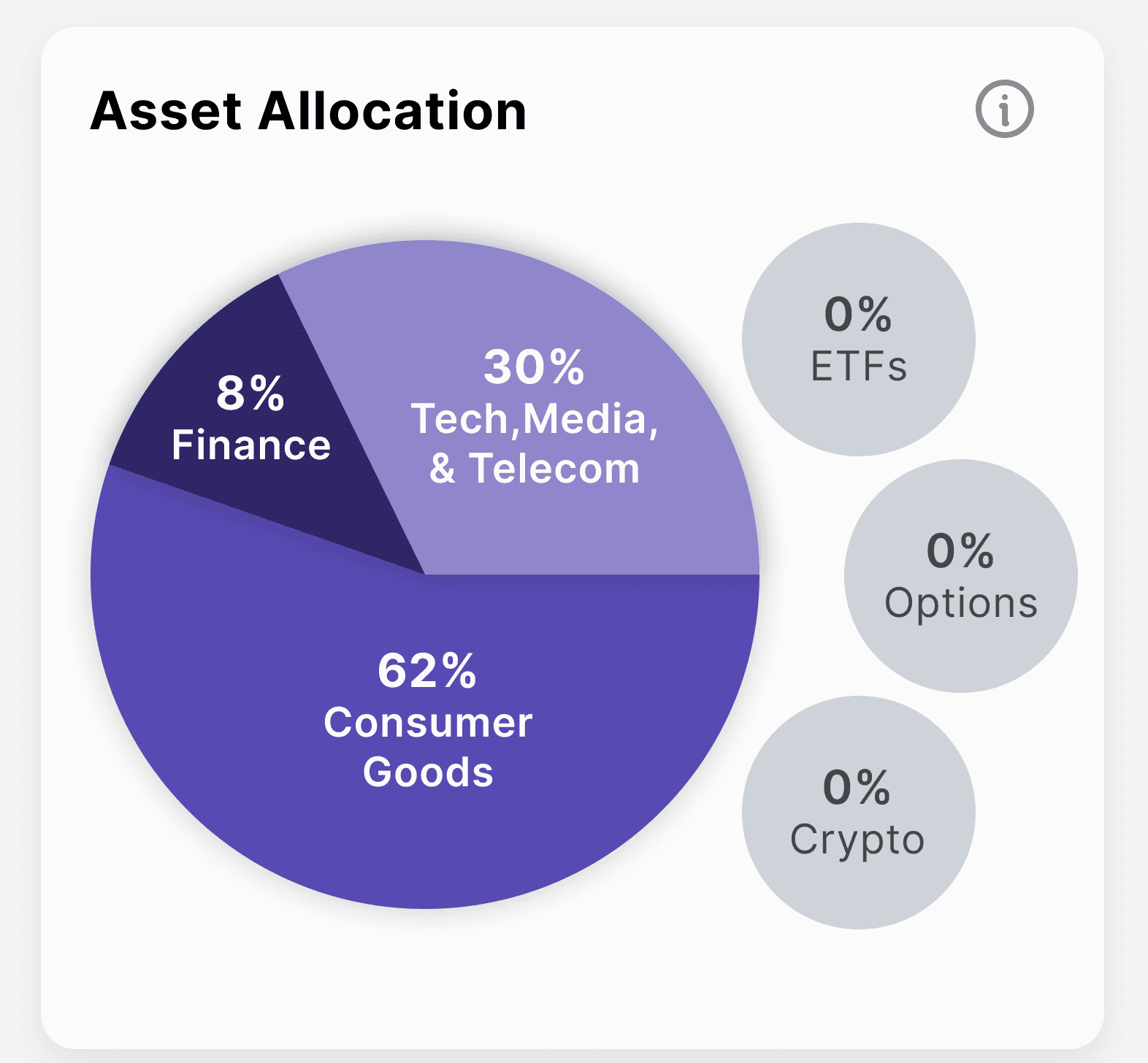

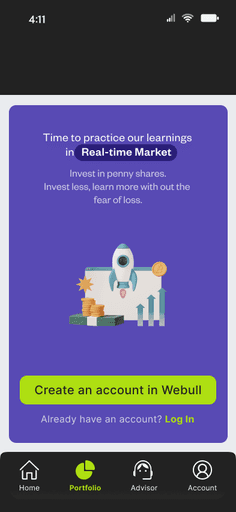

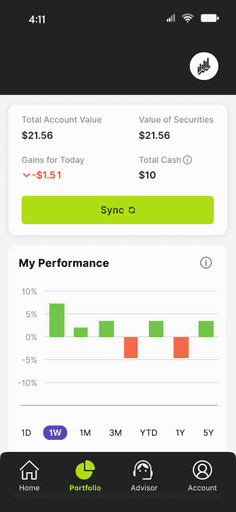

PRACTICE INVESTING

Portfolio Dashboard

Webull Log in

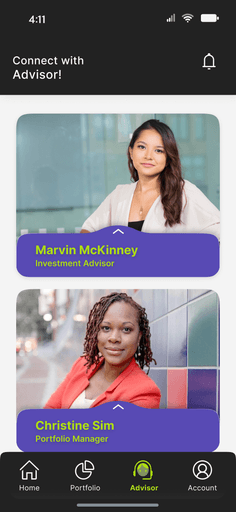

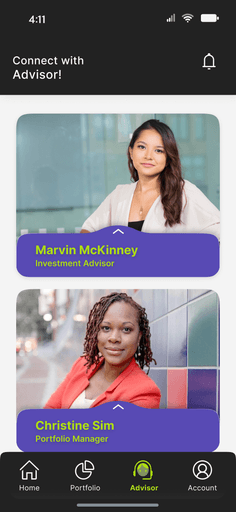

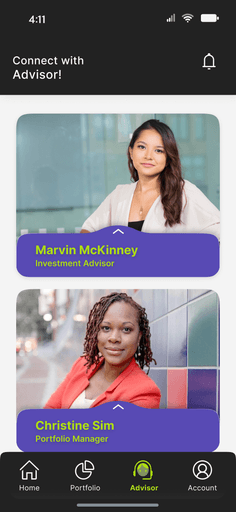

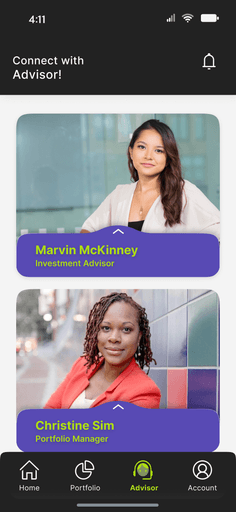

Once connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

BOOK SESSIONS WITH ADVISOR

Advisor Profiles

Book Sessions

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

Sign Up

Onboarding Screen 1

Onboarding Screen 2

Onboarding Quiz

ONBOARDING SCREENS

The high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

TAILORED MODULES

Placard Learning

Level List Screen

Module List

The feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

PRACTICE INVESTING

Portfolio Dashboard

Webull Log in

Once connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

BOOK SESSIONS WITH ADVISOR

Advisor Profiles

Book Sessions

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

Sign Up

Onboarding Screen 1

Onboarding Screen 2

Onboarding Quiz

ONBOARDING SCREENS

The high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

TAILORED MODULES

Placard Learning

Level List Screen

Module List

The feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

PRACTICE INVESTING

Portfolio Dashboard

Webull Log in

Once connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

BOOK SESSIONS WITH ADVISOR

Advisor Profiles

Book Sessions

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

Sign Up

Onboarding Screen 1

Onboarding Screen 2

Onboarding Quiz

ONBOARDING SCREENS

The high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

TAILORED MODULES

Placard Learning

Level List Screen

Module List

The feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

PRACTICE INVESTING

Portfolio Dashboard

Webull Log in

Once connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

BOOK SESSIONS WITH ADVISOR

Advisor Profiles

Book Sessions

ONBOARDING SCREENS

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

TAILORED MODULES

The high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

PRACTICE INVESTING

The feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

BOOK SESSIONS WITH ADVISOR

Once connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

ONBOARDING SCREENS

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

TAILORED MODULES

The high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

PRACTICE INVESTING

The feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

BOOK SESSIONS WITH ADVISOR

Once connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

ONBOARDING SCREENS

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

TAILORED MODULES

The high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

PRACTICE INVESTING

The feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

BOOK SESSIONS WITH ADVISOR

Once connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

ONBOARDING SCREENS

The process of balancing the user experience with visual appeal, ensuring that each component contributed to the app’s overall usability and branding. Adding the surface layer enhanced the app’s look and feel, providing a polished, professional appearance while maintaining ease of use. This approach led to a cohesive, visually consistent outcome that aligned with the goals of the design process, offering users an engaging, intuitive experience with the application.

TAILORED MODULES

The high-fidelity screens illustrate the structured learning journey in the app. The first screen offers an organized overview of available modules, the second breaks down levels within each module, and the third highlights specific placards, providing focused educational resources. These screens balance text and illustrations, ensuring the learning experience remains engaging and avoids becoming text-heavy or dull.

PRACTICE INVESTING

The feature lets users invest in penny stocks via Webull, applying what they have learned in real markets. By linking their Webull account to InvestHer, users can monitor performance and asset allocation on the InvestHer dashboard, helping them track progress and make informed decisions.

BOOK SESSIONS WITH ADVISOR

Once connected, mentees can view their advisor’s available session times. They may schedule one weekly call for topic-specific doubts. Additional calls require a premium plan. InvestHer allows advisor changes to meet evolving needs, with access to Advisor History for reviewing past advice, ensuring a complete financial journey record.

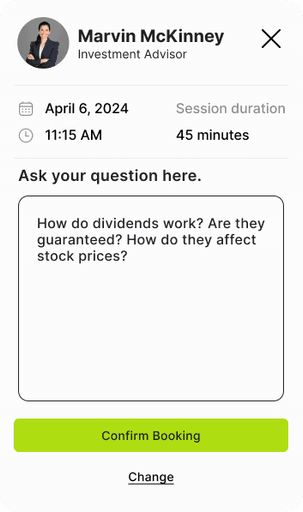

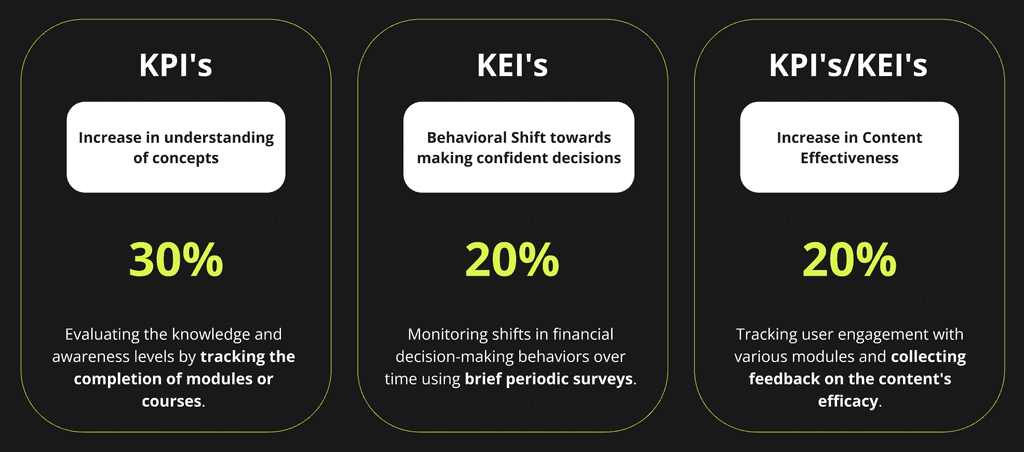

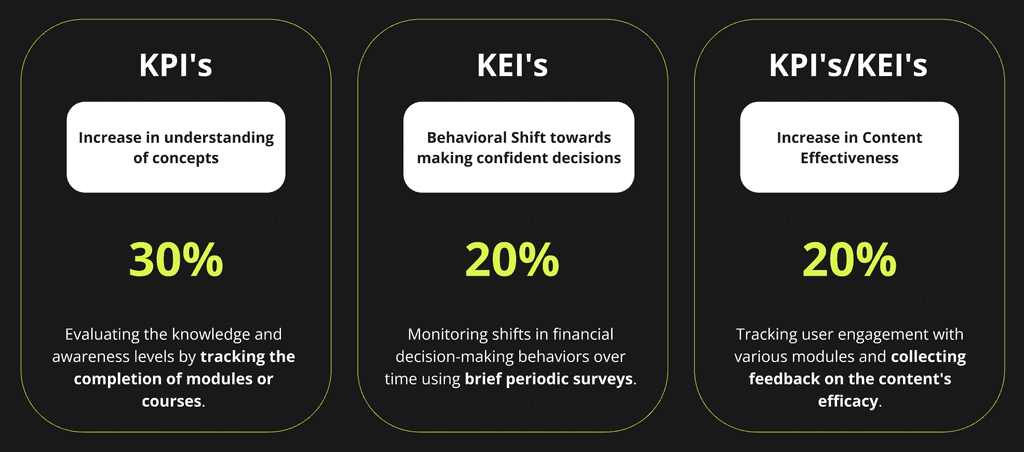

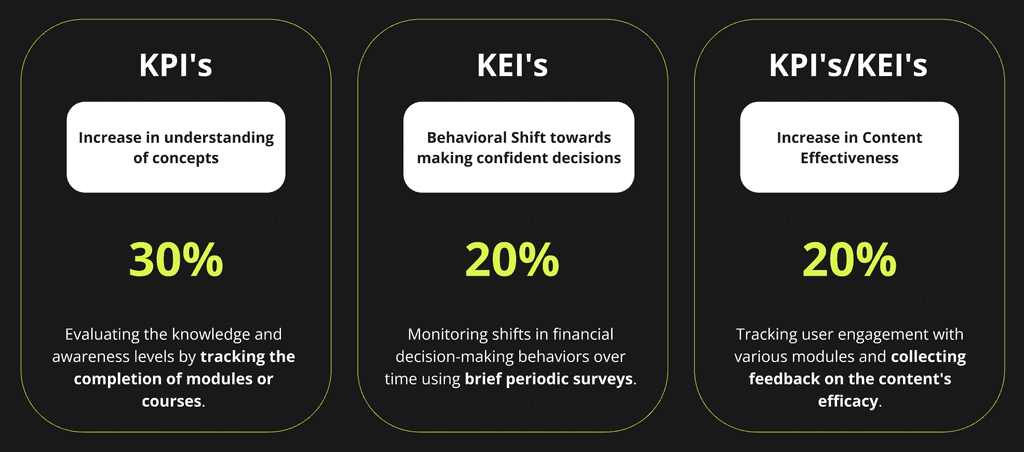

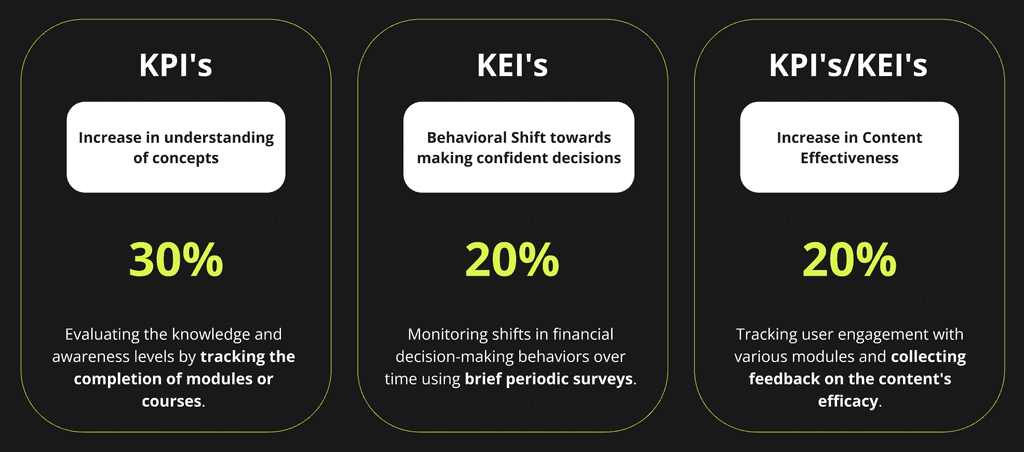

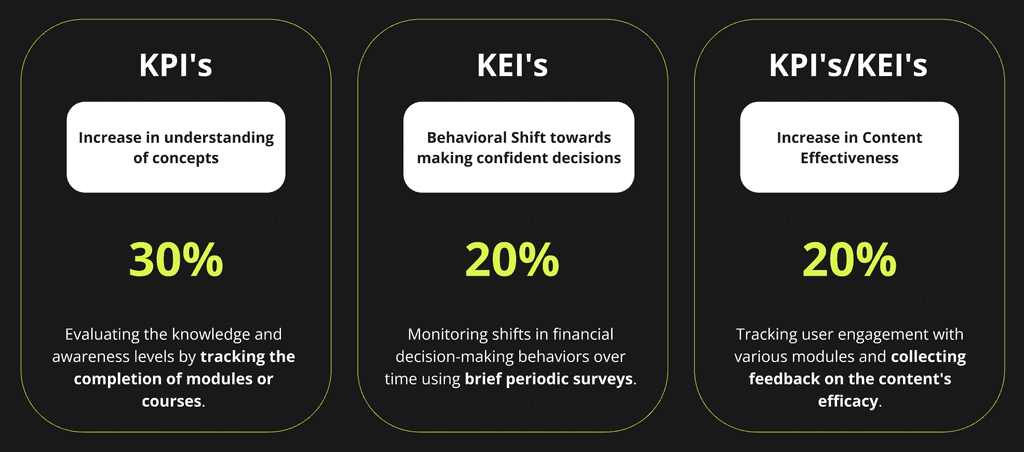

SUCCESS METRICS

SUCCESS METRICS

If this happens, InvestHer is a success!

If this happens, InvestHer is a success!

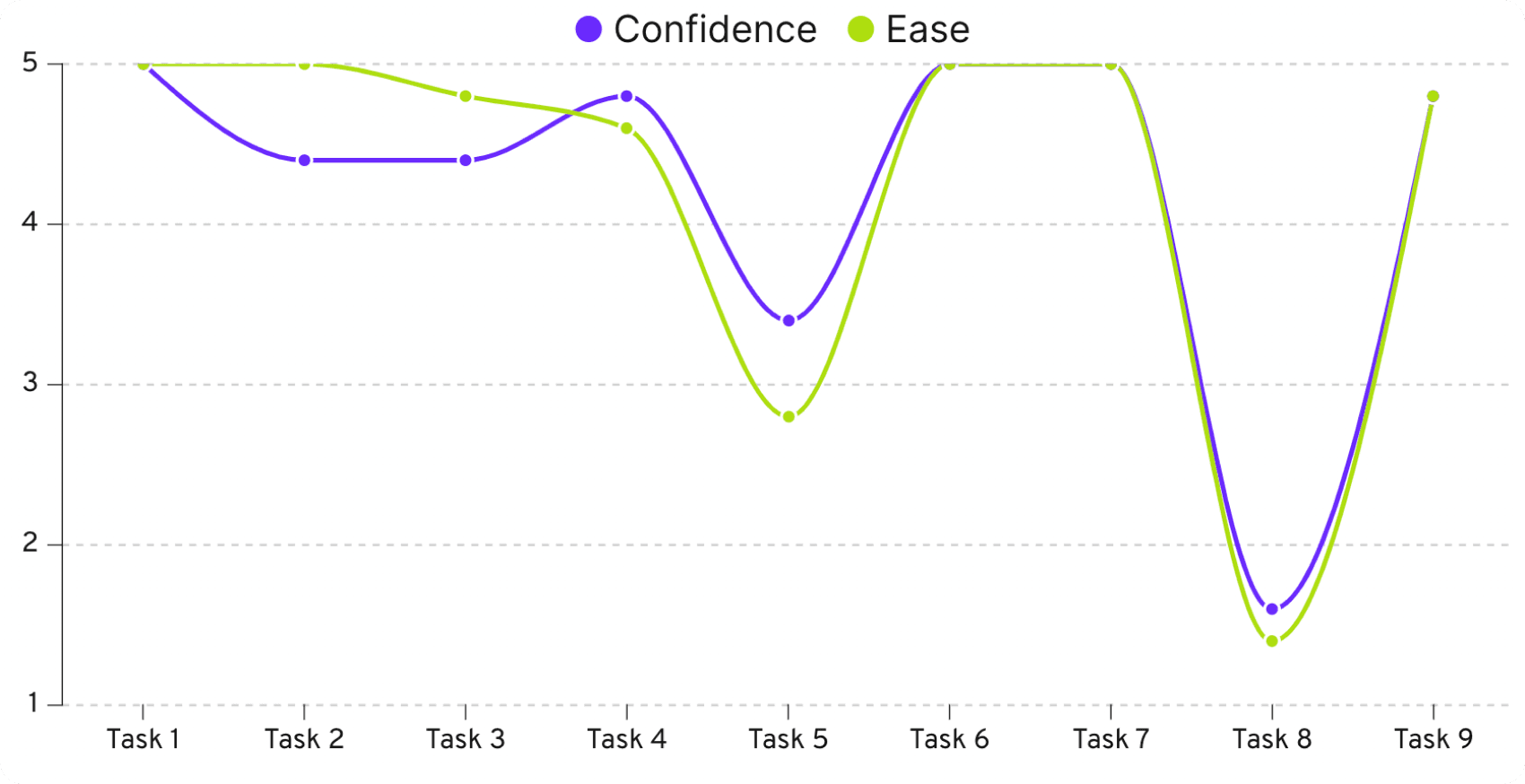

USABILITY TESTING

USABILITY TESTING

It was a Hit!

It was a Hit!

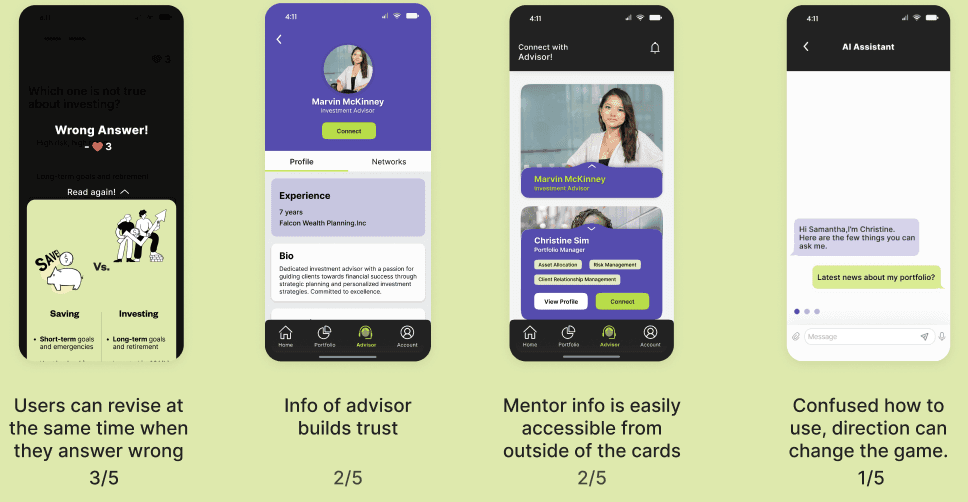

The usability test with five users (30-45 minutes each) revealed key issues: difficulty locating the AI feedback button on the portfolio screen and challenges in changing advisors. These findings emphasized the need for enhanced interface design and user-centric navigation to improve overall accessibility and user experience.

The usability test with five users (30-45 minutes each) revealed key issues: difficulty locating the AI feedback button on the portfolio screen and challenges in changing advisors. These findings emphasized the need for enhanced interface design and user-centric navigation to improve overall accessibility and user experience.

The usability test with five users (30-45 minutes each) revealed key issues: difficulty locating the AI feedback button on the portfolio screen and challenges in changing advisors. These findings emphasized the need for enhanced interface design and user-centric navigation to improve overall accessibility and user experience.

The usability test with five users (30-45 minutes each) revealed key issues: difficulty locating the AI feedback button on the portfolio screen and challenges in changing advisors. These findings emphasized the need for enhanced interface design and user-centric navigation to improve overall accessibility and user experience.

The graph is derived from the usability test results.

The graph is derived from the usability test results.

The graph is derived from the usability test results.

WHAT WENT SOUTH?

WHAT WENT SOUTH?

Usability Feedback : 5 users

Usability Feedback : 5 users

WHAT SURPRISED THEM?

WHAT SURPRISED THEM?

Usability Feedback : 5 users

Usability Feedback : 5 users

FUTURE PLANS TO EXPAND

FUTURE PLANS TO EXPAND

Introduce Knowledge Exchange Marketplace:

Introduce Knowledge Exchange Marketplace:

Introduce Knowledge Exchange Marketplace:

Create a platform where users share and access valuable investment insights.

Create a platform where users share and access valuable investment insights.

Create a platform where users share and access valuable investment insights.

Daily Newsletter Subscription:

Daily Newsletter Subscription:

Daily Newsletter Subscription:

Offer daily updates with financial tips and investment opportunities for subscribers.

Offer daily updates with financial tips and investment opportunities for subscribers.

Offer daily updates with financial tips and investment opportunities for subscribers.

Partnership with FinTech Companies and Conduct Boot Camps for Females:

Partnership with FinTech Companies and Conduct Boot Camps for Females:

Partnership with FinTech Companies and Conduct Boot Camps for Females:

Collaborate with FinTechs to provide boot camps empowering women in investing.

Collaborate with FinTechs to provide boot camps empowering women in investing.

Collaborate with FinTechs to provide boot camps empowering women in investing.

UP NEXT

UP NEXT

UP NEXT